China's Steel Production Cuts: Impact On Iron Ore Prices

Table of Contents

Understanding China's Steel Production Cuts

Reasons Behind the Production Reductions

The Chinese government's drive to achieve carbon neutrality and address environmental concerns is a primary driver behind the steel production cuts. Overcapacity in the steel industry has also been a long-standing issue, leading to inefficient production and environmental damage. These factors have converged to prompt significant interventions.

- National carbon emission reduction targets: The Chinese government has set ambitious goals for reducing carbon emissions, with the steel industry, a major carbon emitter, playing a crucial role in achieving these targets. Specific initiatives include stricter emission standards and penalties for non-compliance.

- Environmental protection measures: Increased scrutiny of environmental impact assessments and stricter enforcement of environmental regulations have led to production limitations for steel mills failing to meet stricter standards.

- Curbing overcapacity: The government is actively working to consolidate the steel industry, phasing out smaller, less efficient mills and encouraging mergers and acquisitions to improve overall industry efficiency.

- Real estate market slowdown: The slowdown in China's real estate sector, a major consumer of steel, has significantly reduced demand, further contributing to the production cuts.

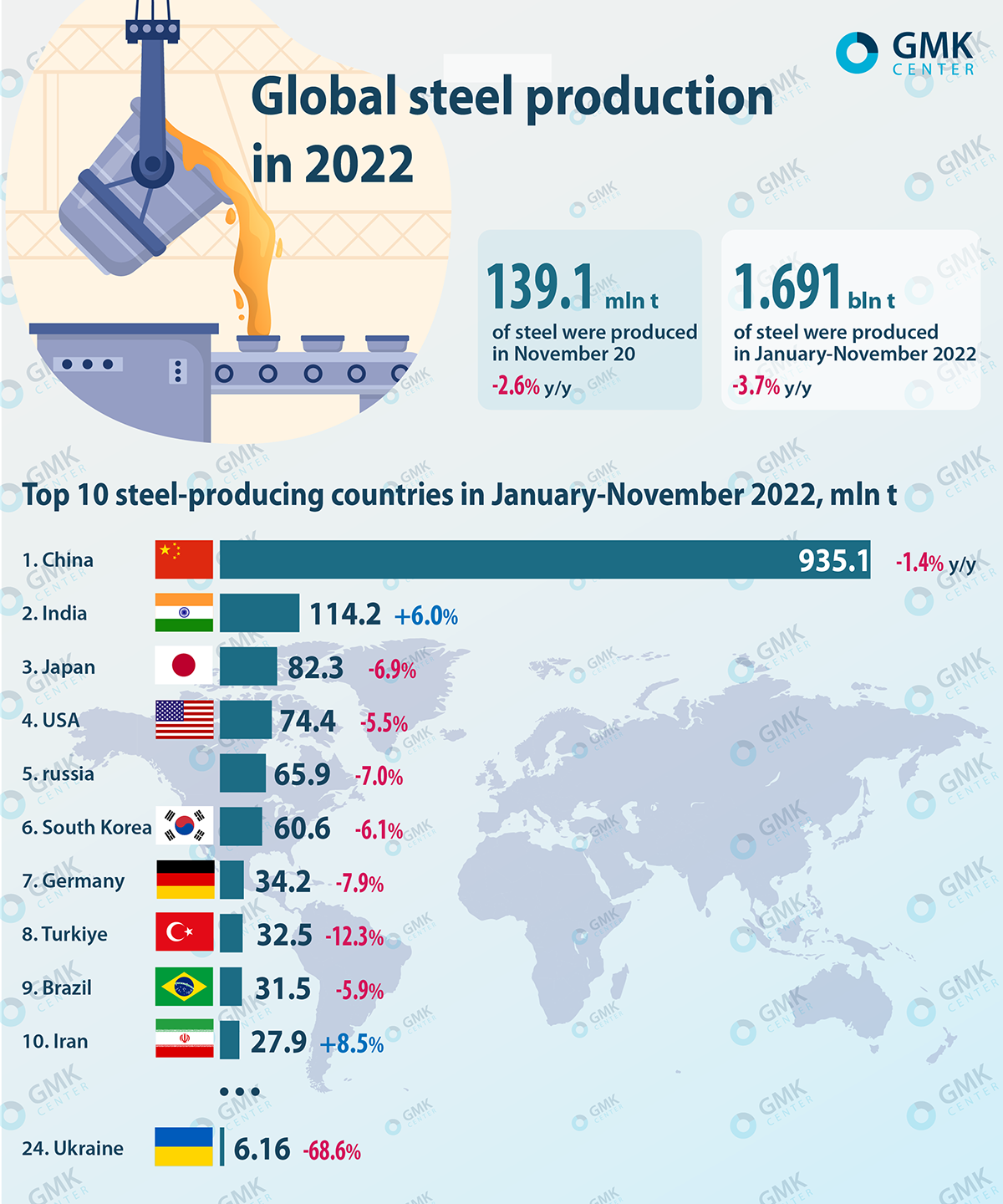

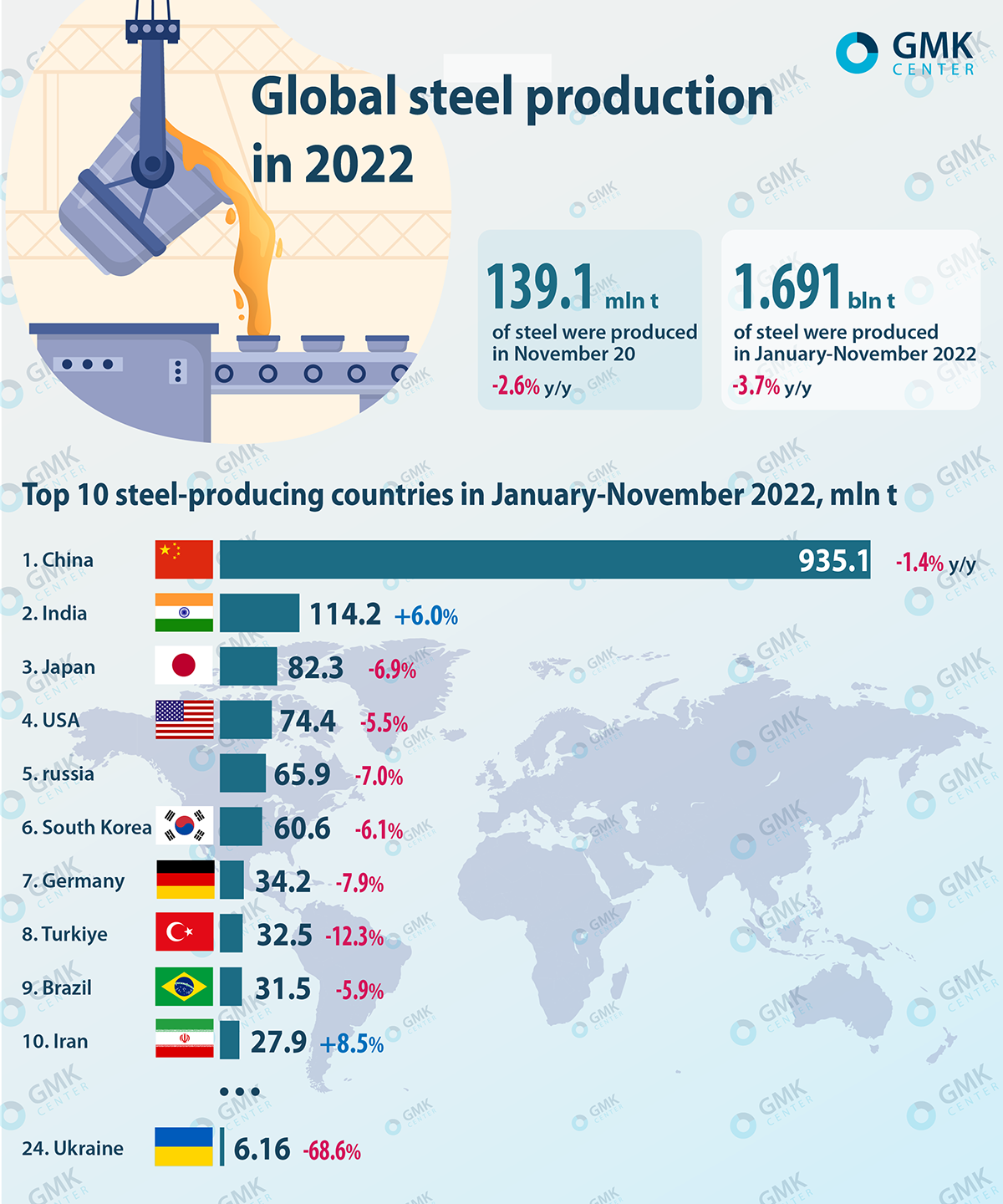

Magnitude of Production Cuts and Their Geographic Distribution

The scale of production cuts is substantial. While precise figures fluctuate, reports indicate a percentage reduction in steel output ranging from X% to Y% in [Year], impacting various regions across China.

