Palantir Competitors: Predicting Top Performing Stocks For The Next 3 Years

Table of Contents

Palantir Technologies has carved a significant niche in the big data analytics and government contracting sectors, leveraging its advanced platforms for data integration and analysis. However, the burgeoning big data analytics market is far from a one-company show. This article analyzes leading Palantir competitors, assessing their potential for strong stock performance over the next three years, offering insights for savvy investors interested in capitalizing on the growth of big data and AI-driven solutions. We'll explore key players, evaluate their financial health, and assess the risks and rewards associated with investing in this dynamic sector.

Key Palantir Competitors in the Big Data Analytics Market

Palantir's core business revolves around providing sophisticated data integration and analytics platforms, primarily to government and enterprise clients. Its competitive advantages include strong security features, a user-friendly interface, and a proven track record of success in complex data analysis projects. However, several companies are vying for market share in this rapidly expanding field. Let's examine some of the key Palantir competitors:

-

C3.ai: C3.ai offers enterprise-grade AI applications built on a proprietary platform.

- Company Overview: Provides pre-built and customizable AI applications for various industries.

- Market Capitalization & Recent Stock Performance: (Insert current data here – requires up-to-date research). Note recent trends and volatility.

- Strengths vs. Palantir: Focus on pre-built solutions, potentially faster implementation.

- Weaknesses vs. Palantir: Less customization for highly specific needs.

- Growth Potential: Strong potential in specific sectors like energy and manufacturing.

-

Databricks: Databricks provides a unified analytics platform built on Apache Spark.

- Company Overview: Offers a collaborative environment for data engineering, data science, and machine learning.

- Market Capitalization & Recent Stock Performance: (Insert current data here – requires up-to-date research)

- Strengths vs. Palantir: Strong open-source foundation, large and active community.

- Weaknesses vs. Palantir: Might require more technical expertise to implement effectively.

- Growth Potential: High growth potential driven by the increasing adoption of cloud-based analytics.

-

Amazon Web Services (AWS): AWS offers a comprehensive suite of big data and analytics services within its cloud platform.

- Company Overview: Part of Amazon, offers a wide range of data services including Redshift, EMR, and SageMaker.

- Market Capitalization & Recent Stock Performance: (Insert current data here – requires up-to-date research)

- Strengths vs. Palantir: Massive scale, broad ecosystem, integration with other AWS services.

- Weaknesses vs. Palantir: Can be complex to manage, cost can escalate quickly.

- Growth Potential: Sustained growth expected due to the dominance of AWS in the cloud computing market.

-

Google Cloud Platform (GCP): Similar to AWS, GCP provides a range of big data and analytics tools.

- Company Overview: Google's cloud computing offering, with services like BigQuery and Dataproc.

- Market Capitalization & Recent Stock Performance: (Insert current data here – requires up-to-date research)

- Strengths vs. Palantir: Strong AI capabilities, integration with Google's other products.

- Weaknesses vs. Palantir: Can be complex for non-technical users, competition with AWS.

- Growth Potential: Strong growth potential, driven by Google's investments in AI and machine learning.

-

Microsoft Azure: Microsoft's cloud platform also offers extensive big data and analytics capabilities.

- Company Overview: Offers a comprehensive suite of data services, including Azure Synapse Analytics and Azure HDInsight.

- Market Capitalization & Recent Stock Performance: (Insert current data here – requires up-to-date research)

- Strengths vs. Palantir: Strong integration with Microsoft's enterprise software products.

- Weaknesses vs. Palantir: Competition from AWS and GCP.

- Growth Potential: Consistent growth anticipated due to Microsoft's strong enterprise relationships.

-

MicroStrategy: MicroStrategy is a business intelligence company providing enterprise analytics, mobility, and cloud services.

- Company Overview: Offers a comprehensive platform for business intelligence and data visualization.

- Market Capitalization & Recent Stock Performance: (Insert current data here – requires up-to-date research)

- Strengths vs. Palantir: Strong focus on business intelligence and reporting.

- Weaknesses vs. Palantir: Less focus on advanced data science and machine learning.

- Growth Potential: Moderate growth potential, dependent on continued enterprise adoption.

