Moody's 30-Year Yield Prediction And The Renewed "Sell America" Trade

Table of Contents

Moody's 30-Year Yield Forecast and its Implications

Understanding Moody's Prediction

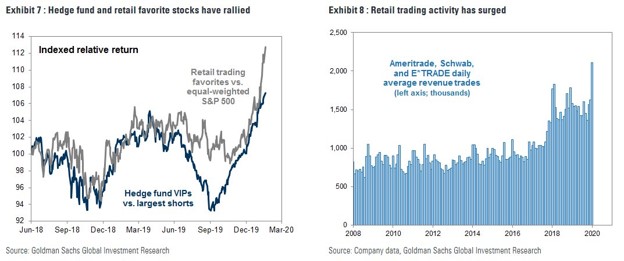

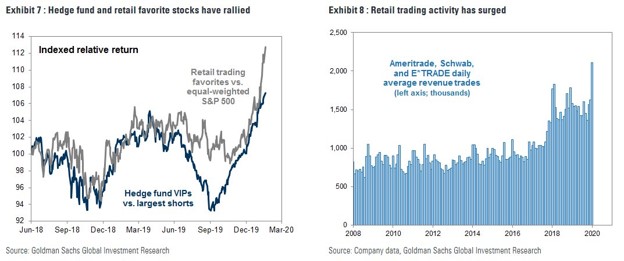

Moody's, a leading credit rating agency, bases its yield forecasts on a complex methodology that considers various macroeconomic factors. These factors include inflation expectations, economic growth projections, Federal Reserve monetary policy, and global economic conditions. While the specific predicted yield and timeframe may vary slightly depending on the report, the core message consistently highlights a trend of rising long-term interest rates. Historically, 30-year Treasury yields have shown significant volatility, influenced by shifts in investor sentiment and global events. Understanding this historical context is crucial for interpreting the current prediction and its potential impact. [Insert chart or graph showing historical 30-year Treasury yield data here]. Keywords: Moody's rating agency, yield curve, long-term interest rates, bond market prediction, Treasury bond yields.

Impact on Bond Markets

Moody's prediction of higher 30-year Treasury yields has significant implications for the bond market, particularly for long-term bonds. Higher yields generally mean lower bond prices, potentially leading to capital losses for investors who hold these bonds. The potential for capital flight from US bonds is a real concern, as investors may seek higher returns elsewhere. This could lead to:

- Impact on pension funds and insurance companies: These institutions, which heavily invest in long-term bonds, face significant challenges in managing their portfolios in a rising-yield environment.

- Effect on corporate borrowing costs: Higher Treasury yields typically translate into higher borrowing costs for corporations, potentially hindering economic growth.

- Potential for increased bond market volatility: As investors adjust their portfolios, the bond market may experience increased volatility, creating uncertainty for investors. Keywords: bond market, fixed income, bond yields, long-term bonds, capital flight, investment risk.

The Renewed "Sell America" Trade: Causes and Consequences

Factors Contributing to "Sell America" Sentiment

The resurgence of the "Sell America" trade is driven by a confluence of factors, including:

- Rising inflation and interest rates: Persistent inflation and the Federal Reserve's efforts to combat it through interest rate hikes have eroded investor confidence in the US dollar and US assets.

- Geopolitical risks and international conflicts: Global instability and uncertainty, stemming from geopolitical events, further contribute to risk aversion and capital outflows from the US.

- US fiscal policy and debt sustainability: Concerns about the sustainability of the US national debt and the effectiveness of fiscal policy add to the negative sentiment surrounding the US economy.

Keywords: capital outflow, dollar devaluation, foreign investment, US economic policy, global economic uncertainty.

Consequences of a "Sell America" Trade

A sustained "Sell America" trade carries substantial consequences:

- Weakening of the US dollar: Reduced demand for US assets can lead to a weakening of the US dollar, impacting its global reserve currency status.

- Increased trade deficits: A weaker dollar makes US exports more expensive and imports cheaper, potentially widening the trade deficit.

- Reduced foreign investment in the US: The outflow of capital can hinder economic growth and investment in the US.

Keywords: US dollar, exchange rates, trade balance, economic nationalism, global trade.

Interplay between Moody's Prediction and the "Sell America" Trade

Moody's 30-year yield prediction can significantly exacerbate the "Sell America" trend. The prediction itself can create a self-fulfilling prophecy: the expectation of higher yields prompts investors to sell US bonds, driving yields even higher and fueling further capital outflows. This feedback loop creates downward pressure on the US dollar, strengthening the "Sell America" dynamic. [Insert chart or graph showing the correlation between Moody's prediction, US bond yields, and the US dollar here]. Keywords: feedback loop, self-fulfilling prophecy, correlation analysis, market sentiment.

Conclusion: Navigating the Uncertainty of Moody's 30-Year Yield Prediction and the "Sell America" Trade

Moody's 30-year yield prediction, coupled with the renewed "Sell America" sentiment, presents a complex and uncertain market environment. Understanding the interplay between these factors is crucial for investors seeking to navigate this landscape. The potential risks are significant, ranging from capital losses in bond markets to a weakening US dollar and slower economic growth. However, opportunities may also arise for astute investors who can anticipate and adapt to these changing dynamics. Stay informed about Moody's 30-year yield predictions and the evolving “Sell America” trade to make sound investment decisions. Conduct thorough research and analysis to fully understand the implications of these trends on your investment portfolio. Careful diversification and a robust investment strategy are essential to mitigate risk in this volatile market.

Featured Posts

-

One Child Missing Another Injured Train Collision Kills Two Adults

May 20, 2025

One Child Missing Another Injured Train Collision Kills Two Adults

May 20, 2025 -

F1 Champions Backing Boosts Mick Schumachers Cadillac Chances

May 20, 2025

F1 Champions Backing Boosts Mick Schumachers Cadillac Chances

May 20, 2025 -

Solve The Nyt Mini Crossword April 13 Answers

May 20, 2025

Solve The Nyt Mini Crossword April 13 Answers

May 20, 2025 -

Dubai Holding Reit Ipo Size Boosted To 584 Million

May 20, 2025

Dubai Holding Reit Ipo Size Boosted To 584 Million

May 20, 2025 -

Army Eyes Drone Truck For Usmc Tomahawk Missile Launch

May 20, 2025

Army Eyes Drone Truck For Usmc Tomahawk Missile Launch

May 20, 2025

Latest Posts

-

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025 -

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025 -

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025 -

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025