Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams: Understanding the Fundamentals

Palantir's success hinges on its ability to leverage its cutting-edge data analytics platforms to serve both government and commercial clients. Understanding its revenue streams is crucial to assessing the long-term potential of Palantir Technologies stock.

Government Contracts: A Core Revenue Driver

Government contracts represent a substantial portion of Palantir's revenue. The company provides sophisticated data analytics solutions to various government agencies, assisting them in areas like national security, intelligence gathering, and public health.

- Key Clients: While specific client details are often confidential due to security concerns, Palantir has publicly acknowledged working with numerous US government agencies and international partners.

- Services Provided: These services range from data integration and analysis to predictive modeling and real-time threat detection.

- Stability and Growth: This segment offers a degree of stability, but growth depends on ongoing government funding and the evolving landscape of national security priorities. Changes in government spending could significantly impact Palantir Government Contracts.

Commercial Partnerships: Expanding into the Private Sector

Palantir is actively expanding its commercial partnerships, seeking to diversify its revenue streams beyond government contracts. This segment presents significant growth potential but also increased competition.

- Key Partnerships: Palantir has secured partnerships with major players across various industries, leveraging its Foundry platform to help organizations manage and analyze their data.

- Impact on Revenue: The commercial sector's contribution to Palantir's revenue is steadily increasing, though it still lags behind government contracts.

- Future Growth Potential: The success of this segment depends on Palantir's ability to effectively compete with established players in the private sector data analytics market. This requires continued innovation and strong sales execution.

Foundry Platform: The Engine of Palantir's Growth

Palantir Foundry is the company's flagship platform, acting as the central engine for its data integration and analysis capabilities. It's a key differentiator in attracting both government and commercial clients.

- Data Integration and Analysis: Foundry enables organizations to integrate data from diverse sources, providing a unified view for analysis and decision-making.

- Competitive Advantages: Its intuitive interface, robust security features, and scalable architecture position Foundry as a strong contender in the data analytics market. However, other players, notably in the cloud, offer competing features.

- Potential for Expansion: Further development and integration of AI and machine learning capabilities will be critical for Foundry's continued growth and maintaining Palantir's competitive advantage.

