Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an investment fund's assets minus its liabilities, per share. For mutual funds and ETFs, it's a crucial indicator of the fund's underlying value. The NAV calculation is straightforward: Assets - Liabilities = Net Asset Value.

- Example: Imagine an ETF with total assets of $10 million and liabilities of $100,000. If there are 1 million shares outstanding, the NAV per share would be (($10,000,000 - $100,000) / 1,000,000) = $9.90.

- NAV vs. Market Price: While NAV reflects the intrinsic value of the ETF's holdings, the market price can fluctuate throughout the trading day. For ETFs, the market price often trades around the NAV, but discrepancies can occur due to supply and demand.

- Daily Calculation: The NAV of an ETF like the Amundi Dow Jones Industrial Average UCITS ETF is typically calculated daily at the close of the market, reflecting the value of its holdings at that point in time.

NAV and the Amundi Dow Jones Industrial Average UCITS ETF

The Amundi Dow Jones Industrial Average UCITS ETF tracks the performance of the Dow Jones Industrial Average, one of the world's most prominent stock market indices. Its NAV is directly influenced by the performance of the 30 constituent companies within the Dow Jones.

- Impact of the Dow Jones Industrial Average: As the underlying index (Dow Jones Industrial Average) rises or falls, the NAV of the Amundi Dow Jones Industrial Average UCITS ETF generally moves in tandem. A strong performance by the Dow usually leads to a higher NAV, and vice-versa.

- Currency Exchange Rates: Since the ETF may hold assets denominated in various currencies, fluctuations in exchange rates can subtly impact the calculated NAV.

- Transparency of NAV Reporting: Amundi, as a reputable fund manager, ensures transparent and readily available NAV reporting for its ETFs, allowing investors easy access to this critical data.

How to Use NAV Information to Make Informed Investment Decisions

Understanding NAV is crucial for making informed investment decisions. It allows you to actively monitor and track the performance of your investment.

- Tracking ETF Performance: By comparing the NAV over time, you can gauge the ETF's growth or decline. Consistent upward trends generally indicate positive performance.

- Buying and Selling: While market price dictates the actual transaction price, NAV provides a benchmark to evaluate whether you're buying or selling at a favorable price relative to the ETF's underlying assets.

- Comparing ETFs: NAV allows for direct comparison of the underlying value of different ETFs, facilitating more informed decisions when diversifying your portfolio.

- Monitoring NAV Changes in Relation to Market Trends: Analyzing NAV changes alongside broader market trends helps understand the ETF's sensitivity to market fluctuations.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

