The Fed's Reasoning: Understanding The Delay In Interest Rate Cuts

Table of Contents

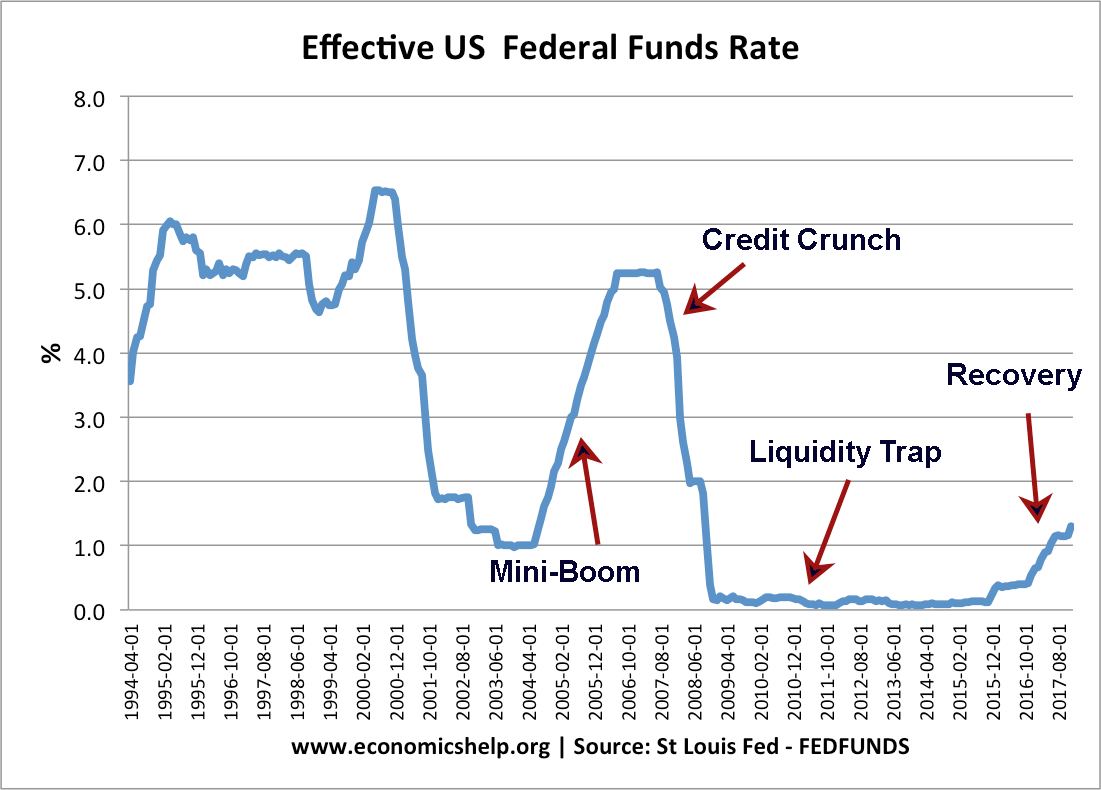

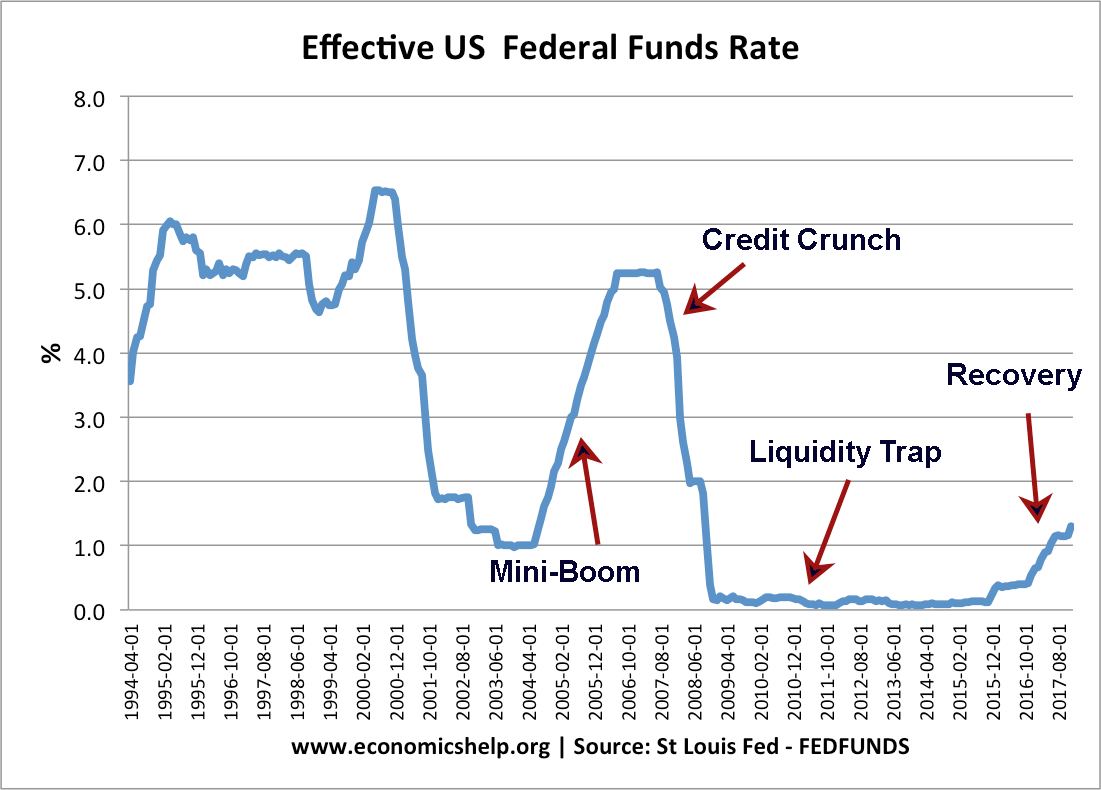

The Federal Reserve's recent decisions to hold off on Fed interest rate cuts, despite widespread anticipation of easing monetary policy, have left many investors and consumers puzzled. This article dissects the Federal Reserve's rationale, exploring the key factors driving their decision and its implications for the economy's future. Understanding the complexities behind these interest rate decisions is crucial for navigating the current economic climate.

<h2>Persistent Inflation as the Primary Obstacle</h2>

Stubbornly high inflation remains the Federal Reserve's most pressing concern, overshadowing calls for interest rate cuts. While inflation has shown some signs of cooling, it still significantly exceeds the Fed's target rate of 2%. This persistent inflation is the primary reason behind the delay in lowering interest rates. Key indicators like the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index, both measures of inflation, continue to reflect elevated price levels.

- Consumer Price Index (CPI): The CPI tracks the average change in prices paid by urban consumers for a basket of consumer goods and services. A persistently high CPI indicates broad-based inflationary pressures.

- Personal Consumption Expenditures (PCE) index: The PCE index, preferred by the Federal Reserve, measures changes in prices paid by consumers for a broader range of goods and services. A high PCE index reinforces the persistence of inflationary pressures.

- Core Inflation: Even excluding volatile food and energy prices (core inflation), the underlying inflationary pressures remain substantial. The Fed is focused on core inflation as it provides a clearer picture of underlying price trends. The persistence of core inflation highlights the challenge in taming price increases.

- Disinflation vs. Deflation: The Fed's goal isn't simply disinflation (a slowing of the inflation rate), but a return to its 2% inflation target. Premature rate cuts risk hindering this goal.

<h2>The Risk of Premature Rate Cuts and Renewed Inflationary Pressure</h2>

The Federal Reserve is acutely aware of the potential consequences of prematurely cutting interest rates while inflation remains elevated. Easing monetary policy too soon could reignite inflationary pressures, leading to an inflationary spiral. This would undermine the Fed's credibility and necessitate even more aggressive interest rate hikes later, potentially causing greater economic harm.

