Dubai Holding Increases REIT IPO Size To $584 Million

Table of Contents

The Increased IPO Size and its Significance

The increase in the Dubai Holding REIT IPO size from its initially planned amount to $584 million speaks volumes about investor confidence and the positive outlook for the Dubai economy. This substantial boost carries significant weight, impacting not only Dubai Holding but also the broader real estate market.

- Increased Investor Confidence: The upward revision signifies a surge in investor interest and belief in the long-term prospects of the Dubai real estate market and Dubai Holding's strategic vision. The initial, smaller IPO size clearly underestimated the market demand.

- Economic Boost for Dubai: The $584 million injection represents a considerable contribution to the Dubai economy, fostering further growth and attracting additional foreign investment. This influx of capital can stimulate further development within the real estate sector and beyond.

- Positive Market Sentiment: This significant increase indicates robust market sentiment, reflecting confidence in Dubai Holding's REIT offering and its underlying assets. The strong demand underscores the attractiveness of Dubai's real estate sector.

- Impact on Dubai Real Estate: The successful IPO could trigger a ripple effect across the Dubai real estate market, potentially leading to increased property values and a rise in investment activity. This heightened interest could lead to further development projects and increased competition.

- Strategic Implications for Dubai Holding: This successful fundraising allows Dubai Holding to pursue strategic acquisitions, expand its real estate portfolio, and solidify its position as a major player in the Dubai and regional REIT market. This increased capital provides significant flexibility for future growth.

Details of the Dubai Holding REIT Offering

The Dubai Holding REIT offering comprises a diverse portfolio of high-quality assets strategically located across prime areas in Dubai. This carefully curated selection aims to provide investors with a balanced and potentially high-yielding investment opportunity.

- REIT Portfolio Assets: The portfolio includes a mix of high-demand properties, likely encompassing a variety of asset classes such as prime office buildings in central business districts, lucrative retail spaces in bustling shopping malls, and desirable residential properties in sought-after neighborhoods.

- Investment Strategy and Target Returns: Dubai Holding will likely outline a clear investment strategy focusing on long-term value appreciation and consistent dividend payouts. The targeted returns will be a key factor attracting investors seeking stable income streams and capital growth.

- Attractive Features for Investors: The REIT will likely emphasize attractive features such as a competitive dividend yield, strong and experienced management team, and a diversified portfolio to minimize risk and maximize returns. Transparency and regular reporting will be key for building investor trust.

- Unique Market Differentiation: Dubai Holding may highlight unique aspects of its REIT, such as a focus on sustainable development, cutting-edge technology integration within its properties, or a strategic location advantage within the burgeoning Dubai real estate market.

Investor Interest and Market Reaction

The market's response to the increased IPO size has been largely positive, with analysts predicting strong investor demand. Several factors contribute to this heightened interest.

- Initial Market Reaction: Early indicators suggest a positive market response, with strong pre-orders and a high level of interest from both institutional and retail investors. This enthusiastic response points towards a successful IPO.

- Factors Driving Investor Interest: The attractive yield, strong management team, prime location of assets, and the overall growth potential of the Dubai real estate market are key factors attracting significant investor interest.

- Risks and Opportunities: While the prospects look promising, potential investors should carefully assess the risks associated with any real estate investment, including market fluctuations and macroeconomic conditions. However, the potential rewards outweigh the risks for many given the growth potential.

- Expert Opinions and Forecasts: Market analysts and experts have expressed optimistic views on the IPO’s success, predicting strong performance based on the positive market sentiment and Dubai Holding’s track record. Forecasts will vary, but generally project a positive outlook.

- Impact on Other Regional REITs: The success of the Dubai Holding REIT could influence other REITs in the region, potentially increasing competition and leading to further innovations within the market.

Comparison with other REIT IPOs in the region

The Dubai Holding REIT IPO stands out amongst other recent offerings in the region. A comparative analysis reveals both advantages and disadvantages.

- Regional Comparison: Comparing the Dubai Holding REIT with similar IPOs in the UAE and the broader Middle East region will reveal its competitive positioning in terms of size, portfolio diversification, and projected returns.

- Competitive Advantages/Disadvantages: The Dubai Holding REIT might possess advantages such as a superior portfolio of assets, a more established management team, or a stronger brand recognition. However, it might also face competitive disadvantages, such as higher valuation multiples compared to other regional REITs.

- Potential Market Share: The increased IPO size positions Dubai Holding to capture a significant market share within the growing Dubai REIT sector, potentially surpassing existing players in the near future.