- Hebei province, a major steel-producing region, has experienced some of the most significant production cuts.

- The reductions have affected different types of steel, with construction steel and rebar production particularly impacted due to the real estate slowdown.

- The impact is not uniformly distributed across all steel mills. Larger, more efficient mills with better environmental records have generally been less affected compared to smaller, less efficient plants.

Direct Impact on Iron Ore Demand

The Link Between Steel Production and Iron Ore Consumption

Iron ore is a fundamental raw material in steelmaking. The production of steel relies heavily on iron ore as the primary source of iron. A simple reduction in steel production directly translates to a reduced demand for iron ore.

- The basic oxygen furnace (BOF) process, the dominant method of steelmaking, uses iron ore as a key input.

- Historically, there's a strong correlation between China's steel output and its iron ore imports. Data shows that periods of high steel production are invariably accompanied by higher iron ore imports.

Reduced Demand Leading to Price Adjustments

The decrease in steel production directly translates to lower demand for iron ore, impacting prices significantly. This reduced demand creates a surplus in the market, leading to a downward pressure on iron ore prices.

- Supply chain dynamics play a role, with iron ore producers adjusting their output and pricing strategies in response to decreased demand.

- The price adjustments are influenced by factors such as transportation costs, global supply, and speculation in the commodity market.

- Industry forecasts predict that iron ore prices will remain under pressure until there's a substantial increase in steel demand.

Indirect Impacts and Market Dynamics

Impact on Global Iron Ore Supply and Demand

China's reduced demand for iron ore has global implications, impacting iron ore markets worldwide. Major iron ore producers, such as Australia and Brazil, are experiencing decreased export demand, affecting their production and revenue streams.

- The global iron ore market is experiencing a period of readjustment, with prices reflecting the reduced Chinese demand.

- Price volatility is expected to continue as global markets react to the fluctuating demand from China.

- Supply chain disruptions and logistics challenges could further exacerbate the price fluctuations.

Influence on Related Industries

The steel production cuts and resulting changes in iron ore prices have ripple effects throughout various industries. Construction, infrastructure, and manufacturing sectors reliant on steel are experiencing impacts.

- Reduced steel availability can lead to delays in construction projects and infrastructure development.

- The economic consequences include potential job losses in steel-related industries and a slowdown in economic activity in dependent sectors.

- Other commodity prices might also be influenced indirectly, as the steel and iron ore market is interconnected with other sectors.

Conclusion: Navigating the Shifting Landscape of China's Steel Production and Iron Ore Prices

China's steel production cuts have demonstrably impacted iron ore prices, both directly through reduced demand and indirectly through global market adjustments. Understanding these market dynamics is crucial for businesses involved in steel, iron ore, and related industries. Future trends will likely depend on the pace of China's economic recovery, government policies on carbon emissions and environmental protection, and global demand for steel. Staying informed about China steel production and iron ore price fluctuations is essential for making sound business decisions. Continue monitoring industry news and analysis to navigate this evolving landscape effectively. [Link to relevant resource].

Featured Posts

-

Wynne Evans Health Update A Nasty Illness And Showbiz Return Hints

May 10, 2025

Wynne Evans Health Update A Nasty Illness And Showbiz Return Hints

May 10, 2025 -

Incendie A Dijon La Mediatheque Champollion Touchee

May 10, 2025

Incendie A Dijon La Mediatheque Champollion Touchee

May 10, 2025 -

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025 -

Elizabeth Hurleys Cleavage Iconic Moments And Red Carpet Glamour

May 10, 2025

Elizabeth Hurleys Cleavage Iconic Moments And Red Carpet Glamour

May 10, 2025 -

Trumps Surgeon General Pick Casey Means And The Significance Of The Maha Movement

May 10, 2025

Trumps Surgeon General Pick Casey Means And The Significance Of The Maha Movement

May 10, 2025