Los Angeles Wildfires And The Growing Market For Disaster-Related Wagers

Table of Contents

The Devastating Impact of Los Angeles Wildfires

The impact of Los Angeles wildfires extends far beyond the immediate flames. The consequences are felt across economic, environmental, and human spheres, creating a ripple effect that necessitates a deeper understanding of the risks involved.

Economic Losses

The financial toll of wildfires in Los Angeles is immense. The cost of Los Angeles wildfire damage includes not only the direct property loss from destroyed homes and businesses but also significant indirect costs. These include lost revenue from business interruption, the expense of emergency response and cleanup, and the long-term impact on local economies. For example, the 2018 Woolsey Fire resulted in billions of dollars in property damage and economic losses. Keywords: Los Angeles wildfire damage, wildfire economic impact, property loss, business interruption.

Environmental Consequences

Beyond the immediate destruction, wildfires inflict lasting environmental damage on Los Angeles. Wildfire environmental impact encompasses habitat destruction for numerous plant and animal species, leading to biodiversity loss and ecosystem instability. The smoke from these fires severely impacts air quality, posing significant health risks to both humans and animals. Long-term ecological damage includes soil erosion, increased risk of flooding, and altered hydrological cycles. Keywords: wildfire environmental impact, air quality, habitat loss, ecological damage.

Human Cost

The human cost of Los Angeles wildfires is perhaps the most heartbreaking aspect. Wildfire casualties include fatalities, injuries, and the immense psychological trauma suffered by survivors. The displacement of entire communities, often with little or no warning, leads to prolonged hardship and uncertainty. The long-term health impacts of wildfire smoke, including respiratory illnesses and cardiovascular problems, further contribute to the human cost. Keywords: wildfire casualties, displacement, health impacts, human cost of wildfires.

- Specific examples: The 2009 Station Fire, the 2017 Thomas Fire, and the 2018 Woolsey Fire all resulted in significant loss of life and displacement.

- Statistics: Thousands have been displaced and hundreds of thousands have suffered from smoke-related health issues in recent years.

- Data on long-term health consequences: Studies continue to document the long-term respiratory and cardiovascular problems resulting from wildfire smoke exposure.

The Rise of Disaster-Related Wagers

The increasing frequency and severity of Los Angeles wildfires have fueled a parallel rise in the market for disaster-related wagers, providing both individuals and institutions with mechanisms to manage and mitigate risk.

Insurance Markets

The wildfire risk significantly influences insurance premiums and the availability of insurance coverage in high-risk areas of Los Angeles. Wildfire insurance premiums have skyrocketed in recent years, making it unaffordable for some homeowners. In certain high-risk zones, securing adequate insurance coverage has become increasingly difficult, leaving many vulnerable to significant financial loss. Keywords: wildfire insurance, insurance premiums, risk assessment, insurance coverage.

Prediction Markets

The emergence of wildfire prediction markets allows individuals to bet on the likelihood, severity, and location of future wildfires. These markets, often utilizing sophisticated predictive modeling and data analytics, offer a novel approach to risk assessment and management. Catastrophe bonds and other financial instruments are also being developed to transfer wildfire risk. Keywords: wildfire prediction markets, catastrophe bonds, risk prediction, predictive modeling.

Other Wagering Opportunities

Beyond prediction markets and traditional insurance, other forms of disaster-related wagers are emerging. These include disaster derivatives and specialized insurance products designed to hedge against specific wildfire risks. These sophisticated financial instruments enable individuals and organizations to manage their exposure to wildfire-related losses. Keywords: disaster derivatives, specialized insurance, hedging strategies, risk management.

- Examples of companies: Several financial technology companies are developing platforms for wildfire prediction markets.

- Ethical considerations: The ethical implications of profiting from disaster predictions need careful consideration.

- Benefits and drawbacks: While these markets can provide valuable risk management tools, they also present potential for speculation and market manipulation.

The Interplay Between Wildfires and the Wagering Market

The relationship between Los Angeles wildfires and the wagering market is dynamic and multifaceted, driven by advances in technology, investor behavior, and regulatory frameworks.

