Palantir Stock Before May 5th: Is It A Buy? Wall Street's Verdict

Table of Contents

Palantir's Recent Performance and Financial Health

Palantir's recent financial performance is crucial in determining its investment viability before May 5th. Examining key metrics offers valuable insights into the company's health and future prospects.

Q4 2022 Earnings and Revenue Growth

Palantir's Q4 2022 earnings report revealed [insert actual figures here, e.g., a revenue of $500 million, representing a [percentage]% year-over-year increase]. This growth, while [positive/negative], needs to be considered in the context of previous quarters.

- Revenue Growth: [Insert specific data and comparison to previous quarters. Highlight trends - accelerating, slowing, etc.]

- Profitability: [Analyze profitability metrics like gross margin and net income. Discuss any changes compared to prior periods.]

- EPS (Earnings Per Share): [State the EPS and compare it to analysts' expectations and previous quarters.] Was it a beat or a miss? What were the key drivers of EPS performance?

These figures provide a snapshot of Palantir's short-term performance, but further analysis is crucial for a complete picture.

Debt Levels and Cash Flow

Assessing Palantir's financial stability requires a look at its debt and cash flow. A healthy cash flow is vital for future growth and investment.

- Debt-to-Equity Ratio: [State the debt-to-equity ratio and compare it to industry benchmarks and previous years.] A high ratio may signal increased risk.

- Free Cash Flow (FCF): [Present the FCF data, explaining its significance for the company's financial health and its ability to fund operations and growth initiatives.] Positive FCF indicates strong financial health.

- Cash and Cash Equivalents: [Include this metric to show Palantir's short-term liquidity. A significant amount of cash on hand mitigates risk.]

Understanding these figures helps determine the company's long-term financial sustainability.

Future Growth Prospects and Market Position

Palantir's future growth potential is highly dependent on its ability to maintain and expand its market share in the competitive data analytics market.

- Market Share: [Discuss Palantir's current market share and its potential for growth in existing and new markets.]

- Competitive Advantage: [Analyze Palantir's key competitive advantages, such as its advanced technology, strong government contracts, or unique data capabilities.]

- Growth Potential: [Assess the potential for growth in specific sectors like government, commercial, or financial services, considering market trends and regulatory changes.]

- Future Outlook: [Provide a balanced perspective on the challenges and opportunities facing Palantir, considering factors like competition and technological advancements.]

Wall Street Analyst Ratings and Price Targets

Understanding Wall Street's sentiment towards Palantir stock is crucial for making informed investment decisions.

Consensus Opinion on Palantir Stock

The consensus opinion among Wall Street analysts regarding Palantir stock before May 5th is [insert the current consensus, e.g., a "Hold" rating].

- Buy Ratings: [State the percentage of analysts recommending a "Buy" rating and explain their reasoning.]

- Hold Ratings: [State the percentage of analysts recommending a "Hold" rating and their rationale.]

- Sell Ratings: [State the percentage of analysts recommending a "Sell" rating and the justifications for their negative outlook.]

- Average Price Target: [State the average price target set by analysts for Palantir stock.]

This data provides a broad overview of analyst sentiment but shouldn't be the sole basis for investment decisions.

Divergence of Opinions and Reasons Thereof

Despite the overall consensus, there's often divergence in analyst opinions on Palantir stock.

- Valuation Debate: [Discuss the different valuation methodologies used by analysts and how they lead to differing price targets.]

- Growth Potential Discrepancies: [Explain how analysts differ in their assessment of Palantir's future growth prospects and market potential.]

- Risk Assessment Variations: [Highlight how analysts vary in their assessment of the risks associated with investing in Palantir.]

Key Factors to Consider Before Investing in Palantir Stock Before May 5th

Several critical factors must be considered before making any investment decisions.

Upcoming Events and Announcements

The period leading up to May 5th could be influenced by upcoming events.

- Earnings Reports: [Mention the expected release date of the next earnings report and its potential impact on the stock price.]

- Product Launches or Updates: [Discuss any anticipated product launches or significant updates that could affect investor sentiment.]

- Strategic Partnerships: [Mention any potential strategic partnerships that could positively or negatively influence the stock price.]

These events can significantly impact the stock's volatility.

Overall Market Conditions

The broader economic climate and market conditions play a significant role.

- Market Sentiment: [Assess the overall market sentiment and its potential impact on Palantir's stock price, considering factors like inflation and interest rates.]

- Economic Outlook: [Discuss the general economic outlook and its implications for the tech sector and specifically for Palantir.]

- Tech Sector Trends: [Analyze broader trends within the technology sector that could affect Palantir’s performance.]

- Market Volatility: [Acknowledge the inherent volatility of the stock market and its potential influence on Palantir's stock price.]

Understanding the broader context is crucial.

Risk Assessment

Investing in Palantir stock carries inherent risks.

- Market Risk: [Explain the risk associated with overall market fluctuations.]

- Financial Risk: [Discuss the risks related to Palantir's financial health and potential changes in its financial performance.]

- Company-Specific Risk: [Highlight any company-specific risks such as competition, regulatory changes, or execution risks.]

