Thailand's Negative Inflation: Implications For Future Interest Rate Cuts

Table of Contents

Understanding Thailand's Negative Inflation

Causes of Negative Inflation in Thailand:

Several factors have contributed to Thailand's unexpected negative inflation. These include:

-

Decreased Consumer Spending: Economic uncertainty, stemming from both global factors and domestic concerns, has led to a decrease in consumer spending. Consumers are delaying major purchases and opting for more frugal spending habits, impacting demand for various goods and services. This decreased demand puts downward pressure on prices.

-

Lower Energy Prices and Global Commodity Price Fluctuations: The global decline in energy prices, particularly oil, has significantly impacted inflation. Fluctuations in global commodity prices have also played a role, with lower prices for several key imports contributing to the deflationary trend.

-

Strong Baht: The relatively strong Thai Baht against other major currencies makes imports cheaper, further suppressing inflation. This strong currency can, however, negatively impact export competitiveness.

-

Government Subsidies and Price Controls: The Thai government has implemented subsidies and price controls on certain essential goods, artificially suppressing price increases and potentially contributing to the negative inflation rate. While intended to alleviate the burden on consumers, these policies may have unintended consequences on market dynamics.

Data released by the Bank of Thailand (BOT) [link to relevant BOT report] shows a [insert specific percentage] decline in the consumer price index (CPI) in [insert month/period]. This is a significant departure from previous trends and underscores the need for a careful analysis of the underlying causes.

Impact of Negative Inflation on the Thai Economy:

Negative inflation, while seemingly beneficial in offering increased purchasing power, presents both positive and negative consequences for the Thai economy:

Positive Impacts:

- Increased Purchasing Power (Temporarily): Consumers can buy more goods and services with the same amount of money. However, this is a short-term benefit; prolonged deflation can lead to decreased consumer spending as consumers postpone purchases anticipating further price drops.

