House Hunting With Student Loan Debt: Tips And Strategies

Table of Contents

Assessing Your Financial Situation

Before you even start browsing houses, a thorough assessment of your financial situation is crucial. This involves understanding your debt-to-income ratio (DTI), creating a realistic budget, and exploring your savings and down payment options.

Understanding Your Debt-to-Income Ratio (DTI)

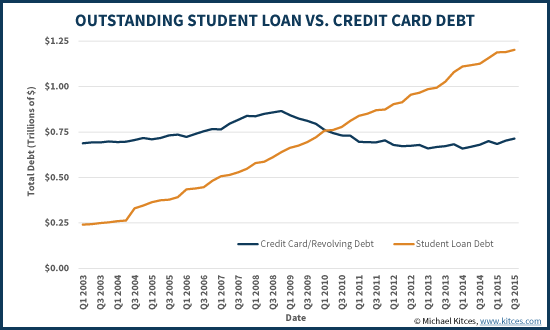

Your Debt-to-Income Ratio is a critical factor lenders consider when assessing your mortgage application. It represents the percentage of your gross monthly income that goes towards debt repayment. A lower DTI significantly improves your chances of mortgage approval and securing a favorable interest rate.

- Calculate your DTI: Add up all your monthly debt payments (including student loans, credit cards, car payments, etc.) and divide by your gross monthly income.

- Improve your DTI: Strategies to lower your DTI include paying down high-interest debt, consolidating your student loans into a single, lower-interest loan, and improving your credit score. A higher credit score often translates to better mortgage terms.

Creating a Realistic Budget

Creating a detailed budget is essential for managing your finances effectively while tackling both student loan payments and homeownership costs. This budget should include:

- Student loan payments: Factor in your current monthly student loan payment amount.

- Housing costs: Include estimated mortgage payments (principal, interest, taxes, insurance – PITI), homeowner's association fees (HOA), and potential maintenance costs.

- Other expenses: Account for groceries, transportation, utilities, entertainment, and any other recurring expenses.

Utilize budgeting tools and apps to track your spending and identify areas where you can cut back. Accurate budgeting is key to ensuring you can comfortably afford both your student loans and a mortgage.

Exploring Your Savings and Down Payment Options

The size of your down payment significantly impacts your mortgage rate and monthly payments. A larger down payment generally leads to a lower interest rate and lower monthly payments. However, saving for a substantial down payment while simultaneously paying off student loans can be challenging.

- Explore government-backed loan programs: First-time homebuyer programs like FHA loans often require lower down payments than conventional loans.

- Consider a smaller down payment: While a larger down payment is ideal, it's not always feasible. Explore options that allow for a smaller down payment, understanding that you might face higher interest rates.

- Maximize savings: Develop a dedicated savings plan specifically for your down payment. Even small, consistent contributions can make a significant difference over time.

Finding the Right Mortgage Lender

Finding a lender who understands your situation and offers competitive rates is crucial. Shopping around and understanding your options are key steps in this process.

Shop Around for the Best Rates

Don't settle for the first mortgage offer you receive. Comparing rates and fees from multiple lenders is essential to securing the best possible terms.

- Use online rate comparison tools: Several websites allow you to compare mortgage rates from various lenders based on your financial profile.

- Consider lender fees and closing costs: These fees can significantly impact the overall cost of your mortgage. Compare the total cost of the mortgage, not just the interest rate.

Understanding Mortgage Options

Several mortgage types cater to borrowers with student loan debt.

- FHA Loans: These government-backed loans often require lower down payments and have more lenient credit score requirements.

- USDA Loans: These loans are designed for rural homebuyers and may offer favorable terms, including low down payment options.

- Conventional Loans: While typically requiring a larger down payment and a higher credit score, conventional loans can offer competitive interest rates.

Carefully weigh the pros and cons of each option based on your specific financial situation.

Negotiating Your Mortgage Terms

Don't be afraid to negotiate! Pre-approval for a mortgage strengthens your negotiating position.

- Negotiate interest rates: Shop around for the best rates and use competing offers to negotiate a lower rate.

- Negotiate loan terms: Discuss loan terms like the loan length and payment schedule to find the best fit for your budget.

- Negotiate closing costs: Explore options to reduce or minimize closing costs.