Analyzing Financial Performance and Growth Projections

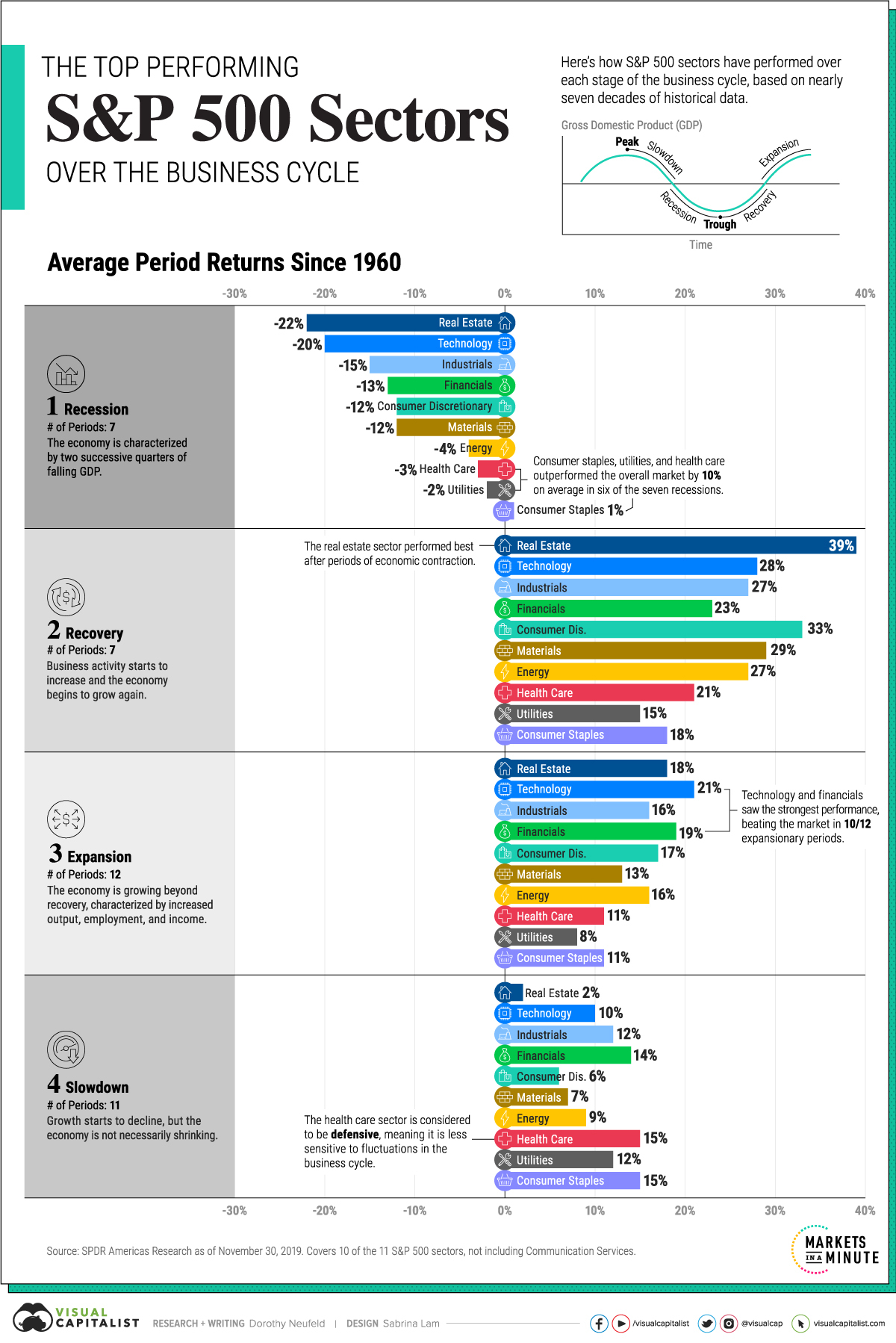

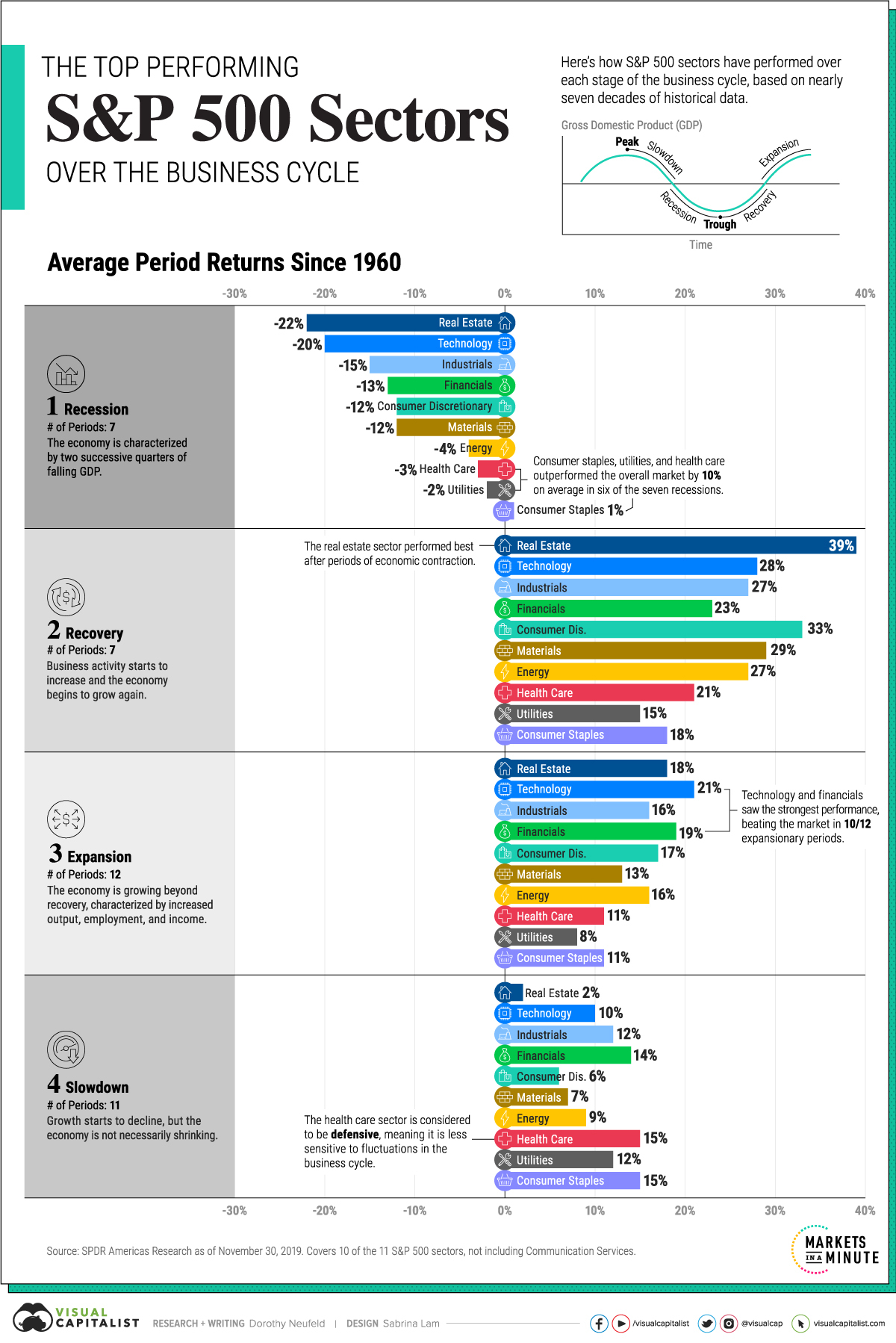

Evaluating potential investments in big data analytics stocks requires a careful assessment of key financial metrics. These include: revenue growth, operating margins, profit margins, debt-to-equity ratio, and cash flow. A comparative analysis of these metrics across the identified Palantir competitors is crucial. (Include charts and graphs comparing revenue growth, profit margins, etc. for each competitor. This section requires significant financial data research and visualization).

