Learning From The Oracle: A Deep Dive Into Warren Buffett's Investment Decisions

Table of Contents

Understanding Warren Buffett's Value Investing Philosophy

At the heart of Warren Buffett's investment strategies lies his unwavering commitment to value investing. This philosophy centers on identifying undervalued companies, focusing on their long-term growth potential, and patiently allocating capital. It's not about chasing short-term gains but about finding fundamentally strong businesses trading below their intrinsic worth.

- Intrinsic Value vs. Market Price: Buffett meticulously assesses a company's intrinsic value – its true worth based on its assets, earnings, and future prospects – and compares it to its market price. He only invests when he finds a significant "margin of safety," meaning the market price is substantially below the intrinsic value.

- Margin of Safety: This crucial concept acts as a buffer against unforeseen circumstances. It ensures that even if the company underperforms slightly, the investor still makes a profit.

- Long-Term Perspective: Buffett is famously patient. He holds investments for years, even decades, allowing the underlying businesses to grow and compound their value. Short-term market fluctuations don't deter him.

- Importance of Company Fundamentals: Buffett delves deep into a company's financial statements, scrutinizing its earnings, cash flow, debt levels, and competitive advantages. He looks for companies with strong, durable competitive moats.

Buffett's application of these principles is evident in his long-term investments in companies like Coca-Cola and Berkshire Hathaway itself. These investments, held for many years, have generated enormous returns reflecting the power of his value investing approach.

Analyzing Buffett's Key Investment Decisions and Their Outcomes

Throughout his career, Buffett has made numerous significant investment decisions, demonstrating the practical application of his value investing philosophy. Analyzing these choices, including both successes and any notable setbacks, provides valuable lessons.

- Successful Investments and Their Reasoning: His acquisition of American Express in the aftermath of the Salad Oil scandal is a prime example. Recognizing the underlying strength of the company despite market panic, Buffett capitalized on the temporarily depressed share price, generating substantial returns.

- Less Successful Investments and Lessons Learned: While Buffett’s track record is largely exceptional, he has acknowledged past investment mistakes. Analyzing these helps illustrate the importance of continuous learning and adaptability even for the most seasoned investors. Openly discussing these instances, rather than hiding them, is a key characteristic of his approach.

- Role of Market Timing (or Lack Thereof): Unlike many investors, Buffett doesn’t attempt to time the market. He focuses on identifying fundamentally sound businesses and holding them for the long term, irrespective of short-term market fluctuations. This long-term perspective is a cornerstone of his success.

