New Jobs Report: U.S. Employment Increases By 177,000 In April, 4.2% Unemployment

Table of Contents

Key Findings of the April Jobs Report

Overall Job Growth

The headline figure – a 177,000 increase in nonfarm payroll employment – represents a modest but positive contribution to the ongoing economic expansion. This surpasses some economists’ predictions, suggesting continued strength in the labor market, even amidst global economic uncertainty.

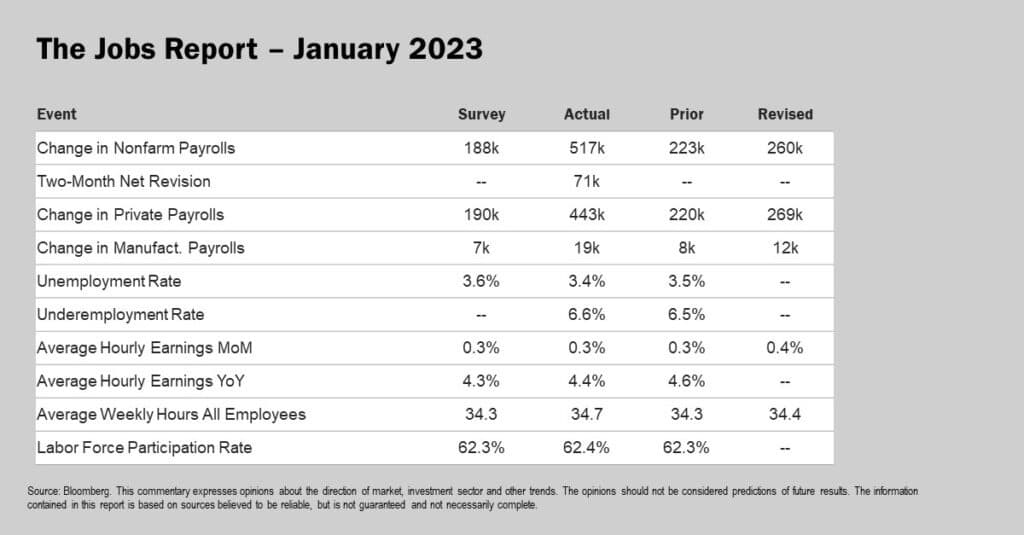

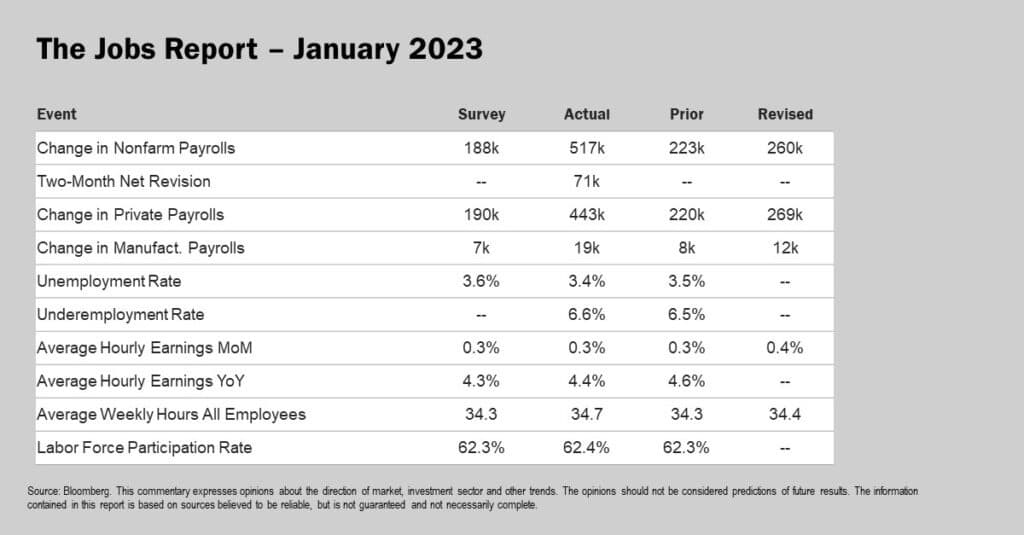

- Comparison to Previous Month: March's job growth figures showed a [insert March's job growth number] increase, indicating a slight slowdown compared to April. However, this should be viewed in context with seasonal adjustments and potential reporting lags.