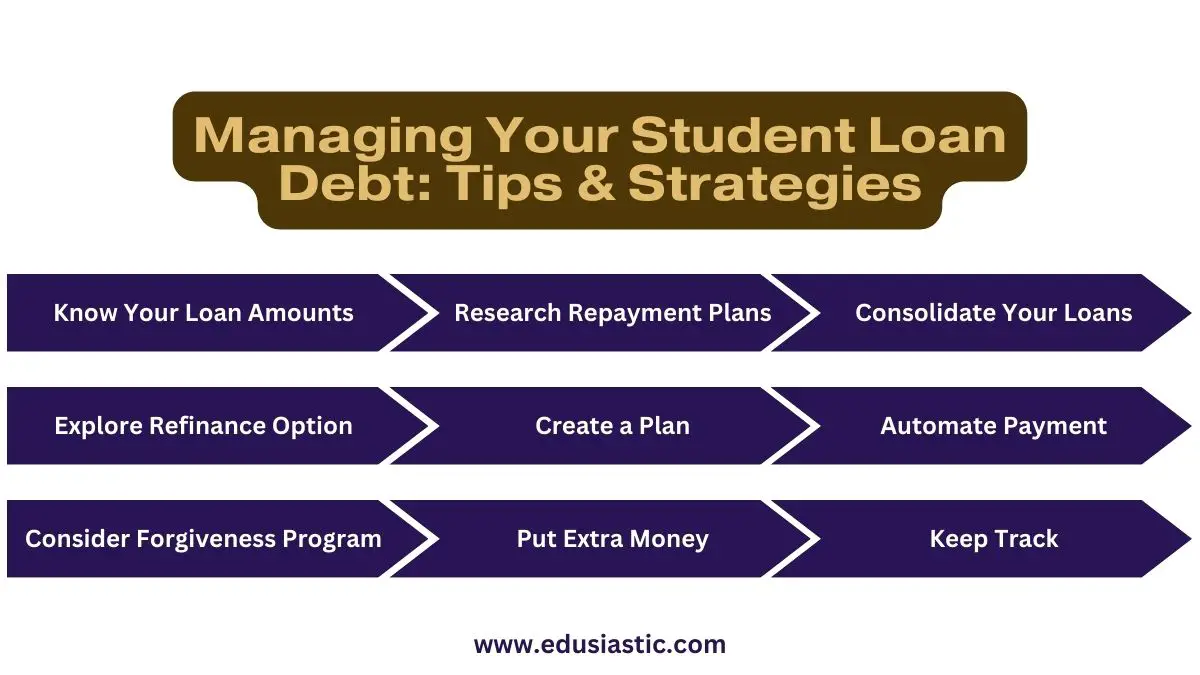

Strategies for Managing Student Loan Debt During Homeownership

Managing both student loan payments and a mortgage requires careful planning and prioritization.

Prioritizing Loan Repayment

Develop a repayment strategy that balances your student loan payments with your mortgage.

- Income-driven repayment plans: Explore options that adjust your monthly payments based on your income.

- Student loan refinancing: Consider refinancing your student loans to secure a lower interest rate, potentially reducing your monthly payments.

Building Good Credit

Maintaining a good credit score is crucial for securing favorable mortgage terms and lower interest rates in the future.

- Pay bills on time: Consistent on-time payments are crucial for improving your credit score.

- Keep credit utilization low: Avoid maxing out your credit cards.

- Monitor your credit reports: Regularly check your credit reports for errors and inaccuracies.

Seeking Financial Advice

Consulting a financial advisor or credit counselor provides personalized guidance tailored to your situation.

- Develop a comprehensive financial plan: A financial advisor can help you create a plan that addresses both your student loan debt and homeownership goals.

- Negotiate with lenders: A credit counselor can assist in negotiating with lenders for better terms.

Conclusion

House hunting with student loan debt presents challenges, but it's definitely achievable with careful planning and the right strategies. By assessing your financial situation, finding the right mortgage lender, and developing a smart debt management plan, you can successfully navigate this journey. Don't let student loan debt derail your dream of homeownership. Start planning your house hunting journey today by using the tips and strategies outlined in this guide. Remember, responsible financial planning and the right approach can make "House Hunting with Student Loan Debt" a successful and rewarding experience!

Featured Posts

-

Popularne Destinacije Za Kupovinu Stanova Izbor Srba

May 17, 2025

Popularne Destinacije Za Kupovinu Stanova Izbor Srba

May 17, 2025 -

Japans Shrinking Economy A Q1 Review And Tariff Outlook

May 17, 2025

Japans Shrinking Economy A Q1 Review And Tariff Outlook

May 17, 2025 -

Twm Krwz Wana Dy Armas Tfasyl Alelaqt Wfrq Alsn Alkbyr

May 17, 2025

Twm Krwz Wana Dy Armas Tfasyl Alelaqt Wfrq Alsn Alkbyr

May 17, 2025 -

Private Lender Refinancing A Guide To Federal Student Loan Consolidation

May 17, 2025

Private Lender Refinancing A Guide To Federal Student Loan Consolidation

May 17, 2025 -

Mitchell Robinsons Season Debut Knicks Center Returns After Ankle Surgery

May 17, 2025

Mitchell Robinsons Season Debut Knicks Center Returns After Ankle Surgery

May 17, 2025

Latest Posts

-

Noticias Deportivas Y Previsiones Semanales De Prensa Latina

May 17, 2025

Noticias Deportivas Y Previsiones Semanales De Prensa Latina

May 17, 2025 -

La Alegria De Alcaraz Su Camino Al Triunfo En Montecarlo

May 17, 2025

La Alegria De Alcaraz Su Camino Al Triunfo En Montecarlo

May 17, 2025 -

Previsiones Deportivas De Prensa Latina Pronosticos Para La Semana

May 17, 2025

Previsiones Deportivas De Prensa Latina Pronosticos Para La Semana

May 17, 2025 -

Lieu Djokovic Co The Vuot Qua Alcaraz De Gianh Chuc Vo Dich Miami Open 2025

May 17, 2025

Lieu Djokovic Co The Vuot Qua Alcaraz De Gianh Chuc Vo Dich Miami Open 2025

May 17, 2025 -

Montecarlo 2024 La Alegria Refleja El Exito De Alcaraz

May 17, 2025

Montecarlo 2024 La Alegria Refleja El Exito De Alcaraz

May 17, 2025