Operation Sindoor: Pakistan Stock Market Plunges, KSE 100 Trading Halted

Table of Contents

Understanding Operation Sindoor and its Impact on the PSX

"Operation Sindoor," a term shrouded in ambiguity, allegedly refers to a series of actions (the specifics of which remain unclear) impacting financial institutions and potentially triggering a loss of investor confidence. The exact nature of the operation and its direct link to the market crash are still under investigation, leading to considerable speculation. The timing, however, is undeniable: the initiation of "Operation Sindoor" coincided with the beginning of the KSE 100's sharp decline.

This confluence of events fueled widespread panic selling. Investors, unsure of the implications of "Operation Sindoor" and fearing further negative consequences, rapidly offloaded their holdings, driving the KSE 100 index sharply downward.

- Specific details about the operation's actions: While precise details are scarce, reports suggest actions targeting specific sectors or individuals within the financial system. Further investigation is needed to uncover the full extent of these actions.

- Timeline of events leading to the market crash: The initial drop in the KSE 100 correlated with news reports surrounding “Operation Sindoor,” followed by increased volatility and ultimately the trading halt.

- Expert opinions on the operation's role: Financial analysts are divided, with some attributing a significant role to "Operation Sindoor" in triggering the crash, while others emphasize pre-existing economic weaknesses.

The KSE 100 Index Freefall: Analyzing the Plunge

The KSE 100 index experienced a catastrophic drop, plummeting by [insert precise percentage]% in a matter of [insert timeframe]. This dramatic fall forced the PSX to halt trading, a highly unusual measure indicating the severity of the situation. The trading halt left investors in limbo, unable to buy or sell their assets, exacerbating the uncertainty and anxiety. The volatility leading up to the halt was significant, with sharp intraday swings reflecting the heightened nervousness in the market.

- Charts and graphs illustrating the KSE 100's decline: [Insert relevant charts and graphs here, clearly labeled and cited].

- Specific sector impacts (e.g., banking, energy, technology): The banking sector, often considered a bellwether for the overall economy, was particularly hard hit, mirroring the broader market downturn. Similarly, energy and technology stocks experienced significant losses.

- Analysis of trading volume before and after the crash: Trading volumes surged before the crash, reflecting the panic selling, and plummeted to zero during the trading halt.

Underlying Economic Factors Contributing to the Crisis

The market crash wasn't solely triggered by "Operation Sindoor." Pakistan's economy was already facing significant headwinds, creating a volatile environment ripe for a major downturn. Pre-existing economic vulnerabilities played a significant role in amplifying the impact of the operation.

- Key economic indicators showing Pakistan's financial fragility: High inflation, a depreciating currency (Pakistani Rupee), a widening current account deficit, and a substantial foreign debt burden all contributed to investor concerns.

- Impact of global economic factors on the PSX: Global economic slowdown and rising interest rates further weakened the already fragile Pakistani economy and investor confidence.

- Government policies and their role in the crisis: Existing government policies and the lack of confidence in their effectiveness contributed to the overall negative sentiment.

Consequences and Potential Recovery Strategies

The consequences of this market crash are far-reaching. Investors have suffered substantial losses, businesses face uncertainty, and the overall Pakistani economy is facing a setback. The short-term impact includes reduced consumer spending and a potential slowdown in economic growth. Long-term consequences could include decreased foreign investment and a prolonged period of economic instability.

The government's response will be crucial. Potential recovery strategies include addressing underlying economic issues, boosting investor confidence through transparent policies, and potentially intervening to stabilize the market. International assistance might also be necessary.

- Predicted economic impact of the crash: Experts predict a slowdown in GDP growth, higher unemployment, and potentially increased social unrest.

- Government's response and potential solutions: The government's immediate response will be vital, focusing on stabilizing the currency, tackling inflation, and reassuring investors.

- Expert predictions for the PSX's future: The outlook for the PSX is uncertain, contingent on effective government intervention, addressing fundamental economic issues, and the restoration of investor confidence.

Conclusion: Navigating the Aftermath of Operation Sindoor and the Pakistan Stock Market Crisis

The sharp plunge in the KSE 100 index, closely linked to "Operation Sindoor," represents a significant crisis for the Pakistan Stock Market and the broader Pakistani economy. The pre-existing economic vulnerabilities, coupled with the uncertainty surrounding "Operation Sindoor," created a perfect storm. The consequences are severe, requiring immediate and decisive action from the government to restore stability and investor confidence.