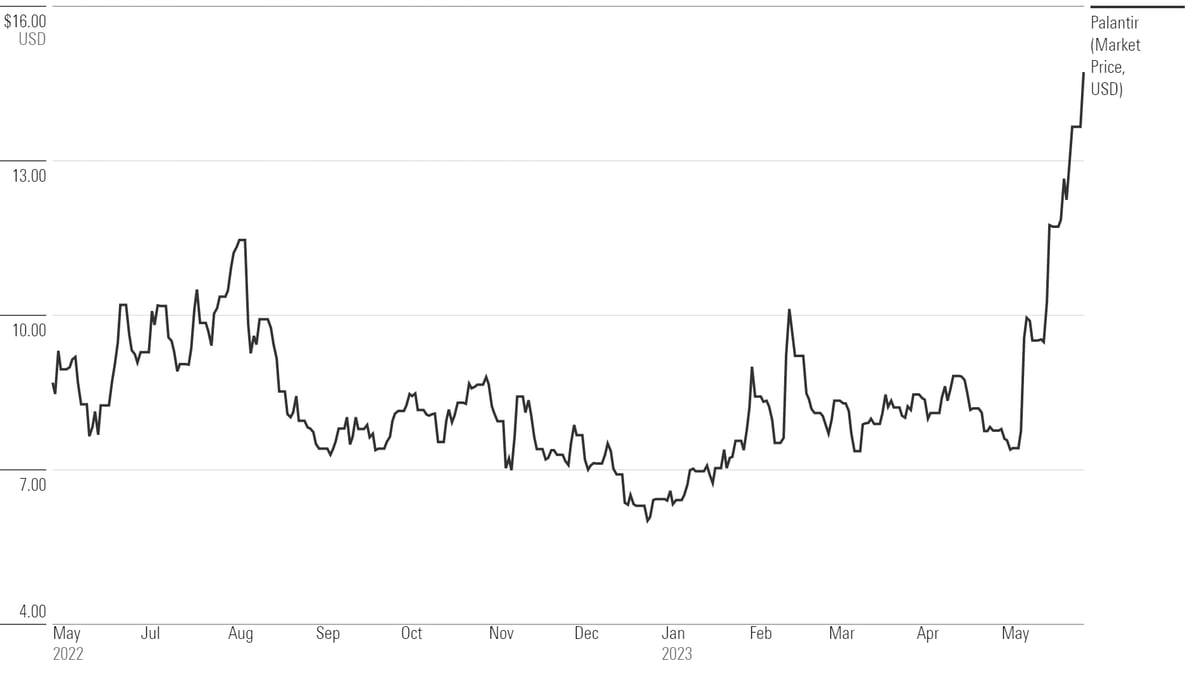

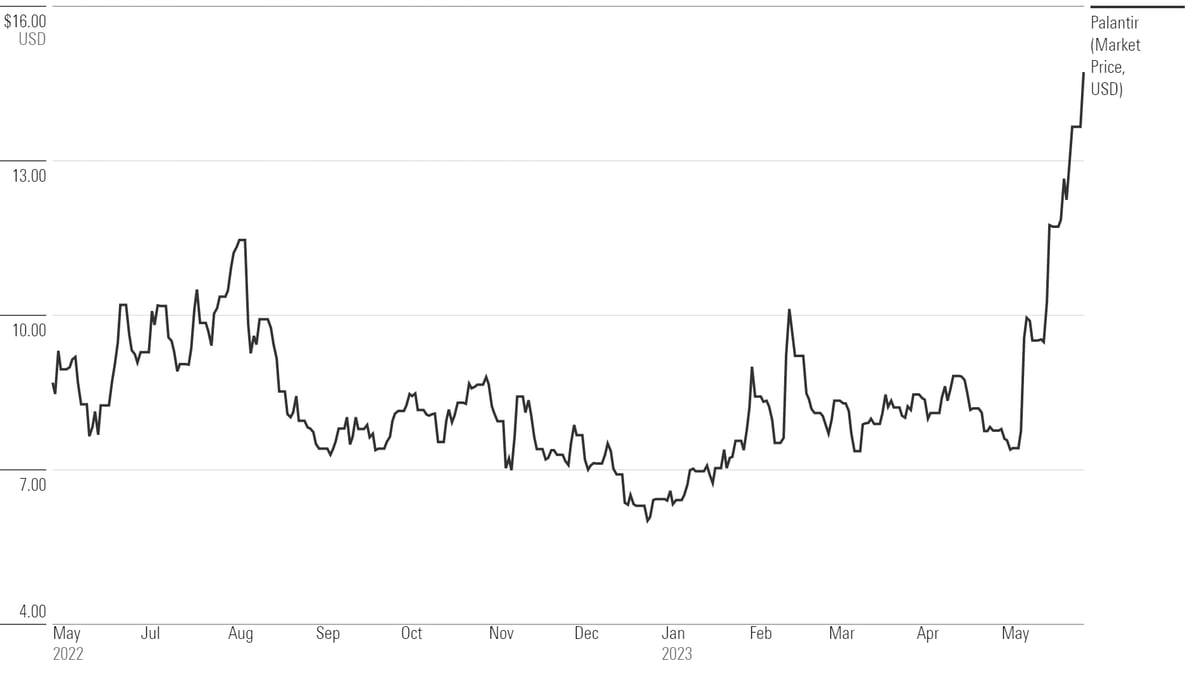

Financial Performance and Valuation: Assessing Palantir's Stock

Analyzing Palantir's financial performance and valuation is crucial for assessing the investment opportunity.

Revenue Growth and Profitability

Palantir has demonstrated significant revenue growth, but profitability remains a key focus for investors.

- Revenue Growth: The company's revenue has shown consistent growth year-over-year, largely driven by government and commercial contracts. Investors scrutinize these reports for signs of sustained growth.

- Profitability: While Palantir is not yet consistently profitable, its path to profitability is a critical factor influencing its stock price. They are making progress on this front.

- Sustainable Profitability: Achieving and maintaining sustainable profitability is essential for long-term investor confidence. This depends on effectively managing costs and scaling operations while continuing revenue growth.

Stock Valuation and Price-to-Sales Ratio

Palantir's valuation, often assessed using metrics like the price-to-sales (P/S) ratio, needs careful consideration.

- Market Capitalization: The company's market capitalization fluctuates significantly based on investor sentiment and overall market conditions.

- Comparison to Competitors: Evaluating Palantir's valuation relative to its competitors is essential to gauge whether it's overvalued or undervalued. This analysis requires looking at similar publicly-traded companies in the data analytics and software sectors.

- Future Price Appreciation: The potential for future price appreciation hinges on factors like revenue growth, profitability, and market share gains.

Debt and Cash Position

Understanding Palantir's financial health involves examining its debt levels and cash reserves.

- Balance Sheet Analysis: A thorough analysis of Palantir's balance sheet provides insights into its financial stability and ability to fund future growth.

- Debt Levels: High debt levels could pose risks, particularly in economic downturns. Investors need to consider whether this will impact their long-term growth prospects.

- Cash Flow: Positive and growing cash flow is a strong indicator of financial health and suggests the company's ability to invest in innovation and expansion.

Risks and Challenges Facing Palantir Technologies

While Palantir presents significant opportunities, investors must also carefully consider the risks.

Competition in the Data Analytics Market

Palantir faces intense competition in the data analytics market from established tech giants and emerging startups.

- Key Competitors: The company competes with major players like AWS, Microsoft Azure, Google Cloud, and other specialized data analytics firms.

- Competitive Advantage: Palantir's competitive advantage lies in its specialized platforms, particularly Foundry, and its expertise in serving government clients. Maintaining this edge will require ongoing innovation.

- Market Share: Maintaining and expanding market share requires continuous product innovation and successful sales and marketing efforts.

Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to the risks associated with government spending and policy changes.

- Risk of Budget Cuts: Reduced government funding could significantly impact Palantir's revenue and growth prospects.

