Analysis: Trump's China Tariffs To Remain At 30% Until Late 2025

Table of Contents

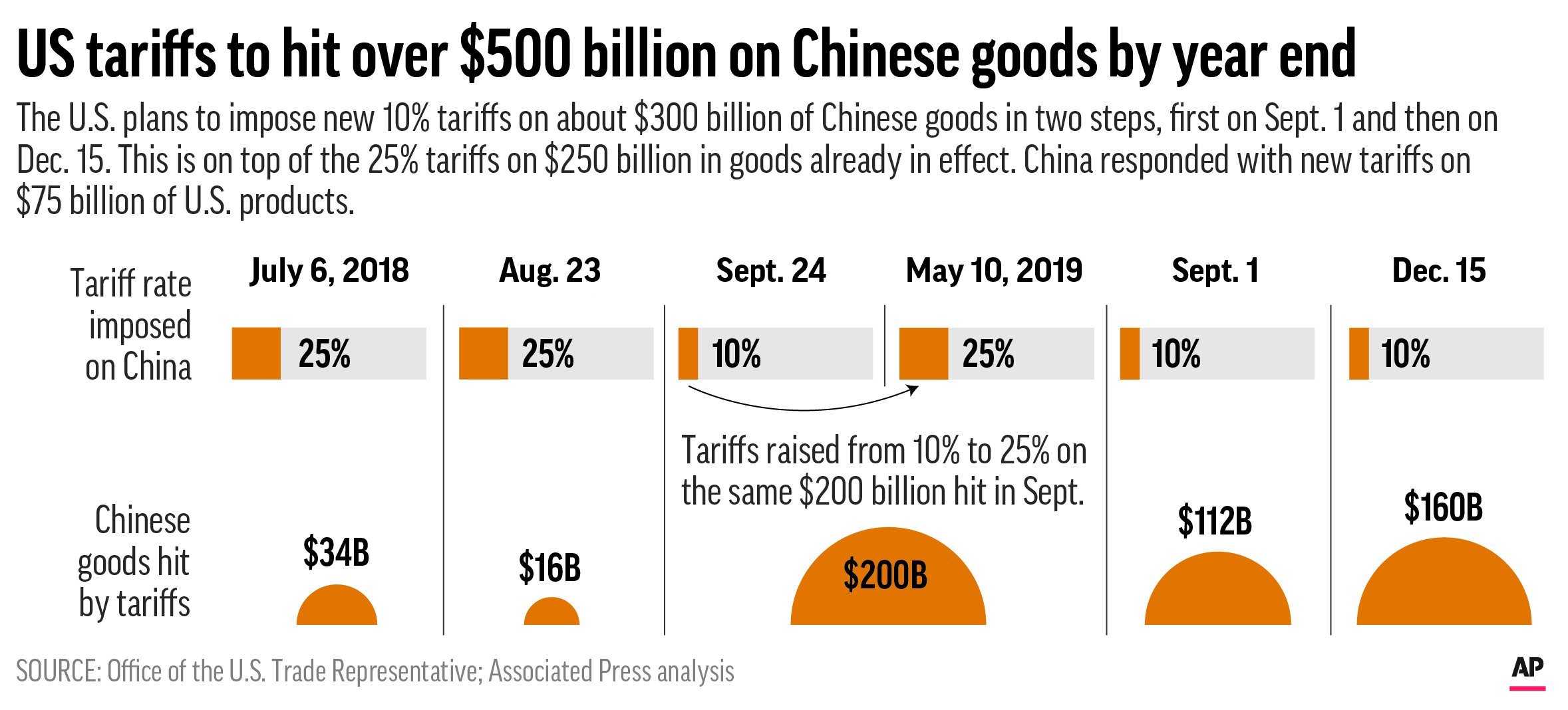

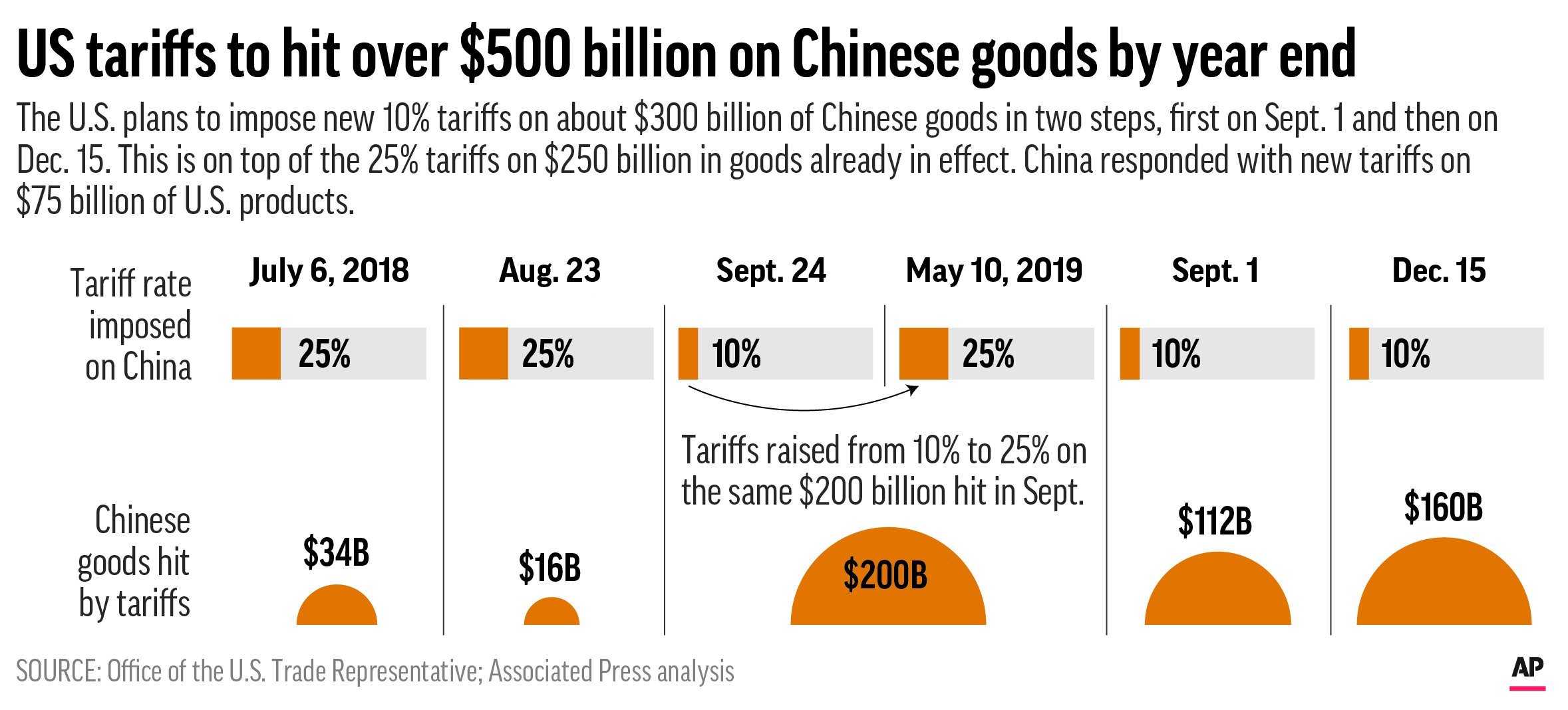

The Timeline of Trump's China Tariffs

The escalating trade war between the US and China under the Trump presidency began in 2018. Initially, tariffs were implemented on a limited range of goods, but they quickly escalated. Key phases included:

- July 2018: Initial tariffs of 25% on $34 billion worth of Chinese goods.

- August 2018: Further tariffs of 25% on another $16 billion worth of goods.

- September 2019: Tariffs increased to 15% on approximately $112 billion of additional Chinese goods.

- December 2018/September 2019: Retaliatory tariffs imposed by China on US goods.

These escalating measures ultimately led to the current 30% tariff on a significant portion of Chinese imports. The types of goods affected are diverse, impacting various sectors including:

- Electronics: Smartphones, computers, and other consumer electronics.

- Textiles: Clothing, fabrics, and home furnishings.

- Machinery: Industrial equipment and manufacturing components.

- Agricultural products: Certain food items and agricultural commodities.

The path to these 30% tariffs involved numerous rounds of negotiations, threats, and counter-threats, ultimately shaping the complex trade landscape we see today.

Economic Consequences of the Extended Tariffs

The prolonged presence of these 30% tariffs carries substantial economic ramifications:

-

Impact on US Consumers: Higher prices on imported goods lead to reduced purchasing power for American consumers. This contributes to inflation and potentially impacts consumer confidence.

- Example: Increased prices on electronics, clothing, and other consumer goods.

-

Effect on US Businesses: Increased costs for imported materials and components reduce the competitiveness of US businesses in both domestic and international markets. This can lead to reduced profits and potential job losses in certain sectors.

- Example: Manufacturers relying on Chinese-made components face higher production costs.

-

Repercussions for Chinese Businesses: The loss of significant export markets to the US directly impacts Chinese businesses. This has spurred retaliatory tariffs, creating a cycle of negative economic consequences for both nations.

- Example: Reduced demand for Chinese-manufactured goods in the US market.

