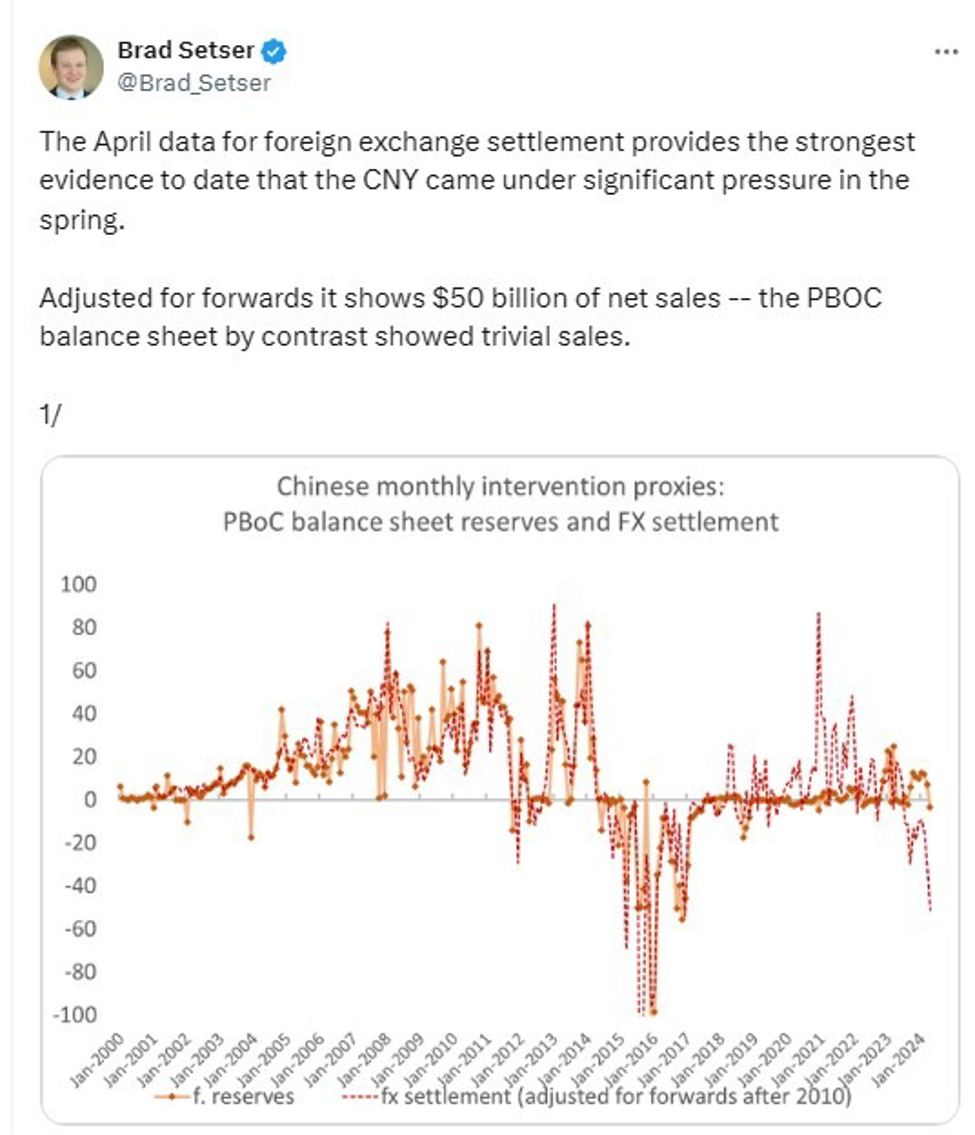

PBOC Daily Yuan Support Below Estimates: A First In 2024

Table of Contents

Reasons Behind the Unexpectedly Low PBOC Yuan Support

The PBOC's decision to lower daily yuan support likely stems from a confluence of factors, signaling a potential shift in its economic priorities and approach to currency management.

Shifting Economic Priorities

The PBOC might be prioritizing other economic goals over maintaining a rigidly controlled exchange rate for the Chinese Yuan (CNY) or RMB. This could involve:

- Inflation Control: If inflationary pressures are rising, the PBOC may choose to allow some Yuan depreciation to cool down the economy, rather than aggressively supporting the currency.

- Supporting Domestic Growth: A weaker Yuan can boost exports by making Chinese goods cheaper internationally, potentially stimulating economic growth. This approach might be favored if domestic demand is weak.

- Managing Capital Flows: Reduced intervention might be a strategy to manage capital outflows and maintain stability within the financial system.

Assessment of Market Forces

The PBOC may be increasingly confident in the ability of market forces to determine the Yuan's value. This suggests a potential move towards a more market-based exchange rate system.

- Increased Market Efficiency: The PBOC might believe that the market is becoming more efficient in pricing the Yuan, reducing the need for significant intervention.

- Gradual Deregulation: This could indicate a longer-term strategy towards greater liberalization of the Chinese currency market.

