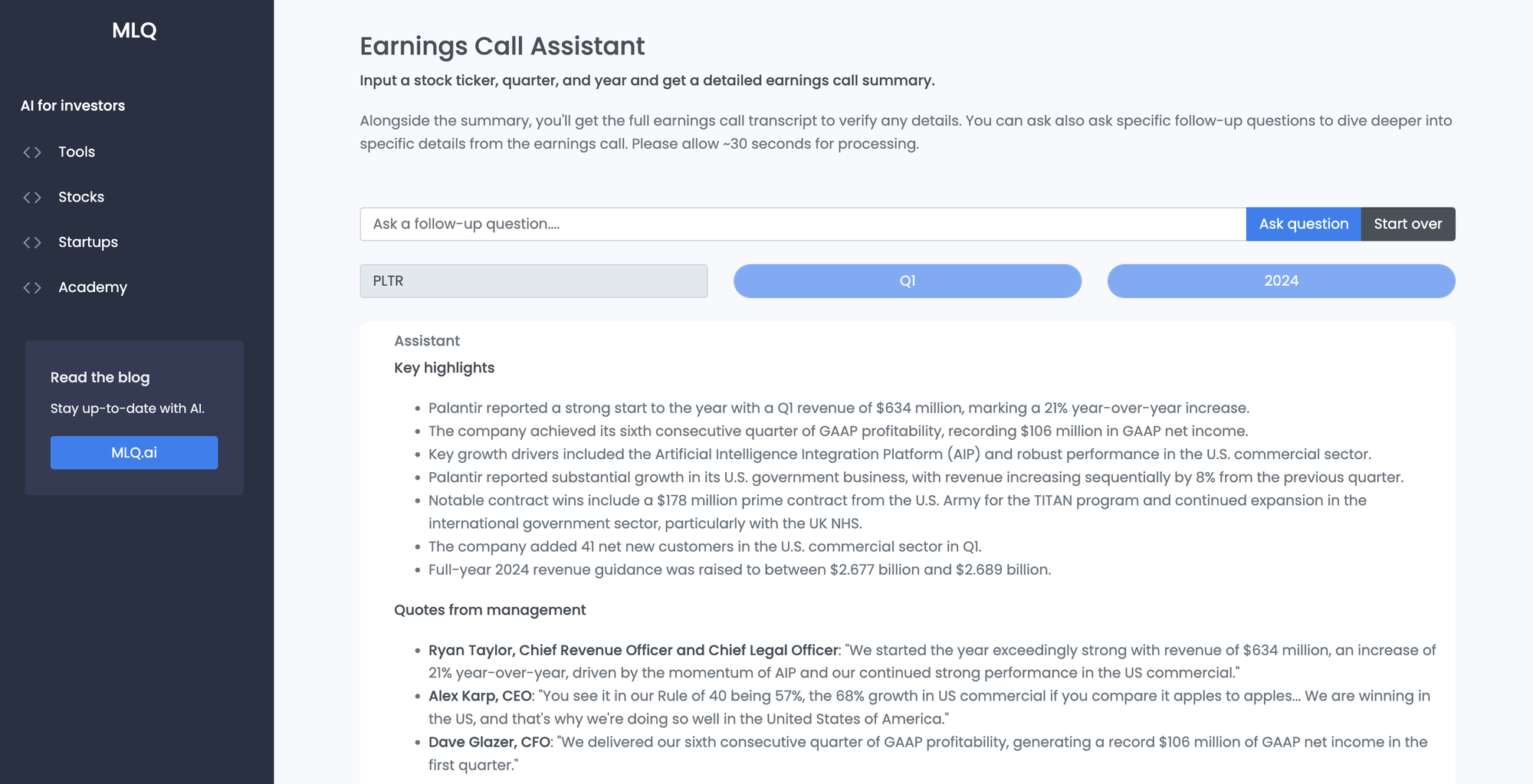

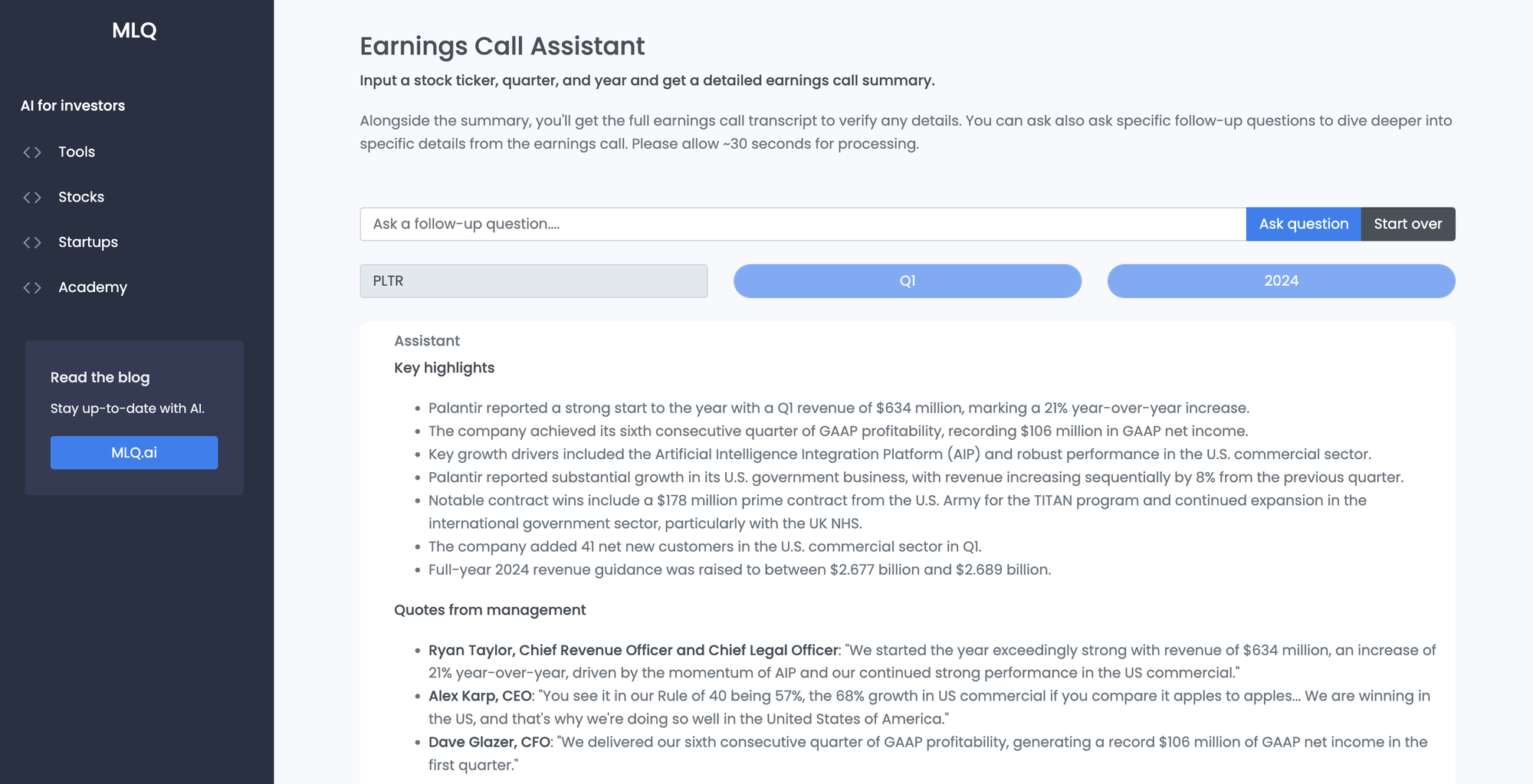

Palantir Stock: Analyzing Q1 2024 Government And Commercial Revenue

Table of Contents

Palantir's Q1 2024 Government Revenue: A Detailed Analysis

Palantir's government revenue continues to be a significant driver of its overall financial performance. Analyzing this sector requires examining both contract wins and the factors influencing growth.

Government Contract Wins and Their Significance

Palantir secured several key government contracts in Q1 2024, demonstrating continued confidence in its platform's capabilities.

- Contract A: A multi-year, multi-million dollar contract with the US Department of Defense, focusing on enhancing national security data analysis. This contract represents a significant expansion of Palantir's existing presence within the DoD ecosystem.

- Contract B: A substantial contract with a major European intelligence agency, highlighting Palantir's growing international presence and demand for its platform's capabilities beyond US borders. This marks a significant expansion into the European government data analytics market.

- Contract C: A contract focusing on improving national security, disaster response, and infrastructure resilience with a significant North American government entity.

These wins underscore Palantir's ability to secure large, complex government contracts, contributing to substantial year-over-year growth in government revenue. The strategic importance of these contracts lies in their long-term nature and their contribution to Palantir's reputation as a trusted provider of critical data analytics solutions to government agencies worldwide. Compared to Q1 2023, government revenue showed a robust increase, further solidifying Palantir's position in this sector. The geographic distribution of these contracts highlights a significant focus on North America, but with growing international opportunities in Europe and elsewhere.

Factors Influencing Government Revenue Growth

Several factors influence Palantir's government revenue growth:

- Geopolitical Factors: Increasing geopolitical instability and the need for advanced data analytics solutions are boosting demand for Palantir's platform.