- Revisions to Prior Months' Data: [Insert information on any revisions to previous months' data, if applicable]. These revisions highlight the dynamic nature of employment data and the importance of considering trends over time rather than focusing solely on individual monthly reports.

- Significance in Context: The 177,000 figure, while seemingly moderate, is significant given the current economic climate. It demonstrates resilience in the face of [mention any current economic headwinds, e.g., inflation, supply chain issues].

Unemployment Rate Remains Stable

The unemployment rate held steady at 4.2%, a figure that indicates a relatively tight labor market. This is generally considered positive, signifying strong employment opportunities. However, it also suggests potential inflationary pressures.

- Labor Force Participation Rate: The labor force participation rate [insert current rate and percentage change] reflects [explain the implications of the participation rate change – is it increasing or decreasing, and what does this suggest about the labor market?].

- Implications for Wages and Inflation: A low unemployment rate typically leads to increased competition for workers, resulting in upward pressure on wages. This wage growth, if significant, can contribute to inflationary pressures.

- Demographic Shifts: Analyzing unemployment figures by demographic groups (age, race, gender) can reveal important insights into the health of the labor market and potential areas of inequality. [Insert relevant data and analysis, if available].

Sector-Specific Job Growth

A deeper dive into the data reveals significant variations in job growth across different sectors. Some industries experienced robust growth, while others saw declines or stagnation, reflecting the nuanced reality of the U.S. economy.

- Significant Job Growth: The technology sector saw significant job growth, driven by [mention specific factors, e.g., increased demand for software engineers, expansion of tech companies]. Similarly, the healthcare sector experienced robust growth fueled by [mention factors, e.g., aging population, increasing demand for healthcare services].

- Job Losses: The retail sector experienced some job losses, potentially attributable to [mention factors, e.g., automation, shifts in consumer spending habits]. Similarly, the manufacturing sector saw [mention job growth or losses and contributing factors].

- Reasons for Growth or Decline: Understanding the underlying reasons for sector-specific job growth or decline is crucial for forecasting future trends and informing policy decisions. [Provide analysis connecting sector performance to broader economic trends].

Analyzing the Implications for the U.S. Economy

Impact on Wages and Inflation

The sustained low unemployment rate puts upward pressure on wages, potentially contributing to inflation. This is a key area for the Federal Reserve to monitor and manage through monetary policy adjustments.

- Unemployment and Wage Growth Correlation: Historically, low unemployment rates correlate with increased wage growth. This is because employers need to offer higher wages to attract and retain talent in a competitive job market.

- Current Inflation Rate and Connection to Employment: The current inflation rate of [insert current inflation rate] is [explain the relationship between the current inflation rate and the unemployment rate – are they positively correlated?].

- Federal Reserve Response: The Federal Reserve is likely to [explain the Federal Reserve's likely response to the current economic situation – will they increase or decrease interest rates?].

Future Outlook and Predictions

Based on the April jobs report, economists are likely to revise their projections for future economic growth and interest rate hikes. The data provides crucial information for economic modeling and forecasting.

- Economists' Predictions: Leading economists [mention names and affiliations of economists] predict [summarize their predictions based on the April Jobs Report]. These predictions vary depending on their economic models and assumptions.

- Possible Scenarios: Based on the data, several scenarios are possible, ranging from continued moderate growth to a potential slowdown depending on various factors, including [mention potential factors, e.g., geopolitical events, consumer confidence].

- Influence on Future Policy Decisions: The April Jobs Report data will heavily influence future policy decisions, including fiscal and monetary policy adjustments designed to maintain economic stability and manage inflation.

Conclusion

The April New Jobs Report reveals a mixed picture of the U.S. economy. While the 177,000 increase in jobs is positive and suggests continued growth, the persistent 4.2% unemployment rate warrants close attention regarding its potential inflationary impact. Analyzing sector-specific trends and understanding the interconnectedness between unemployment, wages, and inflation is crucial for navigating the evolving economic landscape. Stay informed about future U.S. employment reports to better understand the trends shaping the economy and their impact on various sectors. Keep an eye on upcoming reports for further insights into the evolving U.S. employment situation and subscribe to receive future updates on the New Jobs Report analysis!