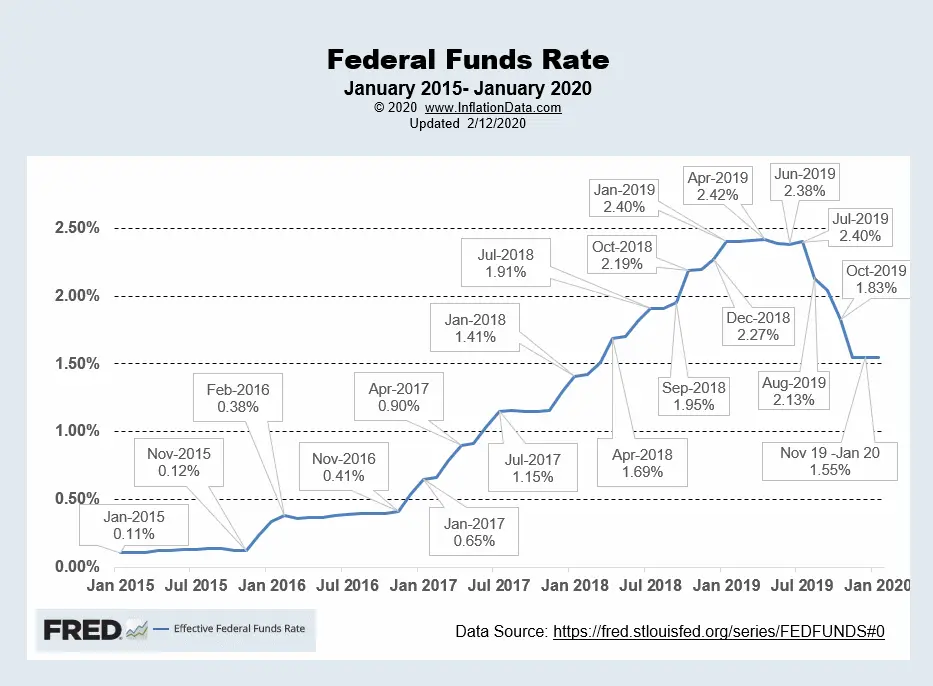

Factors influencing future growth include technological advancements (e.g., advancements in AI and machine learning), regulatory changes (e.g., data privacy regulations), and market demand (e.g., increasing adoption of cloud-based analytics). For example, C3.ai's success is tied to the adoption of AI in various industries, while Databricks' growth hinges on the continued expansion of the open-source Spark ecosystem.

Assessing Risk and Reward in Investing in Palantir Competitors

Investing in the technology sector, especially in rapidly evolving markets like big data analytics, carries inherent risks. These include:

- Competitive pressure: Intense competition from established players and new entrants.

- Technological disruption: Rapid technological advancements can render existing products obsolete.

- Economic downturns: Technology stocks are often more vulnerable during economic recessions.

- Regulatory uncertainty: Changes in data privacy regulations can impact business operations.

Analyzing the competitive landscape and potential threats to each competitor's market share is essential. Evaluating the potential for disruption from new technologies or emerging competitors requires careful consideration. (Provide a risk assessment matrix, or similar visualization, summarizing the risks associated with investing in each competitor). The risk-reward profile of each competitor should be carefully weighed, considering potential returns and associated risks.

Diversification Strategies for a Balanced Portfolio

Diversification is a cornerstone of effective investment strategies. Spreading investments across multiple Palantir competitors minimizes risk and reduces portfolio volatility. A well-diversified portfolio might include a mix of companies representing different aspects of the big data analytics market, such as cloud providers (AWS, GCP, Azure), specialized analytics platforms (Databricks, C3.ai), and business intelligence providers (MicroStrategy). This strategy allows investors to benefit from the overall growth of the sector while mitigating the impact of underperformance in any single company.

Conclusion

This analysis has highlighted several key Palantir competitors and assessed their potential for stock market growth over the next three years. Based on financial performance, growth potential, and risk assessment, (Summarize the top 2-3 most promising competitors based on your analysis). While this information provides valuable insights, it's crucial to remember that the stock market is inherently unpredictable.

Call to Action: While this analysis provides valuable insights into potential investment opportunities in Palantir competitors, conducting thorough due diligence and consulting with a financial advisor is crucial before making any investment decisions. Start your research on top-performing Palantir competitors today to identify the best stocks for your portfolio! Remember to regularly review your investment strategy and adjust it as needed based on market conditions and your personal financial goals.

Featured Posts

-

The Evolving Landscape Of The Chinese Auto Industry Lessons From Bmw And Porsche

May 10, 2025

The Evolving Landscape Of The Chinese Auto Industry Lessons From Bmw And Porsche

May 10, 2025 -

Transgender Childbearing Exploring The Possibility Of Uterine Transplants

May 10, 2025

Transgender Childbearing Exploring The Possibility Of Uterine Transplants

May 10, 2025 -

Interest Rate Decisions Understanding The Feds Cautious Approach

May 10, 2025

Interest Rate Decisions Understanding The Feds Cautious Approach

May 10, 2025 -

Plantation De Vignes A Dijon Projet De 2500 M Aux Valendons

May 10, 2025

Plantation De Vignes A Dijon Projet De 2500 M Aux Valendons

May 10, 2025 -

Dakota Johnson Channels Spring In A Stunning Dress A Mother Daughter Fashion Moment

May 10, 2025

Dakota Johnson Channels Spring In A Stunning Dress A Mother Daughter Fashion Moment

May 10, 2025