Can Film Tax Credits Boost Minnesota's TV And Movie Industry?

Table of Contents

The Current State of Minnesota's Film and Television Production

Existing Infrastructure and Talent Pool

Minnesota possesses a foundation upon which a thriving film industry can be built. The state already boasts a skilled workforce, including actors, directors, cinematographers, and editors. Several post-production facilities are located within the state, providing essential services for film and television projects. However, the infrastructure is not yet fully developed to compete with major industry hubs.

- Existing Studios: While not as numerous as in California or New York, Minnesota has several smaller studios and soundstages available for productions.

- Post-Production Facilities: A network of editing suites, visual effects houses, and sound mixing studios exists, though expansion is needed to attract larger projects.

- Local Talent: Minnesota has a wealth of talented actors, writers, and crew members, often working on independent films or migrating to larger productions in other states. Examples include [mention specific examples of Minnesota-based talent or successful productions].

Challenges Facing the Industry

Despite its potential, Minnesota's film industry faces significant hurdles. A primary challenge is the lack of substantial financial incentives compared to states with aggressive film tax credit programs. This lack of funding makes it difficult to compete for major productions that often choose locations with more attractive incentives.

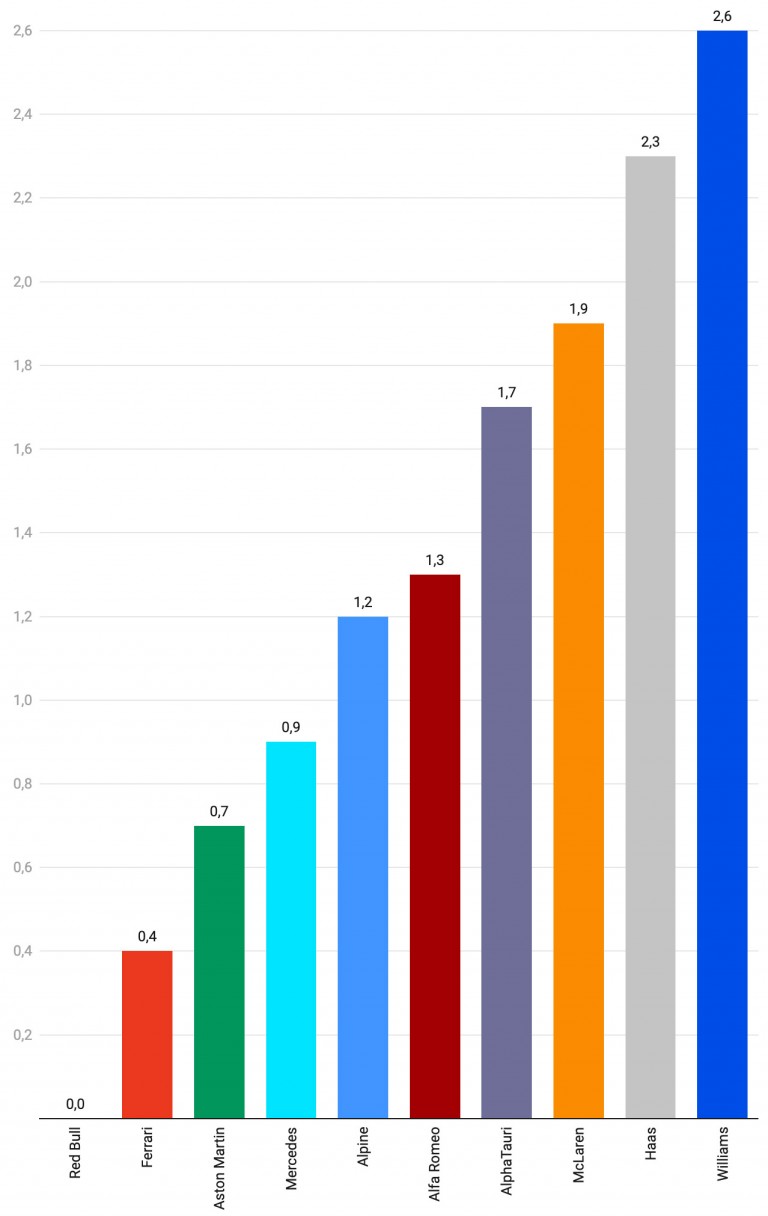

- Insufficient Incentives: Minnesota's current incentives pale in comparison to those offered by states like Georgia, New Mexico, and California. This makes it less attractive to large-scale productions seeking cost-effective filming locations.

