New Wave Of HMRC Letters: What UK Households Need To Know

Table of Contents

- Understanding Different Types of HMRC Letters

- Tax Return Reminders & Updates

- Tax Repayment Letters

- Investigation & Enquiry Letters

- Penalty Letters

- Spotting Fake HMRC Letters (Phishing Scams)

- Identifying Red Flags

- How to Report Suspicious Communications

- Managing Your HMRC Correspondence Effectively

- Setting up an Online Account

- Keeping Records

- Conclusion

Understanding Different Types of HMRC Letters

Receiving a letter from HMRC can be daunting, but understanding the different types can alleviate stress. Knowing what to expect allows for timely and appropriate action.

Tax Return Reminders & Updates

HMRC frequently sends reminders about upcoming tax return deadlines and updates on your tax account. These letters may contain information about:

- Outstanding tax: The amount of tax you owe and the due date.

- Payment deadlines: Important dates to remember for avoiding penalties.

- Your Unique Taxpayer Reference (UTR): A vital number needed for all tax correspondence.

Examples of letter phrasing: Look for formal language, your name and address, and clear reference numbers. Avoid letters with poor grammar or spelling. You can find your online account details by logging into your HMRC online account. Penalties for late filing can be substantial, so always submit your return on time.

Tax Repayment Letters

Legitimate tax repayment letters will contain specific details to verify their authenticity:

- Unique reference number: This number will match the one on your tax records.

- Official HMRC contact details: The letter should include official HMRC addresses, phone numbers and website links. Never rely on links included in emails.

How to check your repayment status online: Log into your Government Gateway account on the official HMRC website. Secure ways to receive repayments include direct bank transfer. Be wary of requests for bank details outside the official HMRC online portal. Common scams involve fake repayment emails or letters asking for personal information to "process" the payment.

Investigation & Enquiry Letters

An investigation or enquiry letter signifies that HMRC requires further information about your tax return or financial records. This doesn't automatically imply wrongdoing, but prompt action is essential.

- Common reasons for an investigation: Discrepancies in your tax return, suspected tax evasion, or a random selection for audit.

- Steps to gather relevant documentation: Collate all relevant financial records, bank statements, and supporting documents to respond thoroughly and accurately.

- Finding qualified tax advisors: If you require assistance, seek advice from a qualified tax advisor or accountant to ensure compliance.

Responding promptly and completely is crucial. Failure to cooperate can lead to further complications.

Penalty Letters

Penalty letters are issued for various reasons, including:

- Late filing: Submitting your tax return after the deadline.

- Late payment: Failing to pay your tax bill by the due date.

- Inaccurate information: Providing incorrect details on your tax return.

Understanding the appeals process: If you believe a penalty is unfair, you can appeal the decision through the established HMRC appeals process. Seeking professional help to reduce penalties can prove invaluable, as an accountant can help explain the circumstances and potentially mitigate the penalty. Payment options may include various methods, but always ensure you are paying through secure and official HMRC channels.

Spotting Fake HMRC Letters (Phishing Scams)

Phishing scams designed to mimic HMRC communications are prevalent. Learning to identify these fraudulent attempts is crucial for protecting your financial information.

Identifying Red Flags

Several warning signs can help you identify fraudulent HMRC letters:

- Grammatical errors and poor spelling: Official HMRC communications are professionally written.

- Unusual email addresses: Beware of emails not ending in @gov.uk or official HMRC domains.

- Urgent requests for personal information: HMRC will never request sensitive data via email or unsolicited mail.

- Threats and demands for immediate payment: Legitimate HMRC communications are clear and do not use threatening language.

- Demands for immediate payment via unconventional methods: HMRC prefers established payment methods.

How to Report Suspicious Communications

Report suspected phishing attempts immediately:

- HMRC's reporting page: Report suspicious emails directly to HMRC using their official reporting channels.

- Action Fraud: Report the incident to Action Fraud, the UK's national reporting centre for fraud and cybercrime.

Never respond to suspicious emails or letters. Instead, change your passwords and take steps to secure your online accounts. Protecting your details is vital.

Managing Your HMRC Correspondence Effectively

Proactive management of your HMRC communications is key to avoiding issues.

Setting up an Online Account

An HMRC online account offers many benefits:

- View correspondence: Access all your HMRC communications in one place.

- Manage tax affairs: Update your details, file your tax return, and make payments securely.

- Receive updates: Stay informed about important deadlines and changes.

Steps to create an online account: Visit the official HMRC website and follow the straightforward steps to register. The benefits of online account management far outweigh the time investment required for setup. Security features of the HMRC online portal are designed to protect your data.

Keeping Records

Maintain detailed records of all financial transactions and HMRC correspondence:

- Types of records to keep: Bank statements, invoices, receipts, and all HMRC letters.

- Recommended storage methods: Both physical and digital storage are viable, with cloud storage offering secure backup.

- How to organize records: Maintain a consistent system for easy access and retrieval.

Keeping meticulous records will facilitate efficient communication with HMRC and ensure compliance.

