Lower Gas Prices: A National Average Near $3 Reflects Economic Slowdown

Table of Contents

The Correlation Between Lower Gas Prices and Reduced Consumer Spending

Lower gas prices typically boost consumer spending. As disposable income increases, people tend to spend more on other goods and services. However, the current situation presents a different dynamic. The national average gas price hovering near $3 doesn't seem to be translating into the expected surge in consumer spending. This suggests a more complex relationship between lower gas prices and the overall economic health.

- Reduced consumer confidence despite lower gas prices: Even with lower fuel costs, many consumers remain hesitant to spend due to broader economic anxieties.

- Higher interest rates impacting purchasing power: Rising interest rates are significantly impacting borrowing costs, reducing disposable income and curbing spending on big-ticket items.

- Concerns about inflation and job security outweighing gas savings: The persistent threat of inflation and potential job losses overshadow the modest savings at the pump. Many consumers are prioritizing savings and debt reduction over discretionary spending.

- Data points supporting decreased consumer spending: Recent retail sales figures show a slowdown in spending, supporting the idea that lower gas prices aren't boosting consumer confidence as expected. This reduced consumer spending is a key indicator of a potential economic slowdown.

Impact of Reduced Global Demand on Crude Oil Prices

The drop in the national average gas price to near $3 is significantly linked to reduced global demand for crude oil. Slower economic activity across the globe translates directly into lower demand for energy, which in turn pushes crude oil prices down. This reduction in demand is the primary driver of lower gas prices.

- Slowing growth in major economies (e.g., China, Europe): Economic slowdowns in China and across Europe are major contributors to reduced global demand for oil.

- Impact of geopolitical instability on oil supply and demand: Geopolitical factors, while impacting supply, haven't been the sole driver of the price drop. Reduced demand plays a far more significant role.

- Increased fuel efficiency of vehicles impacting overall consumption: The increasing fuel efficiency of vehicles is also contributing to lower overall oil consumption, further reducing demand.

- Charts and graphs illustrating the correlation between global economic activity and crude oil prices: (Note: This section would ideally include visual data illustrating the correlation between global economic indicators and crude oil prices.)

The Psychological Impact of Lower Gas Prices During Economic Uncertainty

Even the benefit of lower gas prices near $3 is overshadowed by the pervasive atmosphere of economic uncertainty. Consumers are less likely to increase spending when faced with anxieties about inflation, potential job losses, and the looming threat of a recession. The psychological impact of widespread economic anxiety is significant.

- The influence of inflation and rising interest rates on consumer sentiment: Persistent inflation and climbing interest rates erode consumer confidence, dampening spending enthusiasm even with lower gas prices.

- The impact of potential job losses or economic recession on spending habits: The fear of job losses or a recession significantly influences consumer behavior, leading to a preference for savings over spending.

- The psychological effect of consistently negative economic news: A constant stream of negative economic news further exacerbates consumer anxiety, making them less likely to spend freely.

- Examples of how consumers are still prioritizing savings and avoiding unnecessary spending: Anecdotal evidence and consumer surveys support the observation that many are prioritizing debt repayment and emergency funds over discretionary spending, even with lower gas prices.

Conclusion

The national average gas price nearing $3, while offering some relief at the pump, is a complex economic signal. The correlation between lower gas prices and reduced consumer spending highlights the broader economic anxieties at play. Reduced global demand for crude oil, driven by slowing economic activity worldwide, is a primary factor impacting fuel costs. The psychological impact of economic uncertainty further dampens the positive effects of lower gas prices. Understanding the factors behind these lower gas prices is crucial. Stay tuned for updates on the national average gas price and its impact on the broader economy. Monitor the situation closely to make informed financial decisions in this period of economic uncertainty. The relationship between lower gas prices and overall economic health is dynamic and requires careful observation.

