French Shipping Giant CMA CGM Acquires Turkish Logistics Player For $440M

Table of Contents

- Details of the Acquisition

- Target Company Profile

- Acquisition Price and Financing

- Strategic Rationale Behind the Acquisition

- Expanding CMA CGM's Global Footprint

- Enhancing Supply Chain Capabilities

- Market Implications and Future Outlook

- Impact on the Global Shipping Industry

- Implications for Trade Between Europe and Asia

- Conclusion

Details of the Acquisition

Target Company Profile

While the exact name of the acquired Turkish logistics company remains officially undisclosed at the time of writing, let's refer to it as "Company X" for clarity. Company X is a significant player in the Turkish logistics sector, specializing in land transport, warehousing, and freight forwarding. Its operations are strategically located to service major Turkish ports and industrial hubs, connecting them efficiently to the broader Eurasian trade network. Company X boasts a substantial market share within Turkey and has a strong reputation for its reliable and efficient supply chain solutions. Key strengths include its extensive trucking fleet, modern warehousing facilities, and a well-established network of customs brokerage services. The company also benefits from long-term contracts with key clients, further solidifying its market position.

- Company name and location: Company X, Turkey (Specific city to be added upon official release)

- Specific services offered: Trucking, warehousing, customs brokerage, last-mile delivery, and potentially specialized services like temperature-controlled transportation.

- Annual revenue and employee count: (To be added upon official release - estimations could be used if reliable sources are available)

- Key strategic assets: Extensive trucking fleet, strategically located warehouses, strong customer relationships, experienced management team, and established technological infrastructure.

Acquisition Price and Financing

The acquisition cost of Company X is reported to be $440 million. CMA CGM financed this significant merger and acquisition through a combination of its existing cash reserves and potentially secured debt financing, although the precise breakdown of funding sources has not been publicly disclosed. This substantial acquisition cost reflects the strategic value that CMA CGM places on Company X’s assets and market position within the Turkish logistics sector.

Strategic Rationale Behind the Acquisition

Expanding CMA CGM's Global Footprint

This CMA CGM acquisition represents a major step in expanding its global footprint and enhancing its presence in a strategically vital region. Turkey's geographic location serves as a crucial bridge between Europe and Asia, making it a gateway for significant trade flows along the traditional Silk Road and other vital global trade routes. By acquiring Company X, CMA CGM gains immediate access to a substantial market share within the Turkish logistics sector, opening doors to new customer bases and significantly improving its ability to manage cargo to and from Turkey. This acquisition also offers a stepping stone for expansion into other Central Asian and Middle Eastern markets.

- Access to new markets and customer base: Significant expansion into the Turkish market and potential access to neighboring countries.

- Strengthened logistics network and infrastructure: Acquisition of Company X’s trucking fleet, warehousing capacity, and customs brokerage network strengthens CMA CGM’s land-based logistics capabilities within Turkey.

- Potential synergies with existing CMA CGM operations: Opportunities for integrating Company X’s operations with CMA CGM's existing global network for enhanced efficiency.

- Improved efficiency in handling cargo to and from Turkey: Streamlined end-to-end logistics solutions and reduced transit times.

Enhancing Supply Chain Capabilities

The integration of Company X directly enhances CMA CGM’s supply chain optimization capabilities. The acquisition provides a comprehensive, integrated logistics solution, allowing CMA CGM to offer end-to-end services, from port-to-door delivery, thereby bolstering its position as a leading provider of integrated services. This move strengthens CMA CGM's ability to provide its customers with comprehensive, reliable, and cost-effective solutions across the entire supply chain. This move is key to competing effectively in the dynamic and increasingly competitive global logistics market, where supply chain agility is paramount.

Market Implications and Future Outlook

Impact on the Global Shipping Industry

This CMA CGM acquisition will undoubtedly impact the global shipping market. It signifies a wave of consolidation within the industry, potentially leading to further mergers and acquisitions as major players seek to expand their market share and secure a competitive edge. The increased market share for CMA CGM could influence freight rates and service offerings within the Turkish and potentially broader Eurasian markets. Increased competition within the Turkish logistics sector could lead to greater innovation and more competitive pricing for customers.

- Increased market share for CMA CGM: Strengthened position in the global shipping market and particularly in the strategically important Turkish logistics sector.

- Potential consolidation within the Turkish logistics sector: This acquisition may spur further consolidation within the Turkish logistics industry, with other companies facing pressure to merge or acquire to remain competitive.

- Impact on pricing and service offerings: Potential for more competitive pricing and enhanced service offerings due to increased competition or a shift in market power.

- Long-term implications for trade routes: This acquisition will significantly improve CMA CGM’s ability to handle cargo along key trade routes between Europe and Asia, enhancing efficiency and potentially attracting more trade flows.