Conclusion: Is Palantir Stock a Buy Before May 5th? The Final Verdict

Based on the analysis of Palantir's financial health, Wall Street's assessments, and key market factors, [insert your recommendation: Buy, Hold, or Sell]. While Palantir demonstrates promising growth potential in the data analytics field, considerable risks remain. The volatility surrounding the May 5th date necessitates careful consideration. This analysis weighs the positives and negatives, but individual circumstances and risk tolerance should ultimately guide investment decisions.

Remember, this is not financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions regarding Palantir stock. Further research on Palantir stock is highly recommended to make informed investment decisions and assess Palantir stock's potential for yourself.

Featured Posts

-

Trumps Transgender Military Ban A Comprehensive Overview And Analysis

May 10, 2025

Trumps Transgender Military Ban A Comprehensive Overview And Analysis

May 10, 2025 -

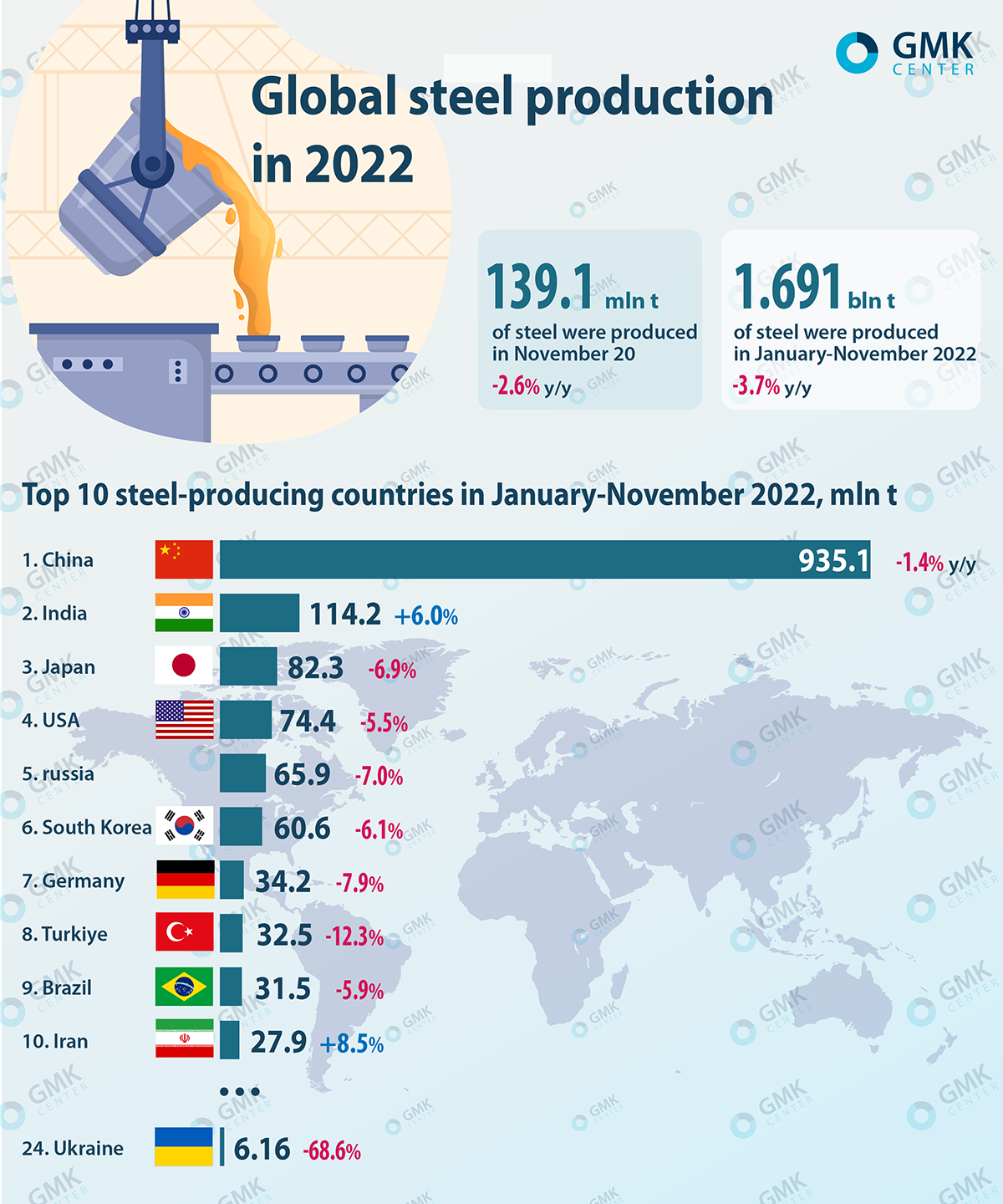

Chinas Steel Production Cuts Impact On Iron Ore Prices

May 10, 2025

Chinas Steel Production Cuts Impact On Iron Ore Prices

May 10, 2025 -

Transgender Experiences And Trumps Executive Orders Sharing Your Story

May 10, 2025

Transgender Experiences And Trumps Executive Orders Sharing Your Story

May 10, 2025 -

Elizabeth Stewart And Lilysilk Partner For A Stunning Spring Collection

May 10, 2025

Elizabeth Stewart And Lilysilk Partner For A Stunning Spring Collection

May 10, 2025 -

Uterine Transplantation A Community Activists Perspective On Transgender Pregnancy

May 10, 2025

Uterine Transplantation A Community Activists Perspective On Transgender Pregnancy

May 10, 2025