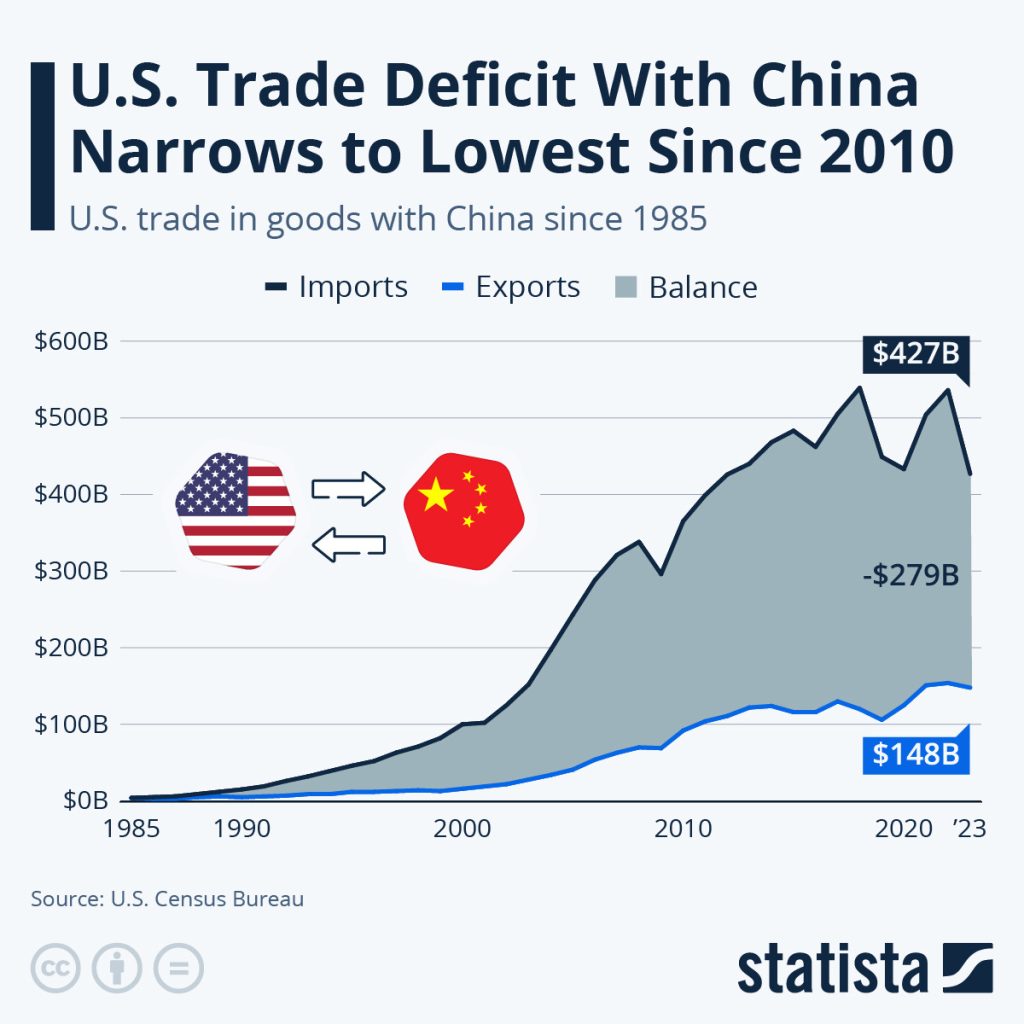

[Insert a graph or chart here showing the long-term performance of some of Buffett's key investments, illustrating the power of compounding and long-term value investing.]

The Importance of Due Diligence in Buffett's Investment Process

Before making any investment decision, Buffett undertakes meticulous due diligence. This thorough research and analysis form the bedrock of his success.

- Thorough Understanding of Company Financials: He meticulously examines balance sheets, income statements, and cash flow statements to gain a comprehensive understanding of the company's financial health.

- Assessing Management Quality and Integrity: Buffett places significant importance on the competence and ethical conduct of the company's management team. He believes that strong management is crucial for long-term success.

- Competitive Landscape Analysis: He thoroughly analyzes the competitive landscape to assess a company's competitive advantages and its ability to sustain its position in the market.

- Long-Term Industry Outlook: He considers the long-term prospects of the industry in which the company operates. He prefers industries with strong tailwinds and long-term growth potential.

Buffett's team plays a crucial role in this process, contributing their expertise and assisting in the extensive research required.

Adaptability and Evolution of Buffett's Investment Strategies

While Buffett's core principles of value investing remain consistent, his investment strategies have evolved over time, reflecting changes in the market and technological advancements.

- Changes in Investment Focus (if any): While consistently valuing fundamentally sound businesses, his focus and investment vehicles have shifted somewhat over time, reflecting the evolution of the market and Berkshire Hathaway's portfolio.

- Adaptation to Technological Advancements: He's acknowledged the transformative impact of technology and has gradually incorporated tech companies into his portfolio, though always maintaining his focus on value and long-term growth.

- Maintaining Core Principles While Adjusting to Changing Environments: The essence of his approach remains the same—identifying undervalued businesses with strong fundamentals and holding them long term. But his methods of research and analysis have adapted to accommodate the modern business landscape.

Mastering the Art of Warren Buffett's Investment Decisions

In conclusion, Warren Buffett's investment success stems from his unwavering commitment to value investing, rigorous due diligence, a long-term perspective, and adaptability. His strategies emphasize understanding a company's intrinsic value, patiently waiting for opportune moments, and rigorously researching the business and its management. Learning from Warren Buffett’s investment decisions is crucial for aspiring investors.

To further your understanding of Warren Buffett’s investment decisions and value investing principles, explore his annual letters to Berkshire Hathaway shareholders, read biographies such as "The Snowball: Warren Buffett and the Business of Life," and delve into books on value investing. By studying his approach, you can develop your own investment strategies and strive towards achieving similar long-term success.

