Up 40% In 2025? A Deep Dive Into Palantir Stock's Future Potential

Table of Contents

Palantir's Growing Government and Commercial Contracts

Palantir's success hinges on its ability to secure and expand its client base across both government and commercial sectors. Its data analytics platforms are highly sought after, driving significant revenue streams.

Government Contracts: A Foundation of Strength

The demand for advanced data analytics within defense and intelligence agencies is consistently high, providing a solid foundation for Palantir's growth. Government contracts represent a significant portion of Palantir's revenue, offering long-term stability and predictability.

- Recent large contracts: Palantir has secured numerous multi-year contracts with various government agencies, including significant deals with the U.S. Department of Defense and intelligence agencies worldwide. These contracts often involve substantial funding and long-term commitments.

- Long-term nature: The nature of these government contracts ensures a steady stream of revenue, reducing the volatility often associated with shorter-term commercial deals. This predictability is crucial for investors looking for stable returns.

- Key clients and services: Palantir provides critical data analytics and intelligence solutions, supporting crucial national security initiatives. Its services range from threat detection and prevention to resource optimization and mission planning. The reliance of government agencies on these services solidifies the ongoing demand for Palantir's expertise.

Commercial Market Expansion: Fueling Future Growth

While government contracts form a crucial part of Palantir's business, its expansion into the commercial sector holds enormous potential. The company is actively targeting key industries like finance, healthcare, and aerospace, demonstrating a commitment to diversification and reduced reliance on single-sector revenue.

- Successful commercial partnerships: Palantir has forged partnerships with major players in various sectors, leveraging its platform's capabilities to improve operational efficiency and decision-making. These collaborations are instrumental in showcasing Palantir's value proposition to a wider audience.

- Market penetration and growth potential: The potential for growth in the commercial sector is vast, given the increasing need for data-driven insights across diverse industries. Palantir's advanced analytics capabilities position it well to capture significant market share.

- Industry specific applications: Palantir's platform is adaptable, allowing for tailored solutions within specific industries. In finance, it can enhance fraud detection and risk management; in healthcare, it can optimize patient care and drug discovery; and in aerospace, it can improve supply chain management and safety protocols.

Technological Innovation and Competitive Advantage

Palantir's continued success relies heavily on its commitment to technological innovation, specifically within the realms of AI and data integration.

AI and Machine Learning Advancements: Driving Efficiency and Insights

Palantir is heavily invested in artificial intelligence and machine learning, incorporating these technologies into its platform to enhance its capabilities and provide more accurate and actionable insights.

- AI applications: Palantir utilizes AI for various tasks, including predictive modeling, anomaly detection, and automated data analysis. These features enhance the platform's effectiveness and provide significant value to clients.

- Patents and intellectual property: Palantir holds numerous patents and intellectual property related to its AI and machine learning advancements, providing a strong competitive moat. This protects its innovative technologies and ensures a unique market position.

- Competitive edge: Palantir's investment in AI and machine learning sets it apart from competitors, providing a significant competitive advantage in the rapidly evolving data analytics landscape.

Data Integration and Platform Scalability: Handling the Data Deluge

Palantir's platform is designed to handle massive datasets and integrate diverse data sources, a critical capability in today's data-driven world.

- Platform scalability: The platform's ability to scale seamlessly ensures that it can adapt to the evolving needs of clients, regardless of the size or complexity of their data.

- Data management capabilities: Palantir's platform excels in managing and analyzing vast amounts of unstructured data, providing clients with comprehensive insights from disparate sources. This is crucial for organizations dealing with data from multiple sources and systems.

- Adaptability and future expansion: The platform's adaptability allows Palantir to expand into new markets and cater to the specific needs of various industries, further fueling growth.

Potential Risks and Challenges to Palantir Stock Growth

While the outlook for Palantir is promising, it's essential to acknowledge the potential risks and challenges that could impact its stock price.

Competition and Market Saturation: Navigating a Crowded Field

The data analytics market is becoming increasingly competitive, with established players and new entrants vying for market share.

- Key competitors: Palantir faces competition from both large technology companies and specialized analytics firms. These competitors offer similar services, requiring Palantir to constantly innovate and differentiate itself.

- Market share analysis: Analyzing Palantir's market share and its growth trajectory relative to its competitors is crucial to assess its future prospects.

- Competitive strategies: Palantir's strategies for maintaining its competitive edge include continuous innovation, strategic partnerships, and a focus on delivering exceptional customer value.

Financial Performance and Profitability: Monitoring Key Metrics

Palantir's financial performance, including revenue growth, profitability, and debt levels, will significantly influence its stock price.

- Key financial metrics: Closely monitoring metrics such as revenue growth, earnings per share (EPS), and operating margins is essential to evaluating Palantir's financial health.

- Profitability trends: Analyzing the trends in Palantir's profitability and its path to sustained profitability is critical for investors.

- Debt levels and financial stability: Assessing Palantir's debt levels and its ability to manage its financial obligations is crucial for assessing its long-term financial stability.

Geopolitical Risks: Navigating Global Uncertainty

Geopolitical events and international relations can significantly impact Palantir's business operations and stock price, particularly given its substantial government contracts.

- Political and economic instability: Instability in regions where Palantir operates could disrupt contract negotiations, impact revenue streams, and negatively affect its stock price.

- International relations: Changes in international relations and trade policies can influence the demand for Palantir's services and its ability to secure new contracts.

- Regulatory hurdles: Navigating the complexities of international regulations and compliance requirements is a crucial aspect of Palantir's operations.

Conclusion: Investing in Palantir Stock – Is 40% Growth Realistic?

