Palantir Stock: Is A 40% Increase By 2025 Realistic? Investment Analysis

Table of Contents

Palantir's Current Market Position and Growth Drivers

Revenue Growth and Profitability

Palantir's recent financial performance offers a crucial insight into its growth trajectory. While revenue has shown consistent growth, profitability remains a key area of focus for investors. Examining key performance indicators (KPIs) such as revenue growth rates, net income, and operating margins is essential for assessing the sustainability of its growth.

- Revenue Growth: Palantir has demonstrated consistent revenue growth, particularly in its government contracts division. However, analyzing the growth rate's consistency and whether it's outpacing the broader big data analytics market is crucial.

- Profitability: Palantir's path to profitability is a critical factor. Analyzing its operating margin and net income trends, alongside the company's guidance, will shed light on its ability to translate revenue growth into sustainable profits. Are they investing heavily in R&D, potentially sacrificing short-term profitability for long-term gains?

- Foundry Platform Performance: The success of Palantir's Foundry platform, its core commercial offering, is crucial to future growth. Tracking its adoption rate, customer acquisition costs, and customer retention are vital for understanding its commercial viability.

Competition and Market Share

The big data analytics market is fiercely competitive. Palantir faces established players like Databricks and Snowflake, each with its own strengths and market share. Understanding Palantir's competitive advantages and market positioning is paramount.

- Unique Selling Propositions (USPs): Palantir's USPs include its strong government relationships, its expertise in complex data analysis, and its focus on data integration and governance. How effectively is it leveraging these advantages to differentiate itself from competitors?

- Market Share: Analyzing Palantir's market share in various segments (government, commercial, etc.) helps assess its dominance and growth potential. Is its market share growing, shrinking, or remaining stagnant?

- Market Size and Growth: The overall size and projected growth of the big data analytics market are also key. A larger and faster-growing market presents more opportunities for Palantir to expand its market share and revenue.

Technological Innovation and Future Product Roadmap

Palantir's commitment to innovation and its future product roadmap are critical factors in determining its long-term growth potential. Analyzing its R&D investments and strategic partnerships is crucial.

- New Product Releases: The frequency and success of new product releases indicate Palantir's ability to adapt to evolving market needs and maintain a competitive edge.

- Strategic Partnerships: Strategic partnerships can accelerate growth by expanding market reach and access to new technologies. Analyzing the impact of such partnerships on revenue and product development is essential.

- Research and Development (R&D): Significant investments in R&D suggest Palantir's commitment to innovation and its ability to develop cutting-edge technologies.

Factors Affecting Palantir's Stock Price

Macroeconomic Factors

Broader macroeconomic trends significantly influence investor sentiment and stock valuations. Interest rates, inflation, and recession risks can significantly impact Palantir's stock price.

- Interest Rate Hikes: Higher interest rates increase borrowing costs, potentially reducing corporate investments and slowing economic growth, impacting Palantir's valuation.

- Inflation: High inflation erodes purchasing power and increases uncertainty, potentially affecting investor confidence in Palantir's future performance.

- Recession Risks: A recession could severely reduce demand for Palantir's services, especially in the commercial sector, significantly affecting its stock price.

Investor Sentiment and Market Volatility

Investor sentiment, driven by news coverage, analyst ratings, and overall market conditions, plays a crucial role in shaping Palantir's stock price.

- Stock Price Fluctuations: Analyzing recent stock price movements and identifying the events or news that caused significant fluctuations is critical.

- Analyst Ratings: Tracking analyst ratings and price targets can provide insights into market expectations and potential future price movements.

- Market Volatility: Periods of high market volatility can amplify price fluctuations, impacting Palantir's stock price disproportionately.

Geopolitical Risks

Geopolitical events can create uncertainty and risk for Palantir, particularly given its reliance on government contracts and international expansion.

- Government Contracts: Changes in government policy or international relations could affect the renewal or award of government contracts, influencing Palantir's revenue streams.

- International Expansion: Expansion into new international markets carries inherent geopolitical risks, including political instability, regulatory hurdles, and currency fluctuations.

- Supply Chain Disruptions: Geopolitical instability can disrupt supply chains, impacting Palantir's operations and potentially affecting its financial performance.

