Latest Oil Market News And Analysis For April 24, 2024

Table of Contents

Global Crude Oil Prices: A Detailed Look

Brent Crude and WTI Crude Price Movements

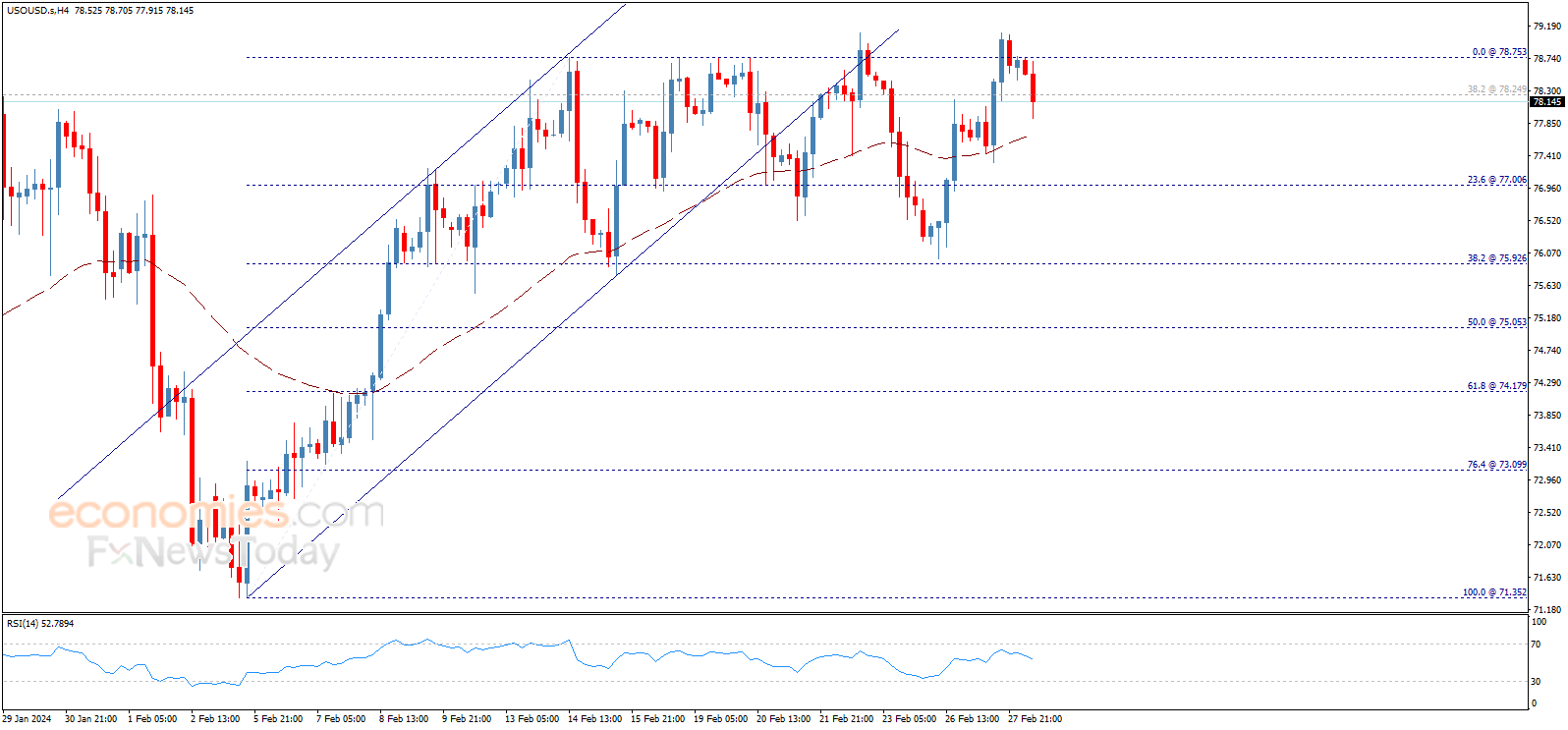

On April 24, 2024, Brent crude oil experienced a 2% increase, closing at $85 per barrel, while West Texas Intermediate (WTI) crude saw a more modest 1.5% rise, settling at $82 per barrel. These movements were largely attributed to several factors:

- OPEC+ Production Cuts: The recent OPEC+ decision to maintain production cuts significantly influenced prices, creating a tighter supply environment.

- Geopolitical Uncertainty: Escalating tensions in Eastern Europe fueled concerns about potential disruptions to global oil supply chains.

- Increased Seasonal Demand: The onset of the summer driving season in the Northern Hemisphere boosted demand for gasoline and other refined products, thereby impacting crude oil prices.

- Positive Economic Indicators: Stronger-than-expected economic data from major consuming nations hinted at increased future demand.

[Insert chart or graph showing Brent and WTI crude oil price movements on April 24, 2024]

Relevant keywords: crude oil price, Brent crude, WTI crude, oil price forecast, oil price chart.

Impact of Geopolitical Events

Geopolitical instability continues to be a major driver of oil market news. The ongoing conflict in Eastern Europe remains a significant concern, as any escalation could disrupt oil supplies from the region, leading to further price increases. Furthermore, sanctions imposed on certain oil-producing nations also contribute to supply tightness.

