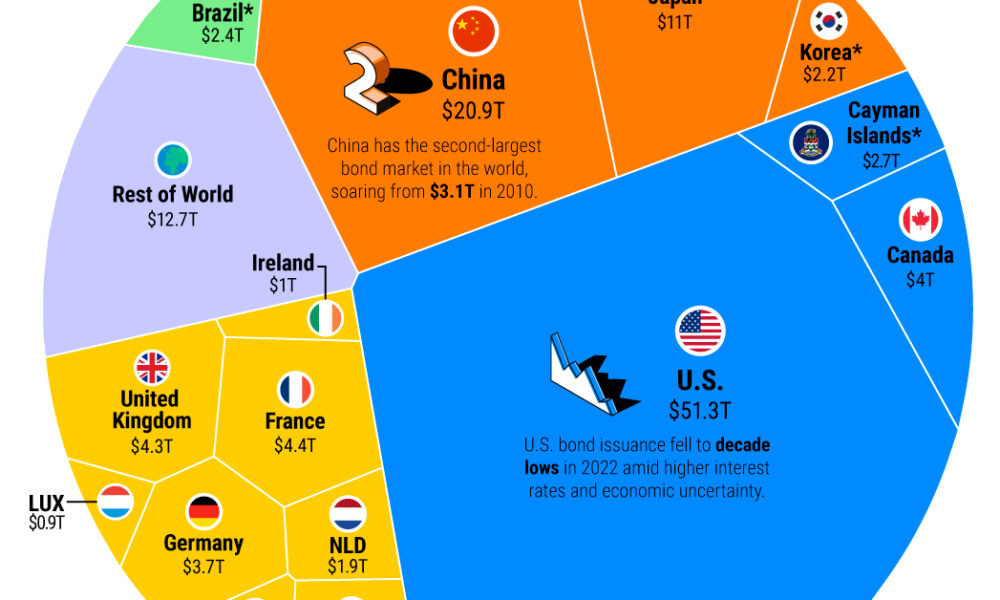

Posthaste: Trouble Brewing In The Global Bond Market

Table of Contents

Rising Interest Rates and their Impact on Bond Prices

The Inverse Relationship

The foundation of the current crisis lies in the inverse relationship between interest rates and bond prices. Simply put, when interest rates rise, bond prices fall. This is because newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This inverse relationship is a fundamental principle of bond investing and is currently playing out dramatically in the global bond market.

- Central Bank Policies: The Federal Reserve (Fed) in the US, the European Central Bank (ECB), and other central banks globally are aggressively raising interest rates to combat stubbornly high inflation. These interest rate hikes are the primary driver of the current bond market volatility.

- Impact on Existing Bond Portfolios: Investors holding existing bonds are experiencing capital losses as the value of their holdings declines in response to rising interest rates. This is particularly true for long-term bonds, which are more sensitive to interest rate changes.

- Implications for Bond Yields: Higher interest rates lead to higher bond yields on newly issued bonds. However, this increased yield comes at the cost of lower prices for existing bonds, creating a complex situation for investors.

- Countries Experiencing Stress: Several countries, particularly those with high levels of government debt, are experiencing significant stress in their bond markets, facing rising borrowing costs and increased risk premiums.

Inflation's Persistent Grip on Global Bond Markets

Inflationary Pressures

Persistent inflation is another major headwind for the global bond market. High inflation erodes the purchasing power of fixed-income investments like bonds, reducing their real return. This makes bonds less appealing to investors seeking to preserve their capital.

- Impact on Real Bond Yields: Inflation significantly impacts real bond yields – the return an investor receives after adjusting for inflation. High inflation can easily wipe out nominal yields, leaving investors with little to no real return.

- Central Bank Challenges: Central banks face a difficult balancing act: controlling inflation without triggering a recession. Aggressive interest rate hikes, while necessary to combat inflation, also risk triggering an economic downturn.

- Supply Chain Disruptions and Geopolitics: Global supply chain disruptions and geopolitical instability are contributing significantly to inflationary pressures, further exacerbating the challenges facing the global bond market.

- Differential Impact on Bond Types: Different types of bonds, such as government bonds and corporate bonds, are affected differently by inflation. Government bonds, particularly those issued by financially stable countries, tend to be viewed as safer havens during inflationary periods.

