Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc: An Investor's Guide

Table of Contents

What is the Amundi MSCI All Country World UCITS ETF USD Acc?

The Amundi MSCI All Country World UCITS ETF USD Acc is an Exchange-Traded Fund that offers investors exposure to a broad range of global equities. Its investment objective is to track the performance of the MSCI All Country World Index, providing a highly diversified portfolio across developed and emerging markets.

- Investment Strategy: Passive replication of the MSCI All Country World Index. This means the ETF aims to hold assets in the same proportions as the index, providing broad global market exposure.

- Underlying Index: The MSCI All Country World Index is a widely recognized benchmark representing large, mid, and small-cap equities from around the globe. This offers significant diversification benefits, reducing reliance on any single market's performance.

- Currency: The ETF is denominated in US Dollars (USD Acc), meaning all transactions and reporting are in USD. This is important for investors to understand their currency exposure.

- Key Features: While specific figures change, you'll want to consider the expense ratio (the annual cost of managing the fund) and the trading volume (how easily you can buy and sell shares) when evaluating the ETF's suitability for your portfolio. Check the fund provider's website for the most up-to-date information on these key features. Keywords: MSCI All Country World Index, global equities, diversification, expense ratio, trading volume.

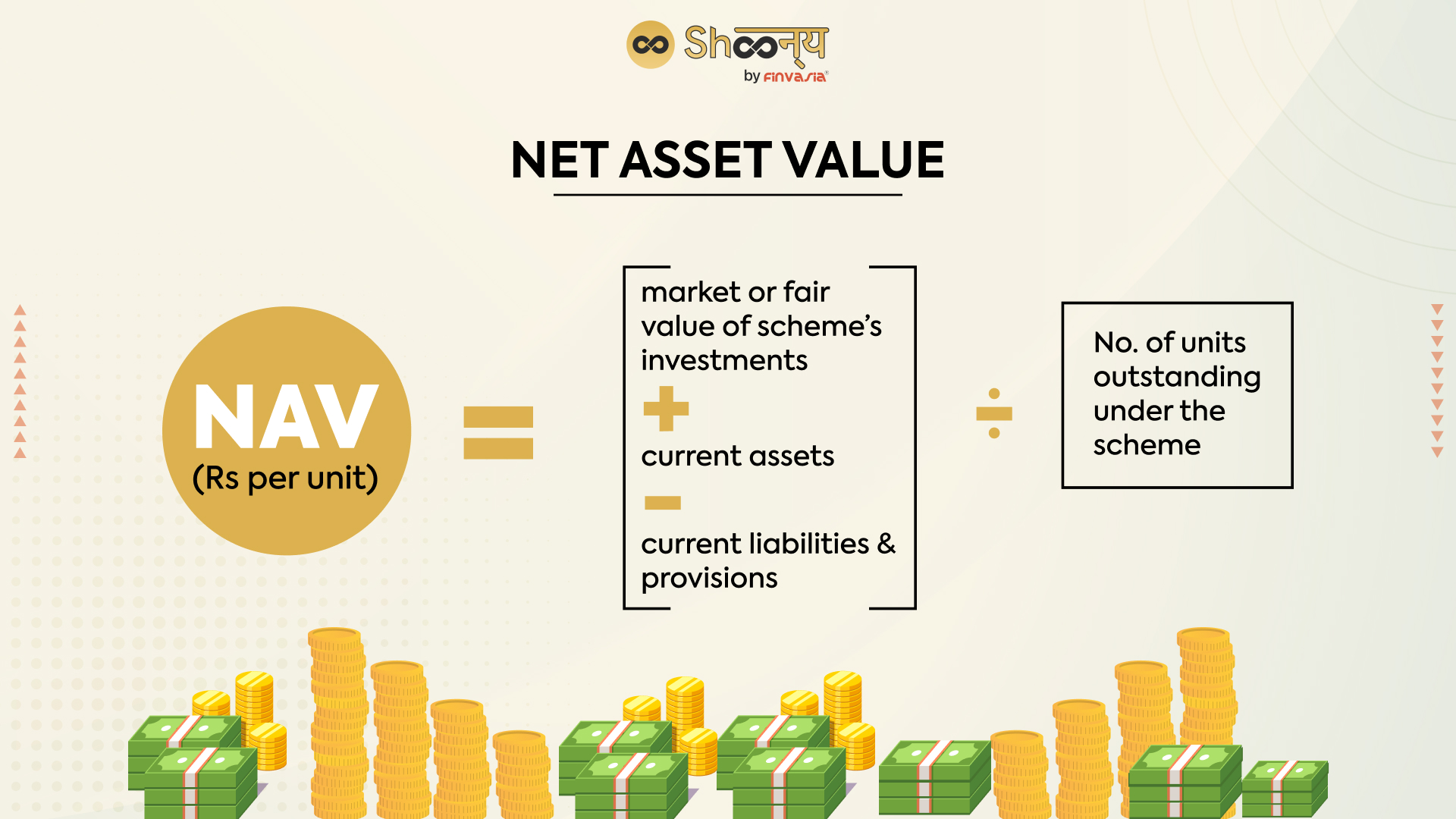

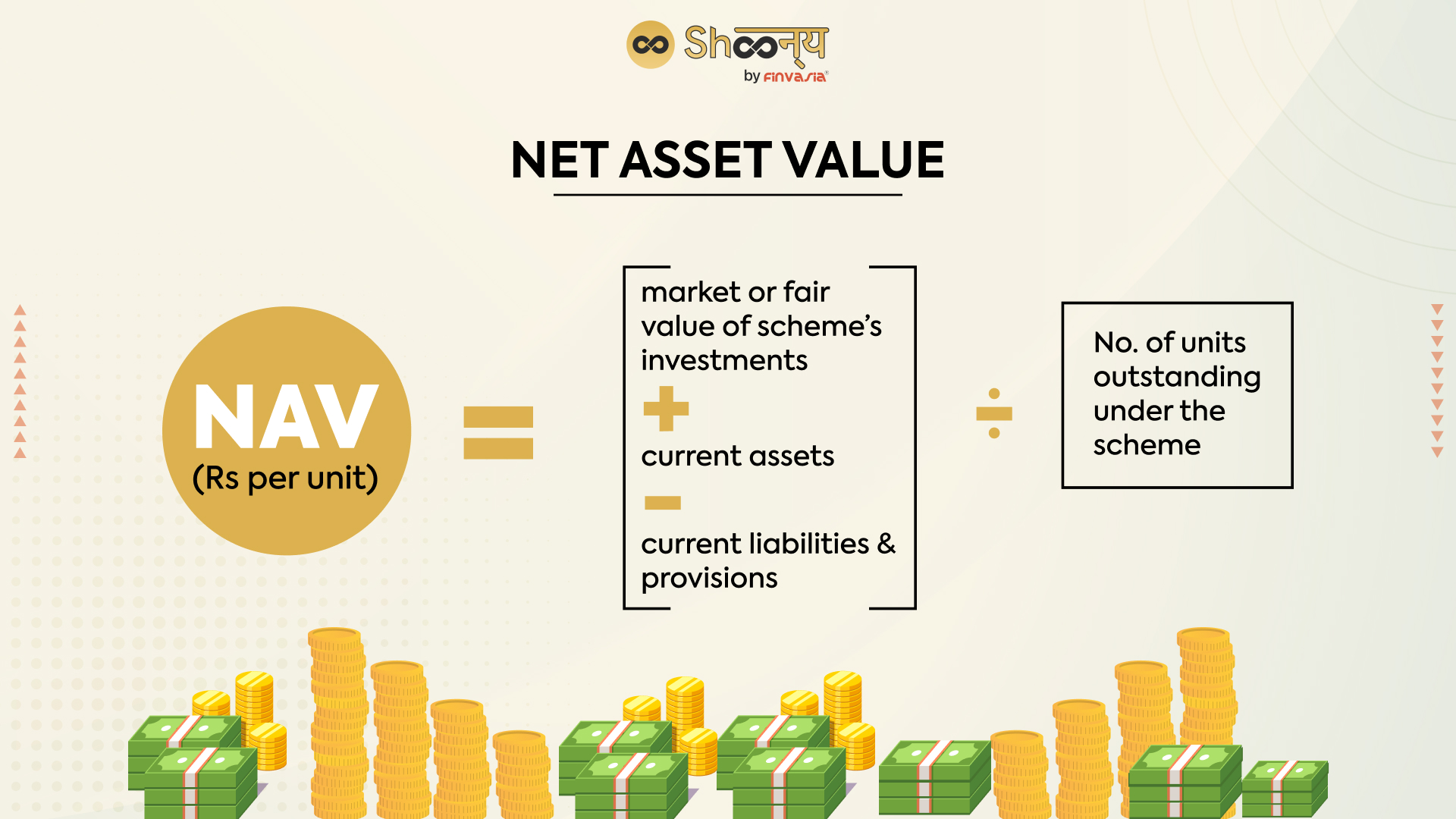

