Palantir Technologies Stock: Buy, Sell, Or Hold? A 2024 Investment Guide

Table of Contents

Palantir Technologies' Business Model and Growth Prospects

Palantir Technologies' core business revolves around providing big data analytics and software platforms to both government and commercial clients. Its flagship platforms, Gotham and Foundry, enable organizations to integrate and analyze massive datasets, uncovering actionable insights for improved decision-making.

Palantir's primary target markets include government agencies (defense, intelligence, etc.) and large commercial enterprises across diverse sectors. Examples of government clients include various branches of the US military and intelligence communities, while commercial clients span industries like finance, healthcare, and energy. Understanding the nuances of these distinct markets is crucial when analyzing Palantir stock price trends.

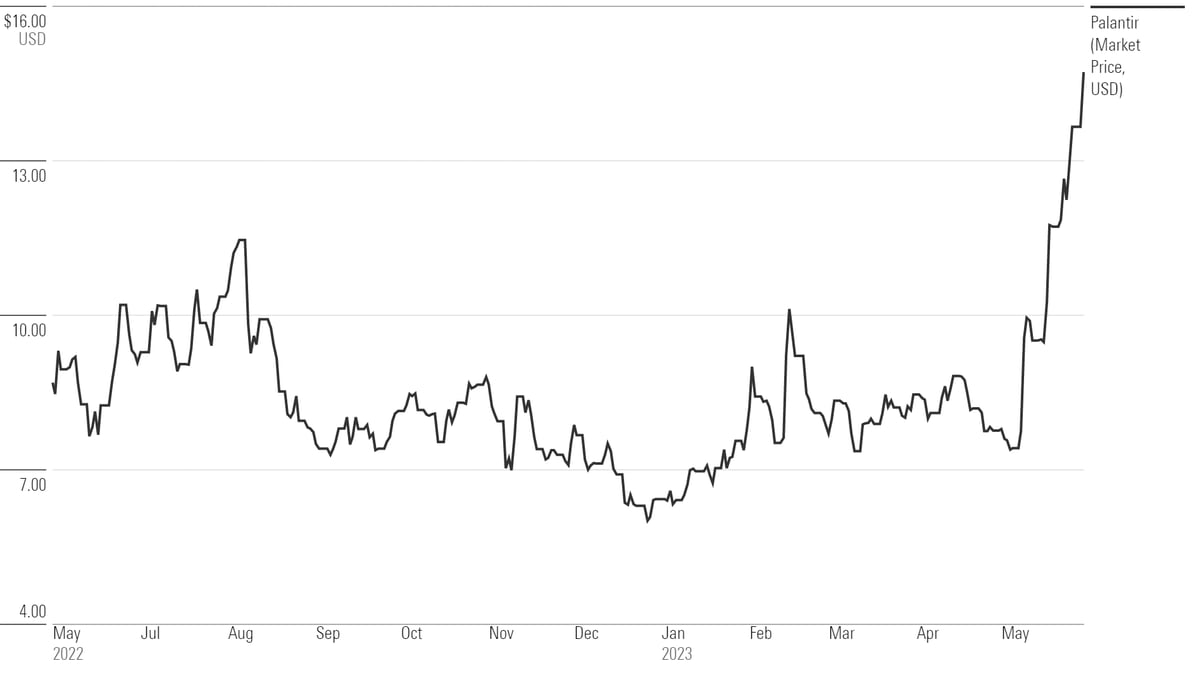

Recent financial performance for Palantir shows a mixed bag. While revenue growth has been positive, profitability remains a challenge. Investors should closely monitor quarterly earnings reports to track key metrics such as revenue growth, operating margins, and customer acquisition costs. Analyzing these trends alongside the Palantir stock price is crucial for informed decision-making.

- Strengths: Data analytics expertise, strong government contracts, expanding commercial market penetration, increasing adoption of AI and machine learning within their platforms.

- Weaknesses: High reliance on government contracts, competition from other data analytics firms (like Databricks and Snowflake), high valuation relative to profitability.

- Opportunities: Growth in AI and machine learning applications, expansion into new markets (e.g., healthcare, finance, and sustainability), potential for increased international sales.

- Threats: Geopolitical risks affecting government contracts, changing government priorities and budget allocations, technological disruption from emerging competitors, data privacy and security concerns.

Analyzing Palantir Stock Valuation and Financials

Evaluating Palantir stock requires a thorough assessment of its valuation metrics. Commonly used metrics include the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and various cash flow measures. Comparing these ratios to those of competitors in the data analytics space is essential for determining whether the Palantir stock price is overvalued or undervalued.

Analyzing Palantir's cash flow and debt levels is also crucial. A strong cash flow suggests financial health and stability, while high debt levels can signal increased financial risk. Investors should scrutinize the company's balance sheet and cash flow statement to gain a comprehensive understanding of its financial position. The company's future earnings expectations, as reflected in analysts' forecasts, are another important consideration when assessing the Palantir stock price.