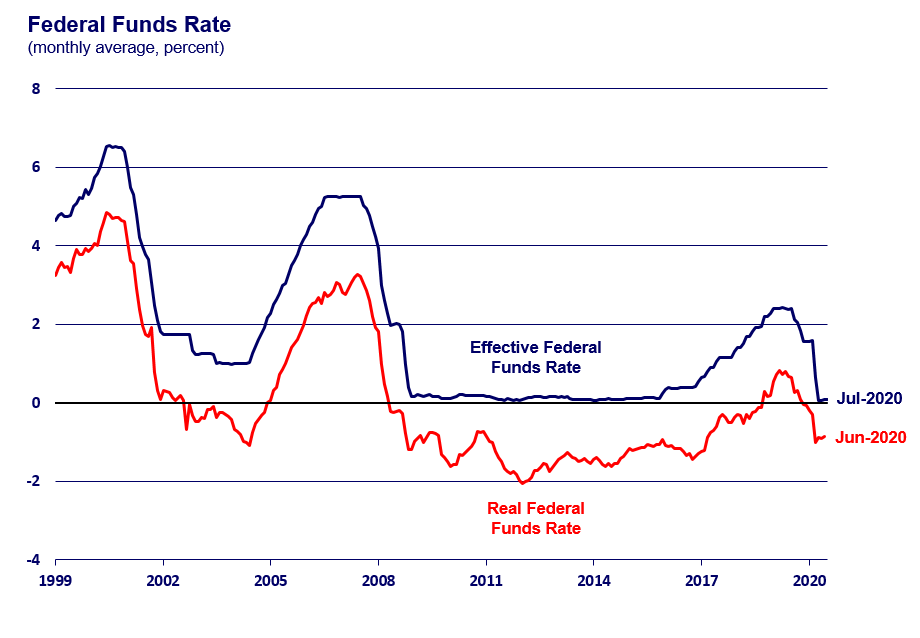

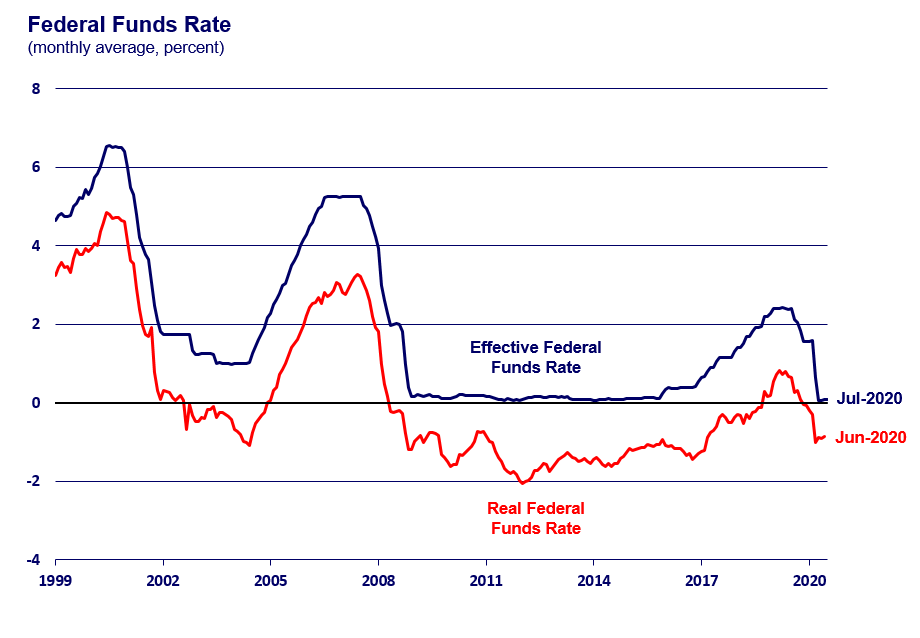

- Lower Borrowing Costs: Lower inflation typically leads to lower interest rates, making borrowing cheaper for businesses and individuals. This can stimulate investment and economic activity.

Negative Impacts:

- Deflationary Spiral Risk: A persistent decline in prices can lead to a deflationary spiral. Consumers delay purchases expecting further price drops, leading to reduced demand, lower production, and further price decreases. This creates a vicious cycle that is difficult to break.

- Decreased Investment: Businesses may postpone investment decisions as they anticipate lower returns in a deflationary environment.

- Economic Stagnation: Negative inflation can lead to economic stagnation, impacting job creation and overall economic growth.

Specific Impacts on Sectors:

- Tourism: A strong Baht can make Thailand more expensive for foreign tourists, impacting tourism revenue.

- Manufacturing: Lower energy prices can benefit manufacturers, but decreased consumer spending can hinder demand for manufactured goods.

- Agriculture: Fluctuating global commodity prices significantly impact agricultural exports and farmers' incomes.

The Bank of Thailand's Response and Potential Future Interest Rate Cuts

Current Monetary Policy Stance:

The Bank of Thailand (BOT) currently maintains an interest rate of [insert current interest rate]. [Insert quote from recent BOT statement regarding monetary policy]. The BOT's decisions are influenced by several factors, including:

- Inflation Targets: The BOT has a specific inflation target for the Thai economy. Negative inflation clearly indicates a miss on this target.

- Economic Growth Forecasts: The BOT's assessment of future economic growth significantly influences its monetary policy decisions.

- Exchange Rate Stability: Maintaining exchange rate stability is a key consideration for the BOT, as a volatile Baht can impact both inflation and economic growth.

Likelihood of Further Interest Rate Cuts:

Given the negative inflation and the desire to stimulate economic growth, further interest rate cuts by the BOT are a distinct possibility. However, the likelihood depends on several factors:

- Persistence of Negative Inflation: If negative inflation persists, the pressure for further rate cuts will increase.

- Global Economic Conditions: The global economic climate will influence the BOT's decisions.

- Domestic Economic Indicators: Key economic indicators like consumer spending, investment, and employment will inform the BOT's assessment of the need for further monetary easing.

[Include quotes from economists and analysts on the likelihood of further interest rate cuts and alternative policy tools]. The BOT might consider alternative measures, such as quantitative easing or targeted lending programs, alongside interest rate adjustments.

Long-Term Implications and Outlook for the Thai Economy

Risks and Challenges:

Prolonged negative inflation poses significant risks to the Thai economy:

- Deflationary Spiral: As discussed earlier, a deflationary spiral is a major concern.

- Economic Stagnation: Persistent deflation can stifle economic growth and lead to job losses.

- Impact on Vulnerable Populations: The negative effects of deflation are disproportionately felt by low-income households and those heavily indebted.

Opportunities and Growth Potential:

Despite the risks, negative inflation also presents some opportunities:

- Increased Export Competitiveness: A strong Baht, while potentially impacting imports, can make Thai exports more competitive in global markets.

- Government Stimulus Packages: The government can implement targeted fiscal stimulus measures to counteract the negative impacts of deflation and boost economic activity.

The Thai government can focus on initiatives that boost domestic demand, encourage investment, and improve infrastructure. These measures, combined with effective monetary policy, are crucial for mitigating the risks and harnessing the potential opportunities presented by the current economic situation.

Conclusion

Thailand's unexpected negative inflation presents a complex challenge for the Thai economy. While temporarily increasing purchasing power, it carries risks such as a deflationary spiral and decreased investment. The Bank of Thailand's response, including the potential for further interest rate cuts, will be crucial in navigating this challenging period. The long-term outlook depends on the effectiveness of both monetary and fiscal policies in stimulating economic growth and mitigating the negative impacts of deflation.

Stay updated on the latest developments concerning Thailand's negative inflation and the potential for future interest rate cuts by regularly consulting reputable financial news sources and the Bank of Thailand's official website. Understanding these dynamics is vital for making informed decisions in the Thai economy.

