Palantir Technologies Stock: Buy, Sell, Or Hold? Evaluating The Investment

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two distinct revenue streams: government contracts and commercial partnerships. Both are crucial to understanding the company's overall financial health and future potential.

Government Contracts

Government contracts form a significant portion of Palantir's revenue. The company provides its sophisticated data analytics platform to various intelligence agencies and defense departments worldwide, assisting in national security and other critical government functions.

- Examples of government clients: While specific details are often confidential due to national security concerns, Palantir has publicly acknowledged working with agencies such as the CIA and various branches of the US military, along with international government organizations.

- Contract values: Contract values vary significantly depending on the scope and duration of the project. While precise figures aren't always publicly available, reports suggest some contracts run into hundreds of millions of dollars.

- Potential risks associated with government reliance: Dependence on government contracts exposes Palantir to potential risks, including changes in government spending, shifts in political priorities, and the potential for contract delays or cancellations. This reliance is a crucial factor in evaluating PLTR stock. Keywords: Government contracts, defense spending, intelligence community, data analytics, national security.

Commercial Partnerships

Palantir is aggressively expanding its commercial partnerships, aiming to diversify its revenue streams beyond government contracts. This sector presents significant growth potential, though it also presents unique challenges.

- Key commercial clients across various sectors: Palantir works with major players in finance, healthcare, and other industries, leveraging its platform for data integration and analytics. Examples include partnerships aimed at improving fraud detection in financial institutions and optimizing operational efficiency in healthcare organizations.

- Success stories: Several successful commercial deployments showcase Palantir's ability to deliver value to its clients, contributing to revenue growth and demonstrating the platform's versatility.

- Challenges faced in commercial expansion: Competition in the commercial market is intense, with established tech giants and agile startups vying for market share. Successfully penetrating and dominating these sectors requires significant investment and strategic partnerships. Keywords: Commercial partnerships, enterprise software, data integration, healthcare analytics, financial services.

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is critical for any investment decision. This section examines key financial metrics and provides insights into the company's current standing.

Revenue Growth and Profitability

Palantir has demonstrated significant revenue growth, but profitability remains a key area of focus for investors. Analyzing key financial ratios offers a clearer picture.

- Year-over-year revenue growth: Investors should carefully review the historical revenue growth figures to gauge the company's trajectory and assess the sustainability of this growth.

- Profitability metrics (net income, EBITDA): Monitoring net income and EBITDA (earnings before interest, taxes, depreciation, and amortization) helps assess the company's ability to generate profits. The trend in these metrics is crucial for long-term investment decisions concerning PLTR stock.

- Comparison to competitors: Benchmarking Palantir's financial performance against its competitors provides context and helps assess its relative strength and potential for future growth. Keywords: Revenue growth, profitability, financial ratios, EBITDA margin, net income, earnings per share (EPS).

Stock Valuation and Price Targets

Evaluating Palantir's stock valuation involves considering its current market price relative to its revenue and comparing it to analyst price targets.

- Current stock price: The current market price reflects investor sentiment and expectations for future performance.

- P/S ratio: The price-to-sales ratio provides insights into the market's valuation of Palantir's revenue.

- Analyst ratings and price targets: Analyst ratings and price targets offer different perspectives on the stock's potential, highlighting the range of expectations among market experts.

- Potential upside/downside: Analyzing various scenarios and assessing potential upside and downside risks provides a balanced view of the investment opportunity. Keywords: Stock valuation, price-to-sales ratio, analyst ratings, price target, stock performance.

Risks and Challenges Facing Palantir

While Palantir exhibits significant potential, understanding the risks and challenges is vital for making informed investment decisions.

Competition and Market Saturation

The data analytics market is highly competitive, with both established tech giants and emerging players vying for market share.

- Key competitors: Identifying key competitors, such as established players in the big data and cloud computing space, is essential for understanding the competitive landscape.

- Market share analysis: Analyzing market share trends helps determine Palantir's position and its ability to maintain or expand its share in a competitive market.

- Potential for increased competition: Assessing the likelihood of increased competition and the potential impact on Palantir's market position is crucial.

- Strategies to maintain market position: Examining Palantir's strategies for maintaining its competitive advantage, such as innovation and strategic partnerships, is essential. Keywords: Competition, market saturation, competitive landscape, market share, strategic advantage.

Dependence on Large Contracts

Palantir's reliance on large, long-term contracts, particularly government contracts, presents a significant risk.

- Contract renewal risks: The risk of contract non-renewal or renegotiation at unfavorable terms could significantly impact Palantir's revenue stream.

- Diversification strategy: Analyzing Palantir's strategy for diversifying its revenue streams beyond large contracts is crucial for assessing long-term sustainability.

- Impact of contract losses on financial performance: Evaluating the potential financial impact of losing major contracts is crucial for understanding the risk profile of PLTR stock. Keywords: Contract risk, contract renewal, revenue diversification, dependence on large clients.

