Navigating Import Tariffs: Challenges For A Montreal Guitar Manufacturer

Table of Contents

Understanding the complexities of Canadian import tariffs on musical instrument components.

Importing materials for guitar manufacturing in Montreal involves navigating the complexities of the Canadian customs process and relevant legislation. Understanding the system is crucial to minimize costs and delays. The Canada Border Services Agency (CBSA) is responsible for enforcing import regulations, including the assessment of duties and taxes. Key legislation includes the Customs Act and its associated regulations.

Identifying tariff codes for guitar parts.

Accurate classification of guitar parts using the correct Harmonized System (HS) codes is paramount. Incorrect classification can lead to significant financial penalties, delays in customs clearance, and potential legal issues. Each component requires its own specific code.

- Wood: Different types of wood (e.g., maple, rosewood) have different HS codes, often impacted by origin and processing.

- Electronics: Pickups, potentiometers, and other electronic components fall under various HS codes depending on their specific characteristics.

- Hardware: Tuners, bridges, and other hardware components will each have their own specific tariff classifications.

Misclassification can result in:

- Increased import duties and taxes: Incorrect codes often lead to higher tariff rates than intended.

- Shipping delays: Customs officials may hold shipments pending clarification of the correct codes.

- Financial penalties: The CBSA can impose significant fines for intentional or negligent misclassification.

Calculating import duties and taxes.

Calculating the total cost of importing guitar parts involves more than just the purchase price. You must factor in:

- Duty: This is a percentage of the value of the goods, determined by the HS code.

- Goods and Services Tax (GST): A 5% tax on the value of the goods plus duty.

- Provincial Sales Tax (PST): This varies by province; Quebec has a PST.

- Brokerage fees: These are fees charged by customs brokers for handling the import process.

Simplified Example:

Let's say you import $1000 worth of wood with a 10% duty rate.

- Duty: $1000 x 0.10 = $100

- GST: ($1000 + $100) x 0.05 = $55

- Total cost (excluding brokerage fees): $1155

Currency fluctuations significantly impact import costs. A stronger Canadian dollar reduces the cost of imports, while a weaker dollar increases them.

Sourcing strategies to mitigate tariff impacts.

Strategic sourcing is crucial for minimizing the impact of import tariffs on a Montreal guitar manufacturer.

Exploring alternative suppliers.

Consider sourcing from countries with preferential trade agreements with Canada, like those under the Canada-United States-Mexico Agreement (CUSMA), the successor to NAFTA. This can significantly reduce or eliminate tariffs on certain components.

- Advantages of US/Mexican sourcing: Reduced or eliminated tariffs, potentially lower transportation costs.

- Advantages of Asian sourcing: Lower labor costs, potentially wider range of materials.

- Disadvantages of Asian sourcing: Higher transportation costs, longer lead times, potential quality control issues.

Careful assessment of cost, quality, shipping times, and potential trade agreements is essential.

Negotiating with suppliers.

Transparent pricing and contract terms are vital for managing import costs.

- Negotiate prices: Explore options like bulk purchasing discounts and long-term contracts.

- Payment terms: Negotiate favorable payment terms to improve cash flow.

- Incoterms: Understanding Incoterms (International Commercial Terms) is crucial, as they define who is responsible for various aspects of shipping and import duties. Choosing the right Incoterms can significantly affect your tariff liability.

Optimizing inventory management.

Just-in-Time (JIT) inventory management minimizes the amount of capital tied up in inventory, reducing the potential impact of tariffs on excess stock. Accurate demand forecasting is key.

- Demand forecasting: Use historical sales data and market trends to predict future demand.

- Supplier relationships: Maintain strong relationships with suppliers to ensure timely delivery of parts.

- Inventory tracking: Implement a robust inventory tracking system to monitor stock levels and prevent overstocking.

Seeking government support and resources for Montreal businesses.

Several government programs and resources can assist Montreal businesses in managing import costs.

Utilizing available government programs.

Explore potential grants, subsidies, or tax credits offered by the federal and provincial governments (e.g., Quebec government programs for manufacturers). These programs can help offset the costs of import tariffs.

