Post-Halt Rally: Analysis Of Chinese Stock Market Performance Following US Discussions And Data Release

Table of Contents

Impact of US-China Discussions on Market Sentiment

The fluctuating nature of US-China relations significantly impacts investor confidence and the overall performance of the Chinese stock market. Positive developments often lead to market rallies, while negative developments can trigger sell-offs and increased volatility.

Easing Trade Tensions and their Effect

- Analysis of specific statements/agreements: Statements indicating a de-escalation of trade tensions, such as agreements on specific trade volumes or tariff reductions, often lead to a surge in investor optimism. The recent agreement on agricultural imports, for example, had a demonstrably positive impact on related sectors.

- Discussion on investor confidence: Easing trade tensions directly boosts investor confidence, encouraging both domestic and foreign investment. This increased confidence translates to higher stock valuations and increased trading activity.

- Impact on specific sectors (e.g., technology): The technology sector, particularly sensitive to US-China trade relations, often experiences significant price swings. Easing tensions usually lead to a recovery in technology stocks, reflecting improved prospects for collaboration and reduced regulatory uncertainty.

The impact of positive rhetoric from US-China talks is undeniable. For instance, the announcement of a "phase one" trade deal in 2019 led to a noticeable surge in the Shanghai Composite Index. Conversely, periods of heightened rhetoric and escalating trade disputes have resulted in significant market corrections.

Geopolitical Uncertainty and its Role

- Analysis of ongoing geopolitical concerns: Lingering geopolitical concerns, such as disputes over Taiwan or intellectual property rights, can introduce uncertainty into the market, leading to risk aversion among investors.

- Discussion on risk aversion: Investors often become more risk-averse during times of heightened geopolitical uncertainty, leading them to reduce their exposure to the Chinese stock market. This can result in capital outflows and depressed stock prices.

- Effect on foreign investment: Geopolitical uncertainty can significantly impact foreign investment in China. Investors may delay or cancel investment plans if they perceive too much political risk.

Data illustrating this impact is readily available. Volatility indices, such as the VIX, often spike during periods of heightened geopolitical tensions, reflecting increased market uncertainty and investor anxiety. Trading volumes also often increase during these periods, as investors react to unfolding events.

Influence of Key Economic Data Releases

Economic data releases, particularly those concerning GDP growth and inflation, play a crucial role in shaping market sentiment and influencing stock prices.

GDP Growth and its Market Implications

- Review of latest GDP figures: The latest GDP figures provide crucial insights into the health of the Chinese economy. Strong GDP growth generally leads to positive market sentiment and higher stock valuations.

- Comparison to previous quarters: Comparing current GDP figures to previous quarters helps to assess the growth trajectory of the economy. A consistent upward trend usually boosts investor confidence.

- Implications for future growth projections: Analysts use current GDP figures to formulate future growth projections. Positive projections tend to fuel market optimism and drive stock prices higher.