Geopolitical Uncertainty and its Ripple Effect on Bond Markets

Global Instability

Geopolitical uncertainty adds another layer of complexity to the global bond market. War, political instability, and other geopolitical events can significantly impact investor confidence and lead to increased market volatility.

- Flight to Safety: During times of geopolitical uncertainty, investors often engage in a "flight to safety," seeking refuge in government bonds issued by countries perceived as politically and economically stable. This increased demand pushes down yields on these "safe haven" assets.

- Sanctions and Trade Wars: Sanctions and trade wars disrupt global capital flows and can destabilize bond markets. Uncertainty about future economic relations can lead to increased risk aversion and higher risk premiums.

- Increased Risk Premiums: Investors demand higher risk premiums – extra yield – for holding bonds issued by countries or companies perceived as being exposed to higher levels of geopolitical risk.

- Specific Geopolitical Impacts: The ongoing war in Ukraine, for instance, has significantly impacted global energy prices and added to inflationary pressures, creating further stress on global bond markets.

Assessing the Risks and Potential Outcomes for the Global Bond Market

Scenario Planning

Several potential scenarios exist for the future of the global bond market.

- Sustained High Interest Rates: A prolonged period of high interest rates could lead to significant further losses in bond portfolios and potentially trigger a recession.

- Bond Market Crash: A sharp correction or even a crash in the bond market remains a significant risk, particularly if investor confidence erodes further.

- Impact on Other Asset Classes: The turmoil in the bond market could have knock-on effects on other asset classes, such as stocks and real estate.

- Government Intervention: Governments may intervene to stabilize their bond markets, but the effectiveness of such intervention is uncertain and depends on the specific circumstances.

Conclusion

The global bond market is facing a confluence of challenges: rising interest rates, persistent inflation, and escalating geopolitical uncertainty. These factors are creating significant volatility and posing considerable risks to investors. Understanding the current turbulence in the global bond market is crucial for investors. The potential for significant losses and wider economic consequences is real. Stay informed about developments in the global bond market outlook and consider consulting a financial advisor to develop robust bond market investment strategies that mitigate risk and help navigate these complex times.

Featured Posts

-

Honeywell To Purchase Johnson Matthey Catalyst Unit Impact And Implications Of The 2 4 Billion Deal

May 23, 2025

Honeywell To Purchase Johnson Matthey Catalyst Unit Impact And Implications Of The 2 4 Billion Deal

May 23, 2025 -

Optimizatsiya Gospodaryuvannya Poradi Dlya Tov Z Odnim Vlasnikom

May 23, 2025

Optimizatsiya Gospodaryuvannya Poradi Dlya Tov Z Odnim Vlasnikom

May 23, 2025 -

The Jonas Brothers Joe Jonas Addresses Fan Couples Argument

May 23, 2025

The Jonas Brothers Joe Jonas Addresses Fan Couples Argument

May 23, 2025 -

How Alix Earle Conquered Gen Z As Dancing With The Stars Newest Marketing Maven

May 23, 2025

How Alix Earle Conquered Gen Z As Dancing With The Stars Newest Marketing Maven

May 23, 2025 -

Big Rig Rock Report 3 12 Trucking Industry Trends And Developments On Rock 106 1

May 23, 2025

Big Rig Rock Report 3 12 Trucking Industry Trends And Developments On Rock 106 1

May 23, 2025

Latest Posts

-

Jonathan Groffs Potential Tony Award History With Just In Time

May 23, 2025

Jonathan Groffs Potential Tony Award History With Just In Time

May 23, 2025 -

A Couples Fight Joe Jonass Reaction The Full Story

May 23, 2025

A Couples Fight Joe Jonass Reaction The Full Story

May 23, 2025 -

Joe Jonass Mature Response To A Couples Argument

May 23, 2025

Joe Jonass Mature Response To A Couples Argument

May 23, 2025 -

A Couples Fight Over Joe Jonas And His Classy Response

May 23, 2025

A Couples Fight Over Joe Jonas And His Classy Response

May 23, 2025 -

Joe Jonass Mature Reaction To A Couples Public Argument

May 23, 2025

Joe Jonass Mature Reaction To A Couples Public Argument

May 23, 2025