Bitcoin Or MicroStrategy Stock: Investment Analysis For 2025

Table of Contents

Understanding Bitcoin's Potential in 2025

Bitcoin's Market Volatility and Growth Projections

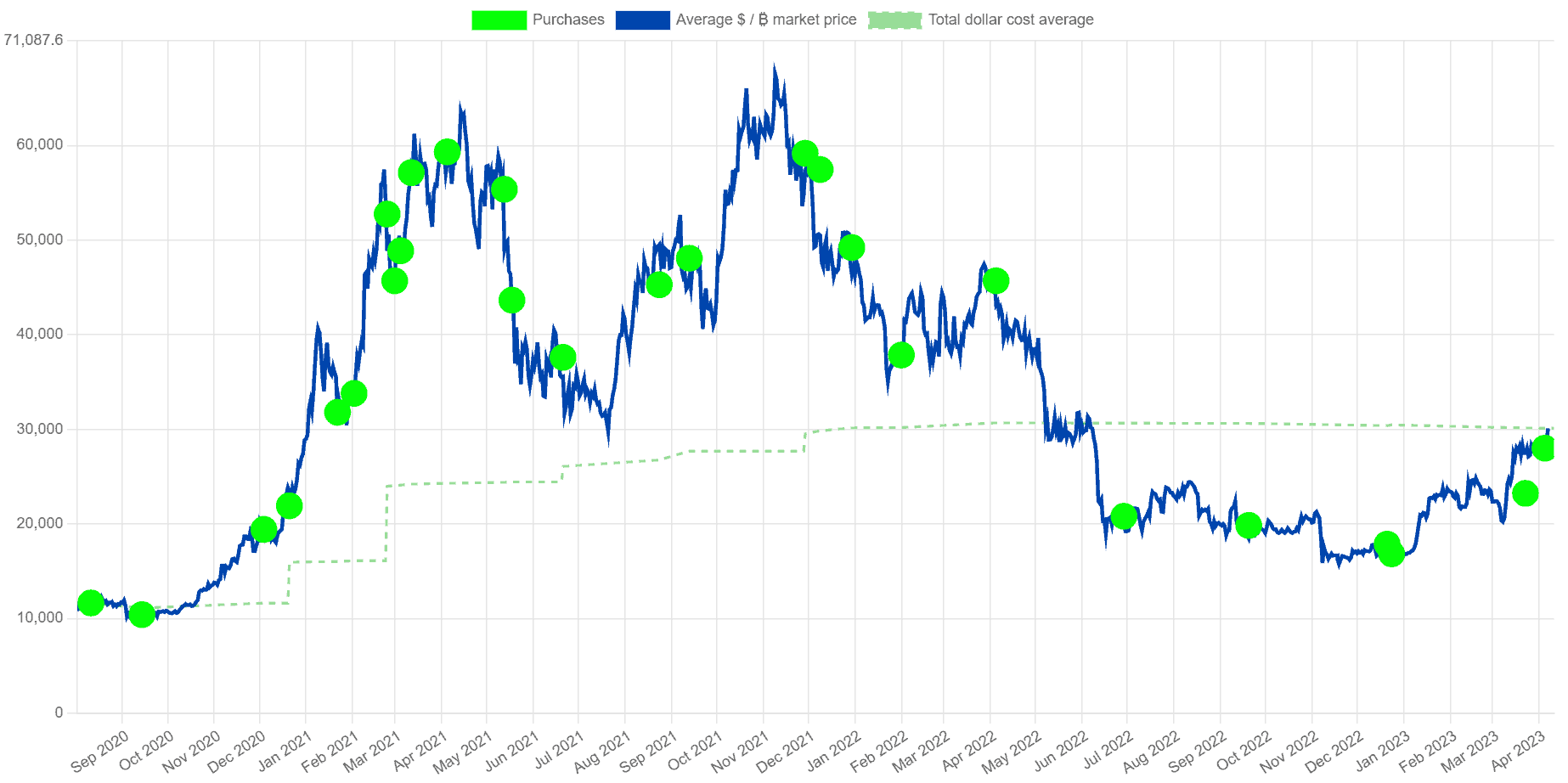

Bitcoin's price has historically been incredibly volatile. Predicting its future value with certainty is impossible. However, several factors can influence its trajectory by 2025. These include increasing adoption rates across various sectors, evolving regulatory landscapes globally, and ongoing technological advancements.