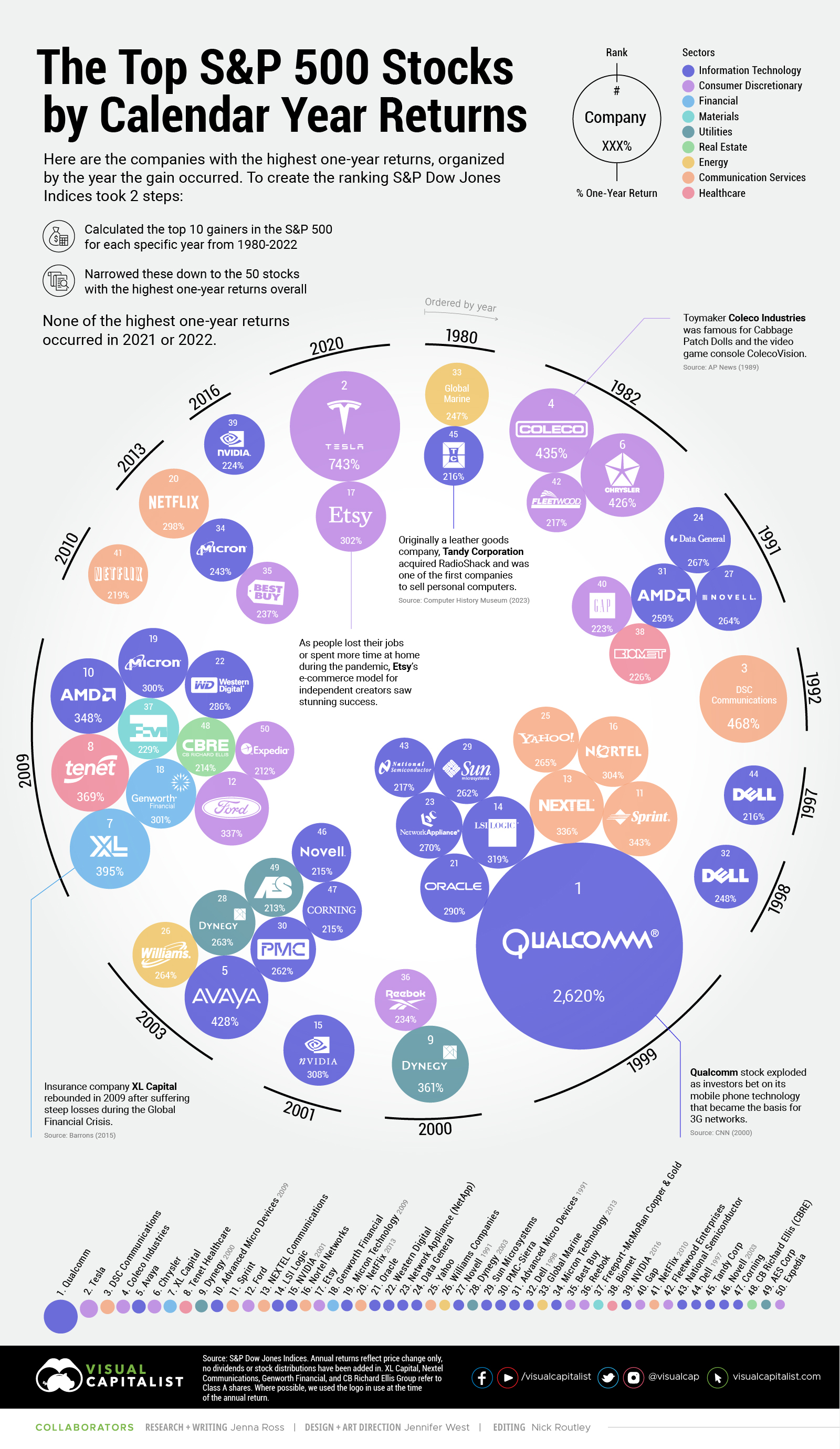

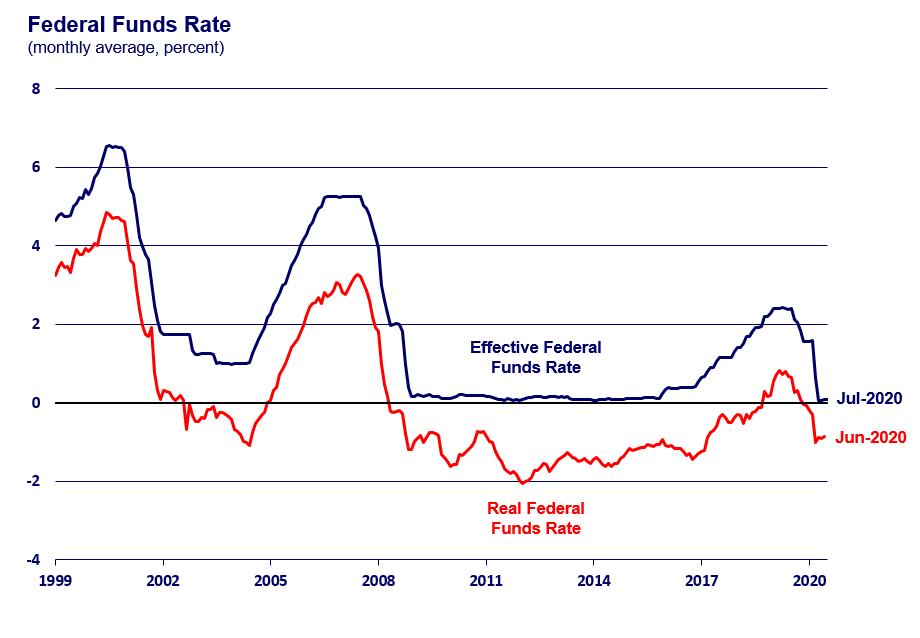

The relationship between GDP performance and stock market response is fairly direct. Strong GDP growth typically correlates with higher stock market returns, while weaker growth can lead to market corrections or stagnation. Charts and graphs visualizing this correlation are readily available from financial news sources.

