Honeywell To Purchase Johnson Matthey Catalyst Unit: Impact And Implications Of The $2.4 Billion Deal

Table of Contents

Honeywell's Strategic Rationale for the Acquisition

Honeywell's decision to acquire Johnson Matthey's catalyst unit is a strategic masterstroke driven by several key factors. This strategic acquisition allows Honeywell to significantly enhance its market position and diversify its portfolio. The core motivations behind this move can be understood through the lens of several strategic objectives:

-

Strengthening Honeywell's Position in Emission Control: This acquisition immediately bolsters Honeywell's already substantial presence in the emission control catalyst market. By incorporating Johnson Matthey's established expertise and client base, Honeywell is poised to become a dominant player.

-

Access to Cutting-Edge Technology and Intellectual Property: Johnson Matthey boasts a formidable portfolio of patented technologies and intellectual property in catalyst development. This acquisition grants Honeywell access to these crucial assets, accelerating its own innovation capabilities and providing a competitive edge.

-

Market Expansion and Diversification: The acquisition opens doors to new geographic markets and customer segments, allowing Honeywell to expand its reach and reduce reliance on existing markets. This diversification strategy mitigates risk and creates opportunities for substantial growth.

-

Synergies and Cost Efficiencies: Consolidation of operations and resources is expected to yield significant cost savings and operational efficiencies. By integrating Johnson Matthey's expertise and infrastructure, Honeywell can streamline its processes and improve profitability.

Impact on Johnson Matthey

For Johnson Matthey, the divestment of its catalyst unit represents a significant strategic realignment. While the $2.4 billion sale provides a substantial financial boost, the primary impact lies in refocusing the company's resources and efforts.

-

Significant Financial Benefits: The $2.4 billion proceeds from the sale will provide Johnson Matthey with substantial capital for reinvestment in other strategic areas, fostering future growth and innovation within its core competencies.

-

Strategic Refocusing: The sale allows Johnson Matthey to streamline its operations and focus on its core competencies and high-growth sectors, potentially leading to enhanced profitability and long-term sustainability.

-

Reinvestment Opportunities: The significant capital injection allows Johnson Matthey to pursue strategic acquisitions, invest in research and development, or expand into new, lucrative markets.

-

Impact on Employees: The transition of the catalyst unit to Honeywell will inevitably have an impact on Johnson Matthey's employees in the divested unit. Careful management of this transition is crucial to minimize disruption and ensure a smooth handover.

Market Implications of the Honeywell Johnson Matthey Catalyst Acquisition

The Honeywell Johnson Matthey Catalyst Acquisition has profound implications for the broader catalyst market, influencing competition, pricing, and innovation.

-

Increased Market Share for Honeywell: Honeywell's acquisition of Johnson Matthey's substantial market share, particularly in the automotive and industrial catalyst sectors, will undeniably shift the competitive landscape.

-

Impact on Pricing and Competition: The merger could potentially lead to changes in pricing strategies among remaining catalyst manufacturers, as the combined entity wields considerable market power. This could influence competition and market dynamics.

-

Innovation and Technological Advancements: The combination of Honeywell's and Johnson Matthey's expertise and resources is likely to stimulate innovation and accelerate the development of new catalyst technologies, particularly in areas such as emission control and sustainable chemistry.

-

Regulatory Considerations: The acquisition is subject to regulatory scrutiny, including potential antitrust reviews, which could influence the final terms and conditions of the deal.

Future Outlook and Potential Challenges for Honeywell

While the Honeywell Johnson Matthey Catalyst Acquisition presents significant opportunities, Honeywell faces integration challenges and market dynamics that require careful management.

-

Integration Challenges: Successfully integrating Johnson Matthey's technology, workforce, and operational processes will be crucial for realizing the synergies and achieving the expected cost savings. This requires careful planning and execution.

-

Maintaining Customer Relationships: Preserving strong relationships with existing customers of both Honeywell and Johnson Matthey will be vital for maintaining market share and ensuring a smooth transition.

-

Regulatory Compliance and Antitrust Concerns: Navigating regulatory hurdles and ensuring compliance with antitrust regulations will be essential to prevent any potential legal complications.

-

Market Dynamics: The acquisition needs to be strategically aligned with future market trends and technological advancements to remain competitive in the dynamic catalyst market.

Conclusion: The Honeywell Johnson Matthey Catalyst Acquisition: A Pivotal Moment in the Industry

The Honeywell Johnson Matthey Catalyst Acquisition marks a pivotal moment in the catalyst industry. This $2.4 billion deal significantly strengthens Honeywell's market position, providing access to advanced technologies and expanding its reach. For Johnson Matthey, the divestment allows for strategic refocusing and reinvestment. The broader market will see increased competition, potential price adjustments, and likely accelerated innovation. While Honeywell faces integration challenges, the long-term prospects are promising. To stay informed about the ongoing developments of this significant Honeywell's acquisition of Johnson Matthey's catalyst business, and other major industry mergers and acquisitions, subscribe to our newsletter for updates. You can also visit Honeywell's and Johnson Matthey's investor relations pages for further details on the Honeywell-Johnson Matthey deal.

