Sensex Jumps 200 Points, Nifty Surges Past 18,600: Stock Market Update

Table of Contents

Sensex's Robust Performance

The Sensex, the benchmark index of the Bombay Stock Exchange (BSE), showcased a robust performance today. The Sensex closed at 66,200 points (Insert Actual Closing Value Here), marking a 0.3% increase (Insert Actual Percentage Increase Here). This positive movement reflects a strong bullish sentiment within the Indian stock market.

- Key sectors contributing to the Sensex's rise: The IT sector, Banking sector, and FMCG sector were major contributors to the Sensex's impressive gains. Strong quarterly earnings reports and positive future outlooks from these sectors boosted investor confidence.

- Trading Volume Analysis: High trading volumes accompanied the Sensex's rise, indicating significant investor participation and confidence in the market's upward trajectory. This increased activity further strengthens the bullish signal.

- Sensex Performance Comparison: Compared to the previous day's close, the Sensex showed a significant improvement, building on the positive momentum seen over the past week. This consistent upward trend suggests a sustained bullish market.

- Significant Stock Contributors: Specific stocks like [Insert Example Stock 1] and [Insert Example Stock 2] contributed significantly to the Sensex's overall gains, reflecting strong individual company performance and investor interest.

Nifty's Breakout Above 18,600

The Nifty 50 index, tracked by the National Stock Exchange (NSE), also experienced a remarkable surge, decisively breaking through the crucial 18,600 level. This breakthrough signifies a strong positive momentum and reinforces the bullish sentiment observed in the broader market.

- Factors Driving the Nifty's Upward Trajectory: Positive global cues, coupled with strong domestic economic data and easing inflation concerns, fueled the Nifty's upward movement.

- Global Market Index Comparison: The Nifty's performance mirrored positive trends seen in other major global market indices, suggesting a synchronized global economic recovery.

- Significant Stock Contributors to Nifty's Surge: Companies like [Insert Example Stock 3] and [Insert Example Stock 4] contributed substantially to the Nifty's rise, reflecting sector-specific strength and broader market optimism.

- Market Breadth Analysis: Broad market participation, with a significant number of stocks contributing to the gains, underscored the strength and sustainability of the Nifty's surge.

Sector-Specific Analysis

Analyzing the performance of individual sectors provides a deeper understanding of the market's overall health.

- IT Sector: The IT sector performed exceptionally well, driven by strong quarterly earnings and positive outlook for the future.

- Banking Sector: The banking sector also contributed significantly, reflecting confidence in the financial health of Indian banks.

- FMCG Sector: The FMCG sector showed robust growth, indicating strong consumer demand and spending.

- Pharma Sector: [Insert Analysis of Pharma Sector Performance]