Featured Posts

-

Anna Kendricks 3 Word Blake Lively Reaction Viral Sensation

May 05, 2025

Anna Kendricks 3 Word Blake Lively Reaction Viral Sensation

May 05, 2025 -

Concerns Rise Over The Future Of Darjeeling Tea

May 05, 2025

Concerns Rise Over The Future Of Darjeeling Tea

May 05, 2025 -

Andrew Cuomos Undisclosed Nuclear Startup Stock Options A 3 Million Question

May 05, 2025

Andrew Cuomos Undisclosed Nuclear Startup Stock Options A 3 Million Question

May 05, 2025 -

Nhl Playoff Standings Update Key Matchups For Showdown Saturday

May 05, 2025

Nhl Playoff Standings Update Key Matchups For Showdown Saturday

May 05, 2025 -

Open Ai And Chat Gpt Facing An Ftc Investigation

May 05, 2025

Open Ai And Chat Gpt Facing An Ftc Investigation

May 05, 2025

Latest Posts

-

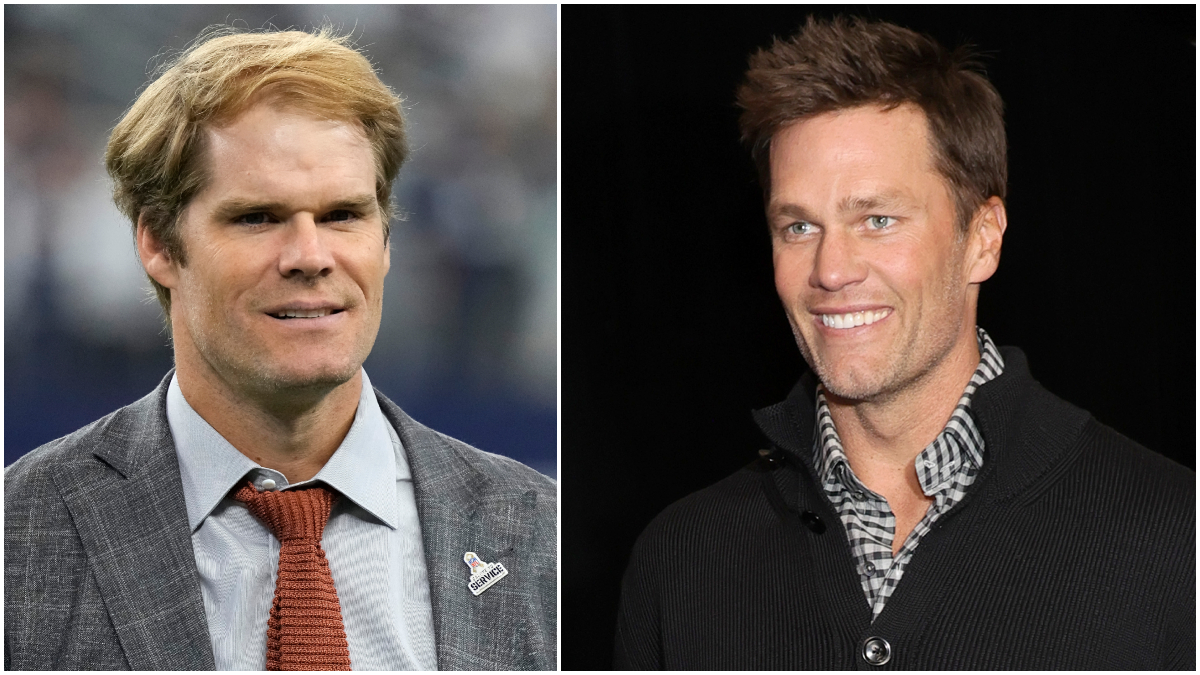

Third Emmy Nomination For Greg Olsen A Win Over Tom Brady

May 05, 2025

Third Emmy Nomination For Greg Olsen A Win Over Tom Brady

May 05, 2025 -

Cut The Cable Cord Watch Fox Live Sports News And Shows Without Cable

May 05, 2025

Cut The Cable Cord Watch Fox Live Sports News And Shows Without Cable

May 05, 2025 -

Emmy Nomination Greg Olsen Edges Out Tom Brady For Third Nomination

May 05, 2025

Emmy Nomination Greg Olsen Edges Out Tom Brady For Third Nomination

May 05, 2025 -

How To Watch Fox Without Cable Live Sports News And Shows

May 05, 2025

How To Watch Fox Without Cable Live Sports News And Shows

May 05, 2025 -

Fox Bolsters Streaming Ambitions With Peter Distads Leadership

May 05, 2025

Fox Bolsters Streaming Ambitions With Peter Distads Leadership

May 05, 2025