Apple Stock Performance: Exceeding Q2 Expectations

Table of Contents

Revenue Growth and Key Drivers

Apple's Q2 revenue surge wasn't a fluke; it was driven by strong performance across several key product categories and service offerings. Let's break down the major contributors:

iPhone Sales Surpass Projections

iPhone sales were a significant driver of Apple's Q2 success, surpassing analysts' projections. Several factors contributed to this impressive performance:

- Specific sales numbers: While precise figures are subject to Apple's official reports, early indications suggest a significant year-over-year increase in iPhone unit sales.

- Comparison to previous quarters: The Q2 sales figures represent a notable improvement compared to the previous quarter and even exceed expectations from the same period last year.

- Market share analysis: Apple maintained or even increased its market share in the premium smartphone segment, showcasing the enduring appeal of its flagship devices. This demonstrates the continued strength of the Apple brand and its ability to compete effectively in a crowded smartphone market. Related keywords: iPhone sales, Apple iPhone, Smartphone market.

Services Revenue Continues to Soar

Apple's services segment, encompassing App Store revenue, Apple Music subscriptions, iCloud storage, and other offerings, continues to be a major growth engine. This recurring revenue stream provides exceptional stability and predictability.

- Growth percentages: The services segment displayed impressive double-digit growth in Q2, significantly contributing to overall revenue.

- Contributions from different service offerings: Each service offering within the segment demonstrated strong performance, indicating a well-diversified and resilient revenue model.

- Future growth potential: With ongoing innovation and expansion into new services, the potential for future growth within this segment remains substantial. Related keywords: Apple Services, App Store revenue, subscription services.

Wearables, Home, and Accessories Maintain Momentum

The wearables, home, and accessories category, featuring the Apple Watch, AirPods, and HomePod, demonstrated continued growth, highlighting the expanding ecosystem of Apple products.

- Sales figures for specific products: Both Apple Watch and AirPods sales contributed significantly to this segment's success, driven by innovative features and strong consumer demand.

- Market trends: Apple's consistent innovation in the wearables sector aligns with broader market trends towards health and fitness tracking and smart home technologies.

- Innovative features driving demand: New features and improved functionalities in these products consistently attract new customers and encourage existing users to upgrade. Related keywords: Apple Watch sales, AirPods sales, wearable technology.

Factors Contributing to Exceeding Expectations

Apple's Q2 success wasn't solely a result of strong product sales; several other factors played a crucial role:

Strong Product Lineup

Apple's compelling product lineup, with its focus on design, user experience, and innovative features, remains a key driver of its success.

- List key products: The iPhone, iPad, Mac, and wearables all contributed significantly to the overall revenue performance.

- Unique selling points: Each product possesses unique features that set it apart from the competition, attracting a loyal customer base.

- Market reception: The positive market reception of Apple's recent product launches further solidified its position as a leading technology brand. Related keywords: Apple products, new product launches, product innovation.

Effective Supply Chain Management

Apple's ability to manage its global supply chain effectively, despite ongoing global challenges, proved to be a critical success factor.

- Discuss strategies employed: Apple's proactive approach to supply chain diversification and risk mitigation enabled it to navigate potential disruptions effectively.

- Resilience shown in facing disruptions: The company demonstrated its ability to adapt and overcome challenges related to component shortages and geopolitical uncertainties.

- Future plans: Apple's ongoing investments in supply chain optimization will enhance its long-term resilience and competitiveness. Related keywords: supply chain management, global supply chain, logistics.

Growing Global Demand

Growing global demand for Apple products, particularly in emerging markets, significantly contributed to the company's strong performance.

- Discuss emerging markets: Apple continues to expand its presence in emerging markets, capitalizing on the growing middle class and increased smartphone penetration.

- Market penetration strategies: Apple's strategies to reach new customers and enhance brand awareness in these markets have proven successful.

- Brand loyalty: Apple's strong brand reputation and loyal customer base continue to drive demand worldwide. Related keywords: global market share, international expansion, brand reputation.

Implications for Future Apple Stock Performance

Apple's Q2 results have significant implications for its future stock performance:

Analyst Predictions and Ratings

Financial analysts have largely responded positively to Apple's Q2 results, with many adjusting their predictions and ratings upwards.

- Include key predictions: Analysts anticipate continued strong performance for Apple in the coming quarters.

- Target prices: Target prices for Apple stock have been revised upward by several analysts, reflecting their optimistic outlook.

- Rating changes: Several investment firms have upgraded their ratings for Apple stock, reflecting increased confidence in the company's future prospects. Related keywords: Apple stock price prediction, stock market analysis, investment advice.

