Magnificent Seven Stocks' Plummeting Value: A $2.5 Trillion Loss

Table of Contents

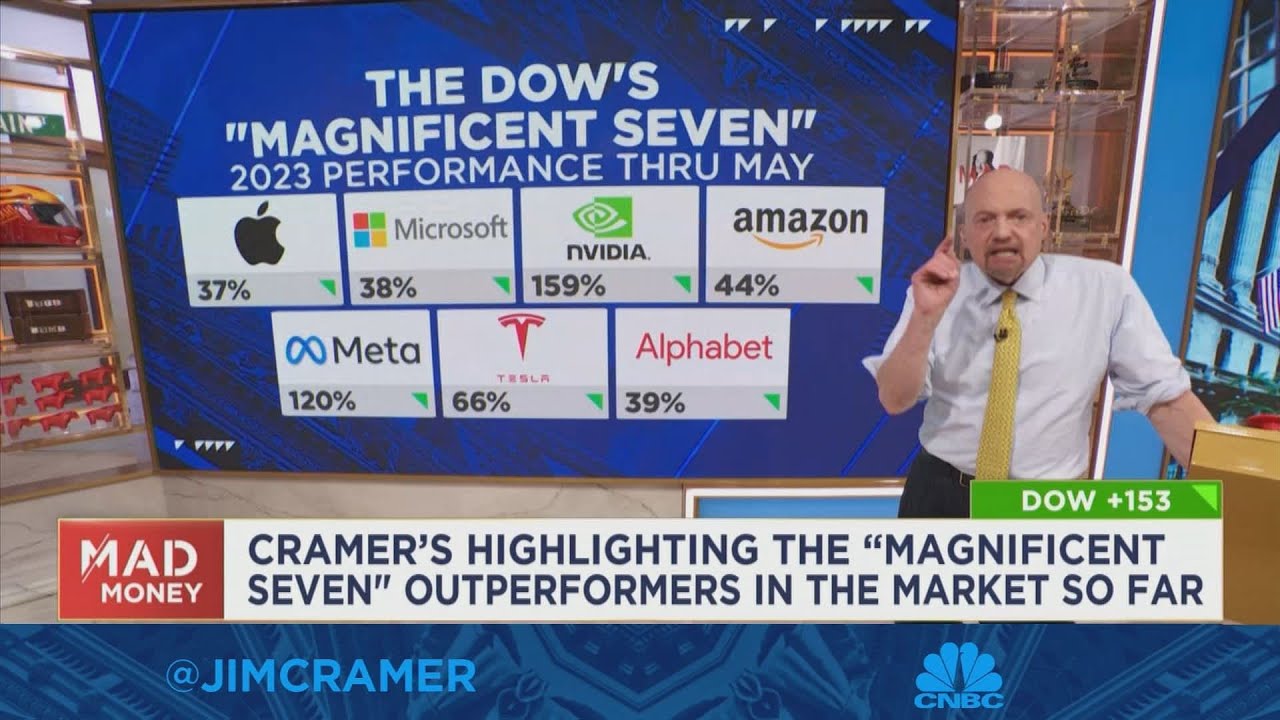

The Key Players: Examining the Magnificent Seven's Losses

The Magnificent Seven's decline represents a significant shift in the tech landscape and broader market sentiment. Let's examine the individual losses:

- Microsoft: [Insert Percentage Loss]% - Microsoft's decline can be attributed partly to slowing growth in its cloud computing division and increased competition. [Link to relevant news article]

- Apple: [Insert Percentage Loss]% - Apple's losses stem from concerns about slowing iPhone sales and increased competition in the smartphone market. [Link to relevant news article]

- Amazon: [Insert Percentage Loss]% - Amazon's stock price has been affected by decreased e-commerce growth, increased operating costs, and slowing growth in its cloud computing business (AWS). [Link to relevant news article]

- Google (Alphabet): [Insert Percentage Loss]% - Google's downturn is linked to concerns about slowing advertising revenue growth and increased competition in the search and digital advertising space. [Link to relevant news article]

- Tesla: [Insert Percentage Loss]% - Tesla's significant drop is a result of production challenges, CEO Elon Musk's controversial actions, and concerns about the overall electric vehicle market. [Link to relevant news article]

- Nvidia: [Insert Percentage Loss]% - Nvidia's stock price has fluctuated due to market uncertainty regarding the semiconductor industry and potential overvaluation after a period of rapid growth. [Link to relevant news article]

- Meta (formerly Facebook): [Insert Percentage Loss]% - Meta's substantial decline is largely attributed to decreased advertising revenue, increased competition from TikTok, and concerns about its metaverse investments. [Link to relevant news article]

Underlying Causes of the Market Downturn

Several interconnected factors contributed to the significant downturn in the Magnificent Seven's stock valuations and the broader market.

