China's Special Bonds: A Response To Trump's Tariffs And Trade War

Table of Contents

The Genesis of China's Special Bonds

The US-China trade war, marked by escalating tariffs and trade restrictions, created considerable economic pressure on China. Tariffs on Chinese exports disrupted various industries, impacting manufacturers, exporters, and ultimately, employment. Facing slowing growth and the need to support affected sectors, the Chinese government turned to fiscal stimulus as a key component of its response strategy. This stimulus aimed to counteract the negative effects of the trade war and maintain economic stability.

A crucial element of this fiscal stimulus was the increased investment in infrastructure projects. The goal was to boost domestic demand, create jobs, and stimulate economic activity. This initiative required substantial funding, which led to the issuance of “special bonds.” These bonds were designed to finance large-scale infrastructure projects and provide targeted support to industries hit hardest by the tariffs.

- Increased infrastructure investment as a key goal: The focus was on upgrading existing infrastructure and building new projects, such as high-speed rail lines, transportation networks, and energy infrastructure.

- Targeted support for specific sectors affected by tariffs: Industries heavily reliant on exports to the US, like manufacturing and agriculture, received preferential access to special bond funding.

- Special bonds as a key financing mechanism for these projects: These bonds provided a relatively quick and efficient way to channel funds towards prioritized infrastructure projects and economic stimulus initiatives.

Mechanisms and Allocation of China's Special Bonds

China's special bonds are primarily issued by local governments, reflecting the decentralized nature of infrastructure development in the country. The allocation process involves a complex interplay between central and local government authorities. The central government sets overall targets and guidelines for special bond issuance, while local governments are responsible for identifying and selecting specific projects.

These bonds predominantly funded infrastructure projects, but also supported investments in technology and other strategic sectors. Project selection criteria emphasized projects with high economic multiplier effects – those that would generate significant downstream economic activity and job creation. While the government aimed for transparency, the process also faced criticism regarding the lack of detailed public information on specific projects and their funding.

- Local government involvement in bond issuance and project selection: This decentralized approach allows for tailored responses to regional economic needs but can also create inconsistencies in project prioritization.

- Prioritization of projects with high economic multiplier effects: The aim was to maximize the impact of each yuan invested through special bonds.

- Transparency and accountability mechanisms (or lack thereof): While the government has made efforts to improve transparency, concerns remain about the potential for misuse or lack of accountability in the allocation process.

Economic Impact and Effectiveness of China's Special Bonds

The issuance of special bonds had a significant impact on the Chinese economy. In the short term, it helped to boost infrastructure investment and maintain economic growth amidst the trade war’s challenges. The increased spending created jobs and stimulated related industries. Long-term effects are still unfolding, but the expansion of infrastructure has the potential to enhance long-term productivity and competitiveness.

However, the effectiveness in completely mitigating the trade war’s negative consequences is debatable. While special bonds contributed to overall economic growth, they couldn't fully offset the impact of tariffs and the disruption of trade relations.

- Data on infrastructure investment fueled by special bonds: While precise figures are sometimes debated, significant increases in infrastructure investment correlate directly with the issuance of special bonds.

- Analysis of employment creation in related sectors: The construction and related industries experienced a boost in employment, helping to absorb some of the job losses in export-oriented sectors.

- Comparison to other government stimulus measures: The special bond program was part of a broader range of stimulus measures, making it difficult to isolate its precise impact.

- Potential for debt accumulation and financial risks: The rapid increase in local government debt due to special bond issuance raises concerns about potential long-term financial risks.

China's Special Bonds in a Broader Geopolitical Context

The issuance of special bonds wasn't merely an economic response; it was also a strategic move within China's broader geopolitical context. It reflected China's ambition for self-reliance and technological independence, reducing reliance on foreign technologies and supply chains. Increased investment in strategic industries, like technology and renewable energy, aimed to strengthen its economic resilience and global competitiveness.

This economic strategy can be seen as a move toward further economic decoupling from the West, especially the US. While not explicitly stated as such, the preference for domestic investments signals a shift toward greater self-sufficiency.

- China's push for self-reliance and technological independence: Special bonds played a role in funding research and development, and the development of domestic supply chains in key technological areas.

- Increased investment in strategic industries: This included sectors critical for national security and long-term economic growth, such as advanced manufacturing, artificial intelligence, and renewable energy.

- Potential for further economic decoupling from the West: The increased focus on domestic investment and technological self-sufficiency indicates a strategic shift away from reliance on Western markets and technologies.

