Market Rally: Sensex Climbs, Leading Stocks Up Over 10% On BSE

Table of Contents

Sensex's Impressive Surge: A Detailed Look at the Numbers

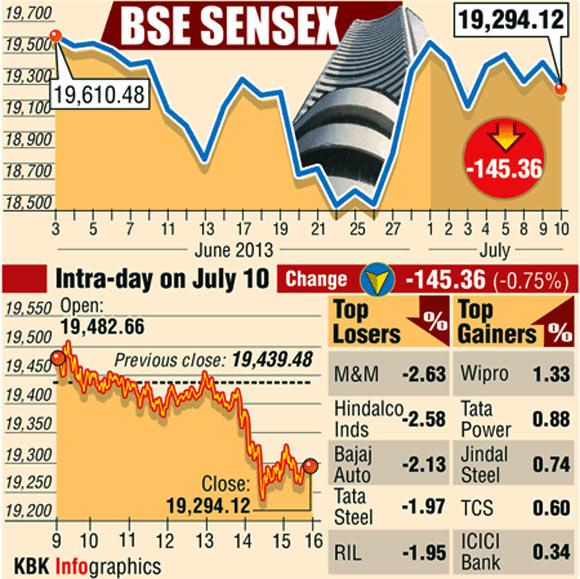

The Sensex experienced a remarkable surge, climbing by a substantial X% (replace X with the actual percentage). This represents a significant gain in Sensex points, reflecting a positive shift in market sentiment. To illustrate this impressive jump, let's examine the closing values:

- Before the Rally: The Sensex closed at Y points on [Date]. (Replace Y with the actual closing value and insert the date)

- After the Rally: The Sensex closed at Z points on [Date]. (Replace Z with the actual closing value and insert the date)

This represents a gain of [Calculate and insert the actual point difference] points. The trading volume during this period was also significantly high, indicating robust participation from investors. A visual representation of this Sensex movement, using a chart or graph, would further highlight the impressive nature of this market surge. Relevant keywords for this section are: Sensex points, Sensex gain, BSE index, market capitalization.

Top Performing Stocks: Which Sectors Led the Charge?

Several stocks significantly outperformed the market during this rally. The top performers across different sectors included:

- Sector 1 (e.g., IT):

- Stock A: +XX% (Replace XX with the percentage gain)

- Stock B: +YY% (Replace YY with the percentage gain)

- Sector 2 (e.g., Banking):

- Stock C: +ZZ% (Replace ZZ with the percentage gain)

- Stock D: +AA% (Replace AA with the percentage gain)

- Sector 3 (e.g., Pharma):

- Stock E: +BB% (Replace BB with the percentage gain)

- Stock F: +CC% (Replace CC with the percentage gain)

(Continue this list for the top 5-10 performing stocks).

The strong performance of these sectors can be attributed to various factors, including positive earnings reports, government policy announcements favorable to these sectors, and increased investor confidence. Keywords for this section include: Top gainers, BSE stocks, sector performance, stock market leaders.

Factors Fueling the Market Rally: Understanding the Drivers

Several macroeconomic factors and specific events contributed to this market rally.

- Positive Global Cues: Positive economic data from global markets boosted investor sentiment, leading to increased investment in Indian equities.

- Easing Inflation: Signs of easing inflation in India improved investor confidence, reducing concerns about interest rate hikes.

- Increased Investor Confidence: Government initiatives and positive economic indicators contributed to a general increase in investor confidence.

- FII and DII Investment: Significant investments from Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) fueled the market rally. [Insert specific data on FII/DII investment if available].

- Specific News Events: [Mention any specific news or events, such as positive corporate announcements or policy changes, that significantly impacted the market].

These factors collectively created a positive environment for the stock market, leading to the impressive Sensex climb. Relevant keywords: Market drivers, macroeconomic factors, FII investment, DII investment, global market trends.

Expert Opinions and Future Outlook: What Lies Ahead?

Market analysts offer varied perspectives on the sustainability of this rally. [Insert quotes from market analysts here, with attribution]. While the current market sentiment is positive, potential risks and challenges remain:

- Global Economic Uncertainty: Global economic uncertainty could impact the Indian stock market.

- Inflationary Pressures: Persistent inflationary pressures could lead to interest rate hikes, impacting market growth.

- Geopolitical Risks: Geopolitical instability could negatively affect investor sentiment.

A balanced perspective is crucial; while the current rally is promising, investors should remain cautious and consider these potential risks. Keywords include: Market predictions, analyst views, stock market outlook, future trends.

Conclusion: Navigating the Market Rally – Your Next Steps

The recent Sensex surge represents a significant market rally, with leading stocks experiencing double-digit gains. This positive market movement was driven by a confluence of factors, including positive global cues, easing inflation, and robust investor confidence. Understanding these drivers is crucial for navigating the current market environment.

For investors, this rally highlights the importance of diversification and long-term investment strategies. While the current market conditions are positive, it’s essential to remain informed and consider both potential gains and risks. Consult with a qualified financial advisor before making any investment decisions.

Stay updated on the latest Sensex and BSE market movements by subscribing to our newsletter! (Link to newsletter signup) Learn more about navigating the stock market with our expert resources. (Link to relevant resources)

Featured Posts

-

Court Approves Hudsons Bay Companys Request To Extend Creditor Protection

May 15, 2025

Court Approves Hudsons Bay Companys Request To Extend Creditor Protection

May 15, 2025 -

Stocks Surged Sensex Rises Top Bse Gainers Up Over 10

May 15, 2025

Stocks Surged Sensex Rises Top Bse Gainers Up Over 10

May 15, 2025 -

Verbetering Van De Meldprocedure Voor Grensoverschrijdend Gedrag Bij De Npo

May 15, 2025

Verbetering Van De Meldprocedure Voor Grensoverschrijdend Gedrag Bij De Npo

May 15, 2025 -

Sensex Rally These Stocks Jumped Over 10 On Bse Today

May 15, 2025

Sensex Rally These Stocks Jumped Over 10 On Bse Today

May 15, 2025 -

Euforias Deleznables Definicion Tipos Y Beneficios

May 15, 2025

Euforias Deleznables Definicion Tipos Y Beneficios

May 15, 2025

Latest Posts

-

Crook Accused Of Millions In Office365 Executive Email Account Breaches

May 15, 2025

Crook Accused Of Millions In Office365 Executive Email Account Breaches

May 15, 2025 -

Office365 Executive Inboxes Targeted Millions In Losses Fbi Investigation

May 15, 2025

Office365 Executive Inboxes Targeted Millions In Losses Fbi Investigation

May 15, 2025 -

Ireland Cabinet Reorganisation Ai Energy And Housing Priorities

May 15, 2025

Ireland Cabinet Reorganisation Ai Energy And Housing Priorities

May 15, 2025 -

Irish Cabinet Reshuffle Focus On Ai Energy And Housing

May 15, 2025

Irish Cabinet Reshuffle Focus On Ai Energy And Housing

May 15, 2025 -

Who To Watch Carneys Cabinet And Its Impact On Business

May 15, 2025

Who To Watch Carneys Cabinet And Its Impact On Business

May 15, 2025