Data and Forecasting

Advancements in data collection and forecasting technologies, including satellite imagery, weather modeling, and sophisticated algorithms, are improving the accuracy of wildfire predictions. This increased accuracy directly impacts the wagering market, influencing both the pricing of insurance policies and the dynamics of prediction markets. Keywords: wildfire forecasting, data analytics, predictive modeling, risk assessment.

Investor Behavior

Investor behavior and market sentiment are significantly influenced by wildfire events and predictions. Periods of increased wildfire activity or alarming predictions often lead to market volatility, as investors react to perceived changes in risk. Understanding investor behavior is critical for analyzing the dynamics of the disaster-related wagering market. Keywords: market volatility, investor behavior, risk appetite, market sentiment.

Regulatory Aspects

The regulatory landscape surrounding disaster-related wagers, including insurance and financial derivatives, is evolving. Government agencies play a crucial role in ensuring market integrity and protecting consumers from unfair practices. Changes in regulation can significantly impact the growth and development of the disaster-related wagering market. Keywords: wildfire regulation, insurance regulation, financial regulation, legal aspects.

- Examples of data usage: Satellite imagery and weather data are integral to predicting wildfire behavior.

- Impact of media coverage: Media portrayals of wildfires can significantly impact investor sentiment.

- Role of government agencies: Regulatory bodies like the California Department of Insurance play a key role in overseeing the insurance market.

Conclusion

The increasing frequency and severity of Los Angeles wildfires are inextricably linked to the expansion of the market for disaster-related wagers. The economic, environmental, and human costs of these wildfires are substantial, highlighting the critical need for effective risk management strategies. The emergence of prediction markets, specialized insurance products, and other forms of disaster-related wagers offers both opportunities and challenges.

Key Takeaways: Los Angeles wildfires pose a significant threat, resulting in massive economic losses, environmental damage, and human suffering. The market for disaster-related wagers is expanding rapidly in response to this growing risk. This market offers potential for risk mitigation but requires careful consideration of ethical and regulatory implications.

Call to Action: Understanding the risks associated with Los Angeles wildfires is crucial for effective disaster preparedness. Learn more about wildfire risk management strategies, explore the opportunities and challenges presented by the growing market for disaster-related wagers, and delve into the ethical and regulatory implications of this emerging field. Further research into wildfire prediction markets and insurance for wildfire risk is vital for better understanding and mitigating the impact of future events.