- Data-Driven Decision Making: Improved economic modeling and data analysis may allow the PBOC to better predict market movements, leading to less frequent and smaller-scale interventions.

Global Economic Uncertainty

External factors also play a crucial role. Global economic headwinds could influence the PBOC's decision.

- Interest Rate Hikes: Interest rate increases in other major economies can strengthen those currencies relative to the Yuan, potentially leading to increased pressure on the CNY.

- Geopolitical Instability: Global geopolitical uncertainty can impact investor sentiment and capital flows, potentially influencing the PBOC's response.

- Commodity Prices: Fluctuations in global commodity prices, particularly those of key exports and imports for China, can significantly affect the Yuan’s value and the need for intervention.

Impact of Reduced PBOC Yuan Support on the Chinese Economy

The reduced PBOC daily yuan support has several potential consequences for the Chinese economy.

Yuan Volatility and its Effects

A less managed Yuan could lead to increased volatility in the exchange rate. This could:

- Impact Trade: Increased volatility makes it harder for businesses to forecast future exchange rates, increasing uncertainty in international trade transactions.

- Affect Inflation: A weaker Yuan can increase the cost of imported goods, potentially contributing to inflation.

- Influence Consumer Confidence: Exchange rate volatility can negatively impact consumer confidence, affecting spending and overall economic growth.

Impact on Foreign Investment

The change in PBOC policy might influence foreign investment in China:

- FDI Flows: Increased Yuan volatility could deter some foreign direct investment (FDI), especially for long-term projects.

- Portfolio Investment: Short-term capital flows might become more sensitive to exchange rate movements, impacting portfolio investment.

- Capital Controls: The PBOC might need to adjust capital controls to manage the effects of increased volatility.

Implications for Chinese Businesses

Chinese businesses, particularly those involved in international trade, could face challenges:

- Hedging Costs: Businesses might incur higher costs to hedge against exchange rate risks.

- Pricing Strategies: Companies will need to adjust their pricing strategies to account for a more volatile Yuan.

- Profitability: Exchange rate fluctuations could impact the profitability of export-oriented businesses.

Global Market Reactions to Reduced PBOC Yuan Support

The reduced PBOC intervention is impacting global markets in several ways:

- Currency Markets: The move has influenced other currencies, particularly those in the Asian region, as investors reassess their positions.

- International Trade: Changes in the Yuan's value affect global trade flows and the competitiveness of various economies.

- Investor Sentiment: The decision has sparked discussions and analysis among investors regarding the future trajectory of the Chinese economy and its implications for global markets.

Conclusion: The Future of PBOC Daily Yuan Support and its Implications

The PBOC's decision to reduce its daily yuan support represents a potential turning point in China's economic strategy. The reasons appear multifaceted, involving a shift in economic priorities, a greater reliance on market mechanisms, and a response to global economic uncertainties. The consequences, while potentially challenging in terms of increased exchange rate volatility and its effect on trade and investment, may also offer opportunities for greater market efficiency and economic restructuring. To understand the evolving dynamics of PBOC daily Yuan intervention and its impact on the global economy, follow the latest updates on PBOC yuan support and remain informed about related economic developments.

Featured Posts

-

Review Of The Best Black Decker Steam Irons Available

May 16, 2025

Review Of The Best Black Decker Steam Irons Available

May 16, 2025 -

Tam Krwz Awr An Ky Nyy Grl Frynd Hqyqt Ya Afwah

May 16, 2025

Tam Krwz Awr An Ky Nyy Grl Frynd Hqyqt Ya Afwah

May 16, 2025 -

How An Under The Radar App Could Challenge Metas Reign

May 16, 2025

How An Under The Radar App Could Challenge Metas Reign

May 16, 2025 -

Yuan Support Measures Underwhelm Pbocs 2024 Intervention

May 16, 2025

Yuan Support Measures Underwhelm Pbocs 2024 Intervention

May 16, 2025 -

Menendez Brothers Judge Allows Resentencing

May 16, 2025

Menendez Brothers Judge Allows Resentencing

May 16, 2025

Latest Posts

-

Analyzing The Dodgers Left Handed Hitters Recent Slump

May 16, 2025

Analyzing The Dodgers Left Handed Hitters Recent Slump

May 16, 2025 -

The Ha Seong Kim Blake Snell Friendship A Case Study In Mlb Mentorship For Koreans

May 16, 2025

The Ha Seong Kim Blake Snell Friendship A Case Study In Mlb Mentorship For Koreans

May 16, 2025 -

Left Handed Hitters Fueling Dodgers Fight To End Slump

May 16, 2025

Left Handed Hitters Fueling Dodgers Fight To End Slump

May 16, 2025 -

Analyzing The Support System Ha Seong Kim Blake Snell And Korean Baseball Players

May 16, 2025

Analyzing The Support System Ha Seong Kim Blake Snell And Korean Baseball Players

May 16, 2025 -

Dodgers Left Handers Eyeing A Comeback After Recent Slump

May 16, 2025

Dodgers Left Handers Eyeing A Comeback After Recent Slump

May 16, 2025