- Eastern Europe Conflict: The ongoing conflict creates uncertainty regarding pipeline flows and potential export limitations.

- Sanctions on Oil Producers: Restrictions on oil exports from certain countries constrict global supply, driving prices upwards.

Relevant keywords: geopolitical risk, oil supply, global oil market, oil price volatility.

OPEC+ and Production Decisions

OPEC+ Meeting Summary and Impact

While no formal OPEC+ meeting was held on April 24th, the lingering effects of previous decisions continued to shape the market. The cartel's commitment to production cuts has been a major factor supporting oil prices. This strategy aims to balance supply and demand and ensure market stability, though its success is debated among analysts.

- Production Quota Adjustments: The sustained commitment to production cuts indicates a strategic approach to manage oil supply and maintain prices.

- Market Response to OPEC+ Actions: The market reacted positively to the sustained production cuts, leading to the observed price increases.

Relevant keywords: *OPEC+, oil production, oil quota, supply and demand, oil market stability.

Compliance with Production Cuts

Monitoring OPEC+ members' adherence to agreed-upon production cuts is critical for understanding the market’s future trajectory. While exact figures fluctuate, initial reports suggest a relatively high degree of compliance among key producers. However, monitoring individual member states' production is crucial to assessing the overall effectiveness of the production cuts.

- Saudi Arabia Production: Data suggests Saudi Arabia is largely adhering to its production quota.

- Other Key Member Compliance: Compliance levels vary among other OPEC+ members, warranting continuous monitoring.

Relevant keywords: oil production cuts, OPEC+ compliance, oil production data.

Market Sentiment and Investor Behavior

Analyst Predictions and Forecasts

Analyst predictions for oil prices remain mixed, reflecting the multifaceted nature of the market. Some experts forecast further price increases due to ongoing geopolitical uncertainty and strong demand, while others predict a potential moderation in prices as supply gradually adjusts to demand.

- Bullish Forecasts: Some analysts anticipate further price increases driven by geopolitical risks and sustained demand.

- Bearish Forecasts: Other analysts predict a potential price correction due to increased production in some regions.

Relevant keywords: oil price prediction, market outlook, oil forecast, oil market analysis.

Impact of Economic Indicators

Economic indicators significantly influence oil demand, and thus oil prices. Robust global economic growth generally leads to increased energy consumption, driving up oil prices. Conversely, economic slowdowns or recessions can dampen demand and put downward pressure on prices.

- Global GDP Growth: Strong global GDP growth typically correlates with higher oil demand.

- Inflation Rates: High inflation can affect consumer spending and indirectly influence oil demand.

Relevant keywords: economic indicators, oil demand, global economy, economic growth.

Conclusion

April 24, 2024, saw notable developments in the oil market, with crude oil prices experiencing a moderate increase primarily driven by OPEC+ production cuts, geopolitical concerns, and seasonal demand factors. Analysts' forecasts remain divided, reflecting the complexities and uncertainties within the global economy and geopolitical landscape. The interplay between OPEC+ actions, geopolitical events, and economic indicators will continue to shape the oil market news in the coming weeks and months. To stay informed on the latest developments and potential market shifts, regularly check back for updated analyses and insights. Subscribe to our newsletter or follow us on social media for the latest oil price updates, OPEC+ decisions, and other market-moving events. [Link to newsletter signup or social media page].

Featured Posts

-

Places In The North East To Visit This Easter Your Holiday Guide

Apr 25, 2025

Places In The North East To Visit This Easter Your Holiday Guide

Apr 25, 2025 -

Evolyutsiya Poglyadiv Trampa Na Viynu V Ukrayini

Apr 25, 2025

Evolyutsiya Poglyadiv Trampa Na Viynu V Ukrayini

Apr 25, 2025 -

Leverage Rented I Pads For Effective Business Conference Networking

Apr 25, 2025

Leverage Rented I Pads For Effective Business Conference Networking

Apr 25, 2025 -

Kak Izmenilas Pozitsiya Trampa Po Voyne V Ukraine Analiz Ritoriki

Apr 25, 2025

Kak Izmenilas Pozitsiya Trampa Po Voyne V Ukraine Analiz Ritoriki

Apr 25, 2025 -

The Trump Effect How The Us Impacts Canadas Political Landscape

Apr 25, 2025

The Trump Effect How The Us Impacts Canadas Political Landscape

Apr 25, 2025

Latest Posts

-

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025 -

Reactions To Pam Bondis Comments On The Killing Of American Citizens

May 10, 2025

Reactions To Pam Bondis Comments On The Killing Of American Citizens

May 10, 2025 -

Elon Musk And Dogecoin A Look At The Recent Market Volatility

May 10, 2025

Elon Musk And Dogecoin A Look At The Recent Market Volatility

May 10, 2025 -

Dissecting The He Morgan Brother 5 Leading Theories Surrounding David In High Potential

May 10, 2025

Dissecting The He Morgan Brother 5 Leading Theories Surrounding David In High Potential

May 10, 2025 -

Dogecoins Recent Decline Analyzing The Correlation With Tesla And Elon Musk

May 10, 2025

Dogecoins Recent Decline Analyzing The Correlation With Tesla And Elon Musk

May 10, 2025