Valuation and Price Target Analysis

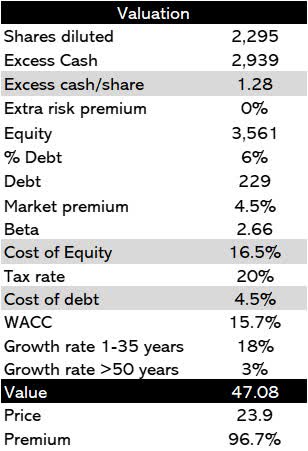

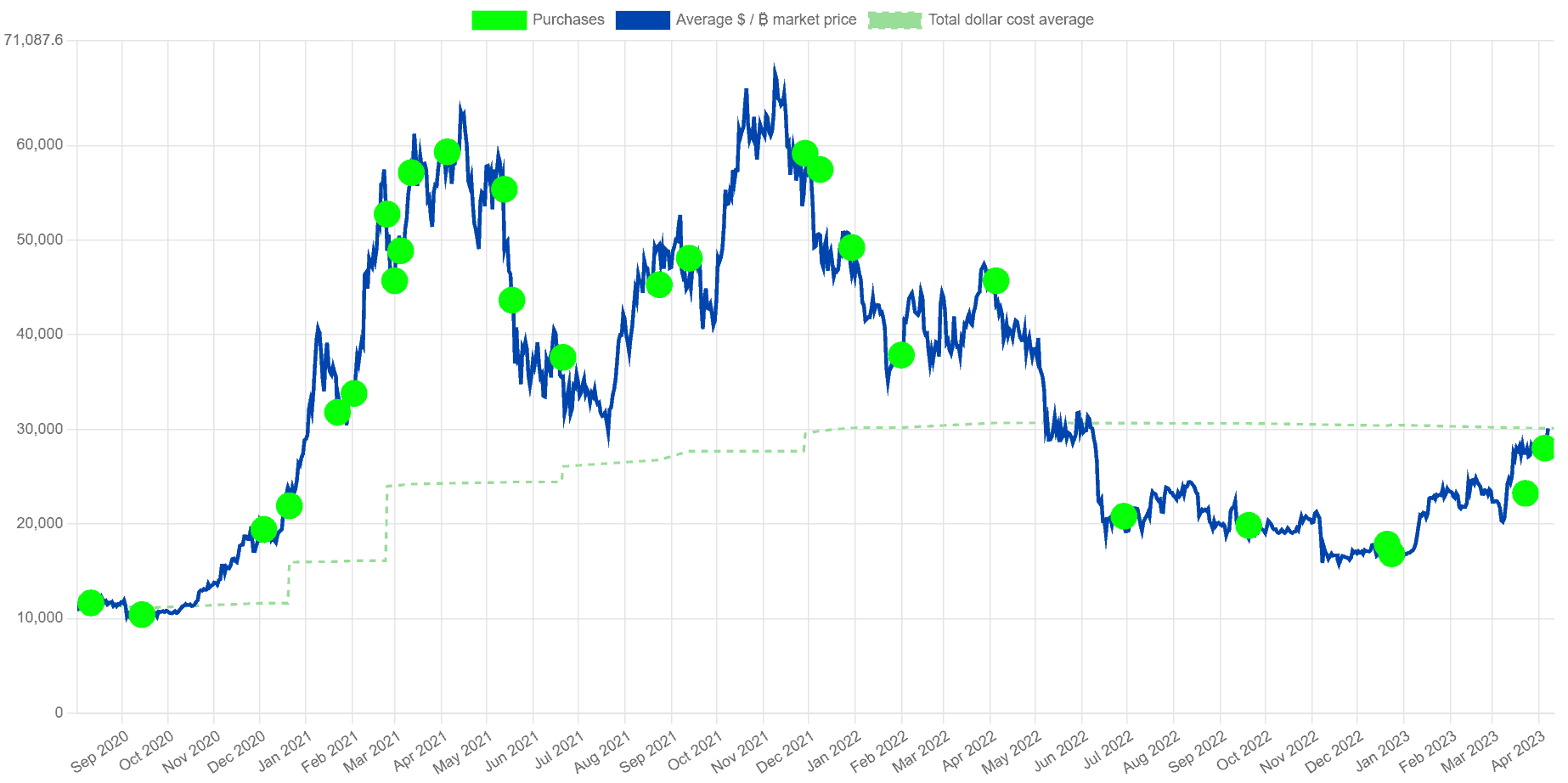

Discounted Cash Flow (DCF) Analysis

A DCF analysis is a common valuation technique used to estimate a company's intrinsic value. By projecting future cash flows and discounting them back to their present value, we can compare the intrinsic value to the current market price.

- Assumptions: The accuracy of a DCF analysis hinges on the assumptions made regarding future growth rates, discount rates, and other key variables. These assumptions must be carefully justified.

- Discount Rate: The discount rate reflects the risk associated with the investment. A higher discount rate leads to a lower estimated intrinsic value.

- Growth Projections: Realistic growth projections are crucial for accurate DCF analysis. These should be based on historical data, industry trends, and Palantir's strategic plans.

Comparable Company Analysis

Comparing Palantir's valuation metrics (P/E ratio, Price-to-Sales ratio, etc.) to those of its competitors provides a relative valuation benchmark.

- Peer Selection: The selection of comparable companies is crucial. Companies should be chosen based on similar business models, industry positioning, and growth prospects.

- Valuation Metrics: Different valuation metrics offer different perspectives on a company's valuation. Analyzing multiple metrics provides a more comprehensive picture.

- Limitations: Comparable company analysis has limitations, as no two companies are exactly alike. Differences in business models, growth trajectories, and risk profiles can affect comparability.

Probability of 40% Increase by 2025

Based on the analysis conducted, the probability of a 40% increase in Palantir's stock price by 2025 is highly dependent on the interplay of the factors discussed above. While Palantir’s growth prospects are promising, the competitive landscape, macroeconomic conditions, and geopolitical risks introduce significant uncertainty. Achieving a 40% increase would require a sustained period of strong revenue growth, improving profitability, and positive investor sentiment amidst a favorable macroeconomic environment.