Inflation Rates and Monetary Policy

- Analysis of inflation data: Inflation data provides insights into the price stability of the economy. High inflation can erode corporate earnings and negatively impact stock valuations.

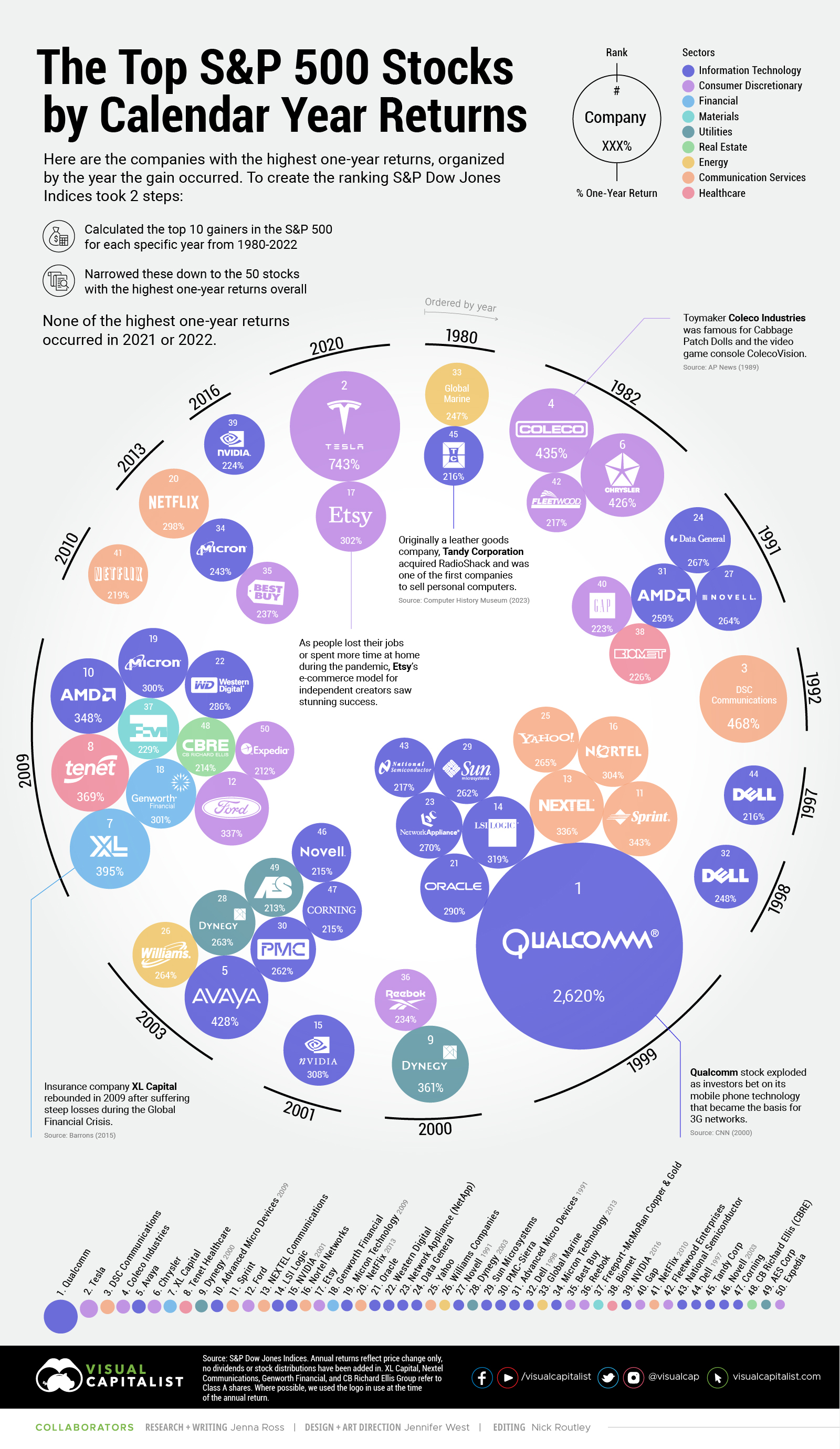

- Impact on interest rates: Central bank responses to inflation, such as adjusting interest rates, can significantly influence stock market performance. Interest rate hikes can dampen economic growth and negatively impact stock prices.

- Potential effect on corporate earnings: Inflation can affect corporate earnings by increasing input costs and reducing consumer spending. This can lead to lower profit margins and reduced stock valuations.