Conclusion

China's Special Bonds served as a significant tool in responding to the economic challenges posed by the Trump-era trade war. They channeled substantial funds into infrastructure projects and strategic industries, boosting economic growth and creating jobs. However, the approach also carries potential risks, such as increasing local government debt. The impact of these bonds extends beyond mere economic stimulus; they represent a crucial element of China's broader geopolitical and economic strategy, underscoring its ambition for self-reliance and a shift in global economic power dynamics.

Understanding China's Special Bonds is crucial for navigating the complexities of the evolving global economic landscape. Further research into the long-term effects of this policy and its implications for international trade is essential. Continue learning about the complexities of China's Special Bonds and their impact on the global economy.

Featured Posts

-

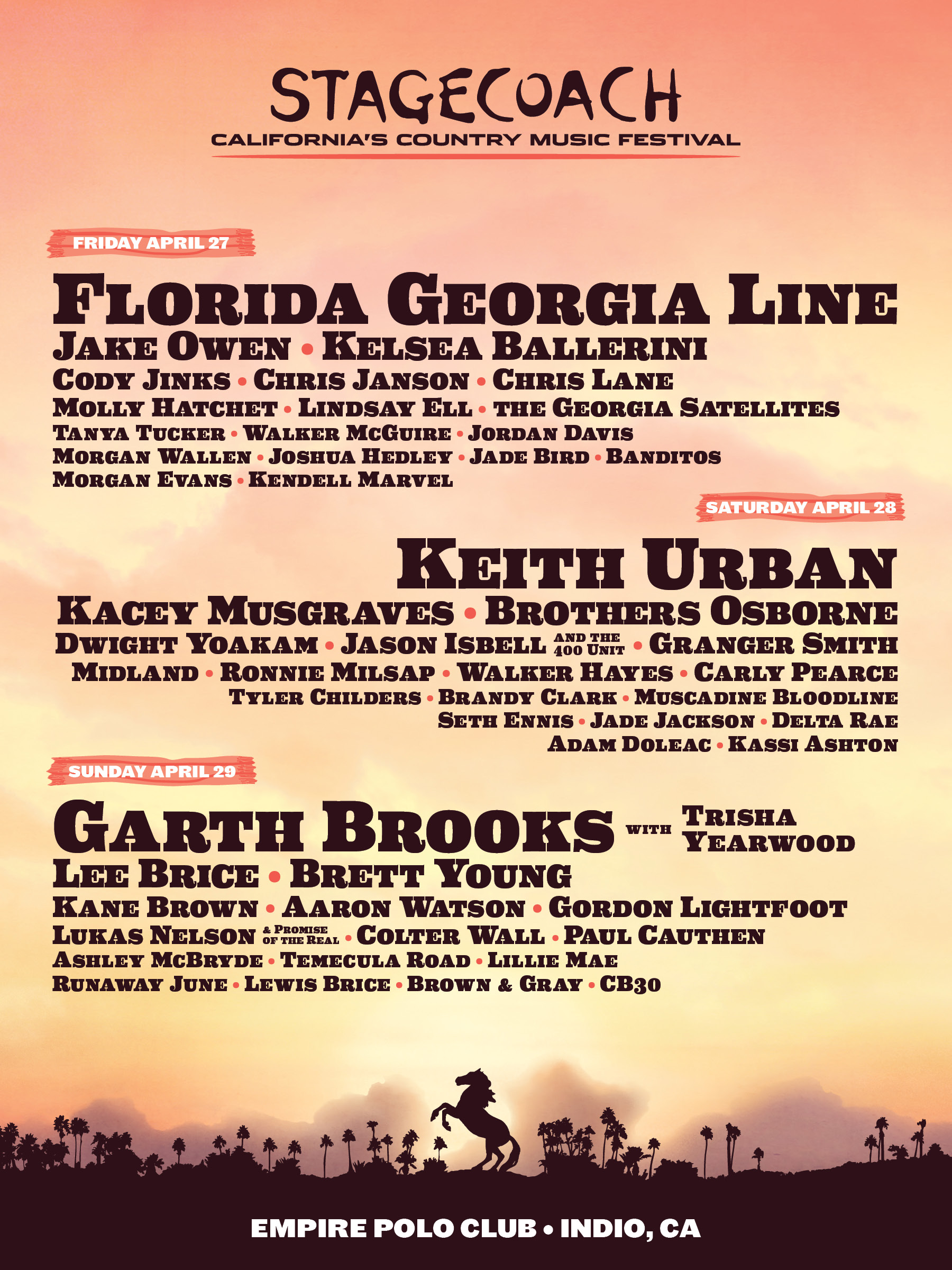

Planning Your Stagecoach 2025 Trip Guide To Artists Activities And The Desert Setting