- Competition from Other States: The competition for film and television projects is fierce. States with generous film tax credit programs actively solicit productions, offering substantial financial benefits to entice them to film within their borders.

- Limited Funding Opportunities: Securing funding for independent film productions in Minnesota can be challenging, hindering the growth of homegrown talent and projects.

How Film Tax Credits Work and Their Potential Benefits

Understanding Film Tax Credit Programs

Film tax credits are financial incentives offered by government entities to production companies that film within their jurisdiction. These credits reduce the overall tax burden of a production, making it more financially viable to film in the designated area. They typically cover a percentage of qualifying expenses, such as salaries, equipment rentals, and location fees.

- Eligibility Criteria: Generally, productions must meet certain criteria to qualify, such as employing a minimum number of local crew members or spending a certain amount within the state.

- Types of Expenses Covered: The specific expenses covered vary by state, but commonly include production labor, post-production services, and location rentals.

- Comparison with Other States: Many states have implemented successful film tax credit programs, resulting in significant economic growth and job creation within their entertainment sectors. Analyzing their models could inform Minnesota's approach.

Economic Impacts of Film Tax Credits

The potential economic benefits of a robust film tax credit program for Minnesota are substantial. These benefits extend beyond the immediate financial impact on production companies.

- Job Creation: Film productions create numerous jobs, from on-set crew members to post-production professionals, boosting employment rates and providing valuable work experience.

- Increased Tourism: Filming in Minnesota could attract tourists who recognize locations from popular movies and TV shows, stimulating the local economy and creating opportunities for tourism-related businesses.

- Revenue Generation: Film productions inject money into the local economy through spending on accommodation, catering, transportation, and other services, benefiting local businesses. [Cite data/statistics to support these claims if available].

Potential Drawbacks and Considerations of Film Tax Credits

Cost to Taxpayers and Potential for Abuse

Implementing film tax credits involves a cost to taxpayers. Concerns exist about the financial burden and the potential for misuse or abuse of the program. Robust oversight mechanisms are crucial to minimize these risks.

- Preventing Fraud: Strict regulations and monitoring processes must be in place to prevent fraudulent claims and ensure accountability. Independent audits and transparent reporting are vital.

- Cost-Benefit Analysis: A thorough cost-benefit analysis is necessary to determine the optimal structure and scope of a film tax credit program, ensuring the financial investment yields a positive return.

Competition and Attracting Productions

Successfully attracting high-quality productions requires a multifaceted strategy. Simply offering tax credits is not enough. A comprehensive marketing campaign is vital to showcase Minnesota's unique assets.

- Marketing the Program: The state needs to actively market its film tax credit program to production companies, highlighting the advantages of filming in Minnesota, such as its diverse landscapes, skilled workforce, and supportive business environment.

- Building Partnerships: Collaborating with industry professionals, film commissions, and other stakeholders is essential to build a strong network and promote Minnesota as a desirable filming location.

Conclusion: Can Film Tax Credits Revitalize Minnesota's Film Industry?

The implementation of a well-designed film tax credit program could significantly benefit Minnesota's film and television industry. While there are potential drawbacks, such as the cost to taxpayers and the need for robust oversight, the potential economic benefits—job creation, tourism stimulation, and revenue generation—are substantial. A balanced approach that carefully considers the program's design, implementation, and monitoring is key. To ensure Minnesota's film industry thrives, supporting film tax credits in Minnesota is crucial. Advocate for a robust film industry in Minnesota by contacting your legislators and learning more about the debate surrounding film tax credits. Support film tax credit initiatives to boost Minnesota's economy and unlock the full potential of its creative sector.

Featured Posts

-

Porsche 911 S T Pts Riviera Blue Rare Find For Sale

Apr 29, 2025

Porsche 911 S T Pts Riviera Blue Rare Find For Sale

Apr 29, 2025 -

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham

Apr 29, 2025 -

Ritka Porsche F1 Motoros Koezuti Csoda

Apr 29, 2025

Ritka Porsche F1 Motoros Koezuti Csoda

Apr 29, 2025 -

Georgia Deputies Shot During Traffic Stop One Killed Another Injured

Apr 29, 2025

Georgia Deputies Shot During Traffic Stop One Killed Another Injured

Apr 29, 2025 -

Pw C Exits Nine African Countries Impact On Senegal Gabon And Madagascar

Apr 29, 2025

Pw C Exits Nine African Countries Impact On Senegal Gabon And Madagascar

Apr 29, 2025