- Performance of Comparable REITs: Analyzing the recent performance of comparable REITs in the region provides valuable insights into potential returns and risks associated with investing in the Dubai Holding REIT.

Conclusion

The Dubai Holding REIT IPO's expansion to $584 million signals significant confidence in the Dubai real estate market and presents a substantial investment opportunity. The increased size reflects strong investor interest and positive market sentiment, promising potential for considerable returns. The detailed portfolio and strategic investment approach of the REIT should attract both local and international investors.

Call to Action: Stay informed about the progress of this landmark Dubai Holding REIT IPO and consider exploring the potential investment opportunity. Learn more about the Dubai Holding REIT and its unique proposition in the dynamic Dubai real estate market. Don't miss out on this potentially lucrative investment in the thriving Dubai real estate sector.

Featured Posts

-

Adressage Des Batiments D Abidjan Explication Du Nouveau Systeme De Numerotation

May 20, 2025

Adressage Des Batiments D Abidjan Explication Du Nouveau Systeme De Numerotation

May 20, 2025 -

Canada Us Trade Oxford Report Challenged On Tariff Levels

May 20, 2025

Canada Us Trade Oxford Report Challenged On Tariff Levels

May 20, 2025 -

Millau Dans Le C Ur De Marc Lievremont Un Passage Memorable

May 20, 2025

Millau Dans Le C Ur De Marc Lievremont Un Passage Memorable

May 20, 2025 -

Stade Toulousain Et Jaminet Reglement Du Litige Des 450 000 E

May 20, 2025

Stade Toulousain Et Jaminet Reglement Du Litige Des 450 000 E

May 20, 2025 -

Cas De Maltraitance Et D Abus Sexuels Presumes A La Fieldview Care Home Maurice Info

May 20, 2025

Cas De Maltraitance Et D Abus Sexuels Presumes A La Fieldview Care Home Maurice Info

May 20, 2025

Latest Posts

-

Good Morning America Stars Face Job Cuts Amidst Backstage Drama

May 20, 2025

Good Morning America Stars Face Job Cuts Amidst Backstage Drama

May 20, 2025 -

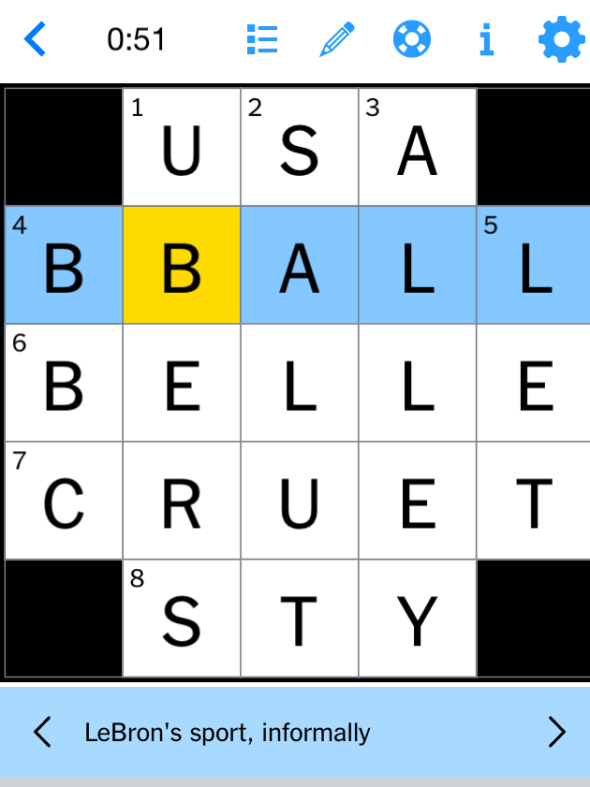

Nyt Mini Crossword Answers And Hints For April 20 2025

May 20, 2025

Nyt Mini Crossword Answers And Hints For April 20 2025

May 20, 2025 -

Ginger Zee Addresses Criticisms About Her Appearance

May 20, 2025

Ginger Zee Addresses Criticisms About Her Appearance

May 20, 2025 -

Gmas Ginger Zee Claps Back At Ageist Comment

May 20, 2025

Gmas Ginger Zee Claps Back At Ageist Comment

May 20, 2025 -

Nyt Crossword April 25 2025 Answers And Solutions

May 20, 2025

Nyt Crossword April 25 2025 Answers And Solutions

May 20, 2025