The future of the PSX remains uncertain. However, successful navigation of this crisis depends on a comprehensive approach addressing both immediate market concerns and underlying economic issues. To understand the ongoing ramifications, consistent monitoring of the situation is crucial. Stay informed about developments in the Pakistan Stock Market and the ongoing implications of "Operation Sindoor" by following reputable financial news sources for updates on the KSE 100 and the Pakistan economy's recovery. Conduct thorough Pakistan Stock Market analysis, follow KSE 100 recovery efforts, and actively seek Operation Sindoor updates from reliable sources.

Featured Posts

-

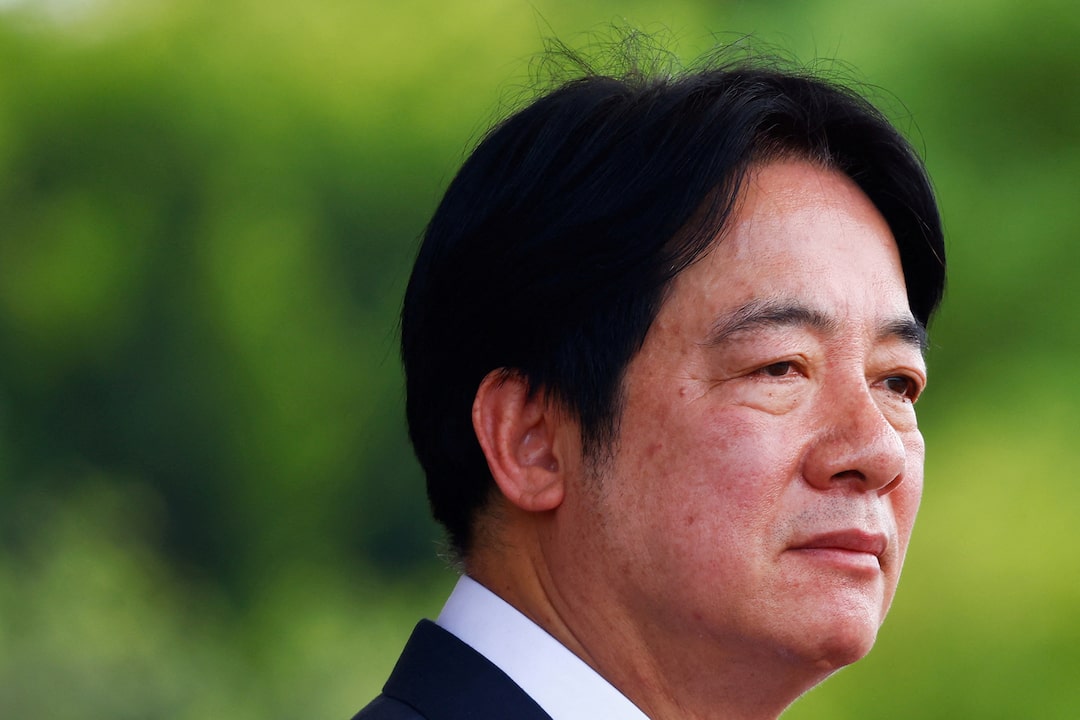

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025

Taiwans Lai Sounds Alarm On Totalitarianism In Ve Day Speech

May 10, 2025 -

Nyt Spelling Bee April 1 2025 Finding The Pangram And All Words

May 10, 2025

Nyt Spelling Bee April 1 2025 Finding The Pangram And All Words

May 10, 2025 -

Wall Streets Resurgence A Look At The Crumbling Bear Market

May 10, 2025

Wall Streets Resurgence A Look At The Crumbling Bear Market

May 10, 2025 -

Sensex And Nifty 50 Surge Understanding The 1 400 And 23 800 Point Rise

May 10, 2025

Sensex And Nifty 50 Surge Understanding The 1 400 And 23 800 Point Rise

May 10, 2025 -

Tesla Stock Decline And Tariffs Push Elon Musks Net Worth Below 300 Billion

May 10, 2025

Tesla Stock Decline And Tariffs Push Elon Musks Net Worth Below 300 Billion

May 10, 2025