Managing Student Loan Debt To Buy Your Dream Home

Table of Contents

Assessing Your Current Financial Situation

Before you can even begin dreaming of a housewarming party, you need a clear picture of your current financial reality. Understanding your financial standing is the first crucial step in managing student loan debt to buy a home.

Understanding Your Student Loan Payments

Your student loan payments are a significant factor in your ability to qualify for a mortgage. Start by gathering all the necessary information about your loans. This includes:

- Loan Servicer: Who manages your loans? Knowing this will help you access your account information.

- Interest Rates: What is the interest rate on each loan? Higher interest rates mean more money paid towards interest over time.

- Repayment Plans: What repayment plan are you currently on? Understanding the implications of your chosen plan is crucial. Common plans include:

- Standard Repayment Plan

- Income-Driven Repayment (IDR) Plans (IBR, PAYE, REPAYE)

- Graduated Repayment Plan

- Extended Repayment Plan

- Total Debt Amount: What is the total amount you owe across all your loans?

Use this information to project your future monthly payments. Many loan servicers provide online tools for this, or you can use free online calculators to estimate your monthly payments.

Evaluating Your Credit Score and Debt-to-Income Ratio (DTI)

Your credit score and debt-to-income ratio (DTI) are paramount in determining your mortgage eligibility. Lenders heavily scrutinize these factors.

- Credit Score Improvement: Aim for a high credit score (ideally 700 or above). Here's how:

- Pay all bills on time.

- Reduce your credit utilization (the amount of credit you use compared to your total credit limit).

- Keep older credit accounts open (with responsible use).

- Debt-to-Income Ratio (DTI): Your DTI represents the percentage of your gross monthly income that goes towards debt payments. A lower DTI significantly improves your chances of mortgage approval. It is calculated as: (Total Monthly Debt Payments / Gross Monthly Income) * 100. Lenders typically prefer a DTI below 43%.

Creating a Realistic Budget

A realistic budget is your roadmap to financial freedom and homeownership. This requires honest self-assessment:

- Track Income and Expenses: Use budgeting apps (Mint, YNAB, Personal Capital) or spreadsheets to meticulously track every dollar.

- Identify Areas to Cut Back: Are there subscriptions you can cancel? Can you reduce dining out or entertainment expenses? Every dollar saved brings you closer to your down payment goal.

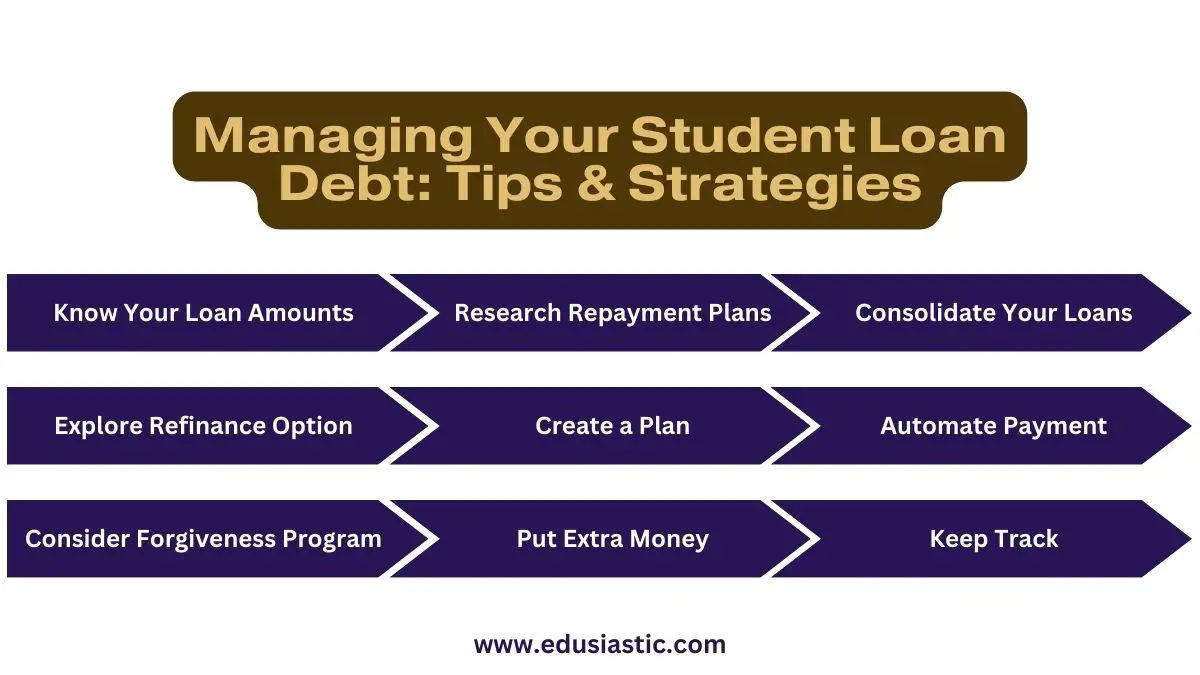

Strategies for Managing Student Loan Debt While Saving for a Down Payment

Juggling student loan payments and saving for a down payment requires strategic planning.