Apr 25, 2025

Planning Your Stagecoach 2025 Trip Guide To Artists Activities And The Desert Setting

Apr 25, 2025 -

Denver Broncos Espn Mock Draft A Slam Dunk Pick

Apr 25, 2025

Denver Broncos Espn Mock Draft A Slam Dunk Pick

Apr 25, 2025 -

Sadie Sinks Casting In Spider Man 4 Evidence From The New Movie Title

Apr 25, 2025

Sadie Sinks Casting In Spider Man 4 Evidence From The New Movie Title

Apr 25, 2025 -

The Xi Factor Chinas Long Game In Its Standoff With The United States

Apr 25, 2025

The Xi Factor Chinas Long Game In Its Standoff With The United States

Apr 25, 2025 -

Nba

Apr 25, 2025

Nba

Apr 25, 2025

Latest Posts

-

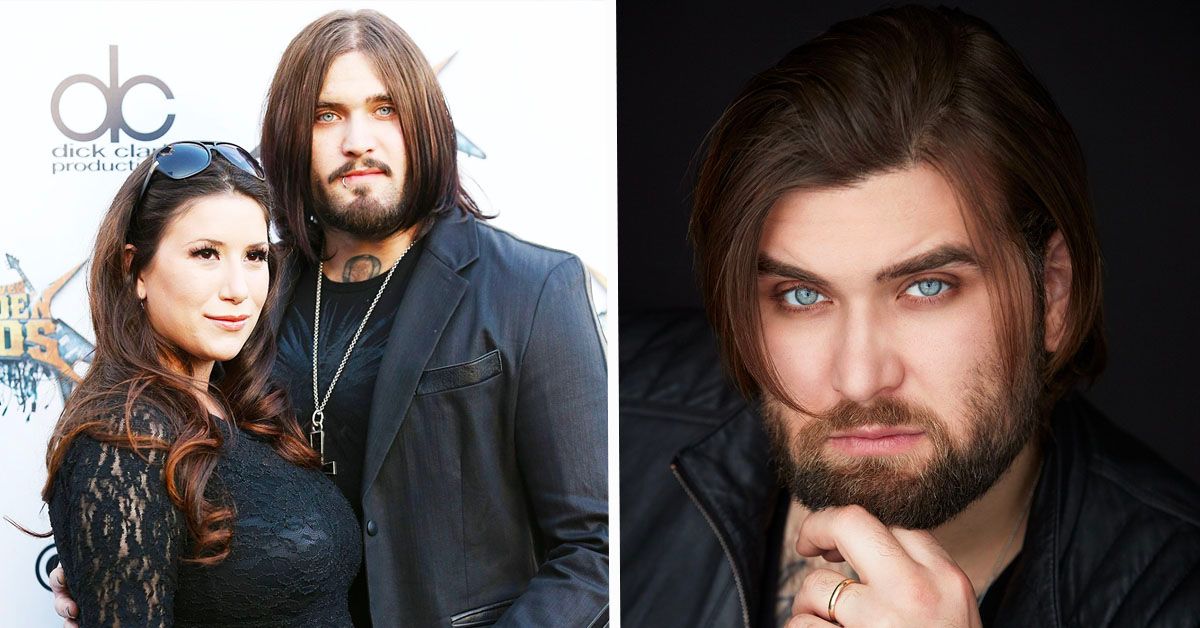

Court Rules In Favor Of Nicolas Cage Weston Cage Case Continues

May 10, 2025

Court Rules In Favor Of Nicolas Cage Weston Cage Case Continues

May 10, 2025 -

Nicolas Cage Lawsuit Update Dismissal And Future Implications

May 10, 2025

Nicolas Cage Lawsuit Update Dismissal And Future Implications

May 10, 2025 -

Weston Cage Cope Ongoing Legal Battle With Father Nicolas Cage

May 10, 2025

Weston Cage Cope Ongoing Legal Battle With Father Nicolas Cage

May 10, 2025 -

Nicolas Cage Wins Partial Victory In Lawsuit Against Son Weston

May 10, 2025

Nicolas Cage Wins Partial Victory In Lawsuit Against Son Weston

May 10, 2025 -

Nicolas Cage Lawsuit Dismissed Son Weston Remains A Defendant

May 10, 2025

Nicolas Cage Lawsuit Dismissed Son Weston Remains A Defendant

May 10, 2025