Lower UK Inflation Eases BOE Rate Cut Pressure, Lifting Pound

Table of Contents

Declining UK Inflation: A Detailed Look

CPI and RPI Figures

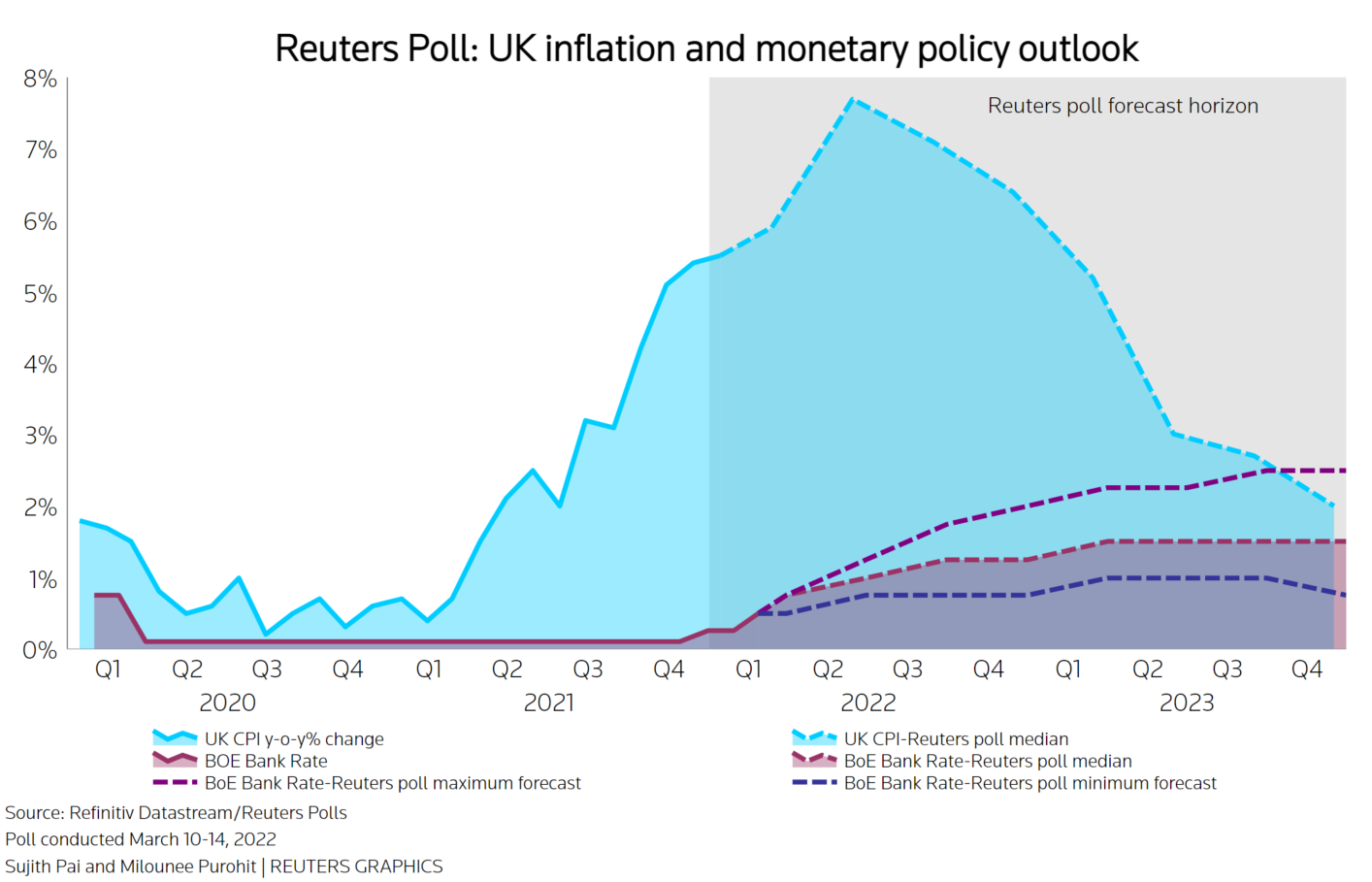

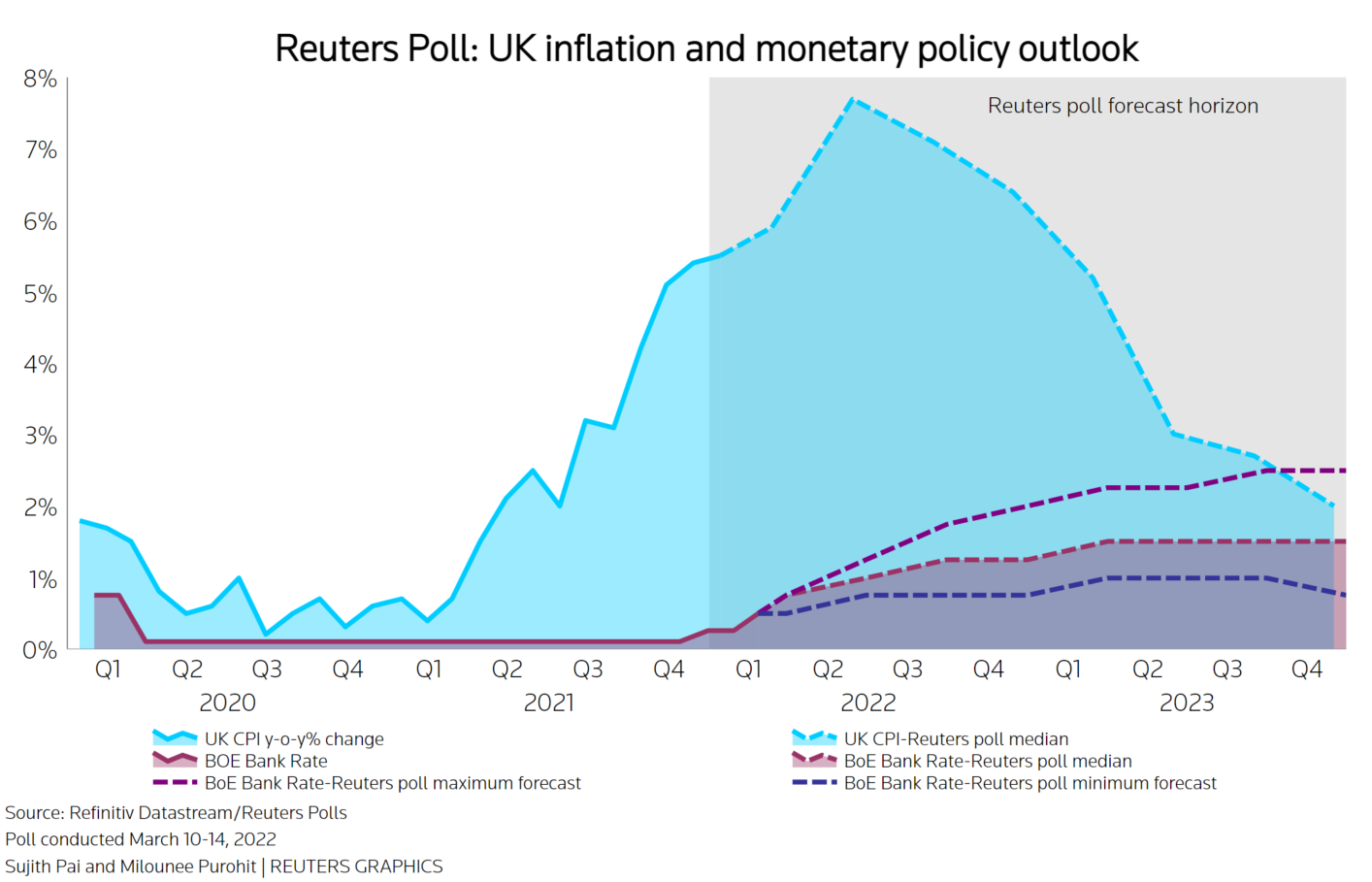

The latest figures released reveal a welcome downward trend in UK inflation. The Consumer Price Index (CPI) has fallen from its peak, showing a [Insert latest CPI percentage change here] decrease compared to [Insert previous period for comparison]. Similarly, the Retail Price Index (RPI), a broader measure of inflation, also reflects this decline, showing a [Insert latest RPI percentage change here] change. These figures represent a significant shift from the high inflation rates witnessed earlier in the year.

Factors Contributing to Lower Inflation

Several factors have contributed to this welcome decline in inflation. The most significant is the easing of energy prices, following a period of substantial increases. Supply chain disruptions, which had fueled inflationary pressures, are also showing signs of improvement, leading to greater stability in the prices of various goods. Furthermore, weakening consumer demand, possibly due to the cost-of-living crisis, plays a role in curbing inflationary pressure.