- Budget Allocations: Government budgets allocated to national security and intelligence gathering directly impact Palantir's revenue potential.

- Competitive Landscape: While competition exists, Palantir's proven track record and specialized platform give it a competitive edge in the government sector.

- Regulations and Procurement: Government procurement processes can influence the timing and size of contract awards. Navigating these complexities effectively is key for maintaining consistent growth.

Palantir's considerable market share in the government data analytics sector is a testament to its platform's effectiveness and the company's strategic relationships with key government agencies.

Palantir's Q1 2024 Commercial Revenue: Exploring Growth Drivers

While government contracts remain a significant revenue source, Palantir's commercial sector is also experiencing growth, albeit at a potentially different pace than government contracts.

Key Commercial Partnerships and Client Acquisition

Palantir is actively expanding its commercial client base across various industries:

- Financial Services: New partnerships with major financial institutions leveraging Palantir's platform for fraud detection, risk management, and regulatory compliance.

- Healthcare: Growing adoption of Palantir's platform by healthcare providers for improving operational efficiency and patient care.

- Energy: Expanding contracts with energy companies utilizing Palantir's platform for optimizing operations, predictive maintenance, and reducing environmental impact.

These partnerships highlight Palantir's ability to adapt its platform to the specific needs of diverse commercial sectors. The platform's advanced functionalities, including data integration, analysis, and visualization capabilities, are driving commercial adoption.

Challenges and Opportunities in the Commercial Market

Despite the growth, challenges remain:

- Competition: The commercial data analytics market is highly competitive, with several established players vying for market share.

- Economic Conditions: Economic downturns can impact commercial spending on data analytics solutions.

- Customer Adoption Rates: Successfully onboarding new commercial clients and ensuring platform adoption can take time.

Palantir's strategies to overcome these challenges include focusing on strategic partnerships, developing tailored solutions for specific industry needs, and expanding its sales and marketing efforts to reach a broader audience. The opportunity for growth in the commercial sector remains significant, given the increasing demand for data-driven decision-making across various industries.

Comparative Analysis: Government vs. Commercial Revenue Performance

Comparing the growth rates of government and commercial revenue in Q1 2024 offers valuable insights. While government revenue demonstrated a strong and consistent increase, the commercial sector showed a slower but still positive growth trajectory. The relative contribution of each sector to Palantir's overall revenue underscores the importance of both sectors for maintaining the company's financial health. The long-term outlook for each sector depends on various factors including governmental spending, economic conditions and market competition.

Investor Implications and Future Outlook for Palantir Stock

The Q1 2024 results provide valuable information for investors. While strong government revenue is encouraging, understanding the growth dynamics of the commercial sector is also crucial for assessing the long-term potential of Palantir stock. Analyst predictions and future earnings expectations vary, reflecting the inherent uncertainties in the technology and data analytics market. Potential risks include increased competition, economic slowdowns, and difficulties in scaling commercial operations. Opportunities include continued growth in the government sector, successful penetration of new commercial markets, and technological advancements that strengthen Palantir's platform capabilities.

Conclusion: Investing in Palantir Stock Based on Q1 2024 Performance

This in-depth look at Palantir's Q1 2024 government and commercial revenue reveals a mixed but largely positive picture. Strong government revenue provides a solid foundation, while growth in the commercial sector indicates potential for future expansion. Key takeaways include the importance of both government and commercial revenue streams for Palantir’s success, the need for careful consideration of the competitive landscape, and the long-term outlook for growth based on continued innovation and strategic partnerships. This analysis of Palantir stock, focusing on Q1 2024 revenue, provides valuable insight for investors. Conduct your own thorough due diligence before making any investment decisions. Learn more about Palantir's future prospects and analyze the latest financial reports to make informed decisions regarding Palantir stock and its potential.

Featured Posts

-

Up 40 In 2025 A Deep Dive Into Palantir Stocks Future Potential

May 09, 2025

Up 40 In 2025 A Deep Dive Into Palantir Stocks Future Potential

May 09, 2025 -

New Totalitarian Threat Lais Warning On Ve Day

May 09, 2025

New Totalitarian Threat Lais Warning On Ve Day

May 09, 2025 -

Anchorage Welcomes Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

Anchorage Welcomes Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025 -

Bayern Muenchen Inter Ja Psg Etenevaet Mestarien Liigan Puolivaelieriin

May 09, 2025

Bayern Muenchen Inter Ja Psg Etenevaet Mestarien Liigan Puolivaelieriin

May 09, 2025 -

Gods Mercy In 1889 A Diverse Religious Landscape

May 09, 2025

Gods Mercy In 1889 A Diverse Religious Landscape

May 09, 2025