- Inflationary Spiral: An inflationary spiral occurs when rising prices lead to increased wage demands, which in turn further fuels price increases, creating a self-perpetuating cycle. The Fed aims to prevent this dangerous scenario.

- Economic Uncertainty: The current economic environment is characterized by significant uncertainty. Predicting future inflation trends with accuracy is exceptionally challenging, making premature easing a high-risk strategy.

- Monetary Policy Tools: The Fed utilizes various monetary policy tools, including interest rate adjustments, to manage inflation and economic growth. Prematurely cutting rates would limit the effectiveness of these tools in the future.

<h2>Assessing the Strength (or Weakness) of the Labor Market</h2>

The Federal Reserve carefully considers the health of the labor market when making interest rate decisions. A robust labor market, characterized by low unemployment and strong wage growth, can contribute to upward pressure on wages and inflation. The Fed monitors key labor market indicators to assess the potential inflationary implications of a tight labor market.

- Unemployment Rate: The unemployment rate provides a snapshot of the proportion of the workforce actively seeking employment but unable to find it. Low unemployment can signal a tight labor market, contributing to wage pressures.

- Job Creation: Consistent job creation indicates a healthy economy but can also lead to increased competition for workers, potentially driving up wages and inflation.

- Wage Growth: Rapid wage growth, while positive for workers, can add to inflationary pressures if it outpaces productivity gains. The Fed monitors wage growth closely as a key indicator of inflationary pressures.

<h3>The Potential for a "Soft Landing" versus Recession</h3>

The Federal Reserve faces the challenging task of navigating a delicate balancing act: cooling inflation without triggering a significant economic downturn. The aim is to achieve a "soft landing," where inflation decreases without causing a recession. However, the risks of a recession remain substantial.

- Soft Landing: A soft landing is a scenario where inflation subsides without causing a significant decline in economic output or a rise in unemployment. It's a challenging goal to achieve.

- Recession Risk: Aggressive interest rate hikes to combat inflation carry the risk of slowing economic growth and potentially triggering a recession. The Fed is carefully weighing the risks of both scenarios.

- GDP Growth: GDP growth is a key indicator of economic health. Slowing GDP growth, coupled with high inflation, increases the probability of a recession. The Fed closely monitors GDP growth as it makes its interest rate decisions.

<h2>Conclusion</h2>

The Fed's delay in cutting interest rates reflects a cautious approach prioritizing the fight against persistent inflation while carefully monitoring labor market conditions and the broader economy. This decision underscores the complexities of monetary policy management in uncertain times and the potential risks associated with premature easing. Understanding the nuances behind these interest rate decisions is critical for making informed financial choices.

Call to Action: Stay informed about the Fed's ongoing assessment of the economy and its future interest rate decisions. Understanding the factors influencing future Fed interest rate cuts is crucial for making informed financial decisions. Follow reputable financial news sources to stay updated on the latest developments and understand the implications of the Fed’s monetary policy.

Featured Posts

-

The Snl Impression That Upset Harry Styles

May 09, 2025

The Snl Impression That Upset Harry Styles

May 09, 2025 -

Povernennya Stivena Kinga Na X Kritika Trampa Ta Maska

May 09, 2025

Povernennya Stivena Kinga Na X Kritika Trampa Ta Maska

May 09, 2025 -

Bekam Nepobedliv Legenda Na Site Vreminja

May 09, 2025

Bekam Nepobedliv Legenda Na Site Vreminja

May 09, 2025 -

Is A Trillion Dollar Palantir Stock Realistic By 2030

May 09, 2025

Is A Trillion Dollar Palantir Stock Realistic By 2030

May 09, 2025 -

Mariah The Scientists Burning Blue Analyzing The Lyrics And Sound

May 09, 2025

Mariah The Scientists Burning Blue Analyzing The Lyrics And Sound

May 09, 2025