- Potential Price Scenarios: While impossible to predict precisely, some analysts forecast significant price appreciation, while others suggest potential consolidation or even correction. The actual outcome will depend on the interplay of numerous factors.

- Factors Influencing Bitcoin's Value: Factors such as macroeconomic conditions (inflation, interest rates), institutional adoption (e.g., further investments by corporations), regulatory clarity (or lack thereof), and technological upgrades (like the Lightning Network) will significantly impact Bitcoin's price.

- Comparison to Historical Performance: Examining Bitcoin's past performance provides some context, but past performance is never a guarantee of future results. The cryptocurrency market remains relatively young, making historical comparisons less reliable than in more established asset classes.

- Expert Opinions: While expert opinions can offer insights, it's crucial to remember that they are not guarantees. Diversify your information sources and form your own informed opinion based on thorough research.

Risks Associated with Direct Bitcoin Investment

Investing directly in Bitcoin carries significant risks. It's crucial to understand these before allocating funds.

- Security Considerations: Bitcoin held on exchanges is vulnerable to hacks. Using secure, hardware wallets is vital to mitigate this risk.

- Regulatory Landscape (by Region): Regulatory uncertainty varies considerably across countries. Some governments are embracing cryptocurrencies, while others remain highly restrictive. This regulatory landscape can dramatically impact Bitcoin’s price and accessibility.

- Potential for Market Crashes: The cryptocurrency market is notoriously volatile and prone to significant price swings. Market crashes are a possibility, and investors should be prepared for potential losses.

- Diversification Strategies to Mitigate Risks: Diversifying your portfolio across multiple asset classes is essential to reduce the overall risk of your investment strategy. Don't put all your eggs in one basket.

Bitcoin's Long-Term Value Proposition

Many believe Bitcoin possesses significant long-term value.

- Scarcity Factor: Bitcoin's limited supply (21 million coins) is a key factor contributing to its potential as a store of value.

- Inflation Hedge Potential: Some investors view Bitcoin as a hedge against inflation, particularly in times of economic uncertainty.

- Adoption by Institutional Investors: Increased institutional adoption lends credibility and potentially contributes to price stability and growth.

- Technological Advancements Driving Adoption: Ongoing technological improvements enhance Bitcoin's scalability, transaction speed, and overall usability, fueling further adoption.

Analyzing MicroStrategy's Investment Strategy and Stock Performance

MicroStrategy's Bitcoin Holdings and Business Model

MicroStrategy, a business intelligence company, has made a significant bet on Bitcoin, holding a substantial amount. This strategy significantly impacts its financial performance.

- Quantity of Bitcoin Held: MicroStrategy's substantial Bitcoin holdings represent a considerable portion of its assets.

- Business Strategy Centered Around Bitcoin: MicroStrategy's business model is now heavily intertwined with Bitcoin's price performance.

- Financial Performance Analysis: MicroStrategy's financial performance is directly linked to the value of its Bitcoin holdings.

- Impact of Bitcoin Price Fluctuations on MicroStrategy's Stock: The price of MicroStrategy stock is highly correlated with Bitcoin's price, creating both opportunities and risks.

Evaluating MicroStrategy Stock as an Indirect Bitcoin Investment

Investing in MicroStrategy offers indirect exposure to Bitcoin. However, it's not without its own set of advantages and disadvantages.

- Correlation between MicroStrategy stock price and Bitcoin price: A strong correlation exists, meaning MicroStrategy stock tends to move in the same direction as Bitcoin's price.

