Tesla Stock Decline And Tariffs Push Elon Musk's Net Worth Below $300 Billion

Table of Contents

Tesla Stock Performance and Market Volatility

Tesla's stock price has experienced a notable downward trend in recent months. This decline isn't isolated but reflects broader market volatility and specific challenges facing the electric vehicle (EV) manufacturer. Several factors contribute to this:

-

Increased Competition in the EV Market: The EV market is rapidly expanding, with established automakers and new entrants aggressively vying for market share. This intensified competition puts pressure on Tesla's pricing strategies and sales volumes, impacting its overall profitability and investor confidence. Companies like BYD and Rivian are posing significant challenges.

-

Concerns about Production Targets and Delivery Timelines: Tesla has faced challenges in consistently meeting its ambitious production targets and delivery timelines. Production bottlenecks, supply chain disruptions, and quality control issues can all negatively influence investor sentiment and stock valuation. Any missed target directly affects the perception of the company's growth potential.

-

Global Economic Uncertainty and its Impact on Consumer Spending: Global economic headwinds, including inflation and rising interest rates, are impacting consumer spending. Luxury goods, such as high-end electric vehicles, are often the first to be affected by reduced consumer confidence, leading to decreased demand and impacting Tesla's sales figures.

-

Investor Sentiment and its Influence on Stock Valuation: Investor sentiment plays a crucial role in shaping Tesla's stock price. Negative news, whether real or perceived, can trigger sell-offs, while positive developments can lead to significant price increases. Elon Musk's own public statements and actions also significantly influence investor perception and the overall valuation of Tesla.

For instance, Tesla's stock price experienced a [insert percentage]% decrease in [time period], accompanied by a [insert data] change in trading volume. These figures clearly demonstrate the significant market volatility impacting Tesla and consequently, Elon Musk's net worth.

The Impact of Tariffs on Tesla's Global Operations

Tariffs imposed on imported materials and exported vehicles significantly impact Tesla's profitability and global operations. These tariffs increase the cost of production and reduce the competitiveness of Tesla's vehicles in certain markets.

-

Specific Regions Impacted: Tariffs on imported batteries and other components increase manufacturing costs in regions like the US and Europe. Export tariffs, on the other hand, make Tesla vehicles less competitive in international markets, particularly in countries with significant import duties. For example, [cite specific examples of tariffs and their impact on Tesla’s operations in specific regions].

-

Long-Term Effects: The long-term consequences of these tariffs could include reduced market share in certain regions, slower growth, and a shift in Tesla's global production and distribution strategies. To mitigate these effects, Tesla may need to adjust its pricing, seek alternative sourcing for components, or even explore relocating manufacturing facilities.

Analysis of Elon Musk's Net Worth Fluctuation

Elon Musk's net worth is intrinsically linked to Tesla's stock price, as Tesla represents a significant portion of his wealth. The recent decline in Tesla's stock price has directly resulted in a substantial decrease in his net worth.

-

Quantifying the Decrease: Elon Musk's net worth has fallen by an estimated [insert dollar amount] since [date], dropping from a peak of [insert dollar amount] to its current level of [insert dollar amount]. This dramatic shift underscores the significant impact of market fluctuations on ultra-high-net-worth individuals.

-

Implications for Musk: This decline in net worth has implications for Musk's personal investments, philanthropic endeavors, and his overall financial standing. It may also influence his decision-making regarding future investments in Tesla and other ventures.

Comparison to other high-net-worth individuals

Many other tech billionaires have experienced similar market-driven fluctuations in their net worth. The recent downturn in the tech sector has impacted the fortunes of numerous individuals, highlighting the inherent volatility associated with investments in high-growth companies. [Give examples of similar situations with other tech billionaires].

Future Outlook for Tesla and Elon Musk's Net Worth

The future performance of Tesla and Elon Musk's net worth remains uncertain, dependent on various factors.

-

Potential Scenarios: Several scenarios could play out. A resurgence in demand, successful new product launches (e.g., Cybertruck), or a more favorable macroeconomic environment could drive a recovery in Tesla's stock price and boost Musk's net worth. Conversely, continued competition, persistent supply chain issues, or further economic downturn could exacerbate the current challenges.

-

Factors for Recovery: A successful launch and ramp-up of new models, improvements in production efficiency, expansion into new markets, and positive investor sentiment are all crucial for a potential recovery in Tesla's stock price. Successful navigation of global economic uncertainties also plays a key role.