Featured Posts

-

Savage X Fenty Bridal Rihannas Latest Collection

May 07, 2025

Savage X Fenty Bridal Rihannas Latest Collection

May 07, 2025 -

Parents Of Twins Killed In San Carlos Street Race Driver Sentenced To Eight Years

May 07, 2025

Parents Of Twins Killed In San Carlos Street Race Driver Sentenced To Eight Years

May 07, 2025 -

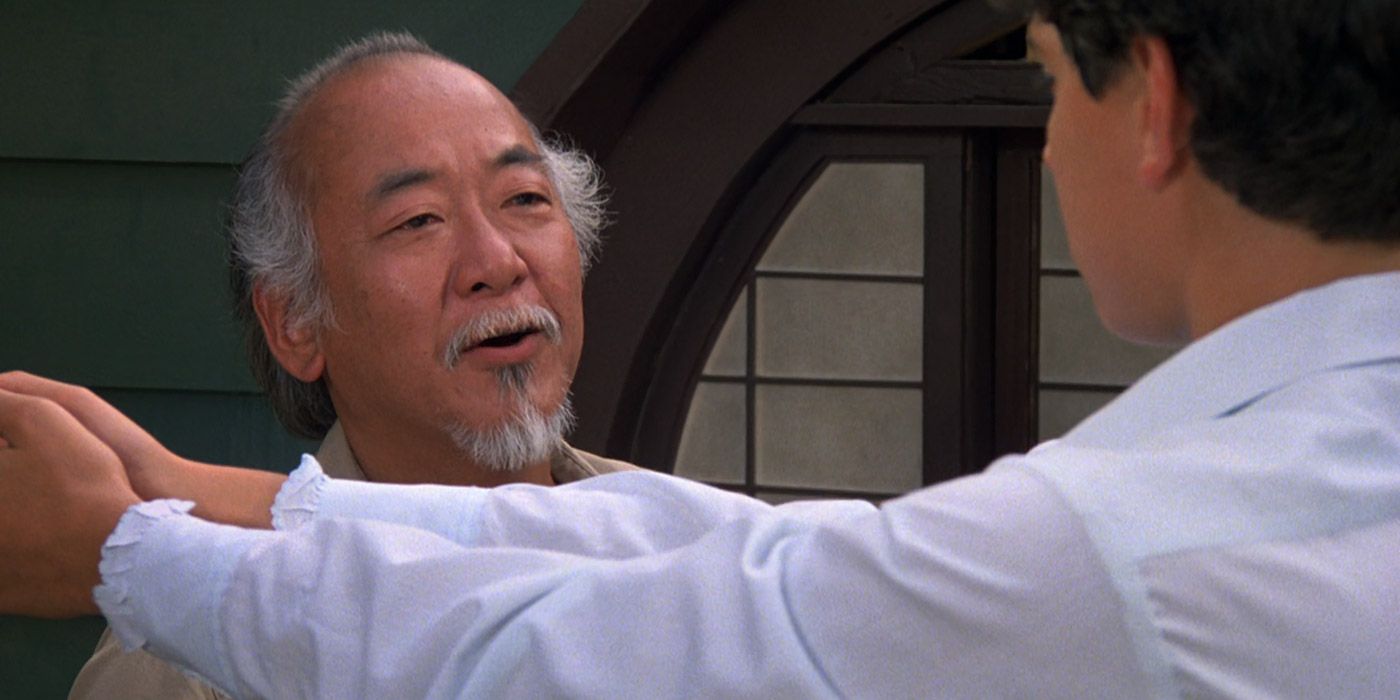

The Karate Kid Part Ii Exploring Mr Miyagis Past And Daniels Growth

May 07, 2025

The Karate Kid Part Ii Exploring Mr Miyagis Past And Daniels Growth

May 07, 2025 -

Concert Onet Le Chateau Christophe Mali En Tete D Affiche

May 07, 2025

Concert Onet Le Chateau Christophe Mali En Tete D Affiche

May 07, 2025 -

A List Celebs Dazzle At The Met Gala Red Carpet

May 07, 2025

A List Celebs Dazzle At The Met Gala Red Carpet

May 07, 2025

Latest Posts

-

Nba Playoffs Game 1 Heat Cavaliers Prediction Picks And Analysis

May 07, 2025

Nba Playoffs Game 1 Heat Cavaliers Prediction Picks And Analysis

May 07, 2025 -

Heat Vs Cavaliers Expert Predictions And Best Bets For Game 1 Playoffs

May 07, 2025

Heat Vs Cavaliers Expert Predictions And Best Bets For Game 1 Playoffs

May 07, 2025 -

Nba Playoffs Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Start Time

May 07, 2025

Nba Playoffs Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Start Time

May 07, 2025 -

Game 1 Nba Playoffs Heat Vs Cavaliers Predictions And Betting Picks

May 07, 2025

Game 1 Nba Playoffs Heat Vs Cavaliers Predictions And Betting Picks

May 07, 2025 -

Nba Playoffs Heat Vs Cavaliers Prediction Best Bets For Game 1

May 07, 2025

Nba Playoffs Heat Vs Cavaliers Prediction Best Bets For Game 1

May 07, 2025