- Risk Diversification Compared to Direct Bitcoin Investment: Investing in MicroStrategy introduces other business risks, diversifying the investment away from pure Bitcoin exposure but also adding another layer of complexity.

- Potential for Capital Appreciation: If Bitcoin's price rises, MicroStrategy's stock price is likely to rise as well.

- Assessment of Company Management: Assessing the competence and strategic vision of MicroStrategy's management team is critical when considering this indirect Bitcoin investment.

Risks Associated with Investing in MicroStrategy Stock

Investing in MicroStrategy carries risks beyond those associated with Bitcoin itself.

- Business Risks Independent of Bitcoin: MicroStrategy's core business operations still face traditional business risks.

- Financial Health of the Company: MicroStrategy's financial health is critical to its stock performance, independent of Bitcoin's price.

- Competitive Landscape: MicroStrategy's position within its industry must also be considered.

- Potential Legal or Regulatory Challenges: Regulatory changes affecting either MicroStrategy or Bitcoin could negatively impact the stock price.

Bitcoin vs. MicroStrategy Stock: A Comparative Analysis

Risk Tolerance and Investment Goals

Aligning your investment choice with your risk tolerance and financial objectives is paramount.

- Risk Profiles (Conservative vs. Aggressive): Direct Bitcoin investment is significantly riskier than investing in MicroStrategy stock.

- Long-Term vs. Short-Term Investment Horizons: Bitcoin is generally considered a long-term investment, while MicroStrategy stock could offer more short-term trading opportunities (though still risky).

- Suitable Investor Profiles for Each Asset Class: Conservative investors might prefer MicroStrategy, while those with higher risk tolerance might opt for direct Bitcoin investment.

Diversification Strategies

Both Bitcoin and MicroStrategy stock can be part of a well-diversified portfolio.

- Asset Allocation Strategies: Carefully allocate your assets across different asset classes to mitigate overall risk.

- Portfolio Diversification Benefits: Diversification helps reduce the impact of losses in any single asset.

- Importance of Risk Management: Implement sound risk management strategies to protect your investment.

- Incorporating Other Asset Classes (Stocks, Bonds, etc.): Don't rely solely on Bitcoin or MicroStrategy; diversify across stocks, bonds, and other asset classes.

Conclusion of the Comparison

The choice between Bitcoin and MicroStrategy stock depends heavily on individual circumstances.

- Summary Table Contrasting Key Features: (A table summarizing key features, risks, and potential rewards would be beneficial here).

- Investment Recommendations Based on Specific Risk Tolerances and Investment Goals: Investors with high risk tolerance and long-term horizons might prefer direct Bitcoin investment. More conservative investors might find MicroStrategy stock a less volatile alternative.

Conclusion

This analysis of Bitcoin vs. MicroStrategy stock highlights the importance of understanding your individual risk tolerance and investment goals before making any decisions. Both offer exposure to Bitcoin, but through vastly different mechanisms and risk profiles. Remember, both direct Bitcoin investment and investment in MicroStrategy stock are speculative and carry significant risks. Thorough research and careful consideration of your financial situation are crucial before investing in either. Make an informed decision about your Bitcoin and MicroStrategy investment strategy for 2025!

