Parkland's US$9 Billion Acquisition: June Shareholder Vote Decides Fate

Table of Contents

The Details of the Proposed Acquisition

Parkland Corporation, a leading independent fuel marketer and convenience store operator, is seeking to acquire [Target Company Name], a significant player in [Target Company's Industry Segment within the energy sector]. [Target Company Name]'s key assets include [List key assets, e.g., a network of strategically located fuel terminals, a robust pipeline infrastructure, a substantial portfolio of retail locations].

Parkland's rationale for this US$9 billion acquisition centers around several key strategic objectives. The acquisition is expected to generate significant synergies through economies of scale in fuel procurement, logistics, and operational efficiencies. Furthermore, it offers Parkland significant market expansion into new geographic territories and access to complementary product lines, enhancing its overall portfolio diversification.

Financially, the acquisition is structured with [Briefly describe financing methods, e.g., a combination of debt and equity financing]. Parkland projects [Mention projected returns on investment or other key financial metrics].

- Key benefits for Parkland: Increased market share, geographical diversification, enhanced product offerings, improved operational efficiency, and potential for significant revenue growth.

- Potential risks and challenges: Integration complexities, regulatory hurdles, potential for unforeseen liabilities, and the risk of overpaying for the target company.

- Comparison to other recent acquisitions: This acquisition compares favorably/unfavorably to [mention a couple of recent comparable acquisitions in the energy sector] in terms of size, strategic rationale, and projected returns. A detailed analysis of these comparisons is crucial for shareholders to form their opinion.

Shareholder Sentiment and Expected Vote Outcome

The current sentiment among Parkland shareholders regarding the US$9 billion acquisition is mixed. While some investors view it as a strategic masterstroke with significant long-term growth potential, others express concerns about the substantial financial commitment and the potential integration challenges.

Public statements from major shareholders and institutional investors are [Summarize public statements; e.g., some institutional investors have publicly endorsed the deal, while others have voiced concerns about valuation]. The potential influence of proxy voting and activist investors could significantly impact the final voting outcome.

- Arguments for the acquisition: Significant growth opportunities, increased market share, enhanced competitiveness, and improved long-term profitability.

- Arguments against the acquisition: High purchase price, potential integration risks, significant debt burden, and uncertain market conditions.

- Predicted voting patterns: [Analyze expected voting patterns based on available information. E.g., A majority of institutional investors are anticipated to vote in favor, but there is significant uncertainty regarding retail shareholder support].

- Potential scenarios post-vote: Successful acquisition leading to market expansion and enhanced profitability; failed acquisition resulting in Parkland pursuing alternative strategies; renegotiation of acquisition terms leading to a revised deal.

Market Reactions and Industry Implications

The market's reaction to the proposed acquisition has been [Describe market reactions, e.g., Parkland's stock price initially increased, then showed some volatility, reflecting investor uncertainty]. Analyst reports have [Summarize analyst opinions, e.g., a mix of positive and negative outlooks depending on the individual analyst’s assessment of the acquisition's success].

The acquisition's potential impact on the broader energy sector is [Discuss potential impacts, e.g., potential consolidation within the fuel marketing sector, pressure on competitor pricing strategies]. The competitive landscape will undoubtedly shift, with rival companies likely adjusting their strategies in response to Parkland's potentially enhanced market position.

- Impact on Parkland's stock price: [Analyze stock price trends leading up to and following the vote and significant news events.]

- Potential changes in market share and competition: [Discuss anticipated changes in the market following the acquisition.]

- Long-term implications for the energy industry: [Explore longer-term implications, such as changes in industry structure and competitive dynamics.]

Alternative Scenarios and Contingency Plans

Should the shareholder vote fail, Parkland may explore several alternative scenarios. These could include renegotiating the acquisition terms with [Target Company Name] to achieve a more favorable deal structure or withdrawing the bid altogether.

Parkland's contingency plans likely involve [Discuss contingency plans, e.g., focusing on organic growth strategies, exploring alternative acquisition targets, or undertaking a comprehensive review of strategic priorities].

- Potential for renegotiation: A renegotiated deal might involve a lower purchase price, a different financing structure, or adjustments to the acquisition scope.

- Alternative strategic options: If the acquisition fails, Parkland may prioritize organic growth initiatives, explore smaller, complementary acquisitions, or even divest certain assets to strengthen its balance sheet.