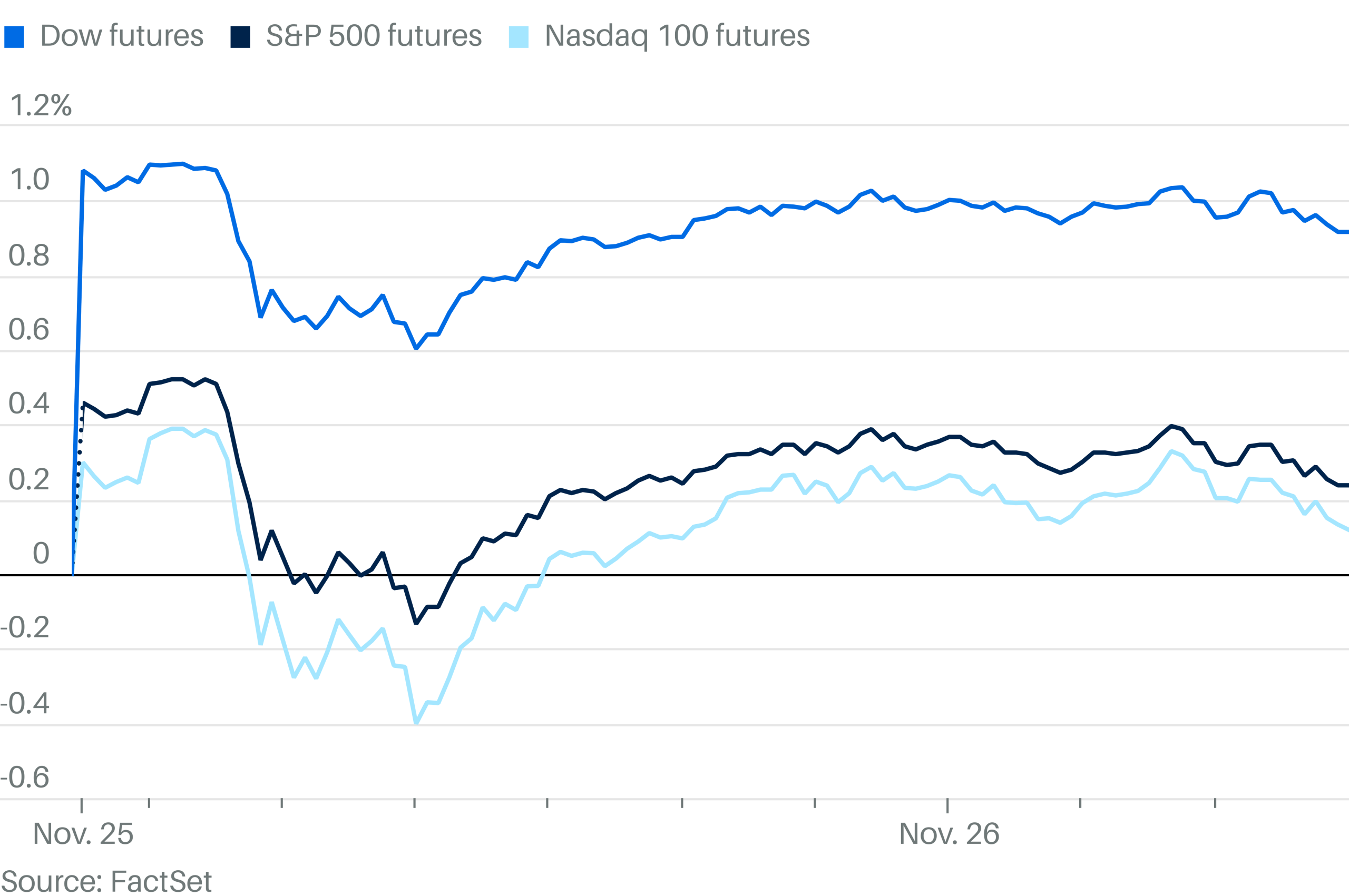

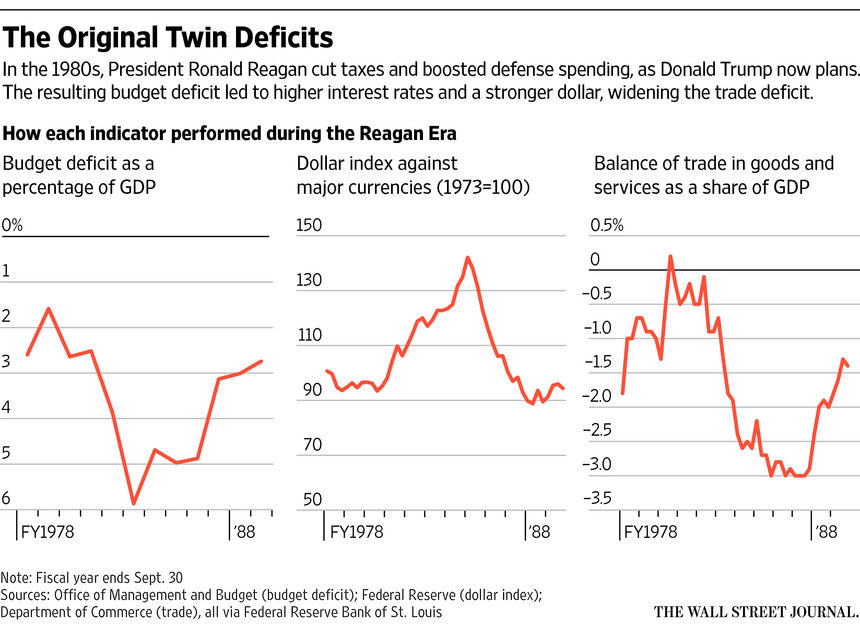

- Market Fluctuations: Broad market trends, economic cycles, and investor sentiment significantly impact the value of the underlying stocks within the Dow Jones Industrial Average, directly influencing the ETF's NAV.