- Supporting Factors: Strong revenue growth from both government and commercial sectors, successful Foundry platform adoption, and successful execution of the product roadmap could contribute positively to a 40% increase.

- Challenging Factors: Increased competition, macroeconomic headwinds (e.g., recession), and negative investor sentiment could hinder the achievement of a 40% increase.

Conclusion: Investing in Palantir Stock – A Realistic Outlook

A 40% increase in Palantir stock by 2025 is a significant target, and achieving it depends on several interconnected factors. While Palantir possesses considerable growth potential driven by its technological capabilities and expanding market presence, significant risks remain. Macroeconomic uncertainty, intense competition, and geopolitical factors could all impact its stock price. This analysis indicates that while a substantial increase is possible, a 40% surge by 2025 is not guaranteed and carries considerable risk. Conduct further research on Palantir's financial statements and industry analysis before making any investment decisions regarding Palantir stock. Remember, this is not financial advice, and individual investment decisions should be based on thorough due diligence and your personal risk tolerance.

Featured Posts

-

Prognoz Pogody V Mae Pochemu Snegopady Tak Trudno Predskazat

May 09, 2025

Prognoz Pogody V Mae Pochemu Snegopady Tak Trudno Predskazat

May 09, 2025 -

The Us Attorney Generals Daily Fox News Strategy A Deeper Look

May 09, 2025

The Us Attorney Generals Daily Fox News Strategy A Deeper Look

May 09, 2025 -

Dakota Johnsons Stunning White Dress At Materialists Premiere

May 09, 2025

Dakota Johnsons Stunning White Dress At Materialists Premiere

May 09, 2025 -

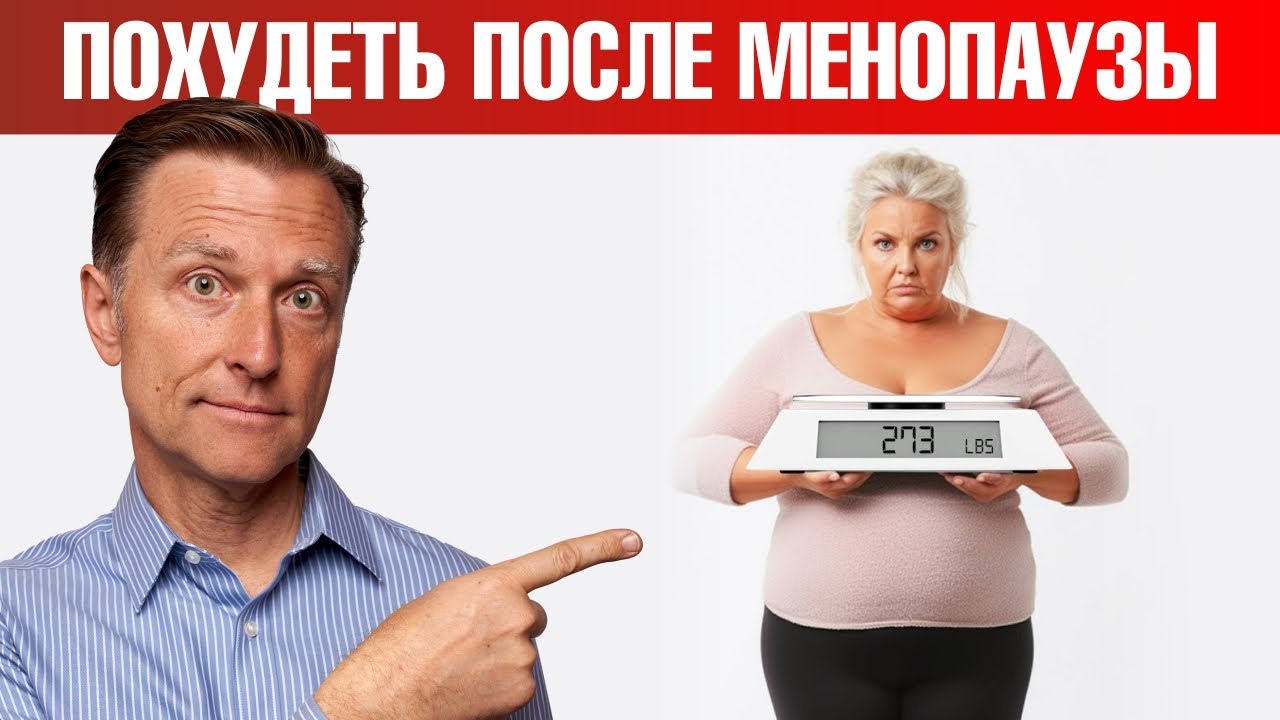

Bitcoin Or Micro Strategy Stock Investment Analysis For 2025

May 09, 2025

Bitcoin Or Micro Strategy Stock Investment Analysis For 2025

May 09, 2025 -

Micro Strategy Stock And Bitcoin A Comparative Investment Analysis For 2025

May 09, 2025

Micro Strategy Stock And Bitcoin A Comparative Investment Analysis For 2025

May 09, 2025