Future Growth and Potential

Palantir's future growth prospects hinge on its ability to innovate, expand into new markets, and successfully execute its strategic goals.

Product Innovation and Development

Palantir's commitment to product innovation and development is crucial for maintaining its competitive edge.

- New product launches: Tracking new product launches and assessing their market potential provides insights into Palantir's ability to adapt to changing market demands.

- R&D investment: Monitoring research and development (R&D) investment indicates Palantir's commitment to long-term growth and innovation.

- Potential new market opportunities: Identifying potential new markets and assessing their potential for revenue growth is crucial for evaluating long-term prospects.

- Strategic acquisitions: Analyzing the potential impact of strategic acquisitions on Palantir's growth trajectory and expansion into new markets is important. Keywords: Product innovation, R&D investment, new product launches, market expansion, strategic acquisitions.

Long-Term Growth Prospects

Evaluating Palantir's long-term growth potential requires a comprehensive assessment of various factors.

- Long-term growth projections: Reviewing long-term growth projections and evaluating their realism and plausibility helps assess potential returns.

- Market opportunity: Analyzing the size and growth potential of the overall market helps determine the potential for Palantir to capture market share.

- Potential for increased market share: Assessing Palantir's ability to increase its market share within the competitive landscape is vital.

- Sustainability of growth: Evaluating the sustainability of Palantir's growth trajectory, considering factors like competition and market saturation, is crucial. Keywords: Long-term growth, market opportunity, sustainable growth, future prospects.

Conclusion

This comprehensive analysis of Palantir Technologies stock reveals a company with significant potential but also considerable risks. While its strong government contracts provide a stable revenue base, its reliance on large contracts and the competitive landscape necessitate careful consideration. Investors should carefully weigh the financial performance, valuation, and inherent risks before deciding whether to buy, sell, or hold PLTR stock. Conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions related to Palantir Technologies stock. Remember, this analysis is not financial advice; the ultimate decision on whether to buy, sell, or hold Palantir Technologies stock rests solely with you.

