Option Trading Strategies: Capitalizing On The AUD-NZD Spread

Table of Contents

Understanding the AUD-NZD Currency Pair

The Australian dollar (AUD) and the New Zealand dollar (NZD) are closely linked, but their exchange rate fluctuates based on various economic factors. Understanding these influences is key to successful AUD-NZD option trading.

Economic Factors Influencing the Spread

The interconnected economies of Australia and New Zealand mean that several factors impact the AUD/NZD exchange rate:

-

Interest Rate Differentials: Higher Australian interest rates generally strengthen the AUD against the NZD, attracting foreign investment. Conversely, higher New Zealand rates favor the NZD. Traders can use interest rate announcements and forecasts to predict AUD-NZD movements.

-

Commodity Prices: Australia is a major exporter of commodities like iron ore and gold. Strong commodity prices boost the AUD, while weaker prices exert downward pressure. Monitoring commodity price indices is crucial for AUD-NZD option trading.

-

Trade Balances: The trade performance of both countries influences their respective currencies. A strong trade surplus generally strengthens the currency. Analyzing trade data can provide insights into future AUD-NZD trends.

-

Political Stability: Political uncertainty or instability in either country can negatively impact its currency, affecting the AUD-NZD spread. Staying informed about political developments is essential.

Analyzing AUD-NZD Charts

Technical analysis is crucial for identifying trading opportunities in the AUD-NZD pair. Here are some key techniques:

-

Support and Resistance Levels: These levels indicate price points where the market has historically shown difficulty breaking through. Identifying these levels helps determine potential entry and exit points.

-

Trend Lines: Connecting swing highs and lows helps identify the overall trend (uptrend, downtrend, or sideways). Trading in the direction of the trend often increases the probability of success.

-

Moving Averages: Moving averages smooth out price fluctuations, helping identify trends and potential reversals. Commonly used averages include the 50-day and 200-day moving averages.

-

Chart Patterns: Recognizing chart patterns like head and shoulders, double tops/bottoms, and triangles can signal potential trend reversals or breakouts.

-

Technical Indicators: Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help confirm trends and identify overbought or oversold conditions. For example, an RSI above 70 might suggest the AUD is overbought against the NZD, presenting a potential shorting opportunity.

Bullish Option Strategies for AUD-NZD

If you anticipate the AUD appreciating against the NZD, bullish option strategies are suitable.

Long Call Options

A long call option gives the buyer the right, but not the obligation, to buy the AUD at a specific price (strike price) by a certain date (expiration date).

-

Risk/Reward Profile: Limited risk (maximum loss is the premium paid), unlimited profit potential.

-

Suitable Market Conditions: Bullish market conditions where the AUD is expected to appreciate significantly.

-

Entry/Exit Points: Enter the trade when you identify a bullish signal (e.g., breakout above resistance). Exit when your target price is reached or before expiration.

-

Strike Price Selection: Choose a strike price slightly above the current market price to maximize profit potential while managing risk.

-

Premium Cost: The cost of the option is the premium, which is deducted from your profit.

-

Example: Buying a call option with a strike price of 1.08 if you anticipate the AUD/NZD rising above that level.