-

Expert Opinions: [Include quotes from analysts or experts regarding Tesla's future prospects and the EV market].

Conclusion:

The decline in Elon Musk's net worth is primarily attributed to the recent downturn in Tesla's stock price, exacerbated by the impact of tariffs on its global operations. Understanding the interplay between Tesla's performance, market volatility, and global economic factors is crucial for comprehending this significant financial shift. Key takeaways include the direct correlation between Tesla's stock and Musk's wealth, the challenges posed by increased competition and tariffs, and the inherent uncertainty surrounding the future of both Tesla and Elon Musk’s financial standing. Stay informed on the evolving situation surrounding Tesla and Elon Musk's net worth. Continue to monitor the stock market and economic factors affecting the electric vehicle industry and other key players impacting the Elon Musk Net Worth. Follow [your website/publication] for further updates and analysis on the future of Tesla and Elon Musk's financial standing.

Featured Posts

-

Increased Eu Action Needed Against Us Tariffs French Minister

May 10, 2025

Increased Eu Action Needed Against Us Tariffs French Minister

May 10, 2025 -

Jeanine Pirros Controversial Stance On Due Process And El Salvador Deportations

May 10, 2025

Jeanine Pirros Controversial Stance On Due Process And El Salvador Deportations

May 10, 2025 -

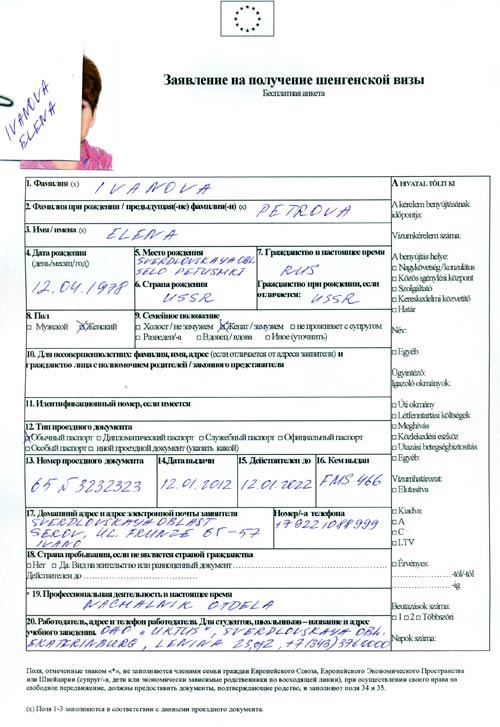

Germaniya Ugroza Novogo Potoka Bezhentsev Iz Ukrainy Rol S Sh A

May 10, 2025

Germaniya Ugroza Novogo Potoka Bezhentsev Iz Ukrainy Rol S Sh A

May 10, 2025 -

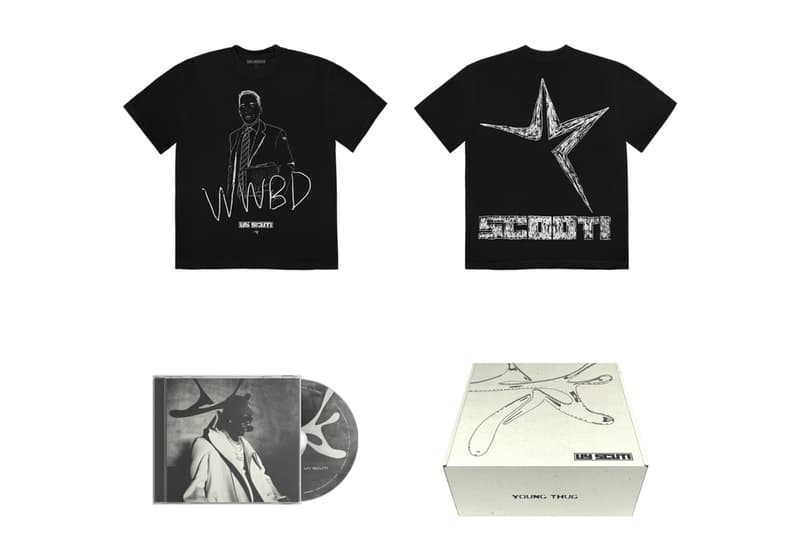

Uy Scuti Release Date Young Thugs New Album

May 10, 2025

Uy Scuti Release Date Young Thugs New Album

May 10, 2025 -

Harry Styles Snl Impression His Reaction To A Bad Performance

May 10, 2025

Harry Styles Snl Impression His Reaction To A Bad Performance

May 10, 2025