Featured Posts

-

Exploring The Big Rig Rock Report 3 12 96 The Rocket Explained

May 23, 2025

Exploring The Big Rig Rock Report 3 12 96 The Rocket Explained

May 23, 2025 -

The Karate Kid Legacy Impact And Influence On Popular Culture

May 23, 2025

The Karate Kid Legacy Impact And Influence On Popular Culture

May 23, 2025 -

County Cricket Anticipation Builds As Familiar Faces Prepare For Trophy Battles

May 23, 2025

County Cricket Anticipation Builds As Familiar Faces Prepare For Trophy Battles

May 23, 2025 -

Karate Kid 6 Ralph Macchios Return And A Controversial Film Revival

May 23, 2025

Karate Kid 6 Ralph Macchios Return And A Controversial Film Revival

May 23, 2025 -

Flintoffs Comeback England Lions Squad Named For India A Series Featuring Woakes

May 23, 2025

Flintoffs Comeback England Lions Squad Named For India A Series Featuring Woakes

May 23, 2025

Latest Posts

-

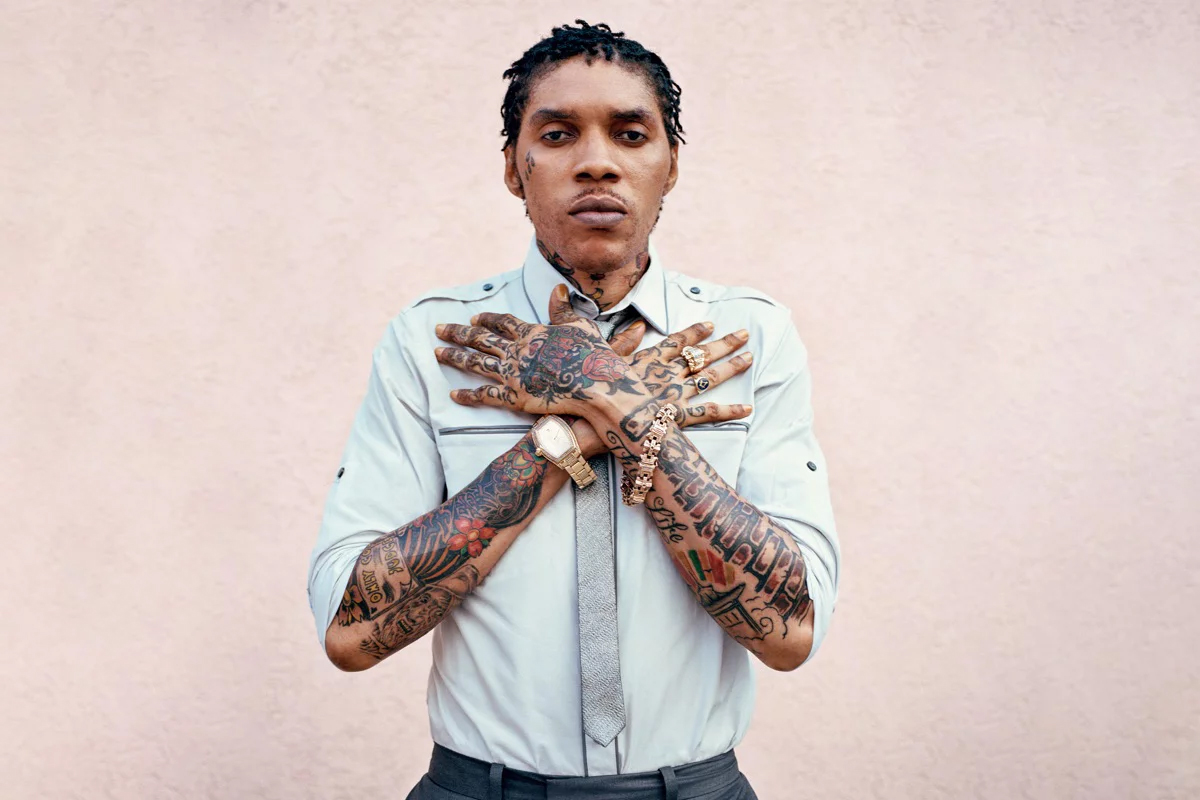

Vybz Kartel Announces New York City Barclay Center Concert

May 23, 2025

Vybz Kartel Announces New York City Barclay Center Concert

May 23, 2025 -

No Opposition Vybz Kartel And The Trinidad Governments Regulations

May 23, 2025

No Opposition Vybz Kartel And The Trinidad Governments Regulations

May 23, 2025 -

Vybz Kartels Response To Trinidads Performance Restrictions

May 23, 2025

Vybz Kartels Response To Trinidads Performance Restrictions

May 23, 2025 -

Trinidad And Tobago Restricts Vybz Kartel Official Statement

May 23, 2025

Trinidad And Tobago Restricts Vybz Kartel Official Statement

May 23, 2025 -

The Role Of Rum Culture In Kartel As Reported By Stabroek News

May 23, 2025

The Role Of Rum Culture In Kartel As Reported By Stabroek News

May 23, 2025