This analysis suggests that Palantir's stock could potentially see significant growth, perhaps even reaching the 40% increase predicted by some analysts by 2025. This potential is driven by its strong government contracts, expansion into the lucrative commercial sector, and continuous investment in AI and data integration. However, the inherent risks associated with market competition, financial performance, and geopolitical factors must be carefully considered. Predicting stock market performance with certainty is impossible. The 40% growth prediction should be viewed with caution, acknowledging the inherent uncertainties involved in any stock market forecast.

Before making any investment decisions related to Palantir stock, thorough research is paramount. Review Palantir's financial reports, analyze industry trends, and consider consulting a financial advisor to assess the risks and potential rewards. Remember to conduct due diligence before investing in any stock, including further research into Palantir's financial performance and the broader data analytics market.

Featured Posts

-

Skepticism Remains Among Shippers Despite Trumps Houthi Truce Announcement

May 09, 2025

Skepticism Remains Among Shippers Despite Trumps Houthi Truce Announcement

May 09, 2025 -

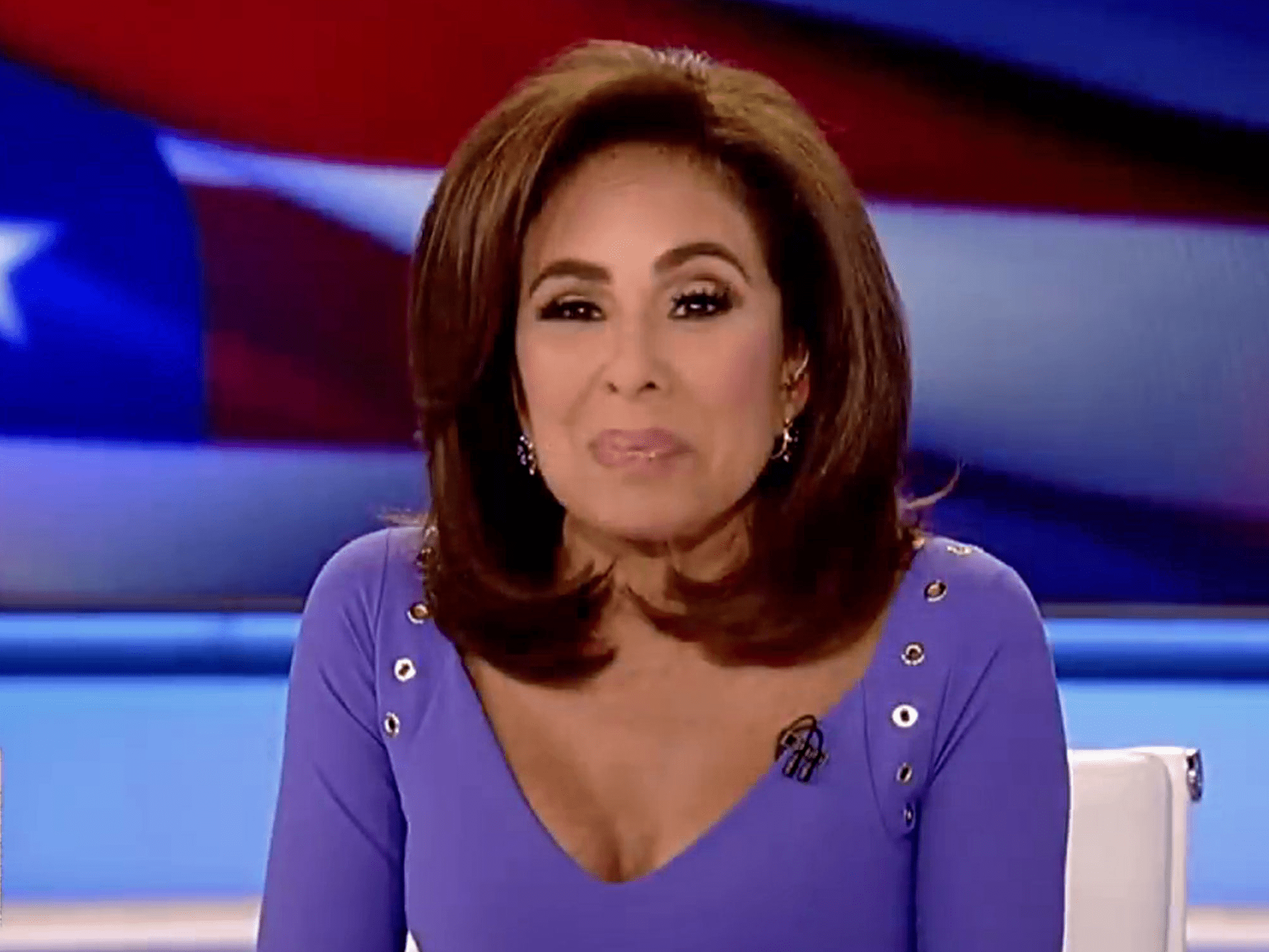

Understanding Jeanine Pirro The Fox News Perspective

May 09, 2025

Understanding Jeanine Pirro The Fox News Perspective

May 09, 2025 -

When Does The Next High Potential Episode Air On Abc

May 09, 2025

When Does The Next High Potential Episode Air On Abc

May 09, 2025 -

Obyavlenie Aeroport Permi Zakryt Do 4 00 Iz Za Snegopada

May 09, 2025

Obyavlenie Aeroport Permi Zakryt Do 4 00 Iz Za Snegopada

May 09, 2025 -

The Correlation Between Us Power And Elon Musks Net Worth A Tesla Analysis

May 09, 2025

The Correlation Between Us Power And Elon Musks Net Worth A Tesla Analysis

May 09, 2025