Navigate The Private Credit Boom: 5 Crucial Do's And Don'ts For Job Seekers

Table of Contents

- Do's for Navigating the Private Credit Job Market

- 1. Network Strategically

- 2. Tailor Your Resume and Cover Letter

- 3. Develop In-Demand Skills

- 4. Prepare for Behavioral and Technical Interviews

- Don'ts for Navigating the Private Credit Job Market

- 1. Don't Neglect Networking

- 2. Don't Submit Generic Applications

- 3. Don't Underestimate the Importance of Due Diligence

- 4. Don't Be Overconfident or Underprepared

- Conclusion

Do's for Navigating the Private Credit Job Market

1. Network Strategically

Networking is paramount in the private credit industry. Don't underestimate the power of building genuine relationships.

- Attend Industry Events: SuperReturn, PEI events, and other industry conferences are excellent places to meet potential employers and learn about the latest market trends. Actively participate in discussions and exchange business cards.

- Leverage Online Platforms: LinkedIn is a powerful tool. Optimize your profile with relevant keywords (e.g., "Private Credit," "Credit Analyst," "Financial Modeling") and connect with recruiters specializing in alternative investments and finance jobs.

- Informational Interviews: Reach out to professionals working in private credit for informational interviews. These conversations provide valuable insights into specific firms and roles, and demonstrate your proactive nature.

- Engage with Webinars and Workshops: Participating in industry webinars and workshops shows your commitment to continuous learning and provides networking opportunities.

2. Tailor Your Resume and Cover Letter

Your application materials are your first impression. Generic applications will likely get lost in the pile.

- Highlight Relevant Skills: Emphasize skills crucial for private credit roles, including financial modeling (Excel, Python), credit analysis, due diligence, portfolio management, and risk assessment.

- Quantify Your Achievements: Instead of simply listing responsibilities, quantify your accomplishments. For example, "Increased efficiency by 15% through process improvement" is far more impactful than "Improved processes."

- Customize for Each Role: Each application should be tailored to the specific requirements of the job description and the firm's investment strategy. Generic applications demonstrate a lack of interest and effort.

- Use Targeted Keywords: Incorporate keywords from the job description into your resume and cover letter to improve your chances of getting noticed by applicant tracking systems (ATS).

3. Develop In-Demand Skills

The private credit industry demands specific expertise. Continuously upgrading your skills is crucial.

- Master Financial Modeling: Proficiency in Excel and Python is essential for financial modeling and analysis.

- Become a Credit Analysis Expert: Develop a strong understanding of credit risk assessment, including different credit scoring methodologies and risk mitigation strategies.

- Understand Legal and Regulatory Aspects: Familiarize yourself with the legal and regulatory landscape surrounding private credit investments.

- Pursue Relevant Certifications: Consider pursuing certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) to demonstrate your commitment to the field.

4. Prepare for Behavioral and Technical Interviews

Interview preparation is key to showcasing your skills and knowledge.

- Practice the STAR Method: Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions, highlighting your problem-solving skills.

- Demonstrate Investment Knowledge: Thoroughly understand various private credit investment strategies, including direct lending, mezzanine financing, and distressed debt.

- Prepare Case Studies: Be ready to discuss case studies demonstrating your analytical abilities and problem-solving approach.

- Research the Firm: Thoroughly research the firm's investment philosophy, portfolio, and culture before the interview. Demonstrate genuine interest.

Don'ts for Navigating the Private Credit Job Market

1. Don't Neglect Networking

Building relationships is crucial; don't rely solely on online applications.

- Don't Underestimate Relationships: Networking events, informational interviews, and leveraging your existing network are invaluable.

- Don't Rely Only on Online Applications: Online applications are important, but they shouldn't be your sole strategy.

- Don't Be Afraid to Reach Out: Proactively reach out to people in your network for advice, referrals, and introductions.

2. Don't Submit Generic Applications

Each application should be unique and tailored to the specific firm and role.

- Don't Use the Same Materials: Avoid sending the same resume and cover letter to multiple firms.

- Avoid Generic Statements: Replace generic statements with specific examples demonstrating your skills and experience.

- Show Genuine Interest: Demonstrate a genuine interest in the specific firm, its investment strategy, and the role you're applying for.

3. Don't Underestimate the Importance of Due Diligence

Thoroughly research firms before applying and ensure alignment with your career goals.