- Dividend Payouts: When the constituent companies of the Dow Jones Industrial Average distribute dividends, this can slightly increase the NAV, although the effect may be temporary.

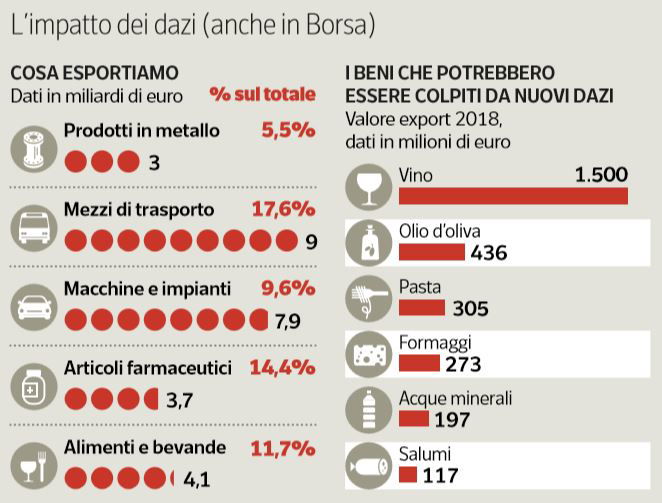

- Economic News and Events: Significant economic news, geopolitical events, and industry-specific developments can all affect the performance of the Dow and subsequently, the ETF's NAV.

- Company Performance: The performance of individual companies within the Dow Jones Industrial Average will have a proportional impact on the overall ETF NAV. A strong performance by one or more major components will generally lead to a higher NAV.

- Investor Sentiment: Market sentiment (bullish or bearish) can influence the trading price of the ETF which in turn affects the NAV in the short term

Conclusion

Understanding Net Asset Value (NAV) is paramount for anyone investing in the Amundi Dow Jones Industrial Average UCITS ETF. By regularly monitoring the NAV and considering the factors that influence it, investors can make more informed decisions, track their investment's growth, and effectively manage their portfolio. Remember to consult the fund's official website for the most up-to-date NAV information. Monitor the Net Asset Value of your Amundi Dow Jones Industrial Average UCITS ETF closely, and consider consulting a financial advisor to help develop a robust investment strategy. Understanding your Amundi Dow Jones Industrial Average UCITS ETF's NAV is key to successful investing.

Featured Posts

-

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In De Plus

May 24, 2025 -

Ferrari Solmi Sopimuksen 13 Vuotiaan Taessae Nimi

May 24, 2025

Ferrari Solmi Sopimuksen 13 Vuotiaan Taessae Nimi

May 24, 2025 -

Ferrari Challenge Racing Days Dominate South Florida

May 24, 2025

Ferrari Challenge Racing Days Dominate South Florida

May 24, 2025 -

New York Times Connections Game Answers And Hints For Puzzle 646 March 18 2025

May 24, 2025

New York Times Connections Game Answers And Hints For Puzzle 646 March 18 2025

May 24, 2025 -

En France La Chine Utilise Tous Les Moyens Pour Reduire Au Silence Les Dissidents

May 24, 2025

En France La Chine Utilise Tous Les Moyens Pour Reduire Au Silence Les Dissidents

May 24, 2025

Latest Posts

-

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025 -

Dazi Usa Come Influenzano I Prezzi Dell Abbigliamento

May 24, 2025

Dazi Usa Come Influenzano I Prezzi Dell Abbigliamento

May 24, 2025 -

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025

Amsterdam Stock Exchange Plunges 2 After Trumps Tariff Hike

May 24, 2025 -

Effetti Dei Dazi Sulle Importazioni Di Moda Negli Usa Guida Ai Prezzi

May 24, 2025

Effetti Dei Dazi Sulle Importazioni Di Moda Negli Usa Guida Ai Prezzi

May 24, 2025 -

All Resolutions Adopted At Imcd N V S Annual General Meeting Of Shareholders

May 24, 2025

All Resolutions Adopted At Imcd N V S Annual General Meeting Of Shareholders

May 24, 2025