The central bank's monetary policy response to inflation plays a critical role. Aggressive interest rate hikes, while controlling inflation, can negatively impact economic growth and stock market performance, creating a delicate balancing act for policymakers.

Sector-Specific Performance Following the Post-Halt Rally

The post-halt rally did not affect all sectors equally. Analyzing sector-specific performance offers valuable insights into the market's diverse responses.

Technology Sector Recovery

- Analysis of tech stock performance: The technology sector, after facing regulatory headwinds, often sees a notable recovery during periods of market stability and improving US-China relations.

- Factors contributing to the recovery: Improved investor sentiment, easing regulatory concerns, and increased investment in technology often contribute to the sector's recovery.

- Future outlook: The future outlook for the technology sector is closely linked to ongoing regulatory developments and the broader global technological landscape.

Specific companies within the technology sector, like Alibaba and Tencent, experienced significant price swings during the period leading up to and following the post-halt rally. Analyzing their individual performance provides further insight into the overall market dynamics.

Real Estate and other Key Sectors

- Performance analysis of other significant sectors: Sectors like real estate, energy, and consumer staples also exhibit varying degrees of correlation with the overall market trends.

- Comparison to the technology sector: Comparing the performance of these sectors with the technology sector reveals differing sensitivities to geopolitical and economic factors.

- Broader market trends: Analyzing these sectors provides a holistic understanding of broader market trends and their impact on the Chinese economy.

The performance of these diverse sectors often offers valuable insights into the overall health and resilience of the Chinese economy. Their varied responses to the post-halt rally highlight the importance of sector-specific analysis in understanding the market's complexities.

Conclusion

This analysis has explored the complex interplay between US-China relations, economic data releases, and the subsequent post-halt rally in the Chinese stock market. The delicate balance between geopolitical factors and economic indicators profoundly influenced market sentiment and investor behavior. Sector-specific performance further highlighted the diverse and nuanced responses within the market.

Understanding the dynamics of the Chinese stock market, particularly during periods of significant geopolitical and economic shifts, is crucial for developing well-informed investment strategies. Continue to monitor developments in US-China relations and key economic data releases to navigate the complexities of the post-halt rally and make well-informed decisions regarding your investments in the Chinese stock market. Stay updated on future analyses to better understand the continuing evolution of the post-halt rally and its implications for your portfolio. A keen understanding of the post-halt rally and its drivers is paramount for successful investment in the Chinese market.

Featured Posts

-

Todays Mlb Game Tigers Vs Mariners Predictions And Expert Picks

May 07, 2025

Todays Mlb Game Tigers Vs Mariners Predictions And Expert Picks

May 07, 2025 -

Thailands Negative Inflation Implications For Future Interest Rate Cuts

May 07, 2025

Thailands Negative Inflation Implications For Future Interest Rate Cuts

May 07, 2025 -

The Karate Kid A Comprehensive Guide To The Film Series

May 07, 2025

The Karate Kid A Comprehensive Guide To The Film Series

May 07, 2025 -

Live Stream Mariners Vs Reds Baseball Game Tv Channel And Online Viewing Guide

May 07, 2025

Live Stream Mariners Vs Reds Baseball Game Tv Channel And Online Viewing Guide

May 07, 2025 -

April 15 2025 Daily Lotto Winning Numbers Announced

May 07, 2025

April 15 2025 Daily Lotto Winning Numbers Announced

May 07, 2025

Latest Posts

-

Nba Playoffs Game 1 Heat Cavaliers Prediction Picks And Analysis

May 07, 2025

Nba Playoffs Game 1 Heat Cavaliers Prediction Picks And Analysis

May 07, 2025 -

Heat Vs Cavaliers Expert Predictions And Best Bets For Game 1 Playoffs

May 07, 2025

Heat Vs Cavaliers Expert Predictions And Best Bets For Game 1 Playoffs

May 07, 2025 -

Nba Playoffs Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Start Time

May 07, 2025

Nba Playoffs Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Start Time

May 07, 2025 -

Game 1 Nba Playoffs Heat Vs Cavaliers Predictions And Betting Picks

May 07, 2025

Game 1 Nba Playoffs Heat Vs Cavaliers Predictions And Betting Picks

May 07, 2025 -

Nba Playoffs Heat Vs Cavaliers Prediction Best Bets For Game 1

May 07, 2025

Nba Playoffs Heat Vs Cavaliers Prediction Best Bets For Game 1

May 07, 2025