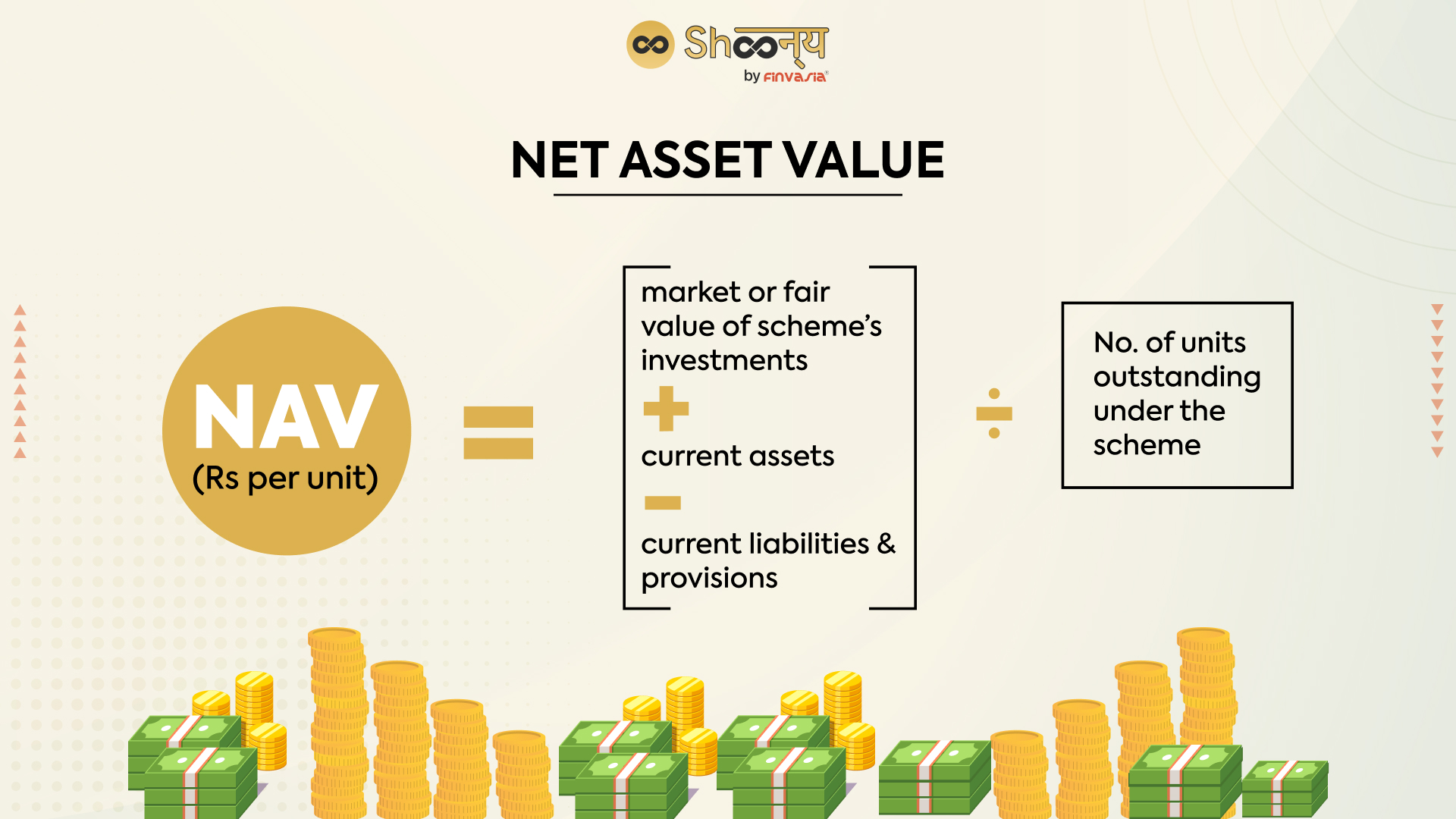

How is the NAV of Amundi MSCI All Country World UCITS ETF USD Acc Calculated?

The NAV (Net Asset Value) of the Amundi MSCI All Country World UCITS ETF USD Acc is calculated daily, typically at the close of market trading. The calculation is relatively straightforward:

NAV = (Total Assets - Total Liabilities) / Number of Shares Outstanding

Let's break down the components:

- Total Assets: This includes the market value of all the securities held within the ETF (stocks, bonds, etc.), any cash reserves, and receivables.

- Total Liabilities: This encompasses expenses incurred by the fund (management fees, administrative costs), any payables (outstanding bills), and other liabilities.

- Number of Shares Outstanding: The total number of ETF shares currently held by investors.