- Government websites: Check the websites of Innovation, Science and Economic Development Canada (ISED) and the Quebec government for relevant programs.

- Industry-specific programs: Look for programs specifically designed to support the manufacturing sector in Quebec.

Engaging with industry associations.

Networking with industry associations can provide valuable support and advice.

- Canadian Manufacturers & Exporters (CME): Offers resources and advocacy for manufacturers.

- Other relevant associations: Research associations specific to the musical instrument industry in Canada.

Conclusion:

Successfully navigating import tariffs is crucial for the financial health and competitiveness of a Montreal guitar manufacturer. By understanding tariff complexities, employing effective sourcing strategies, and leveraging available government support, manufacturers can mitigate these challenges and focus on what they do best: crafting exceptional musical instruments. Proactive planning and a thorough understanding of import tariffs are essential for the continued success of the Montreal guitar-making industry. Don't let import tariffs hinder your business; contact the relevant government agencies and industry associations today for assistance in managing your import tariff obligations.

Featured Posts

-

More Than A Watch Jack O Connells Relationship With The Jlc Reverso

Apr 25, 2025

More Than A Watch Jack O Connells Relationship With The Jlc Reverso

Apr 25, 2025 -

Heartthrobs Accent Revealed Netflixs Steamy New Hit

Apr 25, 2025

Heartthrobs Accent Revealed Netflixs Steamy New Hit

Apr 25, 2025 -

Australias Election Goldman Sachs Forecasts On Fiscal Policy

Apr 25, 2025

Australias Election Goldman Sachs Forecasts On Fiscal Policy

Apr 25, 2025 -

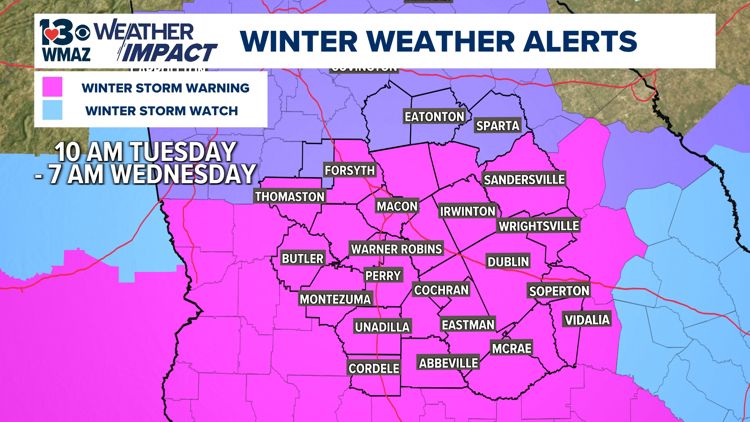

Oklahoma City Winter Storm Road Closures And Accidents

Apr 25, 2025

Oklahoma City Winter Storm Road Closures And Accidents

Apr 25, 2025 -

Explore The North East This Easter Top Places To Visit

Apr 25, 2025

Explore The North East This Easter Top Places To Visit

Apr 25, 2025

Latest Posts

-

Court Rules In Favor Of Nicolas Cage Weston Cage Case Continues

May 10, 2025

Court Rules In Favor Of Nicolas Cage Weston Cage Case Continues

May 10, 2025 -

Nicolas Cage Lawsuit Update Dismissal And Future Implications

May 10, 2025

Nicolas Cage Lawsuit Update Dismissal And Future Implications

May 10, 2025 -

Weston Cage Cope Ongoing Legal Battle With Father Nicolas Cage

May 10, 2025

Weston Cage Cope Ongoing Legal Battle With Father Nicolas Cage

May 10, 2025 -

Nicolas Cage Wins Partial Victory In Lawsuit Against Son Weston

May 10, 2025

Nicolas Cage Wins Partial Victory In Lawsuit Against Son Weston

May 10, 2025 -

Nicolas Cage Lawsuit Dismissed Son Weston Remains A Defendant

May 10, 2025

Nicolas Cage Lawsuit Dismissed Son Weston Remains A Defendant

May 10, 2025