Featured Posts

-

Affaire Bilel Latreche Violences Conjugales A Dijon Audience En Aout

May 09, 2025

Affaire Bilel Latreche Violences Conjugales A Dijon Audience En Aout

May 09, 2025 -

From Wolves Reject To European Elite His Story

May 09, 2025

From Wolves Reject To European Elite His Story

May 09, 2025 -

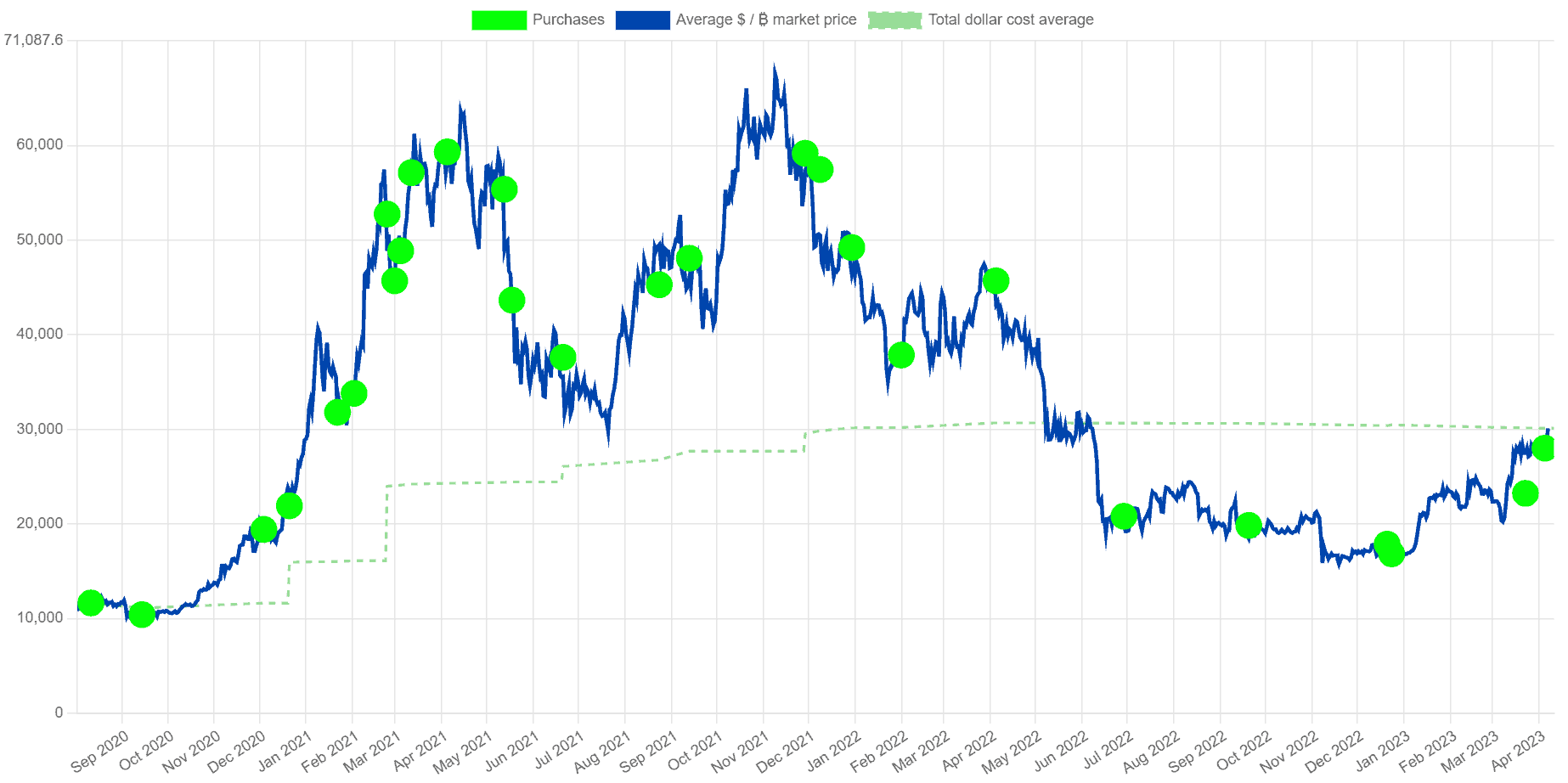

Un Debut D Incendie Mobilise Les Secours A La Mediatheque Champollion De Dijon

May 09, 2025