The calculation ensures the NAV reflects the true underlying value of the ETF's holdings, providing a fair representation of the investment's worth. Keywords: NAV calculation, assets, liabilities, shares outstanding, daily NAV.

Where to Find the NAV of Amundi MSCI All Country World UCITS ETF USD Acc?

Reliable NAV data is readily available through various sources:

- ETF Provider's Website: Amundi's official website is the most accurate source for the daily NAV.

- Financial News Websites: Major financial news providers often publish ETF NAV information, including Bloomberg, Yahoo Finance, and Google Finance.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV alongside other relevant investment data.

Interpreting NAV Data: The NAV is typically presented as a single number representing the value per share. Understanding this number allows you to assess the performance of your investment against the underlying index.

Identifying Reliable Information: While multiple sources provide NAV data, it's essential to prioritize information from reputable sources like the ETF provider or well-established financial institutions to avoid inaccuracies or discrepancies. Keywords: NAV data, ETF provider, financial news, brokerage platform, reliable sources.

Using NAV to Make Informed Investment Decisions

The NAV plays a critical role in making informed investment decisions:

- Tracking Performance: Comparing the NAV over time gives you a clear picture of the ETF's performance against its benchmark index, the MSCI All Country World Index.

- NAV vs. Market Price: The ETF's market price may slightly deviate from the NAV due to supply and demand fluctuations. A close monitoring of this difference is crucial for recognizing arbitrage opportunities.

- Premium/Discount to NAV: If the market price is above the NAV, it's trading at a premium; if it's below, it's trading at a discount. Understanding these discrepancies can inform your buy or sell decisions.

- Buy/Sell Decisions: While NAV is a key factor, consider transaction costs (brokerage fees, taxes) when making buy/sell decisions. Aim to buy at a discount and sell at a premium if possible. Keywords: ETF performance, market price, premium, discount, buy/sell decisions, transaction costs.

Risks Associated with Investing in Amundi MSCI All Country World UCITS ETF USD Acc

Like any investment, the Amundi MSCI All Country World UCITS ETF USD Acc carries inherent risks:

- Market Risk: The value of the ETF can fluctuate due to overall market conditions, impacting your investment returns.

- Currency Risk: As the ETF is denominated in USD, fluctuations in exchange rates can affect returns for investors holding the ETF in a different currency.

- Other Risks: Diversification across numerous assets helps mitigate single-point failures; however, broader macroeconomic factors could still influence the performance of global equities.

Mitigating Risks: Diversification within a larger investment portfolio and adopting a long-term investment strategy are crucial for managing these risks. Keywords: market risk, currency risk, diversification, long-term investment.

Conclusion: Monitoring the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc Investment

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for making informed investment decisions. This article has outlined how the NAV is calculated, where to find reliable data, and how to use it to track performance, identify potential buying or selling opportunities, and manage risk. Regularly monitoring the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc holdings will help you stay informed and make data-driven decisions about your investment portfolio. Stay informed about your investment by regularly checking the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc and making data-driven investment decisions. Keywords: NAV monitoring, informed investment decisions, Amundi MSCI All Country World UCITS ETF USD Acc, ETF investment.

Featured Posts

-

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And Other Highlights

May 25, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And Other Highlights

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc An Investors Guide

May 25, 2025

Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc An Investors Guide

May 25, 2025 -

Mamma Mia Unboxing The New Ferrari Hot Wheels Collection

May 25, 2025

Mamma Mia Unboxing The New Ferrari Hot Wheels Collection

May 25, 2025 -

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 25, 2025

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 25, 2025 -

Nemecke Firmy Rusia Pracovne Miesta Prehlad Najvaecsich Prepustani

May 25, 2025

Nemecke Firmy Rusia Pracovne Miesta Prehlad Najvaecsich Prepustani

May 25, 2025

Latest Posts

-

M56 Closure Current Traffic And Diversion Information Following Serious Accident

May 25, 2025

M56 Closure Current Traffic And Diversion Information Following Serious Accident

May 25, 2025 -

Live M56 Traffic Updates Motorway Closed After Serious Crash

May 25, 2025

Live M56 Traffic Updates Motorway Closed After Serious Crash

May 25, 2025 -

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 25, 2025

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 25, 2025 -

New Diamond Ring Fuels Engagement Rumors For Annie Kilner And Kyle Walker

May 25, 2025

New Diamond Ring Fuels Engagement Rumors For Annie Kilner And Kyle Walker

May 25, 2025 -

Kyle Vs Teddi A Heated Confrontation Over Their Dog Walker

May 25, 2025

Kyle Vs Teddi A Heated Confrontation Over Their Dog Walker

May 25, 2025