- Key financial ratios: P/E ratio, P/S ratio, free cash flow, debt-to-equity ratio. Understanding these ratios and their trends is crucial for assessing the Palantir investment potential.

- Competitor comparison: Comparing valuation metrics with those of similar data analytics companies helps determine if Palantir stock is appropriately priced.

- Debt-to-equity ratio: A high debt-to-equity ratio indicates higher financial risk, affecting the potential return on your Palantir investment.

- Projected growth rates: Analyst forecasts of future revenue and earnings growth significantly impact the projected Palantir stock price.

Risks and Potential Challenges for Palantir Investors

Investing in Palantir Technologies stock carries inherent risks. The high volatility of the Palantir stock price is a significant concern. Competition from established tech giants and smaller, more agile companies also poses a challenge. Regulatory hurdles, especially concerning data privacy and security, could further impact the company's performance and, subsequently, the Palantir stock price.

Geopolitical risks associated with the company's reliance on government contracts present another significant risk factor. Budget cuts or changes in government priorities could negatively affect revenue and profitability. Economic downturns can also impact demand for Palantir's services, further influencing the Palantir stock price.

- Government contract risks: Changes in government spending or policy could dramatically affect Palantir's revenue stream.

- Competition: Established tech giants and emerging data analytics firms are strong competitors.

- Data privacy and security concerns: Breaches or regulatory changes could severely damage Palantir's reputation and business.

- Economic downturns: Reduced spending by both government and commercial clients during economic downturns poses a significant threat.

Comparing Palantir to Competitors

To fully understand Palantir's market position, a comparison with its key competitors is essential. Companies like Databricks, Snowflake, and even larger tech giants like Microsoft and Google offer competing data analytics solutions. A comparative analysis should consider their business models, revenue streams, market share, and overall financial performance. This will highlight Palantir's advantages and disadvantages in the competitive landscape and help you make an informed decision on whether to buy, sell, or hold Palantir stock.

- Key Competitors: Databricks, Snowflake, Microsoft Azure, Google Cloud Platform. Researching these competitors provides a broader perspective on the market dynamics influencing PLTR stock.

- Comparison Table: A table comparing revenue, market share, and key business model differentiators would aid in a comprehensive analysis.

- Competitive Advantages/Disadvantages: Palantir's strengths lie in its specialized government contracts and platform capabilities, while its reliance on these contracts and high valuation are weaknesses.

Expert Opinions and Analyst Ratings on PLTR Stock

The consensus view among leading financial analysts regarding Palantir stock is crucial for investment decisions. Investors should review buy, sell, or hold ratings from reputable sources like Goldman Sachs, Morgan Stanley, and others. Note that these ratings vary and often reflect differing perspectives on Palantir's growth potential and risk profile. Pay close attention to any recent upgrades or downgrades and the reasoning behind them.

- Analyst Ratings: Compile a summary of analyst ratings and their associated price targets.

- Price Targets: Consider the range of price targets provided by various analysts to get a sense of the potential price range for PLTR stock.

- Upgrades/Downgrades: Monitor changes in analyst ratings and the justifications for those changes.

Conclusion: Making Your Palantir Technologies Stock Investment Decision

This guide has analyzed Palantir Technologies' business model, financial performance, competitive landscape, and potential risks. While Palantir possesses significant strengths, including its expertise in data analytics and strong government contracts, it also faces challenges like high valuation and reliance on specific clients. The high volatility of Palantir stock necessitates a careful assessment of your risk tolerance. Based on the presented information, a cautious approach might be warranted; whether it's a buy, sell, or hold situation depends heavily on your individual investment goals and risk profile.

While this guide provides valuable insights into Palantir Technologies stock, remember to conduct your own thorough due diligence before making any investment decisions. Carefully consider your risk tolerance and investment goals when deciding whether to buy, sell, or hold Palantir Technologies stock in 2024.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025 -

Kilmar Abrego Garcia De La Violencia Salvadorena A La Polarizacion Politica Estadounidense

May 09, 2025

Kilmar Abrego Garcia De La Violencia Salvadorena A La Polarizacion Politica Estadounidense

May 09, 2025 -

Stephen King Compares Stranger Things To It Key Similarities And Differences

May 09, 2025

Stephen King Compares Stranger Things To It Key Similarities And Differences

May 09, 2025 -

Draisaitls Lower Body Injury Timeline For Edmonton Oilers Centers Return

May 09, 2025

Draisaitls Lower Body Injury Timeline For Edmonton Oilers Centers Return

May 09, 2025 -

Complete Guide To Nyt Strands Game 405 April 12 2024

May 09, 2025

Complete Guide To Nyt Strands Game 405 April 12 2024

May 09, 2025