MicroStrategy Challenger: A Deep Dive Into The Latest SPAC Investment Frenzy

Table of Contents

The Rise of MicroStrategy and its Impact on the SPAC Market

MicroStrategy's aggressive investment strategy, particularly its substantial holdings in Bitcoin, has significantly impacted the perception of SPACs as a vehicle for unconventional and high-risk investments. This section analyzes MicroStrategy's influence on the SPAC market and examines its own SPAC-related activities.

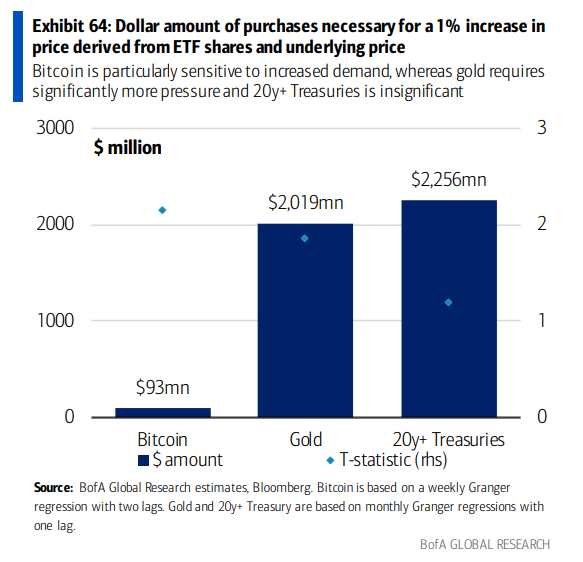

MicroStrategy's Bitcoin Strategy and its Influence

MicroStrategy's decision to invest heavily in Bitcoin, using its substantial cash reserves, was a bold move that sent shockwaves through the financial markets.

- Risks: The volatility of Bitcoin’s price exposes MicroStrategy to significant losses. The strategy is unconventional for a business intelligence company, raising concerns among some investors. Regulatory uncertainty surrounding cryptocurrencies also poses a risk.

- Rewards: The strategy, if successful, could yield massive returns, establishing MicroStrategy as a pioneer in integrating cryptocurrency into its corporate strategy. The move has increased brand visibility and attracted attention from investors interested in both Bitcoin and disruptive business models.

- Market Reaction: The market initially reacted with a mix of skepticism and excitement. While some saw it as a risky gamble, others lauded it as a visionary move. MicroStrategy's stock price has seen significant fluctuations correlated to the price of Bitcoin.

- Impact on Bitcoin: MicroStrategy's substantial investment helped increase institutional adoption of Bitcoin, lending credibility to the cryptocurrency and potentially contributing to its price appreciation.

Analyzing MicroStrategy's SPAC Investments

While MicroStrategy is primarily known for its Bitcoin strategy, it's important to note that the company hasn't directly invested heavily in SPACs themselves, rather using traditional investment methods. Its impact is more felt through the precedent it set regarding unconventional and high-risk investments, making other players more willing to consider similar, higher-risk ventures within the SPAC market.

Emerging MicroStrategy Challengers: Key Players and Their Strategies

Several companies are emulating MicroStrategy's bold approach, albeit with varying strategies and degrees of risk. These "challengers" are actively competing for opportunities within the booming, but volatile, SPAC market.

Identifying Prominent Competitors

Several technology-focused firms are aggressively pursuing SPAC investments. While pinpointing exact competitors to MicroStrategy's unique approach is challenging, we can highlight companies investing in similar sectors or exhibiting similar risk appetite. For example, let's consider (hypothetical examples for illustrative purposes):

-

Company A: Focuses on early-stage AI companies, mirroring the high-growth, high-risk profile of some MicroStrategy-adjacent ventures.

-

Company B: A large private equity firm that utilizes SPACs to acquire and list promising cloud-computing businesses, directly competing for similar targets as companies that might attract MicroStrategy’s attention.

-

Company C: A fintech company using SPACs to consolidate its position within a specific niche, showcasing a different strategic application of SPACs.

-

Key Investments: Each company's portfolio differs significantly reflecting their specific investment thesis. Company A focuses on Series A and B startups, while Company B targets larger, more mature companies.

-

Investment Strategies: Their strategies vary from concentrated bets on specific sectors (Company A) to more diversified approaches (Company B), demonstrating the spectrum of approaches within the SPAC market.

-

Comparison to MicroStrategy: Unlike MicroStrategy’s largely crypto-focused strategy, these challengers diversify across different subsectors within the technology landscape.

Diversification of Investment Strategies

The challengers are demonstrating a broader diversification of investment strategies compared to MicroStrategy’s heavily Bitcoin-focused approach.

- Diverse Investments: Examples include investments in renewable energy, electric vehicles, biotech, and various software-as-a-service (SaaS) businesses.

- Benefits of Diversification: Spreading investments across multiple sectors reduces the impact of any single investment's failure, creating a more resilient portfolio.

- Risks of Diversification: Diversification may dilute returns if some investments perform better than others. It also requires a broader range of expertise and in-depth understanding of numerous industries.