- Energy prices, particularly natural gas, have fallen significantly, resulting in lower household energy bills.

- Supply chain bottlenecks are gradually resolving, reducing transportation costs and the price of imported goods.

- Reduced consumer spending, driven by the high cost of living, is dampening demand and subsequently prices.

- [Add another relevant factor and explain it with details]

Reduced Pressure on the Bank of England (BOE)

BOE's Monetary Policy and Interest Rates

The Bank of England's primary mandate is to maintain price stability and control inflation within its target range. It achieves this primarily through adjustments to interest rates. Higher interest rates generally curb inflation by making borrowing more expensive and reducing consumer spending. Conversely, lower interest rates stimulate economic growth.

Impact of Lower Inflation on BOE Decisions

The decrease in UK inflation reduces the urgency for the BOE to implement further interest rate cuts. While the BOE might maintain a cautious approach, the downward pressure on inflation significantly alters the policy landscape. Previous rate cuts aimed at mitigating the impact of high inflation are now less critical. Future BOE meetings will likely focus on assessing the sustainability of this trend and adjusting monetary policy accordingly.

- Lower inflation reduces the risk of a wage-price spiral.

- Further interest rate cuts could negatively impact the pound and potentially slow economic growth.

- The BOE's recent statements suggest a more data-dependent approach to future rate decisions. [Insert any relevant quotes from BOE officials here].

Strengthening Pound: GBP Exchange Rate Rises

GBP Exchange Rate Performance

The reduced inflationary pressure and the resulting shift in BOE policy have positively impacted the pound sterling. The GBP exchange rate has shown a recent improvement against other major currencies. For instance, the GBP/USD exchange rate has seen a [Insert percentage change here] increase, while the GBP/EUR rate has experienced a [Insert percentage change here] improvement.

Factors Driving Pound Appreciation

The reduced pressure on the BOE to cut interest rates is a primary driver of the pound's appreciation. Investors are increasingly confident in the UK economy's ability to manage inflation, leading to increased demand for the GBP. Other contributing factors include improving global economic sentiment and a shift in investor preferences towards sterling-denominated assets.

- The GBP/USD rate currently sits at [Insert current rate here], indicating a [Insert description of the change] compared to [Insert comparison period].

- The strengthened pound makes imports cheaper but could negatively impact UK exports' competitiveness.

- Predictions for the pound's future performance vary depending on global economic conditions and BOE policy decisions.

Conclusion: Lower UK Inflation and the Future of the Pound

In summary, the decline in UK inflation has significantly reduced the pressure on the Bank of England to further cut interest rates, leading to a strengthening of the pound sterling. This positive development is a result of several factors, including easing energy prices, improving supply chains, and potentially weakening consumer demand. The future trajectory of the pound will depend heavily on the sustainability of this lower inflation trend and the BOE's subsequent policy responses. However, the current situation paints a more optimistic picture for the UK economy and its currency.

To stay informed about UK economic developments and their impact on the GBP exchange rate, regularly check reputable financial news sources and monitor UK inflation closely. Track the pound's performance against other major currencies and follow BOE policy announcements to better understand GBP exchange rate fluctuations and make informed decisions.

Featured Posts

-

Porsche 956 Muezede Tavan Sergilemesinin Nedenleri

May 24, 2025

Porsche 956 Muezede Tavan Sergilemesinin Nedenleri

May 24, 2025 -

Australias Bjk Cup Campaign Ends In Semi Final Defeat

May 24, 2025

Australias Bjk Cup Campaign Ends In Semi Final Defeat

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Canadian Automotive Leaders Urge Bold Response To Trump Administration

May 24, 2025

Canadian Automotive Leaders Urge Bold Response To Trump Administration

May 24, 2025 -

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 24, 2025

Latest Posts

-

Matt Malteses Sixth Album Her In Deep A Conversation On Intimacy And Growth

May 25, 2025

Matt Malteses Sixth Album Her In Deep A Conversation On Intimacy And Growth

May 25, 2025 -

Matt Maltese Discusses Her In Deep Intimacy Growth And His Sixth Album

May 25, 2025

Matt Maltese Discusses Her In Deep Intimacy Growth And His Sixth Album

May 25, 2025 -

Your Step By Step Guide To Bbc Radio 1 Big Weekend Tickets

May 25, 2025

Your Step By Step Guide To Bbc Radio 1 Big Weekend Tickets

May 25, 2025 -

Securing Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025

Securing Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025 -

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025