PFC Takes Action: EoW Transfer To Gensol Promoters Suspended For Documented Fraud

Table of Contents

Details of the Alleged Fraudulent Activity

The alleged fraudulent scheme at Gensol involves a complex web of financial irregularities and misrepresentation. According to documentation obtained by the PFC, the fraudulent activities appear to have been ongoing for several months, involving the misappropriation of funds and the manipulation of financial records. The evidence gathered points to a deliberate attempt to deceive investors and inflate the company's financial performance.

- Specific fraudulent activities identified: These include falsified invoices, undisclosed related-party transactions, and the misrepresentation of revenue streams.

- Evidence supporting the allegations: The PFC's investigation uncovered a trove of incriminating documentation, including emails, bank statements, and internal memos. This evidence strongly suggests a coordinated effort to conceal the fraudulent transactions.

- The scale and potential financial impact of the fraud: The full extent of the financial damage is still under investigation. However, preliminary estimates suggest losses in the millions, potentially impacting investor confidence and market stability.

- Parties implicated in the alleged fraudulent scheme: While the PFC has not publicly named all individuals involved, it is understood that several key Gensol promoters are under scrutiny.

PFC's Response and Suspension of the EoW Transfer

In response to the gravity of the alleged fraud, the PFC acted swiftly and decisively. On [Insert Date of Suspension], the PFC issued a suspension order halting the EoW transfer of funds to Gensol promoters. This immediate action is intended to prevent further losses and protect the interests of investors.

- Date of the suspension order: [Insert Date of Suspension]

- Specific clauses violated: The suspension was issued based on [mention relevant regulations or clauses violated, e.g., Section X of the Financial Regulations Act].

- Statement from PFC regarding the suspension: The PFC released a statement emphasizing its commitment to tackling financial crime and ensuring the integrity of the financial markets. The statement underscored the seriousness of the allegations and the need for a thorough investigation.

- Potential penalties facing Gensol: Gensol faces potential penalties ranging from substantial fines to legal proceedings and even the revocation of its operating license.

Implications and Future Outlook for Gensol and the Market

The PFC's actions have sent shockwaves through the market. The suspension of the EoW transfer and the allegations of fraud have significantly impacted investor confidence.

- Projected impact on Gensol's stock price: Gensol's share price has already experienced a dramatic decline following the announcement of the PFC's investigation and the subsequent suspension.

- Investor sentiment and potential market reactions: Investor sentiment is severely negative, with many expressing concerns about the long-term viability of Gensol. This could trigger a wider sell-off in related sectors.

- Potential long-term consequences for Gensol's business operations: The scandal could severely damage Gensol's reputation, potentially leading to loss of clients, partners, and employees.

- The message this sends to other companies regarding corporate compliance: The PFC's decisive action serves as a strong warning to other companies regarding the importance of adhering to financial regulations and maintaining high standards of corporate governance.

PFC's Ongoing Investigation and Next Steps

The PFC's investigation is ongoing, and further actions are anticipated. The PFC has pledged transparency and accountability throughout the process.

- Timeline for the completion of the investigation: The PFC aims to complete its investigation within [Insert timeframe, if available].

- Potential further actions by the PFC: Further investigations may include forensic accounting, interviews with key personnel, and potentially criminal charges.

- Mechanisms for ensuring transparency and accountability: The PFC has committed to regular updates to keep stakeholders informed about the progress of the investigation.

Conclusion

The PFC's suspension of the EoW transfer to Gensol promoters in response to allegations of fraudulent activity marks a significant development in the ongoing investigation. The potential financial impact is substantial, and the ramifications for Gensol and the broader market are far-reaching. The seriousness of the situation underscores the vital role of regulatory bodies in safeguarding the financial system. Stay informed about this developing story and the PFC’s ongoing investigation into Gensol’s fraudulent activities. Follow us for updates on the PFC's actions concerning Gensol and similar cases of financial misconduct.