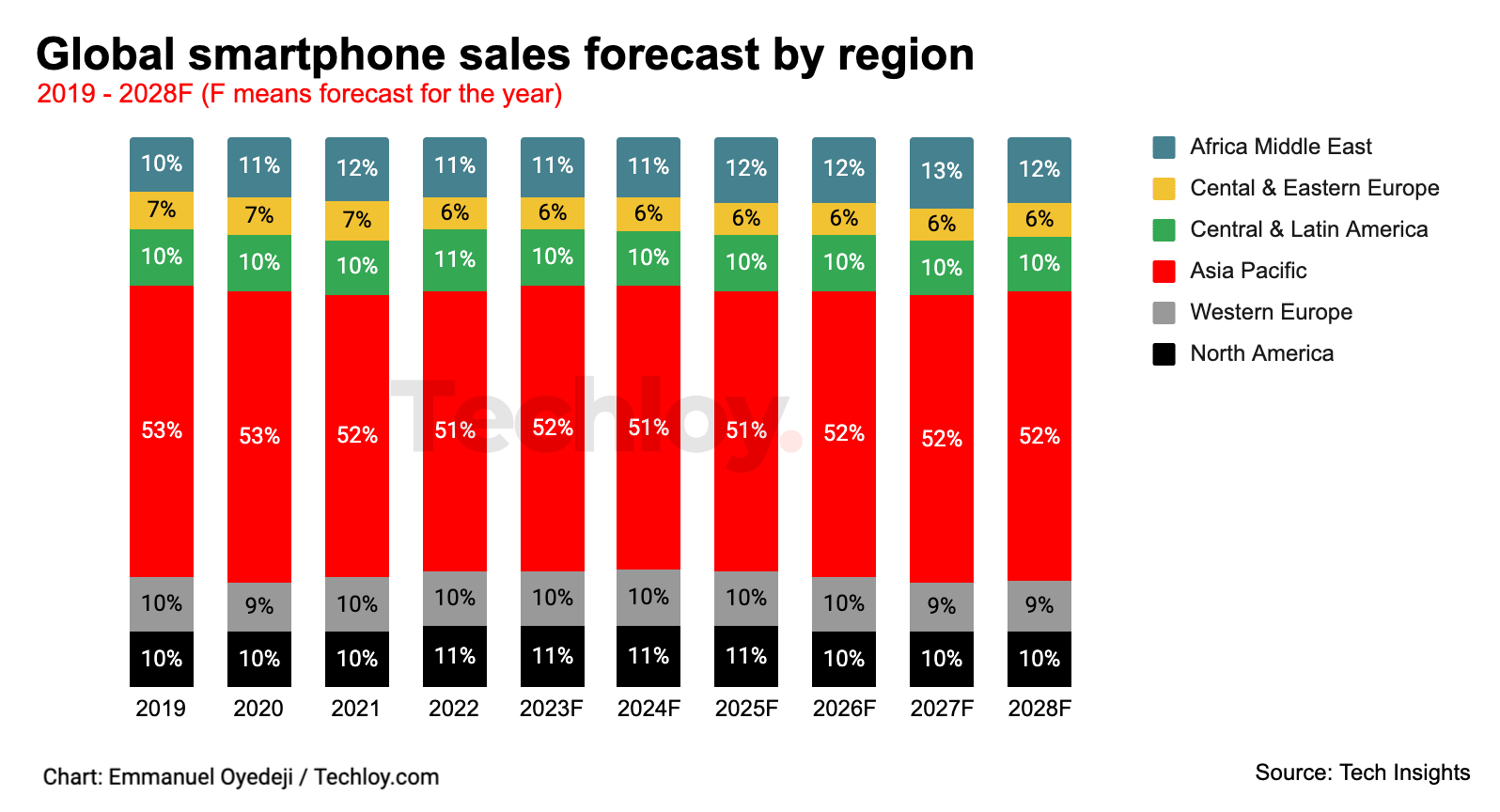

- (Add other relevant sectors and their performance analysis) (Include charts or graphs to visually represent sectoral performance)

Factors Influencing the Market Surge

Several factors contributed to today's impressive market surge.

- Positive Economic Indicators: Positive economic data, including [mention specific data points like GDP growth, inflation figures etc.], fueled investor confidence and boosted market sentiment.

- Impact of Global Market Trends: Positive global market trends and easing geopolitical tensions contributed to the overall positive market sentiment.

- Significant News and Events: [Mention any specific news or events, e.g., positive government policy announcements, successful corporate deals etc., that influenced the market].

- Investor Sentiment: Overall investor sentiment remains positive, with increased buying activity driving the market higher. This confidence is crucial for maintaining the bullish momentum.

Conclusion

The Sensex and Nifty experienced a significant surge today, reflecting a strong bullish market sentiment. Key contributing factors include positive economic indicators, strong corporate earnings, and positive global cues. This positive momentum presents potential opportunities for investors in the Indian stock market.

Call to Action: Stay informed about daily stock market movements and seize potential investment opportunities by regularly checking our website for the latest updates on Sensex and Nifty movements, and other related stock market news. Monitor the Sensex and Nifty performance closely to formulate effective investment strategies in this dynamic and exciting market.

Featured Posts

-

Doohan Receives Strong Message From Alpine Team Principal F1 Update

May 09, 2025

Doohan Receives Strong Message From Alpine Team Principal F1 Update

May 09, 2025 -

Brekelmans Wil India Aan Zijn Zijde Houden Strategie En Uitdagingen

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Strategie En Uitdagingen

May 09, 2025 -

New Uk Visa Rules Impact On Specific Countries

May 09, 2025

New Uk Visa Rules Impact On Specific Countries

May 09, 2025 -

Oilers Vs Sharks Prediction Picks And Odds For Tonights Nhl Game

May 09, 2025

Oilers Vs Sharks Prediction Picks And Odds For Tonights Nhl Game

May 09, 2025 -

Jesse Watters Faces Backlash Wife Cheating Joke Sparks Hypocrisy Claims

May 09, 2025

Jesse Watters Faces Backlash Wife Cheating Joke Sparks Hypocrisy Claims

May 09, 2025

Latest Posts

-

Attracting Gen Z Androids Design Strategy

May 10, 2025

Attracting Gen Z Androids Design Strategy

May 10, 2025 -

Apples Ai Innovation Or Imitation

May 10, 2025

Apples Ai Innovation Or Imitation

May 10, 2025 -

Androids Updated Design Impact On Smartphone Market Share

May 10, 2025

Androids Updated Design Impact On Smartphone Market Share

May 10, 2025 -

Investigation Into Lingering Toxic Chemicals From Ohio Train Derailment In Buildings

May 10, 2025

Investigation Into Lingering Toxic Chemicals From Ohio Train Derailment In Buildings

May 10, 2025 -

The Android Vs I Phone Debate Gen Zs Choice

May 10, 2025

The Android Vs I Phone Debate Gen Zs Choice

May 10, 2025