Featured Posts

-

Aoc Calls Out Fox News Host For Trump Adoration

May 10, 2025

Aoc Calls Out Fox News Host For Trump Adoration

May 10, 2025 -

Large Scale Music Festival With Olly Murs At Picturesque Castle Near Manchester

May 10, 2025

Large Scale Music Festival With Olly Murs At Picturesque Castle Near Manchester

May 10, 2025 -

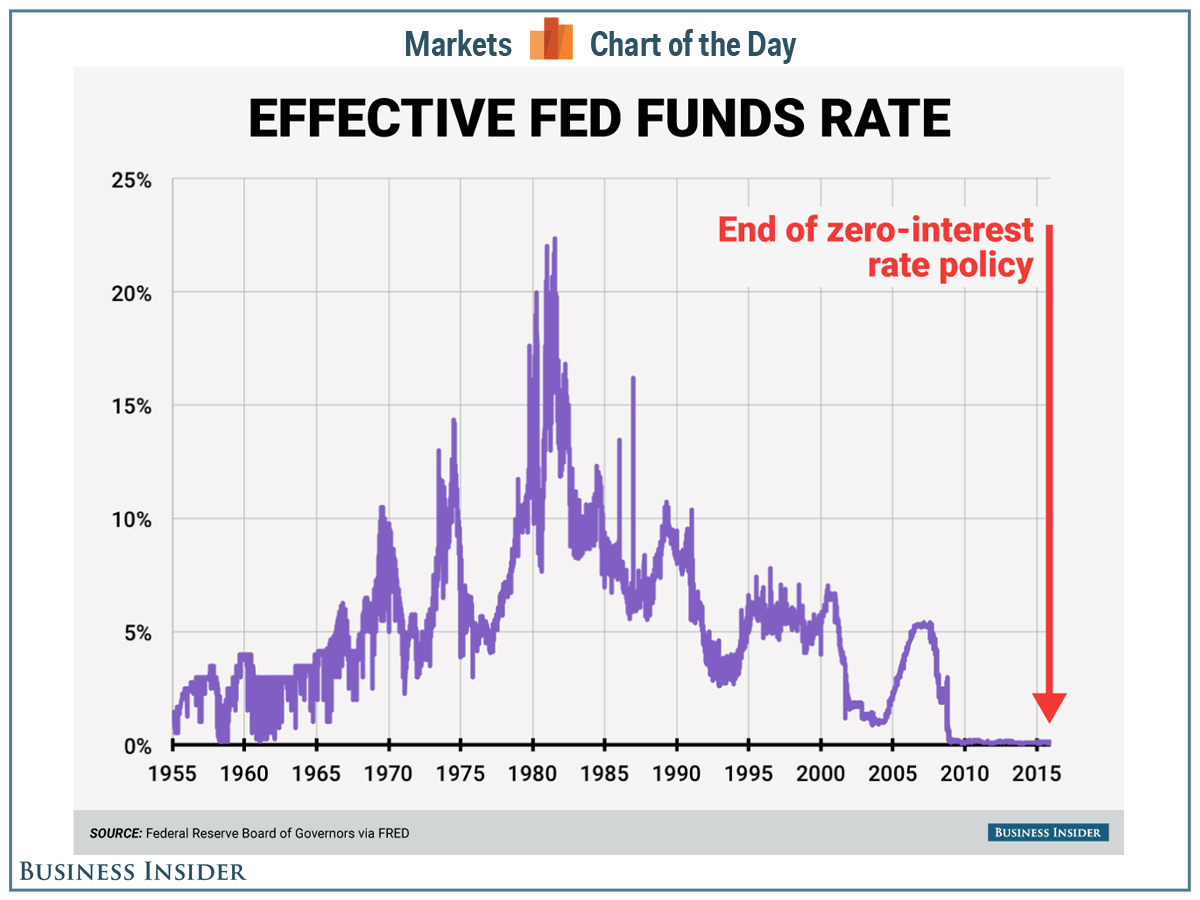

Federal Reserves Stance A Deep Dive Into Why Rate Cuts Are Delayed

May 10, 2025

Federal Reserves Stance A Deep Dive Into Why Rate Cuts Are Delayed

May 10, 2025 -

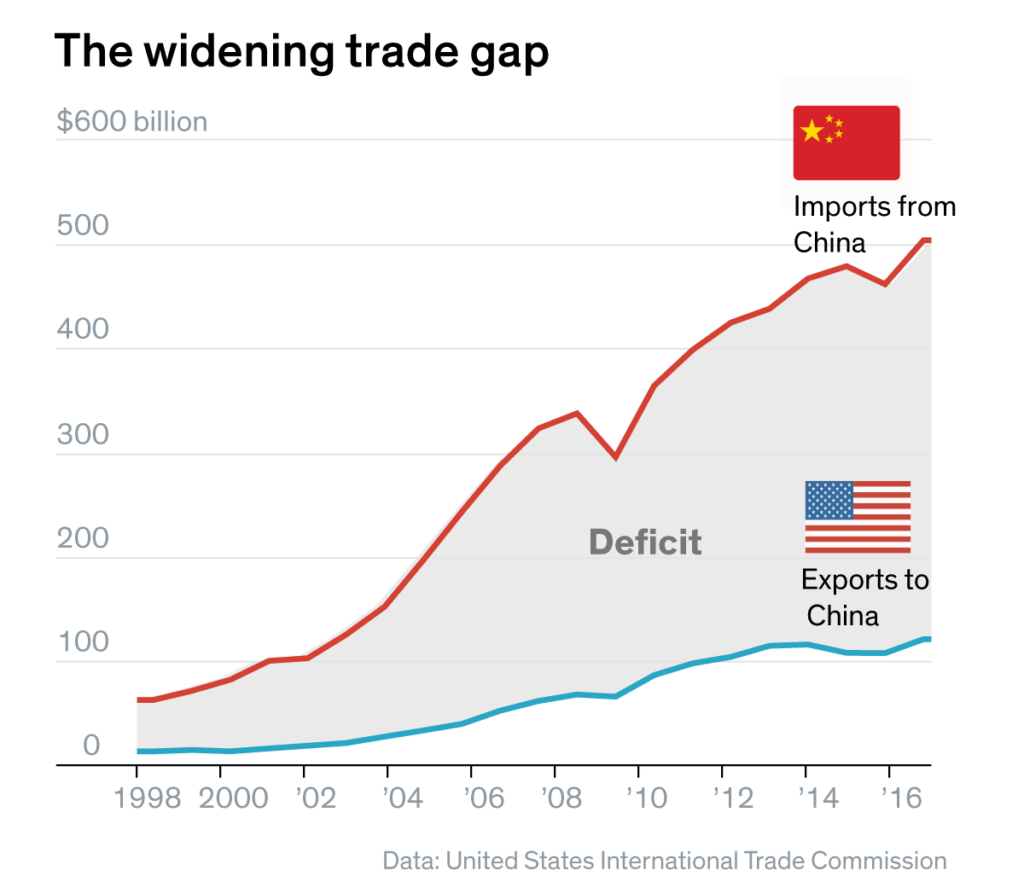

174 Billion Loss Trumps Trade War Impacts Top Global Billionaires

May 10, 2025

174 Billion Loss Trumps Trade War Impacts Top Global Billionaires

May 10, 2025 -

Elizabeth Hurleys Maldives Holiday Bikini Photos And Relaxation

May 10, 2025

Elizabeth Hurleys Maldives Holiday Bikini Photos And Relaxation

May 10, 2025