Dubai Holding REIT IPO: Size Boosted To $584 Million

Table of Contents

Increased IPO Size and its Significance

The initial planned size of the Dubai Holding REIT IPO was smaller than the final $584 million figure. This substantial increase reflects several crucial factors: overwhelmingly positive market response, robust investor confidence in Dubai’s real estate sector, and the attractive yield and growth potential offered by the REIT itself. The expansion signifies a strong belief in the long-term prospects of Dubai's property market and the strategic positioning of Dubai Holding's assets.

- Increased investor interest: The IPO attracted significant interest from both local and international investors seeking exposure to Dubai's prime real estate.

- Strong market performance: Dubai's real estate market has demonstrated consistent strength and growth, boosting investor confidence.

- Attractive yield and growth potential: The REIT offers a compelling proposition with projected high returns and significant long-term growth potential.

- Strategic asset positioning: Dubai Holding has strategically curated a portfolio of high-value assets within the REIT, enhancing its appeal to investors.

Dubai Holding REIT's Asset Portfolio and Investment Strategy

The Dubai Holding REIT's portfolio encompasses a diverse range of high-quality properties across various sectors, including residential, commercial, and retail spaces. This diversification mitigates risk and provides a stable income stream. The REIT's investment strategy focuses on acquiring and managing income-generating assets in prime locations within Dubai, aiming for consistent and sustainable growth.

- Geographic diversification: The portfolio includes properties strategically located across Dubai's most desirable areas, maximizing rental income and capital appreciation potential.

- High-yielding assets: The REIT prioritizes properties with a proven track record of strong rental yields, providing a reliable income stream for investors.

- Future acquisitions and expansion: The REIT has plans for future acquisitions to further enhance its portfolio and strengthen its market position. This signifies ongoing growth and expansion opportunities for investors.

- Long-term growth in Dubai real estate: The REIT is well-positioned to capitalize on the continued growth and development of Dubai's real estate sector.

Implications for the Dubai Real Estate Market

The Dubai Holding REIT IPO, particularly with its increased size, has significant implications for the broader Dubai real estate market. It is expected to inject substantial liquidity, attracting further foreign investment and stimulating the sector's growth.

- Increased liquidity and foreign investment: The IPO's success will attract more international capital into the Dubai real estate market, boosting overall liquidity.

- Further development and growth: The influx of capital will likely drive further development and construction projects within Dubai.

- Boost to investor confidence: The IPO's strong performance reinforces confidence in the Dubai economy and its real estate sector.

- Benchmark for future REIT IPOs: This IPO sets a strong precedent for future Real Estate Investment Trust offerings in the region, potentially catalyzing further development in the REIT market within the UAE.

Investment Opportunities and Risks

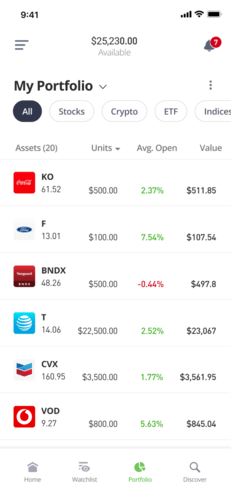

The Dubai Holding REIT IPO presents a potentially lucrative investment opportunity with the potential for high returns based on projected yields and long-term growth within the Dubai real estate market. However, like any investment, there are inherent risks.

- Potential for high returns: The projected yields and growth potential of the REIT suggest significant returns for investors.

- Market fluctuations: Real estate investment is subject to market fluctuations, and values can rise and fall.

- Due diligence: Thorough due diligence is crucial before investing in any REIT or other investment vehicle. Carefully analyze the prospectus and seek professional financial advice.

- Portfolio diversification: Diversifying your investment portfolio is a sound strategy to mitigate risk. The Dubai Holding REIT can be one component of a broader, well-diversified strategy.

Conclusion

The boosted $584 million IPO for the Dubai Holding REIT signifies a major development for Dubai's real estate market and offers a compelling investment opportunity. The increased size reflects investor confidence and the attractiveness of the REIT's portfolio. However, potential investors should conduct thorough due diligence and understand the associated risks.

Call to Action: Don't miss the chance to participate in this exciting investment opportunity. Learn more about the Dubai Holding REIT IPO and carefully consider its potential. Remember to research the prospectus thoroughly and seek professional financial advice before making any investment decisions related to the Dubai Holding REIT or any other Real Estate Investment Trust.

Featured Posts

-

Activision Blizzard Merger Ftcs Appeal Challenges Microsofts Victory

May 20, 2025

Activision Blizzard Merger Ftcs Appeal Challenges Microsofts Victory

May 20, 2025 -

March 20th 2025 Nyt Mini Crossword Answers

May 20, 2025

March 20th 2025 Nyt Mini Crossword Answers

May 20, 2025 -

Improving Siri Apples Investment In Llm Technology

May 20, 2025

Improving Siri Apples Investment In Llm Technology

May 20, 2025 -

Nyt Mini Crossword Today Hints And Answers For March 5 2025

May 20, 2025

Nyt Mini Crossword Today Hints And Answers For March 5 2025

May 20, 2025 -

L Affaire Jaminet Reglee Le Joueur Rembourse Le Stade Toulousain

May 20, 2025

L Affaire Jaminet Reglee Le Joueur Rembourse Le Stade Toulousain

May 20, 2025

Latest Posts

-

Qbts Stock Predicting The Earnings Reaction

May 20, 2025

Qbts Stock Predicting The Earnings Reaction

May 20, 2025 -

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025 -

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025 -

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025