Featured Posts

-

Patrick Schwarzenegger And Abby Champion Wedding Postponement Explained

May 06, 2025

Patrick Schwarzenegger And Abby Champion Wedding Postponement Explained

May 06, 2025 -

Alterya Joins Chainalysis Enhancing Blockchain Analytics With Ai

May 06, 2025

Alterya Joins Chainalysis Enhancing Blockchain Analytics With Ai

May 06, 2025 -

Open Ai Facing Ftc Investigation Concerns And Analysis

May 06, 2025

Open Ai Facing Ftc Investigation Concerns And Analysis

May 06, 2025 -

Patrik Svarceneger Borba Za Uspeh Izvan Senke Oca

May 06, 2025

Patrik Svarceneger Borba Za Uspeh Izvan Senke Oca

May 06, 2025 -

Millions Stolen Insider Reveals Office365 Breach And Executive Targeting

May 06, 2025

Millions Stolen Insider Reveals Office365 Breach And Executive Targeting

May 06, 2025

Latest Posts

-

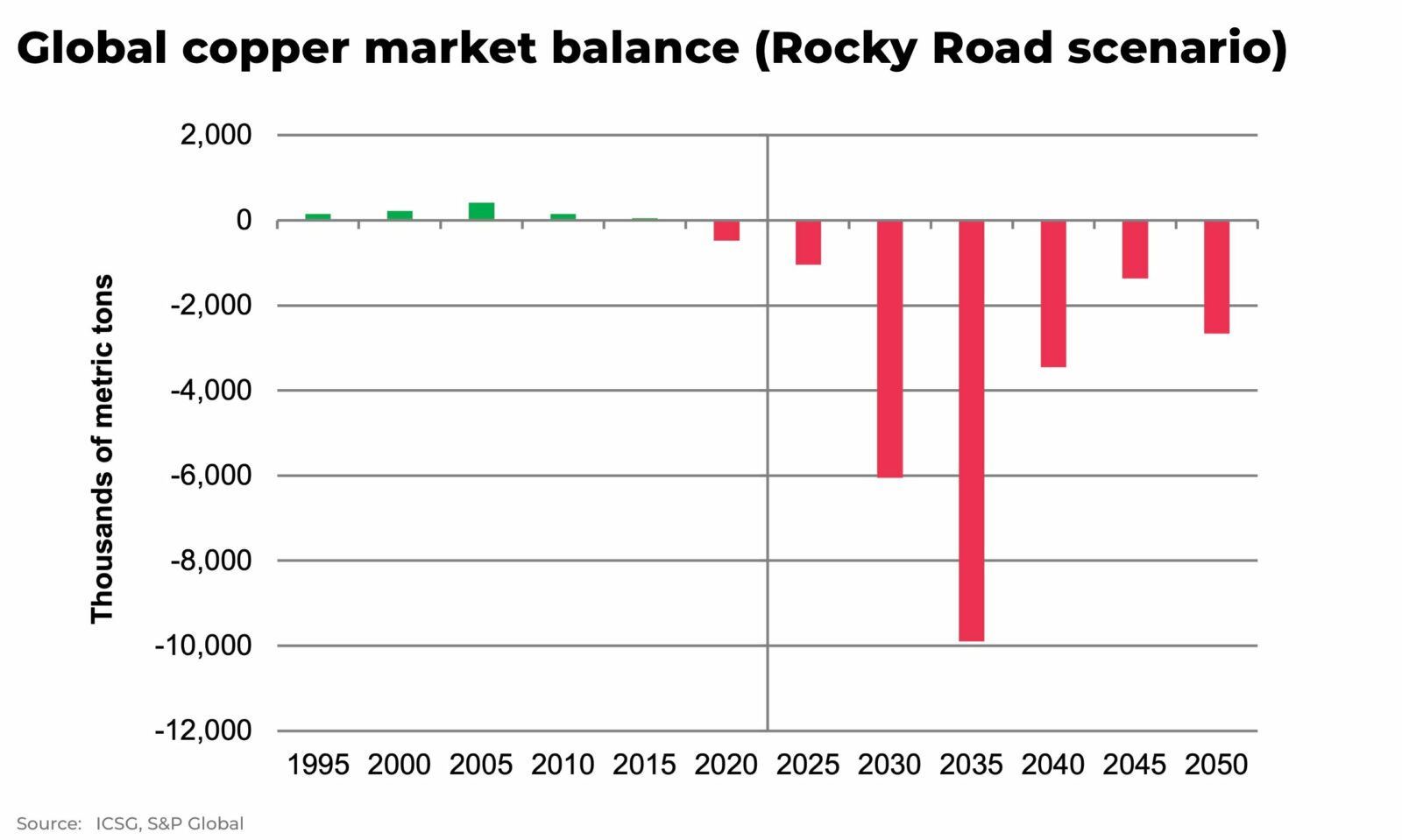

Analysis Copper Prices React To Chinas Us Trade Talk Consideration

May 06, 2025

Analysis Copper Prices React To Chinas Us Trade Talk Consideration

May 06, 2025 -

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025

Us China Trade Uncertainty Drives Copper Market Volatility

May 06, 2025 -

The Copper Market And The Us China Trade Dynamic

May 06, 2025

The Copper Market And The Us China Trade Dynamic

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Nudity Chris Pratts Response

May 06, 2025

Patrick Schwarzeneggers White Lotus Nudity Chris Pratts Response

May 06, 2025 -

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025

Rising Copper Prices Analysis Of Chinas Influence And Us Trade Relations

May 06, 2025