Un Debut D Incendie Mobilise Les Secours A La Mediatheque Champollion De Dijon

May 09, 2025 -

Nhl Playoffs Oilers Vs Kings Prediction Best Bets For Tonights Game 1

May 09, 2025

Nhl Playoffs Oilers Vs Kings Prediction Best Bets For Tonights Game 1

May 09, 2025 -

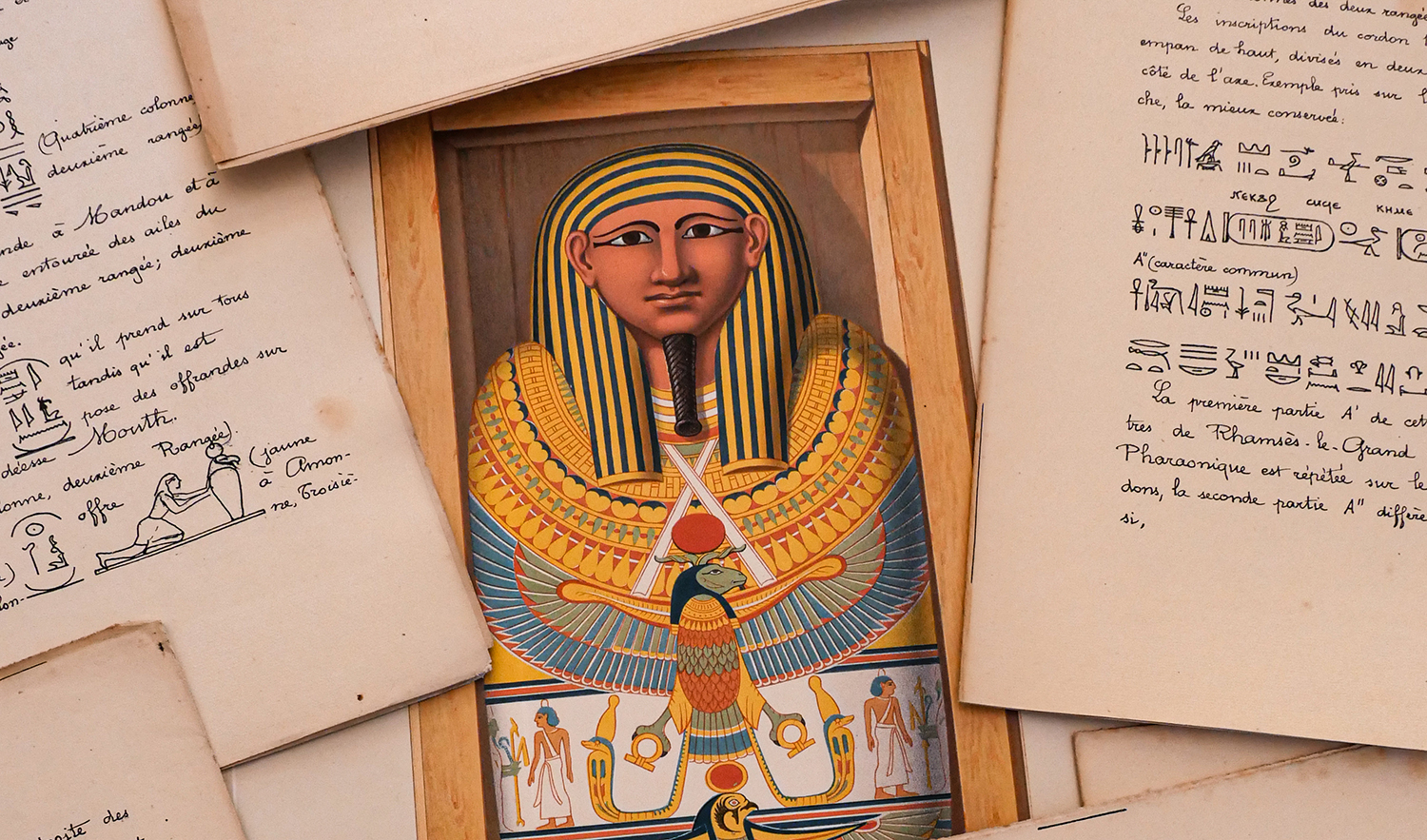

Fox News Internal Dispute Trump Tariffs And The Financial Fallout

May 09, 2025

Fox News Internal Dispute Trump Tariffs And The Financial Fallout

May 09, 2025