Featured Posts

-

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025

Outrun Movie Michael Bay Directing Sydney Sweeney Cast

May 22, 2025 -

Julianne Moore Kevin Bacon Star In Netflixs New Limited Series Siren

May 22, 2025

Julianne Moore Kevin Bacon Star In Netflixs New Limited Series Siren

May 22, 2025 -

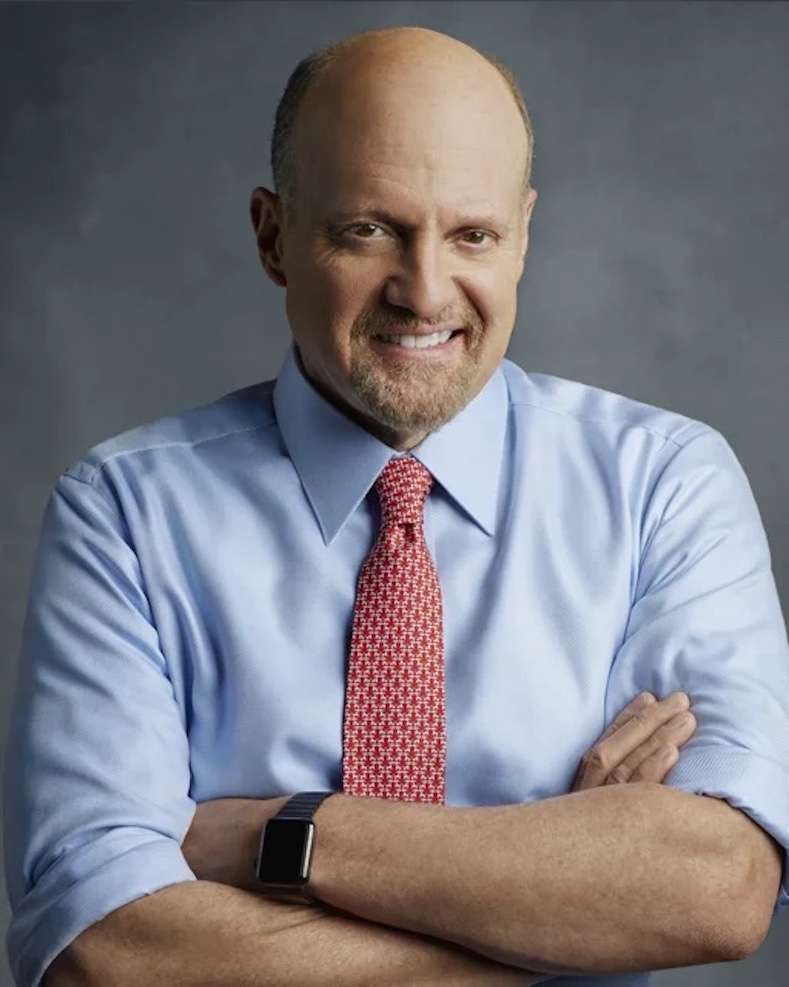

Core Weave Crwv A Deep Dive Into Jim Cramers Assessment And The Open Ai Factor

May 22, 2025

Core Weave Crwv A Deep Dive Into Jim Cramers Assessment And The Open Ai Factor

May 22, 2025 -

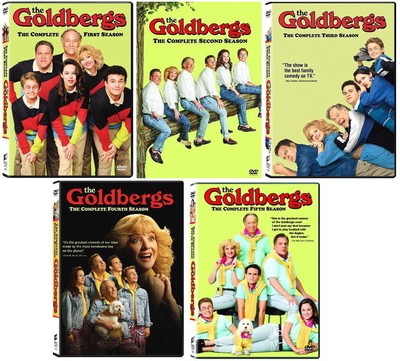

The Goldbergs A Complete Guide To The Episodes And Seasons

May 22, 2025

The Goldbergs A Complete Guide To The Episodes And Seasons

May 22, 2025 -

Abn Amro Ziet Occasionverkoop Flink Toenemen Groeiend Autobezit Als Drijfveer

May 22, 2025

Abn Amro Ziet Occasionverkoop Flink Toenemen Groeiend Autobezit Als Drijfveer

May 22, 2025

Latest Posts

-

Liga De Naciones Los Memes Que Dejo La Derrota De Panama Ante Mexico

May 22, 2025

Liga De Naciones Los Memes Que Dejo La Derrota De Panama Ante Mexico

May 22, 2025 -

Panama Vs Mexico Los Memes Que Inundaron Las Redes Sociales Tras La Final

May 22, 2025

Panama Vs Mexico Los Memes Que Inundaron Las Redes Sociales Tras La Final

May 22, 2025 -

La Derrota De Panama Una Recopilacion De Los Mejores Memes

May 22, 2025

La Derrota De Panama Una Recopilacion De Los Mejores Memes

May 22, 2025 -

Government Responds To Heightened Security Concerns At Israeli Embassies

May 22, 2025

Government Responds To Heightened Security Concerns At Israeli Embassies

May 22, 2025 -

Memes De La Final De La Liga De Naciones Panama Vs Mexico

May 22, 2025

Memes De La Final De La Liga De Naciones Panama Vs Mexico

May 22, 2025