Featured Posts

-

Southeast Texas Gears Up For Crucial May 2025 Municipal Elections

May 18, 2025

Southeast Texas Gears Up For Crucial May 2025 Municipal Elections

May 18, 2025 -

Stock Market Valuation Concerns Bof A Offers A Different View

May 18, 2025

Stock Market Valuation Concerns Bof A Offers A Different View

May 18, 2025 -

Enhanced Coding With Chat Gpt The Ai Coding Agent Explained

May 18, 2025

Enhanced Coding With Chat Gpt The Ai Coding Agent Explained

May 18, 2025 -

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Mob Land Premiere Debut

May 18, 2025

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Mob Land Premiere Debut

May 18, 2025 -

Japans Metropolis An Insiders Guide To Local Experiences

May 18, 2025

Japans Metropolis An Insiders Guide To Local Experiences

May 18, 2025

Latest Posts

-

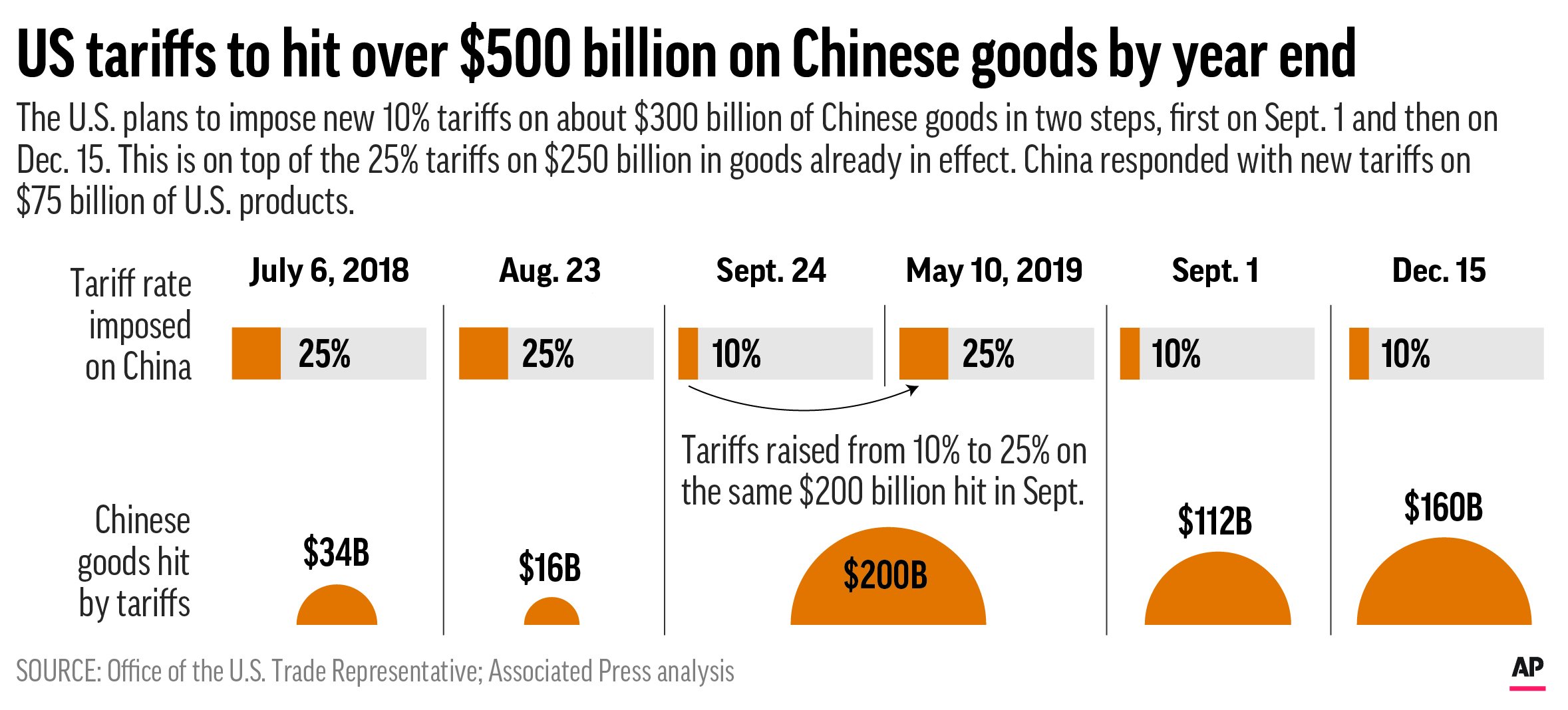

Analysis Trumps China Tariffs To Remain At 30 Until Late 2025

May 18, 2025

Analysis Trumps China Tariffs To Remain At 30 Until Late 2025

May 18, 2025 -

30 Tariffs On China Trumps Policy Extension Forecast To 2025

May 18, 2025

30 Tariffs On China Trumps Policy Extension Forecast To 2025

May 18, 2025 -

Analyzing Trumps Aerospace Agreements Substance Vs Spectacle

May 18, 2025

Analyzing Trumps Aerospace Agreements Substance Vs Spectacle

May 18, 2025 -

Trumps Aerospace Deals A Deep Dive Into The Numbers And Missing Details

May 18, 2025

Trumps Aerospace Deals A Deep Dive Into The Numbers And Missing Details

May 18, 2025 -

Kanye West Bianca Censori Enjoy Dinner Date In Spain Amidst Relationship Speculation

May 18, 2025

Kanye West Bianca Censori Enjoy Dinner Date In Spain Amidst Relationship Speculation

May 18, 2025