Rising Interest Rates and Inflation

The Federal Reserve's aggressive interest rate hikes to combat inflation have significantly impacted tech valuations.

- Higher interest rates increase bond yields, making them a more attractive investment compared to higher-risk tech stocks. This shift in investor preference leads to capital flowing out of the tech sector.

- Inflation erodes consumer spending power, impacting demand for tech products and services, ultimately affecting corporate profits and stock prices.

- Data shows a strong negative correlation between rising interest rates and tech stock performance. [Insert relevant data and statistics here, linking to a credible source]

Geopolitical Instability and Supply Chain Issues

Global events and ongoing geopolitical instability have created uncertainty in the market and disrupted supply chains.

- The war in Ukraine and ongoing tensions with China have created supply chain bottlenecks and increased input costs for technology companies.

- These disruptions impact production, profitability, and investor confidence, contributing to market volatility.

- Specific examples include semiconductor shortages impacting Nvidia and supply chain issues impacting Apple's production timelines.

Overvaluation and Market Correction

The rapid growth in tech stocks in the preceding years may have led to overvaluation in some cases.

- Market corrections are a natural part of the economic cycle, acting as a necessary reset after periods of rapid growth.

- Overvaluation makes companies more vulnerable to price drops when market sentiment shifts.

- Historical data shows that previous market corrections have eventually been followed by periods of recovery. [Insert relevant data and statistics here, linking to a credible source]

The Impact on Investors and the Broader Economy

The $2.5 trillion loss in the Magnificent Seven's market capitalization has significant implications for investors and the broader economy.

Individual Investor Losses

The downturn has resulted in substantial losses for individual investors holding shares in these companies.

- Diversification is crucial for mitigating risk. Investors should not overly concentrate their portfolios in a single sector or a limited number of stocks.

- Risk management strategies, including stop-loss orders and dollar-cost averaging, can help reduce the impact of market fluctuations.

- Significant investment losses can have a substantial emotional impact. Seeking financial advice during times of market volatility is recommended.

Economic Ripple Effects

The decline in the Magnificent Seven's value has potential ripple effects throughout the economy.

- Reduced valuations can impact employment within these companies and their supply chains.

- Decreased consumer spending due to economic uncertainty could lead to a broader slowdown.

- Government intervention or regulatory changes might be implemented to address market instability and protect investors.

Conclusion

The plummeting value of the Magnificent Seven stocks, resulting in a $2.5 trillion loss, is a significant event driven by a confluence of factors, including rising interest rates, inflation, geopolitical instability, supply chain issues, and potential overvaluation. Understanding these contributing factors is crucial for navigating future market volatility. Stay informed about market trends and diversify your investments to mitigate risks. Learn more about mitigating investment risk in the face of future "Magnificent Seven" stock fluctuations. Stay updated on market analyses to make informed decisions about your investments. Don't let the decline of the Magnificent Seven deter you – learn from this experience and build a resilient investment strategy.

Featured Posts

-

Yukon Political Standoff Contempt Motion Over Mine Managers Silence

Apr 29, 2025

Yukon Political Standoff Contempt Motion Over Mine Managers Silence

Apr 29, 2025 -

Reduce Adhd Symptoms Naturally Practical Tips And Techniques

Apr 29, 2025

Reduce Adhd Symptoms Naturally Practical Tips And Techniques

Apr 29, 2025 -

Trans Rights Rally 20 000 Join The Fight For Equality

Apr 29, 2025

Trans Rights Rally 20 000 Join The Fight For Equality

Apr 29, 2025 -

Can Film Tax Credits Boost Minnesotas Tv And Movie Industry

Apr 29, 2025

Can Film Tax Credits Boost Minnesotas Tv And Movie Industry

Apr 29, 2025 -

Porsche 356 Zuffenhausen Sejarah Produksi Dan Warisan Jerman

Apr 29, 2025

Porsche 356 Zuffenhausen Sejarah Produksi Dan Warisan Jerman

Apr 29, 2025