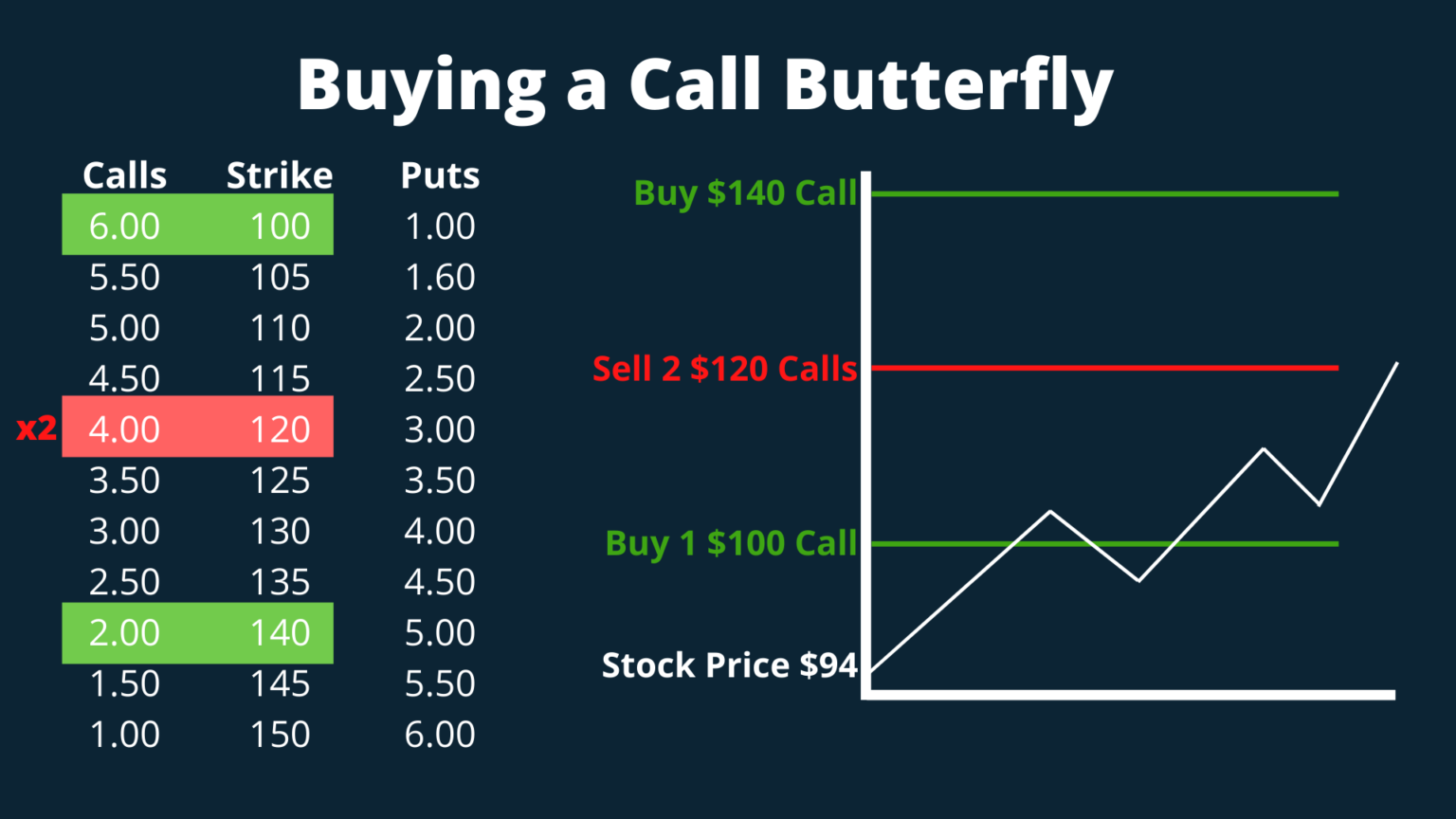

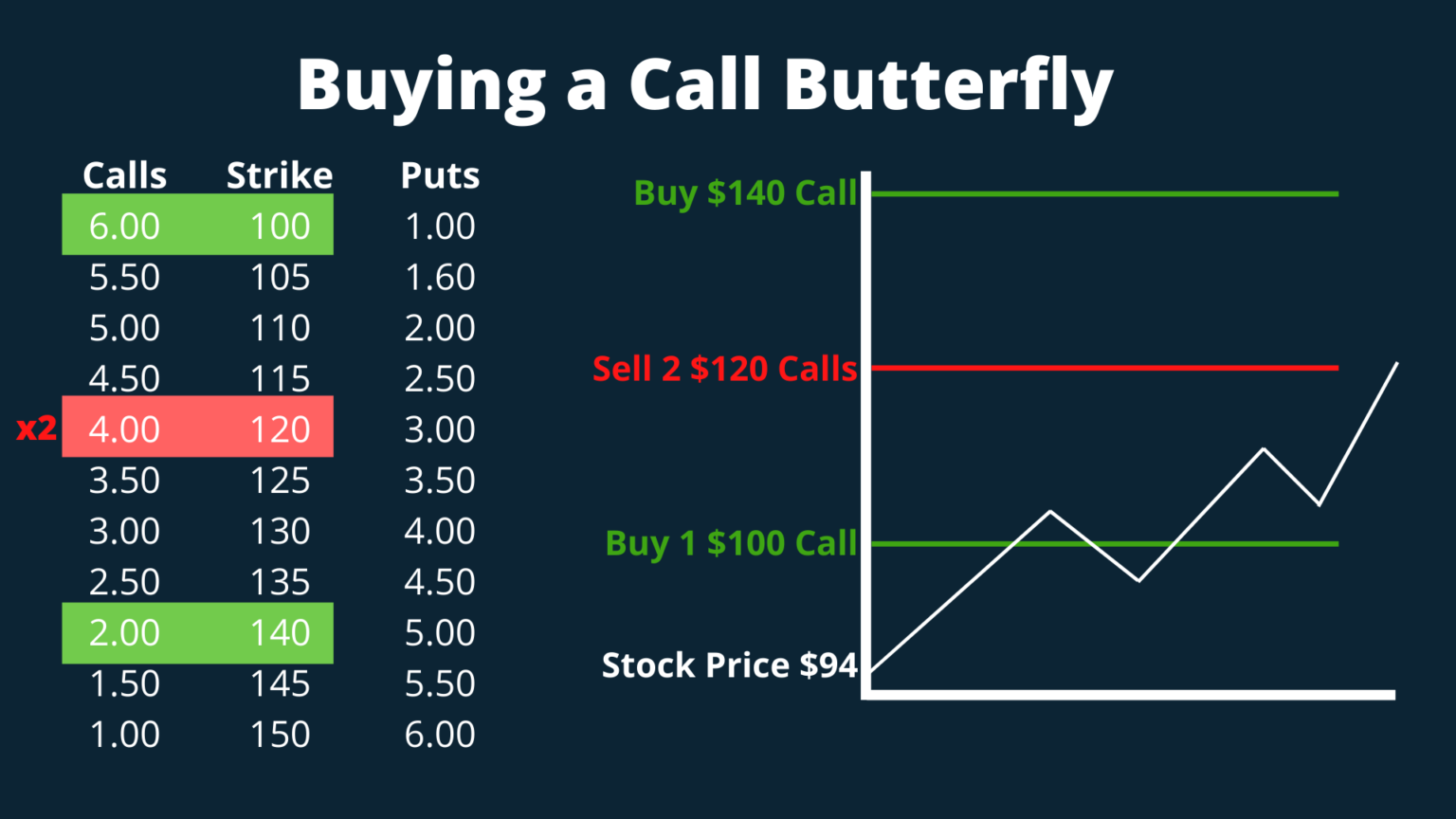

Bull Call Spread

A bull call spread involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price.

-

Advantages: Lower cost than a long call, limited risk.

-

Suitable Market Conditions: Mildly bullish markets where a moderate appreciation of the AUD is expected.

-

Mechanics: The profit is limited to the difference between the strike prices minus the net premium paid. The maximum loss is the net premium.

-

Example: Buying a call option at 1.07 and selling a call option at 1.09 to profit from a moderate increase in the AUD/NZD rate.

Bearish Option Strategies for AUD-NZD

If you anticipate the AUD depreciating against the NZD, bearish option strategies are suitable.

Long Put Options

A long put option gives the buyer the right, but not the obligation, to sell the AUD at a specific price (strike price) by a certain date (expiration date).

-

Risk/Reward Profile: Limited risk (maximum loss is the premium paid), limited profit potential (maximum profit is the strike price minus the premium).

-

Suitable Market Conditions: Bearish market conditions where the AUD is expected to depreciate significantly.

-

Entry/Exit Points: Enter the trade when you identify a bearish signal (e.g., breakdown below support). Exit when your target price is reached or before expiration.

-

Strike Price Selection: Choose a strike price slightly below the current market price to maximize profit potential.

-

Example: Buying a put option with a strike price of 1.06 if you anticipate the AUD/NZD falling below that level.