- Geopolitical Risks: Changes in geopolitical relations could affect contracts with international government clients.

- Regulatory Changes: New regulations could impact Palantir's ability to operate in specific government markets.

Technological Disruptions

Rapid technological advancements could disrupt Palantir's business model if it fails to adapt quickly enough.

- AI and Machine Learning: Advancements in AI and machine learning are constantly reshaping the data analytics landscape. Palantir needs to stay ahead of the curve to remain competitive.

- Cloud Computing: The dominance of cloud computing platforms could impact Palantir's ability to compete effectively. They need to consider cloud-based strategies.

- Adaptability: Palantir's ability to adapt to changing technological landscapes will be crucial for its long-term success.

Conclusion: Should You Buy Palantir Technologies Stock Now? A Final Verdict

Palantir Technologies stock presents a complex investment opportunity. While its cutting-edge technology and strong government partnerships offer potential for significant growth, the risks associated with competition, government dependence, and technological disruptions need careful consideration. Our analysis suggests that Palantir's future performance hinges on its success in expanding its commercial partnerships, achieving sustainable profitability, and maintaining its technological edge. Whether or not Palantir Technologies stock is a "buy" depends on your individual risk tolerance and investment horizon.

Therefore, we recommend conducting thorough due diligence and considering your own financial goals before making any investment decisions regarding Palantir Technologies stock. Consult a qualified financial advisor for personalized advice. For more information, visit Palantir's investor relations page [link to Palantir investor relations page].

Featured Posts

-

Arkema Premiere Ligue Le Psg Brise La Serie De Dijon

May 09, 2025

Arkema Premiere Ligue Le Psg Brise La Serie De Dijon

May 09, 2025 -

The Post Roe Landscape Over The Counter Birth Control And Its Significance

May 09, 2025

The Post Roe Landscape Over The Counter Birth Control And Its Significance

May 09, 2025 -

Hertls Hat Trick Leads Golden Knights Past Red Wings

May 09, 2025

Hertls Hat Trick Leads Golden Knights Past Red Wings

May 09, 2025 -

Addressing West Hams 25 Million Financial Shortfall

May 09, 2025

Addressing West Hams 25 Million Financial Shortfall

May 09, 2025 -

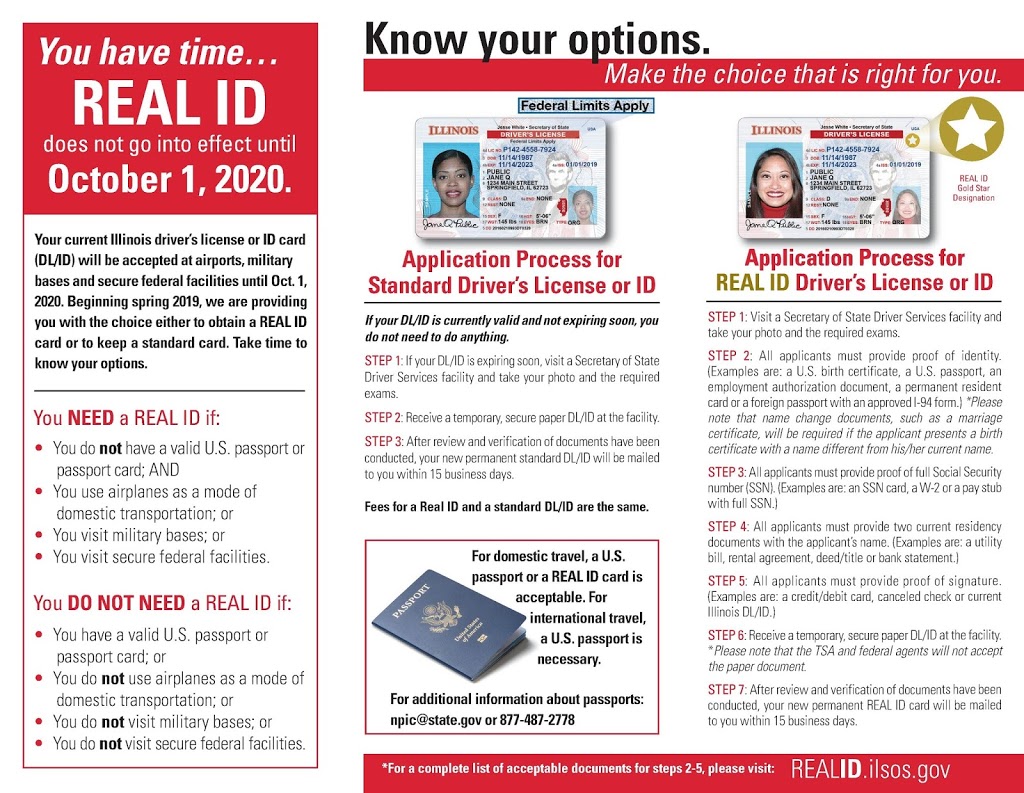

Your Summer Travel Checklist Real Id Compliance And More

May 09, 2025

Your Summer Travel Checklist Real Id Compliance And More

May 09, 2025