Market Reaction: Gold Rises On Trump's Less Confrontational Stance

Table of Contents

Understanding the Initial Market Reaction to Trump's Statements

Analysis of Pre-Statement Gold Prices and Trading Volumes

Before the announcement of Trump's shift in stance, gold prices had been relatively stable, exhibiting a sideways trend.

- Gold Price (Spot): $1,900 - $1,920 per troy ounce (example data - replace with actual data)

- Trading Volume: Averaged 150 million ounces per day (example data - replace with actual data)

- VIX Volatility Index: Remained relatively low, indicating a degree of market complacency (replace with actual VIX data).

Immediate Impact of the News on Gold Futures and Spot Prices

The news of Trump's less aggressive tone triggered an immediate and noticeable price jump in gold.

- (Insert Chart Here): A chart showing the sharp increase in gold prices immediately following the announcement is crucial here. Clearly label the axes and the timeframe.

- Speed and Magnitude: The price increase was swift, with gold prices surging by approximately $10-$15 per ounce within hours (replace with actual data). This rapid movement signifies a strong market reaction.

- USD/Gold: The US dollar weakened slightly against gold (USD/Gold ratio increased) following the announcement, further supporting the upward price movement in gold.

Why a Less Confrontational Stance Impacts Gold Prices

The Role of Geopolitical Uncertainty in Gold Investment

Gold is frequently considered a safe-haven asset, meaning its value tends to increase during times of geopolitical uncertainty or economic instability.

- Safe Haven Status: Investors often flock to gold as a store of value when facing global uncertainty, reducing their exposure to riskier assets.

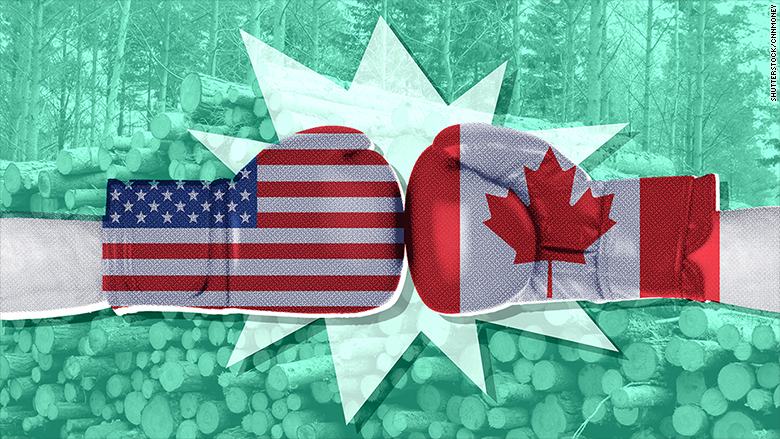

- Trump's Previous Policies: Trump's previously confrontational trade policies and international statements had created considerable geopolitical uncertainty, driving up demand for gold.

- Past Examples: Numerous past geopolitical events, such as the 2008 financial crisis and various international conflicts, have shown a clear correlation between heightened uncertainty and increased gold prices.

Decreased Demand for Riskier Assets

Gold prices typically exhibit an inverse relationship with risk appetite.

- Inverse Relationship: When investors perceive lower risk, they are more likely to invest in riskier assets (stocks, bonds, etc.), leading to lower gold demand.

- Reduced Perceived Risk: Trump's less confrontational stance reduced the perceived geopolitical risk in the minds of many investors.

- Capital Shift: This shift in perception led to a reallocation of capital from riskier assets toward safer options like gold, pushing its price upward.

Alternative Explanations for the Gold Price Increase

Influence of Other Economic Factors

While Trump's altered stance likely played a significant role, it's crucial to consider other potential factors.

- Inflation Concerns: Rising inflation can boost gold prices, as it erodes the purchasing power of fiat currencies. Analyze current inflation rates to assess their influence.

- Currency Fluctuations: Changes in the value of the US dollar, relative to other currencies, can affect gold prices. Examine USD movements in the period surrounding the price surge.

- Data Analysis: Thoroughly analyze economic data from the period to determine the relative contribution of each factor to the price increase.

Technical Analysis of Gold Price Charts

Technical analysis can provide additional insights into the price movement.

- Breakout from Resistance: Did the price break through a significant resistance level on the charts? (Include relevant charts and explanations).

- Technical Indicators: Examine relevant technical indicators (e.g., moving averages, RSI) to see if they corroborate the price increase.

- Limitations: Technical analysis should be used in conjunction with fundamental analysis (as discussed above) to gain a holistic understanding.

Conclusion: Market Reaction: Gold Rises on Trump's Less Confrontational Stance – Key Takeaways and Future Outlook

In summary, while multiple factors influenced the rise in gold prices, Trump's less confrontational stance appears to have played a significant role. The shift towards reduced geopolitical uncertainty likely decreased demand for riskier assets, causing a flow of capital into the gold market. However, it's crucial to remember that economic indicators and technical analysis should be considered alongside political events for a comprehensive understanding of gold price movements. The future trajectory of gold prices will depend on evolving geopolitical situations, economic conditions, and investor sentiment.

Stay informed about the ongoing market reaction to political events by subscribing to our daily market update – understanding the intricacies of gold price movements can empower your investment decisions.

Featured Posts

-

Ftc Challenges Court Ruling On Microsofts Activision Acquisition

Apr 25, 2025

Ftc Challenges Court Ruling On Microsofts Activision Acquisition

Apr 25, 2025 -

Chinas Special Bonds A Response To Trumps Tariffs And Trade War

Apr 25, 2025

Chinas Special Bonds A Response To Trumps Tariffs And Trade War

Apr 25, 2025 -

Millions Stolen In Executive Office365 Data Breach Fbi Investigating

Apr 25, 2025

Millions Stolen In Executive Office365 Data Breach Fbi Investigating

Apr 25, 2025 -

Courtney Act And Tony Armstrong Your Sbs Eurovision Hosts

Apr 25, 2025

Courtney Act And Tony Armstrong Your Sbs Eurovision Hosts

Apr 25, 2025 -

Stagecoach Festival 2025 What To Expect From The Lineup And Experience

Apr 25, 2025

Stagecoach Festival 2025 What To Expect From The Lineup And Experience

Apr 25, 2025

Latest Posts

-

The Us Attorney General Fox News And The Importance Of Context

May 10, 2025

The Us Attorney General Fox News And The Importance Of Context

May 10, 2025 -

Exploring Alternative Canola Suppliers Chinas Post Canada Approach

May 10, 2025

Exploring Alternative Canola Suppliers Chinas Post Canada Approach

May 10, 2025 -

Chinas Canola Import Diversification A Market Analysis

May 10, 2025

Chinas Canola Import Diversification A Market Analysis

May 10, 2025 -

The Impact Of China Canada Relations On Global Canola Markets

May 10, 2025

The Impact Of China Canada Relations On Global Canola Markets

May 10, 2025 -

Chinas Canola Strategy Beyond The Canada Trade Dispute

May 10, 2025

Chinas Canola Strategy Beyond The Canada Trade Dispute

May 10, 2025