Prioritize High-Interest Debt

Focus your repayment efforts on high-interest student loans first. The sooner you pay these off, the less interest you'll accrue over the long run. Consider using debt repayment methods like:

- The Avalanche Method: Prioritize paying off the debt with the highest interest rate first.

- The Snowball Method: Prioritize paying off the smallest debt first, regardless of interest rate, for psychological motivation.

Negotiating lower interest rates with your loan servicer is also a valuable strategy.

Explore Loan Refinancing Options

Refinancing your student loans might lower your monthly payments, freeing up funds for your down payment. However, proceed cautiously:

- Pros: Lower monthly payments, potentially lower interest rates.

- Cons: Potential for longer repayment terms, fees associated with refinancing.

Thoroughly compare offers before making a decision. Consider your credit score, interest rates, and loan terms.

Increase Your Income

Boosting your income significantly accelerates your savings.

- Side Hustles: Explore freelancing, gig work (Uber, DoorDash), or part-time jobs to supplement your income.

- Career Advancement: Focus on career development to increase your earning potential in the long term.

Securing a Mortgage with Student Loan Debt

Even with student loan debt, securing a mortgage is achievable with careful planning.

Shop Around for the Best Mortgage Rates

Compare mortgage rates from various lenders. Some specialize in working with borrowers who have student loan debt. Consider:

- Conventional Mortgages: Standard mortgages offered by banks and credit unions.

- FHA Loans: Backed by the Federal Housing Administration, requiring lower down payments.

- VA Loans: Available to eligible veterans and military personnel, often with no down payment required.

Factors influencing interest rates include your credit score, loan-to-value ratio (LTV), and prevailing interest rates.

Understand Mortgage Insurance

With a down payment less than 20%, you'll likely need Private Mortgage Insurance (PMI).

- PMI Explained: PMI protects the lender against losses if you default on your mortgage.

- Eliminating PMI: You can eliminate PMI once your home equity reaches 20%.

Prepare for a Thorough Application Process

Be prepared for a comprehensive review of your finances. Gather the necessary documents:

- Pay stubs

- Bank statements

- Tax returns

- Student loan statements

A well-organized application increases your chances of approval.

Conclusion

Managing student loan debt to buy a home is achievable with careful planning and a proactive approach. By assessing your finances, strategically managing your debt, and securing a suitable mortgage, you can realize your dream of homeownership. Don't let student loan debt derail your dreams; use the strategies outlined in this article to successfully manage your student loan debt and buy a home. Start planning your financial future and take the first step towards owning your dream home today!

Featured Posts

-

Analyzing The Mavericks Losses Brunsons Departure Compared To The Doncic Trade Near Miss

May 17, 2025

Analyzing The Mavericks Losses Brunsons Departure Compared To The Doncic Trade Near Miss

May 17, 2025 -

Examining Trumps Remarks On A New F 55 And F 22 Modernization

May 17, 2025

Examining Trumps Remarks On A New F 55 And F 22 Modernization

May 17, 2025 -

Thibodeaus Evolution Fixing A Weakness Saving The Knicks From Disaster

May 17, 2025

Thibodeaus Evolution Fixing A Weakness Saving The Knicks From Disaster

May 17, 2025 -

Novak Djokovic Miami Acik Finalini Kapti

May 17, 2025

Novak Djokovic Miami Acik Finalini Kapti

May 17, 2025 -

House Hunting With Student Loan Debt Tips And Strategies

May 17, 2025

House Hunting With Student Loan Debt Tips And Strategies

May 17, 2025

Latest Posts

-

De Volta Aos Gramados Ex Vasco Conquista Camisa 10 E Mira Copa 2026 Nos Emirados Arabes

May 17, 2025

De Volta Aos Gramados Ex Vasco Conquista Camisa 10 E Mira Copa 2026 Nos Emirados Arabes

May 17, 2025 -

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Sonha Com A Copa De 2026

May 17, 2025

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Sonha Com A Copa De 2026

May 17, 2025 -

Nos Emirados Arabes Ex Jogador Do Vasco Conquista Camisa 10 E Almeja Copa 2026

May 17, 2025

Nos Emirados Arabes Ex Jogador Do Vasco Conquista Camisa 10 E Almeja Copa 2026

May 17, 2025 -

Brasilien Und Die Emirate Chancen Und Risiken Von Investitionen In Favelas

May 17, 2025

Brasilien Und Die Emirate Chancen Und Risiken Von Investitionen In Favelas

May 17, 2025 -

Favelas Als Investitionsobjekt Die Strategie Der Emirate In Brasilien

May 17, 2025

Favelas Als Investitionsobjekt Die Strategie Der Emirate In Brasilien

May 17, 2025