Palantir Stock Investment: Considerations Before May 5th

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Analyzing Palantir's (PLTR) recent financial performance is crucial for any potential Palantir stock investment. The company's success hinges on revenue growth, profit margins, and securing significant contracts. Let's delve into the key aspects:

- Q1 2024 Earnings Summary: [Insert summary of Q1 2024 earnings, including revenue figures, net income/loss, and any significant announcements. Link to official Palantir financial reports]. This data provides a snapshot of the company's current financial health and sets the stage for future projections.

- Key Growth Drivers: Palantir's growth is driven by its government and commercial partnerships. Government contracts often represent large, stable revenue streams, while commercial partnerships offer opportunities for scalability and expansion into new markets. Analyzing the balance between these two sectors is key.

- Profitability Trends: Examining Palantir's profitability trends – including gross margin, operating margin, and net margin – provides insights into its ability to translate revenue into profit. This is a critical factor for long-term Palantir stock investment.

- Analyst Ratings and Price Targets: Numerous financial analysts offer ratings and price targets for PLTR stock. Consider these projections, but remember they are opinions, not guarantees. Understanding the rationale behind these predictions can offer valuable context. [Link to reputable financial analysis sites offering Palantir stock projections].

Understanding Palantir's Business Model and Risks

Palantir's core business revolves around providing data analytics and software platforms to government and commercial clients. While this presents significant potential, understanding the business model and associated risks is vital for any Palantir stock investment.

- Government vs. Commercial Revenue Breakdown: A significant portion of Palantir's revenue comes from government contracts. This provides stability but also creates dependence on government spending and regulatory processes. The proportion of revenue from commercial clients indicates the company's ability to diversify and potentially reduce this risk.

- Key Competitors and Competitive Advantages: Palantir faces competition from other data analytics and software companies. Identifying its key competitors and understanding Palantir's competitive advantages (e.g., proprietary technology, strong client relationships) is essential.

- Data Privacy and Security Concerns: As a company handling sensitive data, Palantir faces significant data privacy and security concerns. Any breaches or regulatory issues could negatively impact the Palantir stock price.

- Geopolitical Risks: Palantir's business involves international operations, making it susceptible to geopolitical risks and international regulatory changes. Understanding these potential risks is crucial for informed investment.

Evaluating Palantir's Valuation and Stock Price

Before investing in Palantir stock, a thorough valuation analysis is necessary. This involves comparing the company's current valuation to its historical performance and industry peers.

- Historical Stock Price Performance: Reviewing Palantir's historical stock price performance helps gauge its volatility and potential for growth. [Link to charts showing PLTR stock price history].

- Key Valuation Metrics: Analyze key valuation metrics like the price-to-earnings (P/E) ratio and price-to-sales ratio to assess whether the Palantir stock price is fairly valued.

- Comparison with Competitors' Valuations: Comparing Palantir's valuation to its competitors provides context and helps determine whether its stock is overvalued or undervalued.

Considering Alternative Investment Strategies

While Palantir stock offers potential returns, it's crucial to consider alternative investment strategies to diversify your portfolio and manage risk.

- Diversification Strategies: Diversification is key to mitigating risk. Investing in a range of assets, including stocks, bonds, and real estate, reduces reliance on a single investment like Palantir stock.

- Index Funds and ETFs: Index funds and ETFs offer diversification at a lower cost than actively managed funds. They provide exposure to a broad market index, reducing risk associated with individual stocks.

- Risk Tolerance Assessment: Before making any investment decisions, it's essential to assess your personal risk tolerance. Investing in individual stocks like PLTR involves higher risk compared to more conservative investment options.

Conclusion: Making Informed Decisions about Your Palantir Stock Investment Before May 5th

Investing in Palantir stock requires careful consideration of its financial performance, business model, valuation, and associated risks. This article has highlighted key factors to analyze before making a decision before May 5th. Remember to conduct thorough due diligence, analyze the latest financial reports, and understand the potential risks involved. Don't hesitate to seek professional financial advice if needed. Invest wisely in Palantir stock, and make informed Palantir investment decisions based on your own risk tolerance and financial goals. Consider your Palantir stock strategy before May 5th.