Conclusion: The Future Hinges on the June Shareholder Vote for Parkland's US$9 Billion Acquisition

The June shareholder vote represents a pivotal moment for Parkland Corporation. The outcome of this US$9 billion acquisition will significantly impact the company's future growth trajectory, its position within the energy sector, and the competitive dynamics of the market. The potential scenarios – a successful acquisition leading to market dominance, a failed acquisition forcing a strategic rethink, or a renegotiated deal – all hold significant implications for investors and the wider energy industry. Understanding shareholder sentiment, market reactions, and the potential consequences is crucial for navigating this significant event.

Stay tuned for updates on the outcome of Parkland's US$9 billion acquisition and the impact on the energy market. Follow us for the latest analysis on this landmark deal and other significant mergers and acquisitions in the sector.

Featured Posts

-

Nhl 25 This Weeks Arcade Mode Reveal

May 07, 2025

Nhl 25 This Weeks Arcade Mode Reveal

May 07, 2025 -

Oficialne Svetovy Pohar V Hokeji Sa Vrati V Roku 2028

May 07, 2025

Oficialne Svetovy Pohar V Hokeji Sa Vrati V Roku 2028

May 07, 2025 -

The Impact Of Trumps Xrp Support On Institutional Interest

May 07, 2025

The Impact Of Trumps Xrp Support On Institutional Interest

May 07, 2025 -

Is A Trade Imminent Pittsburgh Steelers And Their Top Wide Receiver

May 07, 2025

Is A Trade Imminent Pittsburgh Steelers And Their Top Wide Receiver

May 07, 2025 -

Kocani In Okolica Pokop Zrtev Smrtonosnega Pozara V Nocnem Klubu

May 07, 2025

Kocani In Okolica Pokop Zrtev Smrtonosnega Pozara V Nocnem Klubu

May 07, 2025

Latest Posts

-

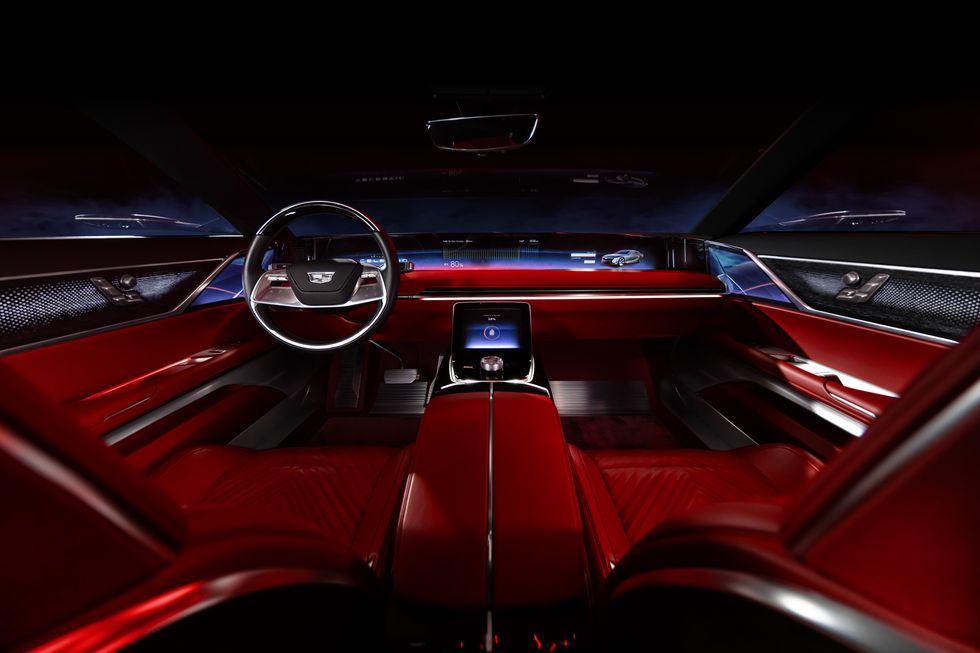

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025 -

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025

Cadillac Celestiq First Drive Review A 360 000 Electric Luxury Experience

May 08, 2025 -

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025 -

The Rise Of Deadly Fungi A Looming Public Health Emergency

May 08, 2025

The Rise Of Deadly Fungi A Looming Public Health Emergency

May 08, 2025 -

Chinas Rate Cuts Easier Bank Lending Amidst Tariff Impact

May 08, 2025

Chinas Rate Cuts Easier Bank Lending Amidst Tariff Impact

May 08, 2025