Bear Put Spread

A bear put spread involves buying a put option at a higher strike price and simultaneously selling a put option at a lower strike price.

-

Advantages: Lower cost than a long put, limited risk.

-

Suitable Market Conditions: Mildly bearish markets where a moderate depreciation of the AUD is expected.

-

Mechanics: The profit is limited to the difference between the strike prices minus the net premium paid. The maximum loss is the net premium.

-

Example: Buying a put option at 1.07 and selling a put option at 1.06 to profit from a moderate decrease in the AUD/NZD rate.

Risk Management in AUD-NZD Option Trading

Effective risk management is paramount for long-term success in AUD-NZD option trading.

Position Sizing

Determining the appropriate position size is crucial. It should be based on your risk tolerance and account capital. Never risk more than a small percentage of your trading capital on a single trade.

- Risk Management Techniques: Employ stop-loss orders to automatically limit potential losses. Diversify your portfolio across different strategies and assets to reduce overall risk.

Diversification

Don't put all your eggs in one basket. Diversify your trading across different strategies, currency pairs, and asset classes to mitigate risk and improve your overall portfolio performance.

Conclusion

Mastering option trading strategies on the AUD-NZD pair can lead to significant returns. By carefully analyzing economic factors, employing technical analysis, and utilizing appropriate bullish and bearish options strategies, you can effectively capitalize on price fluctuations. Remember that consistent risk management is crucial for long-term success. Start exploring the power of AUD-NZD option trading today and unlock your potential for profitable forex trading. Learn more about effective AUD-NZD option trading strategies and start building your portfolio strategically!

Featured Posts

-

Understanding Greg Abel Berkshire Hathaways Next Ceo

May 06, 2025

Understanding Greg Abel Berkshire Hathaways Next Ceo

May 06, 2025 -

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Aritzia On Tariffs Price Stability Amidst Trade Adjustments

May 06, 2025

Aritzia On Tariffs Price Stability Amidst Trade Adjustments

May 06, 2025 -

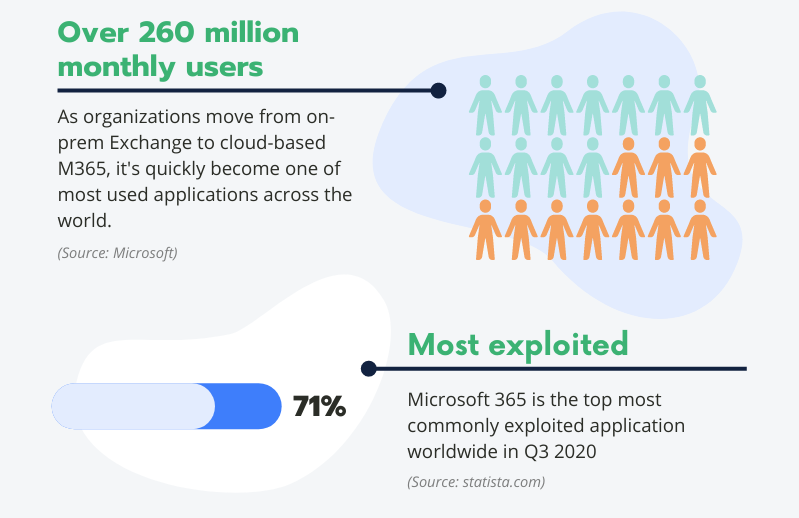

Office365 Security Failure Leads To Millions In Losses For Executives

May 06, 2025

Office365 Security Failure Leads To Millions In Losses For Executives

May 06, 2025 -

Patrick Schwarzenegger And White Lotus Maria Shrivers Honest Assessment

May 06, 2025

Patrick Schwarzenegger And White Lotus Maria Shrivers Honest Assessment

May 06, 2025

Latest Posts

-

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025

Patrick Schwarzeneggers White Lotus Nude Scene Chris Pratt Weighs In

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Nude Scene

May 06, 2025 -

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025

Shvartsenegger I Chempion Pravda O Syemke Dlya Kim Kardashyan

May 06, 2025 -

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Foto Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025