- Research the Firm: Understand their investment strategy, portfolio, recent transactions, and company culture.

- Align with Your Goals: Only apply for roles that align with your long-term career aspirations.

- Understand the Culture: Research the firm's culture to ensure a good fit.

4. Don't Be Overconfident or Underprepared

The private credit market is competitive; thorough preparation is essential.

- Don't Assume Success: Don't assume your skills alone will secure a job; thorough preparation is crucial.

- Understand the Competition: Acknowledge the high level of competition and prepare accordingly.

- Prepare for Interviews: Practice your answers, research the company, and anticipate potential questions.

Conclusion

The private credit boom presents exciting career opportunities. By following these do's and don'ts, you can significantly improve your chances of landing your dream private credit job. Remember to network effectively, tailor your applications, develop in-demand skills, and prepare thoroughly for interviews. Don't delay – start navigating the private credit job market today and secure your future in this thriving industry. Begin your journey to success by mastering the art of finding private credit jobs and building a strong career in this dynamic field.

Capital Summertime Ball 2025 Tickets A Buyers Guide

Capital Summertime Ball 2025 Tickets A Buyers Guide

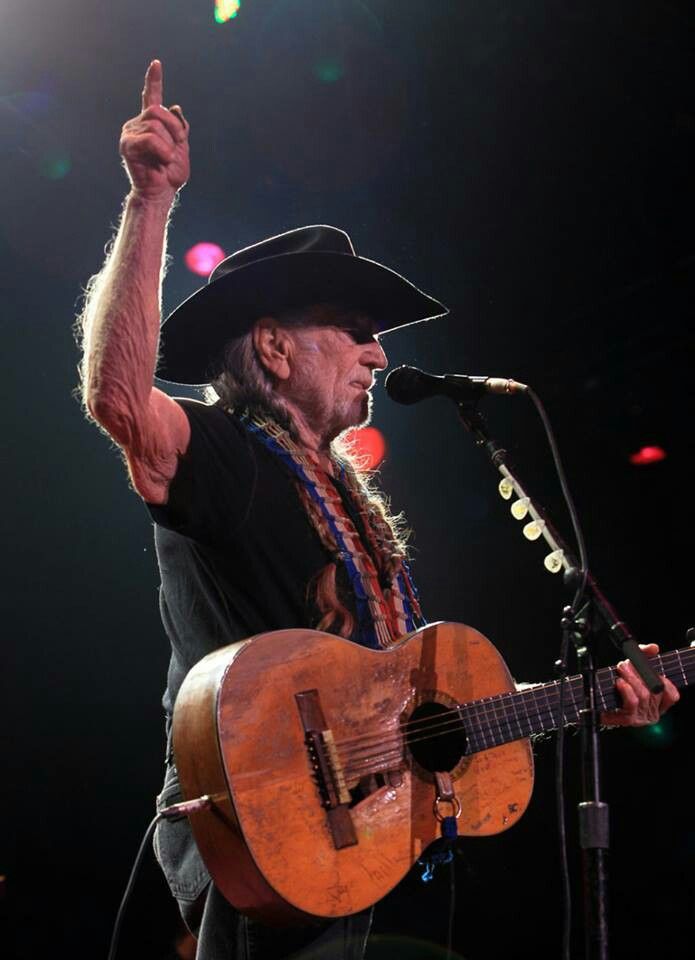

Key Facts About Willie Nelsons Life And Music

Key Facts About Willie Nelsons Life And Music

Will Republican Infighting Sink Trumps Big Beautiful Tax Bill

Will Republican Infighting Sink Trumps Big Beautiful Tax Bill

Wifes Statement On Sons Care Of Willie Nelson

Wifes Statement On Sons Care Of Willie Nelson

Mlb Considering Petition To Reinstate Pete Rose A Report

Mlb Considering Petition To Reinstate Pete Rose A Report

The Nintendo Switch Technologys Convergence With Gaming

The Nintendo Switch Technologys Convergence With Gaming

Nintendo Switch Technological Innovation And Its Impact

Nintendo Switch Technological Innovation And Its Impact

Has Technology Finally Caught Up To Nintendo With The Switch

Has Technology Finally Caught Up To Nintendo With The Switch

The Switch And Nintendo Bridging The Technological Gap

The Switch And Nintendo Bridging The Technological Gap

Analyzing Nintendos Switch A Technological Catch Up

Analyzing Nintendos Switch A Technological Catch Up