Featured Posts

-

Bencic Triumphs At The Abu Dhabi Open

Apr 27, 2025

Bencic Triumphs At The Abu Dhabi Open

Apr 27, 2025 -

Bencic Victoria Tras Nueve Meses De Maternidad Un Ejemplo De Superacion

Apr 27, 2025

Bencic Victoria Tras Nueve Meses De Maternidad Un Ejemplo De Superacion

Apr 27, 2025 -

Record Breaking 3 Million Sale For Camille Claudel Bronze Sculpture

Apr 27, 2025

Record Breaking 3 Million Sale For Camille Claudel Bronze Sculpture

Apr 27, 2025 -

Anti Vaccine Advocate Review Of Autism Vaccine Link Sparks Outrage Nbc Connecticut Sources

Apr 27, 2025

Anti Vaccine Advocate Review Of Autism Vaccine Link Sparks Outrage Nbc Connecticut Sources

Apr 27, 2025 -

Ariana Grandes Stunning Hair And Tattoo Transformation Professional Help Behind The Look

Apr 27, 2025

Ariana Grandes Stunning Hair And Tattoo Transformation Professional Help Behind The Look

Apr 27, 2025

Latest Posts

-

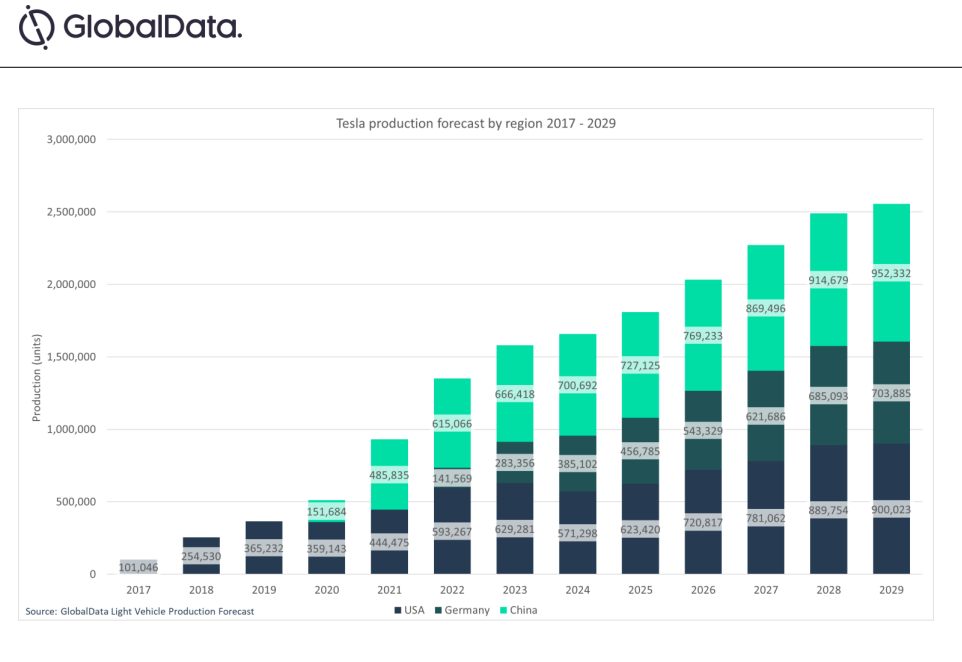

Understanding Teslas Canadian Price Increases And Inventory Strategy

Apr 27, 2025

Understanding Teslas Canadian Price Increases And Inventory Strategy

Apr 27, 2025 -

Teslas Canadian Price Hikes A Deep Dive Into The Reasons And Implications

Apr 27, 2025

Teslas Canadian Price Hikes A Deep Dive Into The Reasons And Implications

Apr 27, 2025 -

French Shipping Giant Cma Cgm Acquires Turkish Logistics Player For 440 M

Apr 27, 2025

French Shipping Giant Cma Cgm Acquires Turkish Logistics Player For 440 M

Apr 27, 2025 -

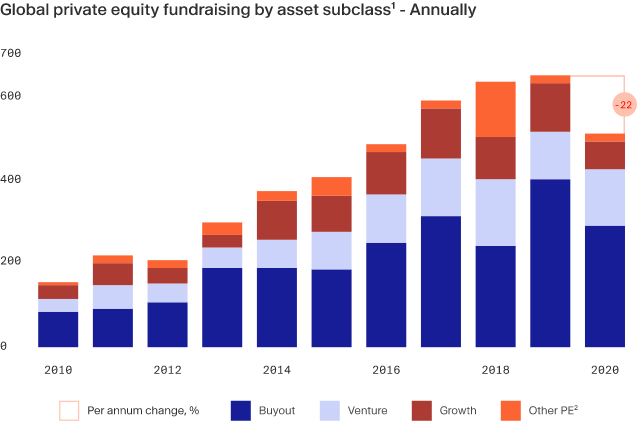

Analysis Recent Turmoil Exposes Cracks In Private Credit Market

Apr 27, 2025

Analysis Recent Turmoil Exposes Cracks In Private Credit Market

Apr 27, 2025 -

The Widening Cracks In Private Credit A Weekly Market Update

Apr 27, 2025

The Widening Cracks In Private Credit A Weekly Market Update

Apr 27, 2025