The Risks and Rewards of the Current SPAC Investment Frenzy

The SPAC market, while offering exciting opportunities, is inherently risky. This section examines both the potential for high returns and the substantial risks involved.

Understanding the Volatility of the SPAC Market

The SPAC market is known for its volatility. Several factors contribute to this:

- Failed SPAC Mergers: Many SPACs fail to complete mergers with target companies, leaving investors with losses. This can occur due to poor due diligence, market conditions, or issues with the target company.

- Market Downturns: Market downturns disproportionately impact speculative investments like SPACs, often leading to significant value declines.

- Importance of Due Diligence: Thorough due diligence is critical to identify potentially successful SPACs, evaluating the management team, the target company's financials, and the overall market conditions.

Assessing the Potential for High Returns (and Losses)

SPAC investments offer the potential for substantial gains, but they also carry the risk of significant losses.

- Successful SPAC Investments: Many SPAC mergers result in successful companies, generating high returns for investors. However, identifying these winners before the merger is crucial.

- Balanced Perspective: A balanced view is essential – the market contains both success stories and significant failures. Understanding both sides is vital for making informed decisions.

Conclusion

MicroStrategy's bold strategy has significantly impacted the SPAC market, showcasing the potential, and the risks, of unconventional investments. Emerging challengers are adopting similar approaches, but with diversified strategies, showcasing the evolving nature of this dynamic investment vehicle. While the SPAC investment frenzy offers lucrative opportunities, it's crucial to acknowledge the substantial risks involved. Before investing in any MicroStrategy challenger or SPAC, thorough due diligence and a clear understanding of market volatility are paramount. Learn from MicroStrategy’s experience and the strategies of its challengers to make informed decisions in this dynamic sector. Remember to conduct comprehensive research before investing in any SPAC investment.