Potential Risks and Challenges

Despite the positive outlook, several risks and challenges could impact Apple's future performance:

- Market competition: Increased competition in the smartphone and other technology markets could put pressure on Apple's market share and profitability.

- Economic slowdown: A global economic slowdown could reduce consumer spending and affect demand for Apple products.

- Geopolitical uncertainty: Geopolitical instability could disrupt supply chains and negatively impact sales in certain regions. Related keywords: market competition, economic factors, risk assessment.

Long-Term Growth Potential

Despite potential risks, Apple's long-term growth potential remains significant, driven by several key factors:

- Key initiatives: Ongoing investments in research and development, expansion into new markets, and strategic acquisitions will further fuel growth.

- Future product plans: Apple's pipeline of innovative products and services suggests a strong foundation for continued growth.

- Expansion strategies: Apple's strategic expansion into new markets and service offerings will provide additional avenues for growth. Related keywords: future growth, long-term investment, strategic planning.

Conclusion

Apple's Q2 exceeded expectations due to strong product sales, effective supply chain management, and growing global demand. These factors suggest a positive outlook for future Apple stock performance. However, investors should also consider potential risks and challenges. Stay tuned for updates on Apple stock performance as we continue to monitor its progress. Consider diversifying your portfolio with strong performers like Apple to capitalize on its continued growth potential.

Featured Posts

-

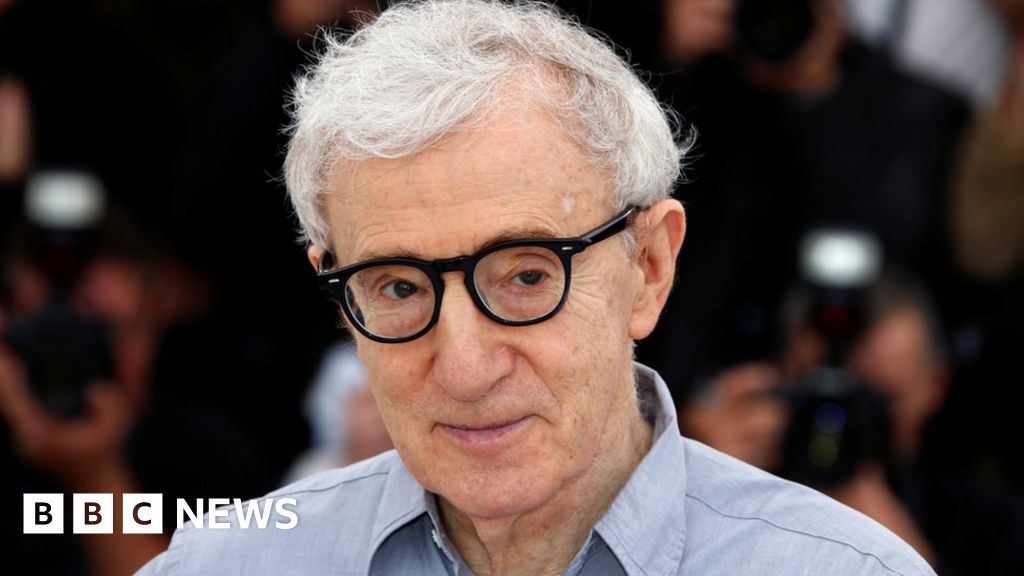

Did Woody Allen Abuse Dylan Farrow Sean Penn Weighs In

May 24, 2025

Did Woody Allen Abuse Dylan Farrow Sean Penn Weighs In

May 24, 2025 -

Ferrari Challenge South Floridas Thrilling Racing Weekend

May 24, 2025

Ferrari Challenge South Floridas Thrilling Racing Weekend

May 24, 2025 -

M6 Closure Real Time Updates On Crash And Traffic Impact

May 24, 2025

M6 Closure Real Time Updates On Crash And Traffic Impact

May 24, 2025 -

Global Deforestation Surges Wildfires Drive Unprecedented Losses

May 24, 2025

Global Deforestation Surges Wildfires Drive Unprecedented Losses

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travel Guide

May 24, 2025

Latest Posts

-

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025

Accessing Italian Citizenship The New Great Grandparent Clause

May 24, 2025 -

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025

Revised Italian Citizenship Law Great Grandparent Lineage And Eligibility

May 24, 2025 -

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025

Italian Citizenship New Rules For Claiming Through Great Grandparents

May 24, 2025 -

Italy Amends Citizenship Law Eligibility Via Great Grandparents Explained

May 24, 2025

Italy Amends Citizenship Law Eligibility Via Great Grandparents Explained

May 24, 2025 -

Generating A Poop Podcast How Ai Processes Repetitive Scatological Documents

May 24, 2025

Generating A Poop Podcast How Ai Processes Repetitive Scatological Documents

May 24, 2025