Featured Posts

-

Policia Britanica Prende Mulher Que Se Diz Madeleine Mc Cann

May 09, 2025

Policia Britanica Prende Mulher Que Se Diz Madeleine Mc Cann

May 09, 2025 -

Colin Cowherd Doubles Down Why Jayson Tatum Remains Underappreciated

May 09, 2025

Colin Cowherd Doubles Down Why Jayson Tatum Remains Underappreciated

May 09, 2025 -

Arkema Premiere Ligue Dijon Vs Psg Analyse Du Match Decisif

May 09, 2025

Arkema Premiere Ligue Dijon Vs Psg Analyse Du Match Decisif

May 09, 2025 -

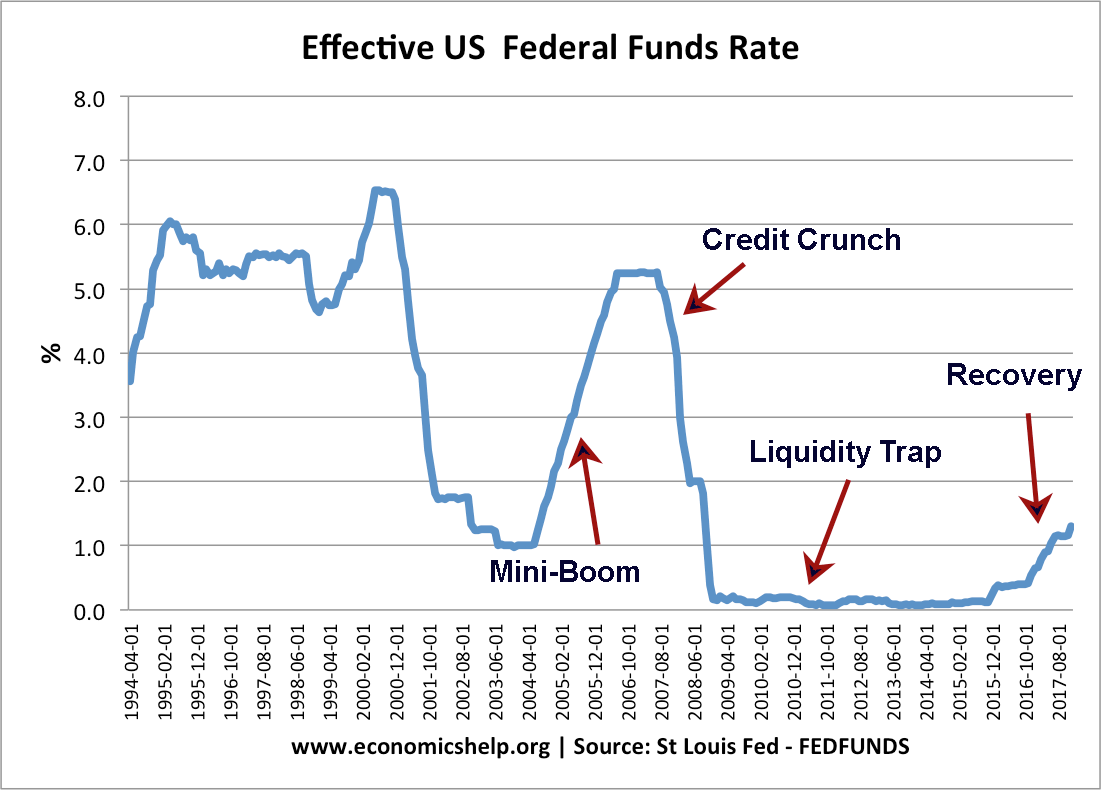

The Feds Reasoning Understanding The Delay In Interest Rate Cuts

May 09, 2025

The Feds Reasoning Understanding The Delay In Interest Rate Cuts

May 09, 2025 -

Tranh Cai Loi Khai Bao Mau Bao Hanh Tre Em Tien Giang

May 09, 2025

Tranh Cai Loi Khai Bao Mau Bao Hanh Tre Em Tien Giang

May 09, 2025