Pakistan's Stock Market Instability: PSX Portal Issues And Current Events

Table of Contents

Understanding the Current State of the PSX

Recent Market Trends and Volatility

The PSX has shown considerable volatility, reflecting the interplay of various economic and political factors. The PSX index, a key indicator of market performance, has experienced both sharp gains and substantial losses in recent periods. This fluctuation directly impacts market capitalization and trading volume.

- Example 1: A sudden drop in the PSX index following a significant political event.

- Example 2: A period of substantial growth driven by positive economic indicators.

- Example 3: A decline mirroring global market downturns.

Key factors driving this instability include:

- Political Uncertainty: Political instability often leads to investor hesitancy and capital flight.

- Economic Challenges: Inflation, currency devaluation, and fiscal deficits significantly impact market sentiment.

- Global Market Influences: International economic trends and geopolitical events inevitably affect the PSX.

Impact of Geopolitical Factors on PSX Performance

Geopolitical risk is a significant factor influencing the PSX. Regional tensions and global events directly affect investor confidence and foreign investment.

- Example 1: The impact of regional conflicts on investor sentiment and capital flows.

- Example 2: The effect of global economic sanctions on market stability.

- Example 3: The influence of international relations on foreign investment in the PSX.

International relations and global economic trends play a crucial role. Positive global developments can boost investor confidence, leading to increased trading activity and market growth, while negative events can trigger significant sell-offs.

Analyzing PSX Portal Issues and their Impact

Technical Glitches and System Downtime

Reports of PSX portal downtime and technical glitches have raised concerns about the reliability of the trading platform. These system errors can disrupt trading activity, leading to lost opportunities and potential financial losses for investors.

- Example 1: An instance of prolonged system downtime preventing investors from executing trades.

- Example 2: Technical glitches causing inaccurate display of market data.

- Example 3: System failures leading to delays in settlement processes.

Addressing these issues requires:

- Improved IT infrastructure and system upgrades.

- Robust disaster recovery plans to minimize downtime.

- Regular system maintenance and testing to prevent errors.

Transparency and Information Access

The level of transparency provided through the PSX portal regarding market data, regulations, and company disclosures is crucial for investor confidence. Readily available and reliable information is vital for informed decision-making.

- Areas needing improvement: Timely dissemination of crucial market data, clearer explanations of regulations, and easy access to company financial statements.

- Enhanced transparency measures: Improved data visualization tools, simplified regulatory documentation, and increased use of digital communication channels.

The Role of Government Policies and Regulations

Government Interventions and their Effect

Government policies, both monetary and fiscal, significantly impact the PSX's stability. Interventions aim to manage inflation, stimulate economic growth, and maintain market stability.

- Example 1: The impact of interest rate adjustments on investor behavior and market sentiment.

- Example 2: The effect of government spending programs on economic growth and market performance.

- Example 3: The consequences of regulatory changes on market participants.

Analyzing the effectiveness of these interventions requires careful consideration of both short-term and long-term effects.

Future Regulatory Outlook and Investor Protection

Future regulatory reforms and initiatives aimed at improving investor protection and market transparency are crucial for enhancing confidence in the PSX. A robust regulatory framework is essential for attracting both domestic and foreign investment.

- Potential regulatory changes: Strengthening investor protection laws, improving corporate governance standards, and enhancing market surveillance mechanisms.

- Investor protection initiatives: Increasing awareness of investor rights, improving dispute resolution mechanisms, and promoting financial literacy.

Conclusion

Pakistan's stock market instability is a complex issue stemming from the interplay of various economic, political, and technological factors. PSX portal issues, coupled with current events, significantly impact market confidence. Addressing these challenges requires improvements in PSX portal reliability, increased transparency, effective government interventions, and robust regulatory reforms focusing on investor protection. Understanding Pakistan's stock market instability and staying updated on PSX portal developments is crucial for navigating the complexities of the market. Continue to monitor the PSX for updates and make informed investment decisions based on reliable information.

Featured Posts

-

High Potentials Bold Finale Why Abc Was Impressed

May 09, 2025

High Potentials Bold Finale Why Abc Was Impressed

May 09, 2025 -

France And Poland Strengthen Ties Friendship Treaty On The Horizon

May 09, 2025

France And Poland Strengthen Ties Friendship Treaty On The Horizon

May 09, 2025 -

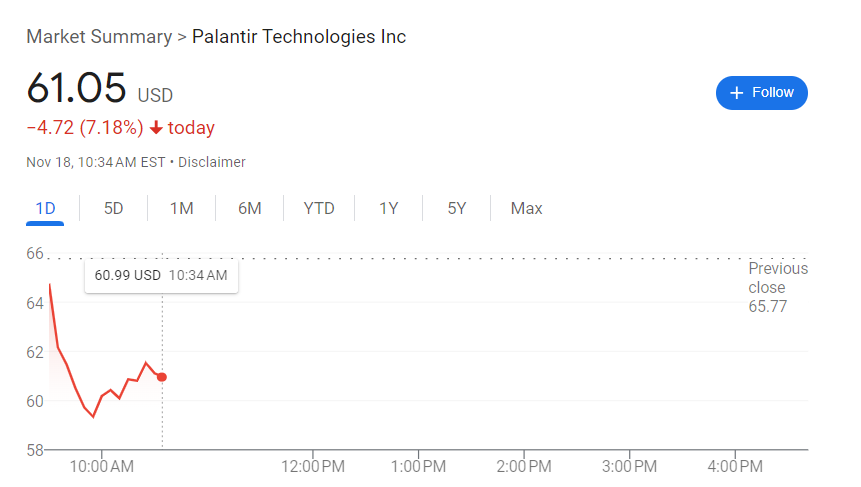

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025 -

Public Shows Support For Wynne Evans Following Allegations

May 09, 2025

Public Shows Support For Wynne Evans Following Allegations

May 09, 2025 -

Zelenskiy Tramp V Vatikane Makron Otsenil Itogi Vstrechi

May 09, 2025

Zelenskiy Tramp V Vatikane Makron Otsenil Itogi Vstrechi

May 09, 2025