Conclusion

This guide has highlighted the importance of understanding different types of HMRC letters, identifying scams, and managing your HMRC correspondence effectively. Remember to always verify the authenticity of any HMRC communication and never respond to suspicious emails or letters. If you're unsure about a letter you've received, contact HMRC directly through official channels. Staying informed about potential HMRC letters is crucial for protecting yourself against scams and ensuring you comply with tax regulations. Learning to identify and manage HMRC letters properly will give you peace of mind. Take control of your HMRC correspondence today.

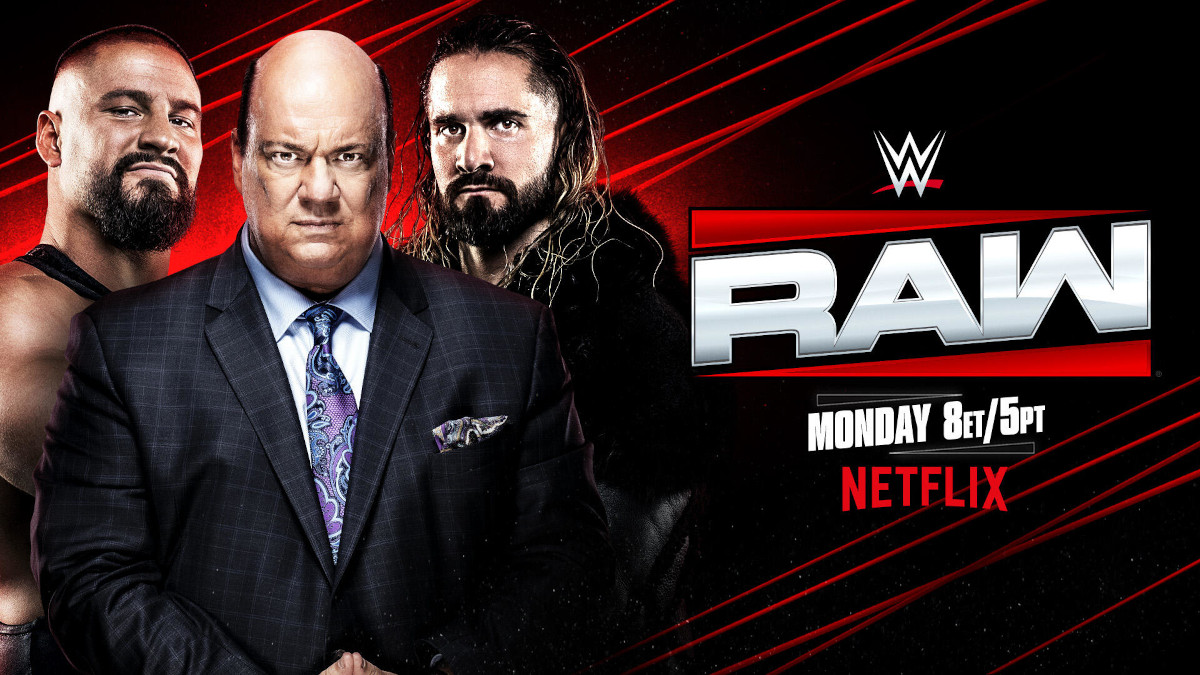

Wwe News Road To Money In The Bank Ripley And Perez Secure Qualification

Wwe News Road To Money In The Bank Ripley And Perez Secure Qualification

Dubai Holding Increases Reit Ipo Size To 584 Million

Dubai Holding Increases Reit Ipo Size To 584 Million

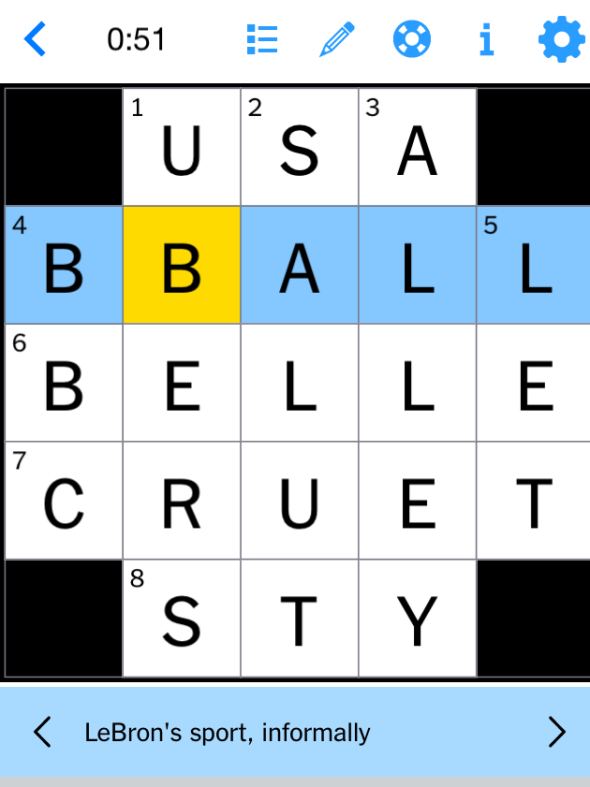

Nyt Mini Crossword Answers For March 22 Complete Solutions

Nyt Mini Crossword Answers For March 22 Complete Solutions

Rhea Ripley And Roxanne Perez Road To The 2025 Money In The Bank Ladder Match

Rhea Ripley And Roxanne Perez Road To The 2025 Money In The Bank Ladder Match

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Case