Live Now, Pay Later Financing: A Comprehensive Overview

Table of Contents

How Live Now, Pay Later Financing Works

Live now, pay later financing allows consumers to purchase goods and services immediately and pay for them in installments over a predetermined period. The application process is typically quick and straightforward, often requiring only basic personal information and a linked bank account or debit card. This simplicity is a major draw for many consumers.

Payment schedules vary depending on the provider and the purchase amount. Some offer weekly payments, others bi-weekly or monthly installments, providing flexibility tailored to individual financial situations. It's crucial to understand the terms before committing, especially regarding interest and fees.

While some BNPL services offer interest-free options for prompt payment, others charge interest, particularly if payments are late or missed. Late payment fees can significantly increase the total cost, making it more expensive than the initial purchase price. It's essential to know the interest rate, late payment fees, and any other potential charges upfront.

Several types of BNPL services exist. Some are integrated directly into online retailers’ checkout processes, seamlessly integrating with your purchase. Others operate as standalone apps, offering broader accessibility across various merchants. Choosing between these options depends largely on individual spending habits and preferred shopping venues.

- Easy online application

- Flexible repayment options

- Potential for interest charges

- Late payment penalties

Benefits of Live Now, Pay Later Financing

Live now, pay later financing offers several potential advantages, particularly for responsible users. For example, it can facilitate improved budget management by spreading the cost of larger purchases over time, making them more manageable. This approach can help consumers avoid overwhelming their monthly budget with a single large expense.

Furthermore, BNPL can be a valuable credit-building tool, especially for individuals with limited credit history. Making timely payments demonstrates responsible financial behavior, which can positively impact your credit score over time. This can open up more opportunities for traditional credit products in the future.

The convenience and speed of the process are undeniable benefits. Applying for and receiving approval often takes only minutes, allowing for immediate purchases without lengthy delays. This is especially appealing for time-sensitive purchases or unexpected expenses.

Finally, BNPL can increase purchasing power, enabling consumers to buy items they might otherwise postpone or forgo entirely. This is especially useful for necessary purchases, such as appliances or medical treatments.

- Convenient payment plans

- Access to credit for all

- Faster purchase process

- Potential credit building

Drawbacks and Risks of Live Now, Pay Later Financing

Despite its advantages, BNPL financing also presents potential drawbacks and risks. Overspending is a significant concern. The ease of access can lead to impulsive purchases, resulting in accumulating debt if not managed responsibly. It’s crucial to budget carefully and only use BNPL for planned purchases you can comfortably afford to repay.

High interest rates, while not always present, are a potential pitfall. If payments are missed or not made in full, many BNPL providers charge substantial interest rates, significantly increasing the total cost. Understanding the interest rate structure is vital before agreeing to any plan.

Missed payments can negatively impact your credit score, even with BNPL services that don't directly report to credit bureaus. Late payments may be reported to debt collection agencies, further harming your creditworthiness.

Finally, aggressive collection practices are a concern for some providers. While uncommon with reputable companies, late or missed payments can trigger aggressive debt collection methods, resulting in stress and financial hardship.

- Risk of overspending

- High interest rates (if applicable)

- Negative impact on credit score

- Aggressive debt collection (in certain cases)

Choosing the Right Live Now, Pay Later Provider

Selecting a suitable live now, pay later provider requires careful consideration. Comparison shopping is crucial. Examine different providers' fees, interest rates, and repayment terms to identify the most favorable option. Don't just focus on the initial offer; look at the potential long-term costs.

Reading online reviews from other users offers invaluable insights into each provider's reputation, customer service, and collection practices. Pay attention to both positive and negative feedback to get a comprehensive view.

Always carefully read the terms and conditions before agreeing to any plan. Understand the interest rates, late payment fees, and repayment schedules. Don't be afraid to ask questions if anything is unclear.

Finally, assess your financial situation before using BNPL. Ensure you have a budget and the financial discipline to manage repayments without jeopardizing your financial stability. Avoid using BNPL if you're already struggling with debt or have difficulty managing your finances.

- Compare interest rates & fees

- Check online reviews

- Read the terms & conditions carefully

- Evaluate your financial situation

Conclusion

Live now, pay later financing offers a convenient way to spread the cost of purchases, but responsible use is paramount. While it can improve budget management and even help build credit for some, it also carries risks, including overspending, high interest rates, and potential damage to credit scores. Choosing a reputable provider and carefully evaluating your financial situation are essential for avoiding potential pitfalls. Remember, using BNPL responsibly means only using it for purchases you can afford to repay on time. Find the best live now, pay later financing option for you today! Learn more about responsible live now, pay later financing strategies to make informed choices that align with your financial goals.

Featured Posts

-

Msyrt Awstabynkw Almmyzt Ela Almlaeb Altrabyt

May 30, 2025

Msyrt Awstabynkw Almmyzt Ela Almlaeb Altrabyt

May 30, 2025 -

Alcaraz Claims Maiden Monte Carlo Championship

May 30, 2025

Alcaraz Claims Maiden Monte Carlo Championship

May 30, 2025 -

Milei And The Tuttle Twins Free Market Education For Argentine Children

May 30, 2025

Milei And The Tuttle Twins Free Market Education For Argentine Children

May 30, 2025 -

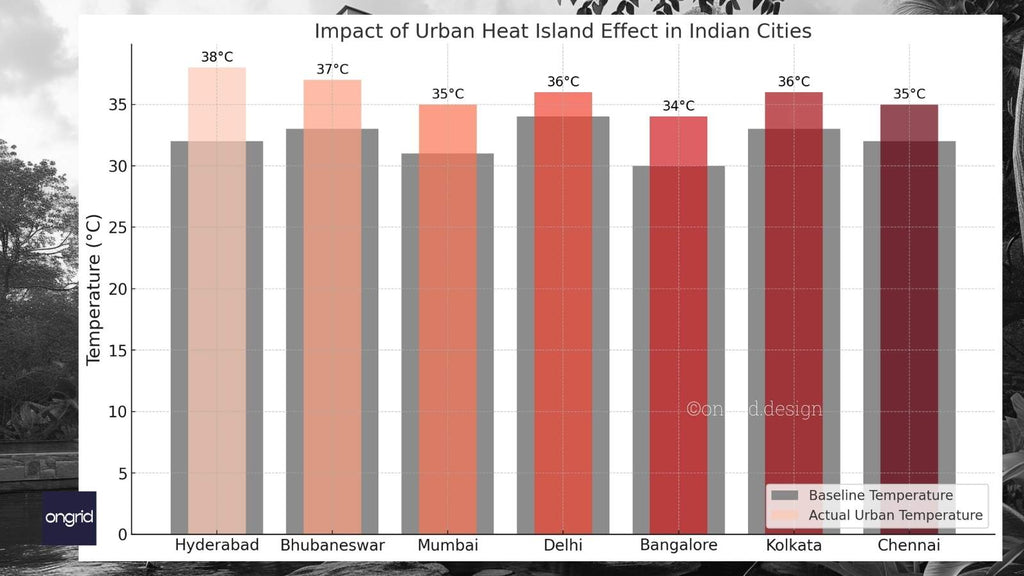

Mitigating Urban Heat Island Effect In India Through Innovative Construction Materials

May 30, 2025

Mitigating Urban Heat Island Effect In India Through Innovative Construction Materials

May 30, 2025 -

The Bruno Fernandes Transfer How Man United Beat Tottenham To His Signing

May 30, 2025

The Bruno Fernandes Transfer How Man United Beat Tottenham To His Signing

May 30, 2025