Implications for Trade Between Europe and Asia

Turkey’s strategic location at the crossroads of Europe and Asia makes this CMA CGM acquisition particularly significant for Eurasian trade. The acquisition facilitates smoother and more efficient movement of goods between these two continents, potentially boosting trade volumes and enhancing economic ties. This improved connectivity could further contribute to the development of the "New Silk Road" initiatives and other trade partnerships involving Eurasian nations.

Conclusion

CMA CGM's $440 million acquisition of Company X represents a pivotal moment in the global shipping industry. This strategic move significantly expands CMA CGM's global reach, strengthens its supply chain capabilities, and enhances its position in the critical Eurasian trade corridor. The implications are far-reaching, impacting the competitive landscape, freight rates, and the overall flow of goods between Europe and Asia. This CMA CGM acquisition showcases a significant investment in future growth and market dominance. Stay informed about this significant CMA CGM acquisition and follow our updates on the evolving global shipping industry to learn more about the impact of this strategic move.

Exploring Ariana Grandes Style Evolution Professional Help And Creative Choices

Exploring Ariana Grandes Style Evolution Professional Help And Creative Choices

Open Thread February 16 2025 Discussion

Open Thread February 16 2025 Discussion

Charleston Open Pegula Upsets Collins In Thrilling Match

Charleston Open Pegula Upsets Collins In Thrilling Match

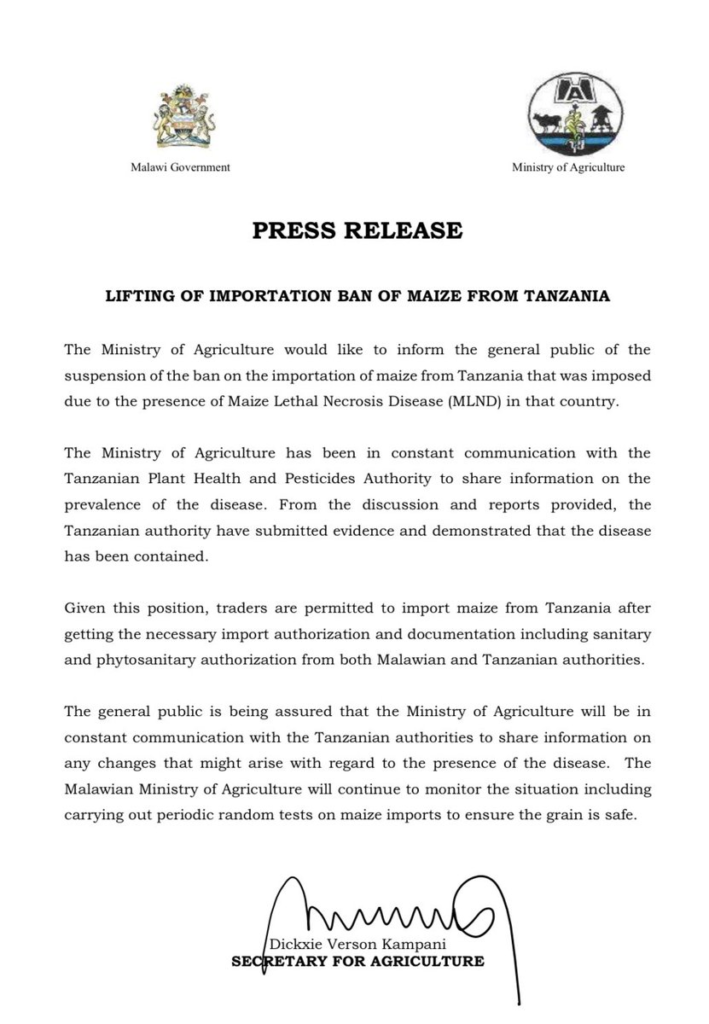

Potential End To Farm Import Ban Following South Africa Tanzania Discussions

Potential End To Farm Import Ban Following South Africa Tanzania Discussions

Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

Buy Ariana Grande Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

11 Drop In Three Days Amsterdam Stock Exchange Faces Significant Losses

11 Drop In Three Days Amsterdam Stock Exchange Faces Significant Losses

Amsterdam Exchange Plunges Three Days Of Heavy Losses Totaling 11

Amsterdam Exchange Plunges Three Days Of Heavy Losses Totaling 11

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Losses Down 11

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Losses Down 11

The Philips Future Health Index 2025 How Ai Will Reshape Global Healthcare

The Philips Future Health Index 2025 How Ai Will Reshape Global Healthcare

Le Borse Crollano L Ue Pronta A Reagire Ai Nuovi Dazi

Le Borse Crollano L Ue Pronta A Reagire Ai Nuovi Dazi