Featured Posts

-

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025

X Men Rogues Costume Evolution A Surprising Shift

May 08, 2025 -

Breaking Bread With Scholars A Guide To Meaningful Academic Discussions

May 08, 2025

Breaking Bread With Scholars A Guide To Meaningful Academic Discussions

May 08, 2025 -

March 7th Nba Game Thunder Vs Trail Blazers Time Tv And Streaming

May 08, 2025

March 7th Nba Game Thunder Vs Trail Blazers Time Tv And Streaming

May 08, 2025 -

Could A 10x Bitcoin Multiplier Reshape Wall Street

May 08, 2025

Could A 10x Bitcoin Multiplier Reshape Wall Street

May 08, 2025 -

Lahore Zoo Ticket Price Increase Minister Aurangzebs Response

May 08, 2025

Lahore Zoo Ticket Price Increase Minister Aurangzebs Response

May 08, 2025

Latest Posts

-

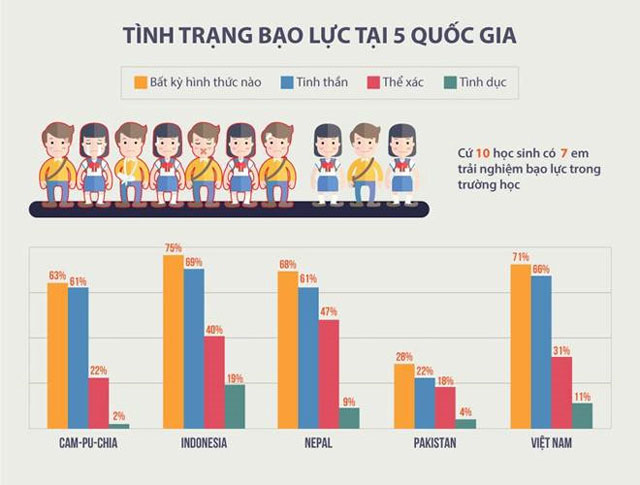

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025 -

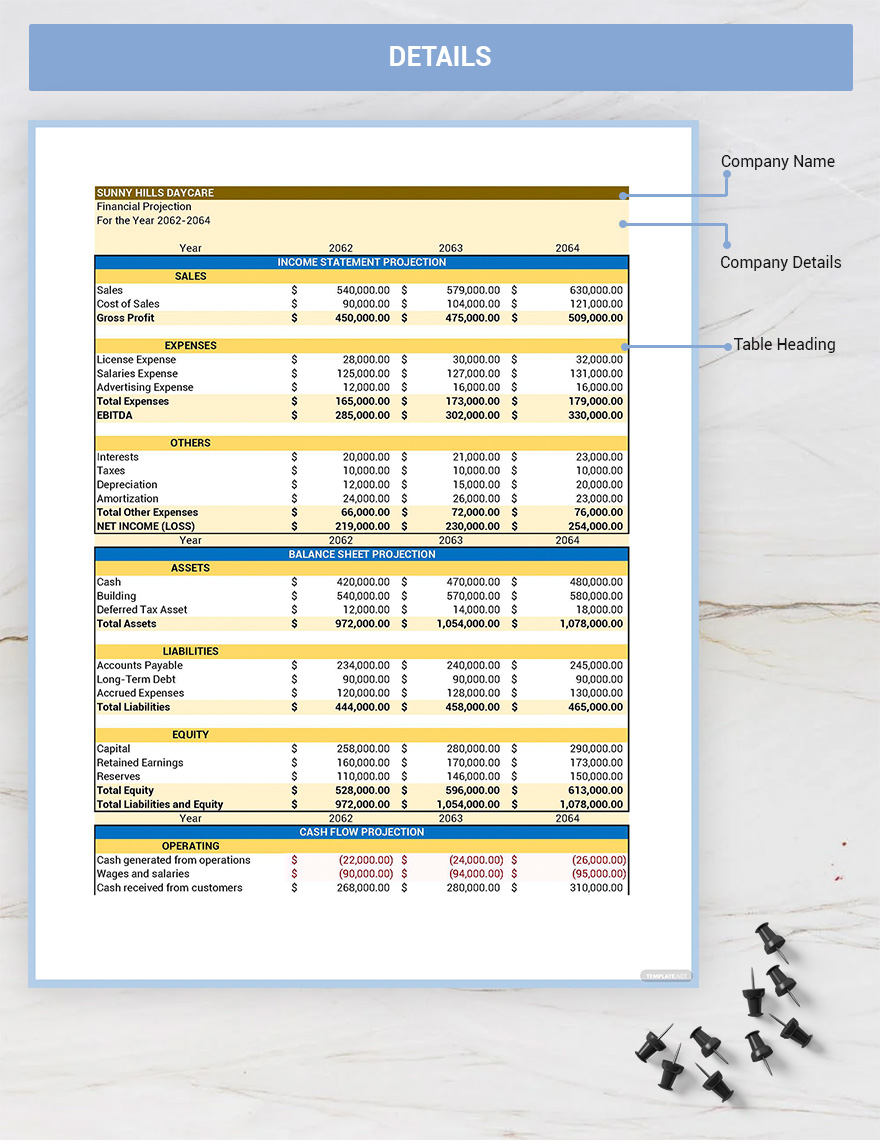

From 3 000 Babysitter To 3 600 Daycare A Financial Nightmare

May 09, 2025

From 3 000 Babysitter To 3 600 Daycare A Financial Nightmare

May 09, 2025 -

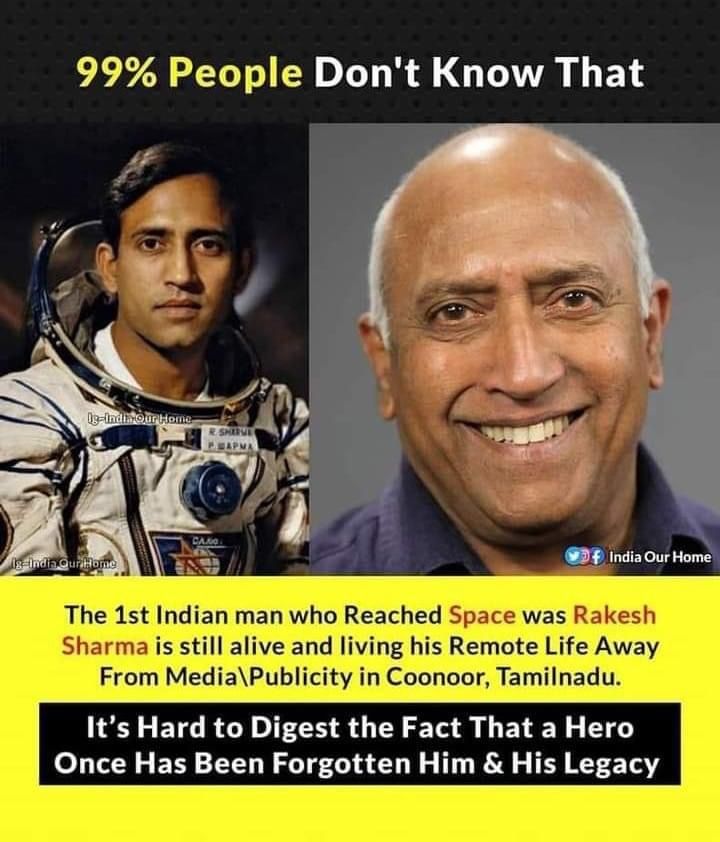

The Current Endeavors Of Rakesh Sharma Indias Pioneer Astronaut

May 09, 2025

The Current Endeavors Of Rakesh Sharma Indias Pioneer Astronaut

May 09, 2025 -

Handhaven Van De Band Nederland India De Aanpak Van Brekelmans

May 09, 2025

Handhaven Van De Band Nederland India De Aanpak Van Brekelmans

May 09, 2025 -

Expensive Babysitting Leads To Even Higher Daycare Costs A Cautionary Tale

May 09, 2025

Expensive Babysitting Leads To Even Higher Daycare Costs A Cautionary Tale

May 09, 2025