-

Inflationary Pressures: The added costs associated with tariffs contribute to overall inflation, impacting everything from everyday consumer goods to larger capital investments. This creates a ripple effect throughout the economy, potentially slowing overall growth.

-

Job Displacement: While some argue that tariffs protect domestic jobs, others contend that increased prices and reduced competitiveness lead to job losses or shifts in manufacturing to other countries.

Political Ramifications and Future Trade Negotiations

The extended 30% tariffs significantly impact the Biden administration's approach to US-China relations. While the Biden administration hasn't fully reversed the Trump-era tariffs, its approach has been more nuanced, focusing on:

- Strategic Competition: Addressing China's economic practices through multilateral alliances rather than solely through unilateral tariffs.

- Negotiations: Engaging in discussions with China on various trade issues but without a complete dismantling of the existing tariff structure.

- Focus on specific areas: Targeting certain sectors or practices for greater scrutiny rather than broad-based tariffs.

The future of trade negotiations remains uncertain. Potential scenarios include:

- Partial removal of tariffs: Targeted reductions on certain goods based on negotiations and progress in other areas.

- Maintenance of the status quo: Continuation of the 30% tariffs for an extended period, potentially leading to further economic adjustments.

- Further escalation: The possibility of additional tariffs or trade restrictions depending on future events.

Industries Most Affected by the 30% Tariffs

Several industries are disproportionately affected by the 30% China tariffs:

- Manufacturing: Businesses reliant on imported Chinese components experience significant cost increases.

- Agriculture: Certain agricultural products face reduced market access in China due to retaliatory tariffs.

- Retail: Increased prices lead to reduced consumer spending and profit margins.

- Technology: The electronics industry, reliant on Chinese manufacturing, has been deeply affected.

These industries have employed various strategies to mitigate the impact, including:

- Relocation of production: Shifting manufacturing operations to other countries to avoid tariffs.

- Diversification of suppliers: Finding alternative sources for materials and components outside of China.

- Lobbying for government support: Seeking assistance and relief measures from their respective governments.

Examples include companies that have had to adjust their supply chains to lessen their dependence on Chinese goods, absorbing some of the increased costs. Government support, while existing in some form, often falls short of completely offsetting the impact of these tariffs.

Conclusion

The extension of Trump's 30% China tariffs until late 2025 represents a significant and ongoing challenge to US-China trade relations. The economic consequences, including increased prices for consumers and reduced competitiveness for businesses, are substantial. The political ramifications are equally significant, shaping the Biden administration's approach to trade policy and the broader geopolitical relationship between the two countries. Understanding the implications of these prolonged Trump China tariffs is crucial for businesses and consumers alike. Stay informed and prepare for the long-term effects of this significant trade policy. Continue your research on "Trump's China trade policy," "impact of tariffs on the US economy," or "future of US-China trade relations" to stay abreast of the latest developments.

Featured Posts

-

Bbc Three Hd Programming Catch Easy A Now

May 18, 2025

Bbc Three Hd Programming Catch Easy A Now

May 18, 2025 -

Conservative Revolt Threatens Gop Tax Plans Passage

May 18, 2025

Conservative Revolt Threatens Gop Tax Plans Passage

May 18, 2025 -

Exclusive Update Taylor Swift And Blake Livelys Response To The It Ends With Us Lawsuit

May 18, 2025

Exclusive Update Taylor Swift And Blake Livelys Response To The It Ends With Us Lawsuit

May 18, 2025 -

Why Isnt The American Manhunt Osama Bin Laden Documentary On Netflix

May 18, 2025

Why Isnt The American Manhunt Osama Bin Laden Documentary On Netflix

May 18, 2025 -

Unseen Cannes Hilarious Pictures From Before Cell Phones

May 18, 2025

Unseen Cannes Hilarious Pictures From Before Cell Phones

May 18, 2025

Latest Posts

-

You Toon Caption Contest Booing Bears Reign Supreme

May 18, 2025

You Toon Caption Contest Booing Bears Reign Supreme

May 18, 2025 -

Galesburg Welcomes Jersey Mikes Subs

May 18, 2025

Galesburg Welcomes Jersey Mikes Subs

May 18, 2025 -

Booing Bears Claim Victory In You Toon Caption Contest

May 18, 2025

Booing Bears Claim Victory In You Toon Caption Contest

May 18, 2025 -

Jersey Mikes Subs Coming To Galesburg

May 18, 2025

Jersey Mikes Subs Coming To Galesburg

May 18, 2025 -

Childs Life Saved Thanks To Suffolk Boys Courage At Great Wolf Lodge

May 18, 2025

Childs Life Saved Thanks To Suffolk Boys Courage At Great Wolf Lodge

May 18, 2025